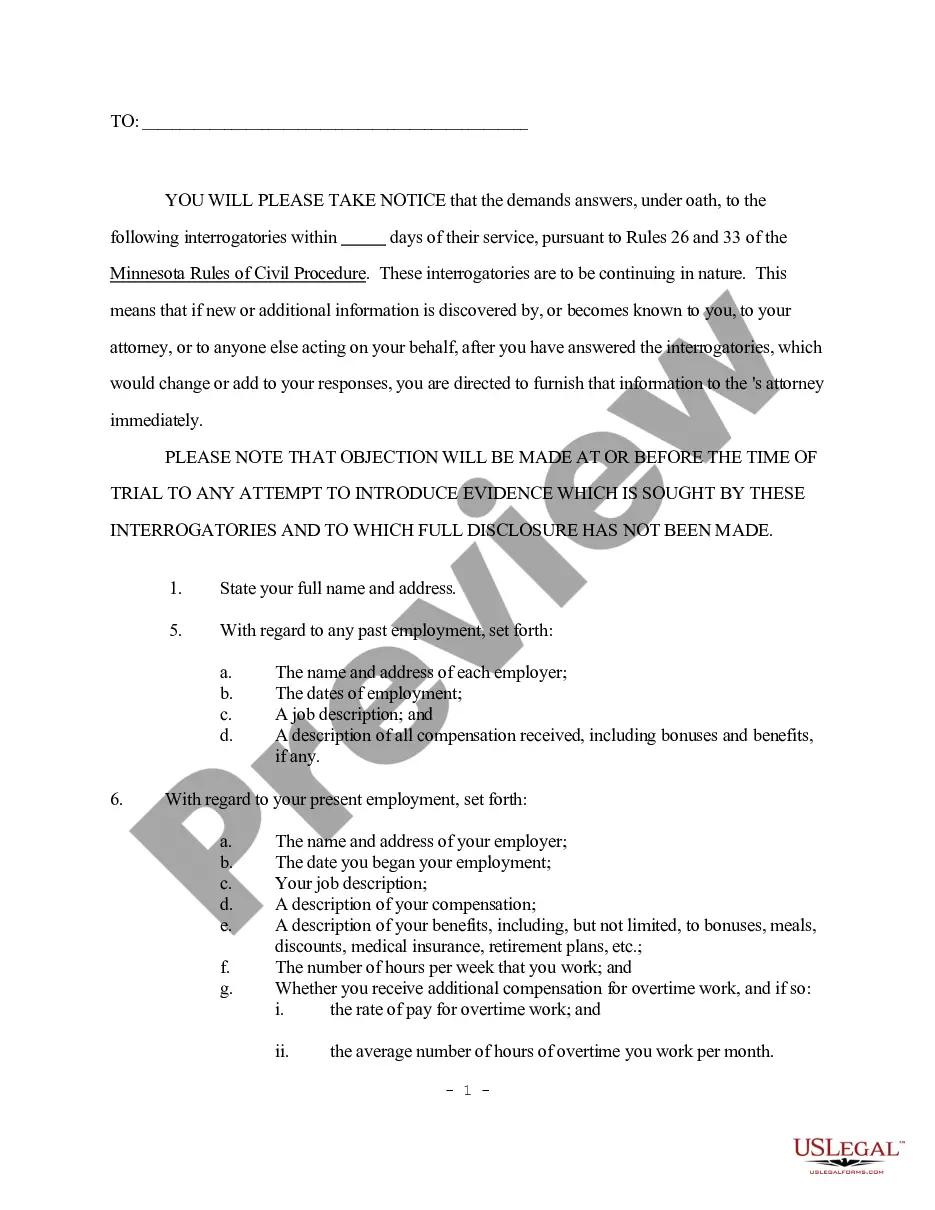

This is aletter of intent for stock acquisition. It can be used by the counsel for either the seller or purchaser and confirms the discussions to date between the seller and the purchaser. It discusses all matters in principal and binding agreements between the two parties.

Kansas Simple Letter of Intent for Stock Acquisition

Description

How to fill out Simple Letter Of Intent For Stock Acquisition?

Discovering the right authorized record design can be a have difficulties. Naturally, there are tons of web templates accessible on the Internet, but how would you obtain the authorized develop you want? Utilize the US Legal Forms web site. The support delivers a large number of web templates, including the Kansas Simple Letter of Intent for Stock Acquisition, which can be used for company and personal requirements. Each of the varieties are inspected by pros and satisfy federal and state needs.

In case you are presently authorized, log in for your account and click the Download key to get the Kansas Simple Letter of Intent for Stock Acquisition. Use your account to look from the authorized varieties you possess bought earlier. Visit the My Forms tab of your respective account and get one more backup from the record you want.

In case you are a brand new user of US Legal Forms, allow me to share basic recommendations that you should follow:

- Initially, make certain you have selected the proper develop for your city/area. You can look through the form while using Preview key and study the form explanation to make sure this is basically the best for you.

- When the develop fails to satisfy your expectations, take advantage of the Seach industry to obtain the correct develop.

- When you are positive that the form is proper, go through the Acquire now key to get the develop.

- Select the costs plan you need and enter in the required info. Make your account and pay for your order using your PayPal account or credit card.

- Choose the document structure and acquire the authorized record design for your device.

- Full, change and printing and indication the received Kansas Simple Letter of Intent for Stock Acquisition.

US Legal Forms is the largest local library of authorized varieties that you can see a variety of record web templates. Utilize the company to acquire skillfully-manufactured paperwork that follow status needs.

Form popularity

FAQ

Similar to a cover letter or letter of interest, a letter of intent follows a business letter format. It should be a few paragraphs that introduce you as a candidate, outline your intentions, and encourage the reader to follow up.

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

Format your letter of intent just like a cover letter?with three paragraphs and 1-inch margins. Use your first paragraph to hook the reader fast with your #1 accomplishment. In paragraph two, add more achievements that show you fit the job like hand-in-glove. Write a call-to-action in the last paragraph of your LOI.

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

Use the first one or two sentences of your letter to formally introduce yourself. This section can include your name, a brief explanation of your current experience level and your reason for writing. For example, if you're a recent graduate, include information about your degree and areas of study.

How to Fill Out an Investment Letter of Intent Step 1 ? Effective date and subject. ... Step 2 ? Investor and investment. ... Step 3 ? Investment amount. ... Step 4 ? Principal shareholders. ... Step 5 ? Shares. ... Step 6 ? Transaction. ... Step 7 ? Financing. ... Step 8 ? Access to information.

Components of a LOI Opening Paragraph: Your summary statement. ... Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1?2 paragraphs; before or after the Project Activity) ... Credentials (1?2 paragraphs) ... Budget (1?2 paragraphs) ... Closing (1 paragraph) ... Signature.

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.