Kansas Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

Have you been inside a placement that you will need papers for sometimes company or individual uses almost every working day? There are tons of legitimate record layouts available online, but getting types you can rely on isn`t easy. US Legal Forms provides 1000s of develop layouts, such as the Kansas Form of Parent Guaranty, that are published to meet federal and state requirements.

In case you are previously acquainted with US Legal Forms web site and get a free account, basically log in. Afterward, you are able to obtain the Kansas Form of Parent Guaranty format.

Should you not have an accounts and wish to start using US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for the right city/state.

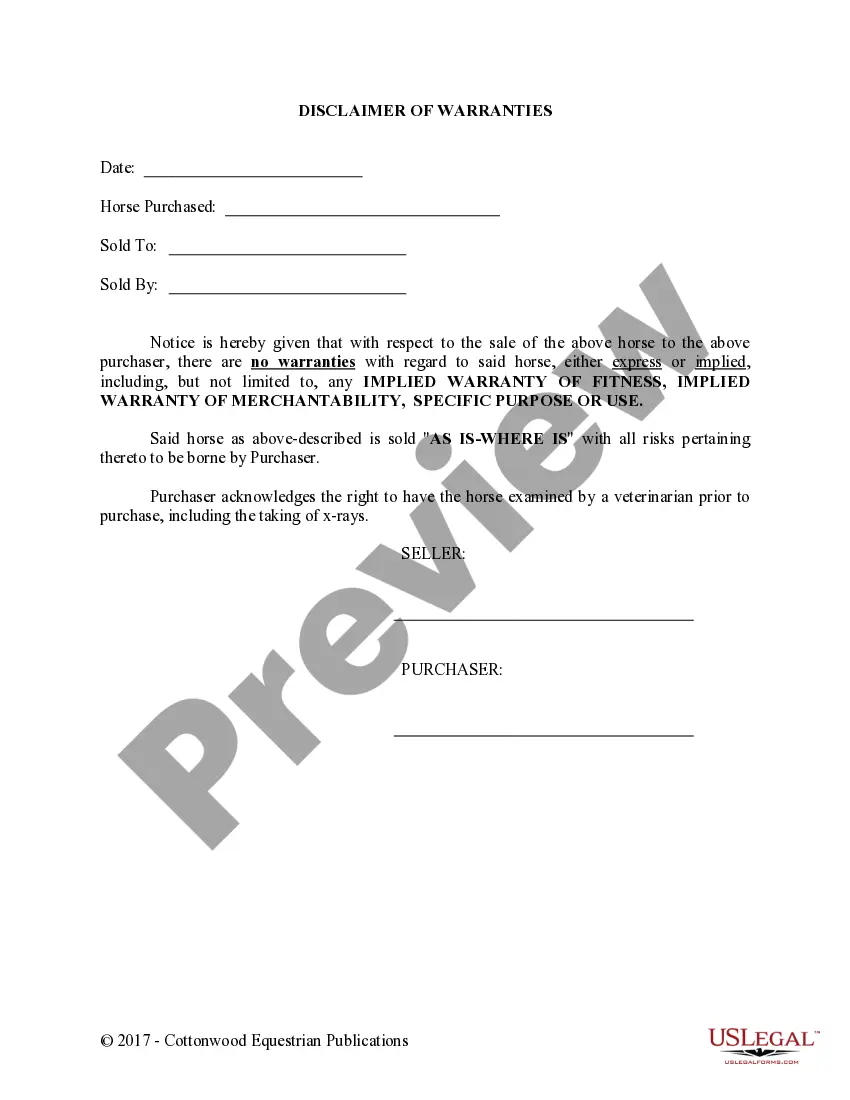

- Take advantage of the Preview switch to check the form.

- Read the explanation to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you`re searching for, make use of the Lookup area to discover the develop that suits you and requirements.

- When you find the right develop, click on Purchase now.

- Choose the costs program you need, fill in the required information to produce your money, and buy the order utilizing your PayPal or bank card.

- Decide on a hassle-free file format and obtain your copy.

Find each of the record layouts you may have bought in the My Forms food selection. You can get a further copy of Kansas Form of Parent Guaranty whenever, if needed. Just go through the required develop to obtain or produce the record format.

Use US Legal Forms, probably the most comprehensive collection of legitimate forms, to save lots of some time and steer clear of mistakes. The assistance provides professionally created legitimate record layouts which you can use for an array of uses. Produce a free account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

The guarantee is a contract by which a natural or legal person guarantees or assures the fulfillment of obligations, assuming the payment a debt of another person if this does not.

What is a Guaranty Of Payment? A guaranty of payment is a document that guarantees the person who signs it will pay any debts or liabilities incurred by another party. For example, this agreement can be helpful when a seller needs financial assurance from a buyer.

The Guarantee Agreement Form Using a guarantee agreement form formalizes your agreement by setting out the terms under which you will provide financial backing for the repayment of a loan or debt. This assures that a lease or mortgage will be paid or credit card charges paid off.

Guarantees are typically used in banking transactions as a form of collateral for a debt. In such circumstances, they are a contractual arrangement where one party agrees to answer for the liability of another party to another party.

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

Definition. The form of payment guarantee controls how the payment of a sales document item is guaranteed. In Risk Management for Receivables you can use both credit management as well as the following forms of payment guarantee: Financial documentary payments (for example, letters of credits or documentary collection) ...

A Guaranty Agreement is a contract that outlines your role in the process. It supports the obligation of a borrower to a lender; in the primary contract the borrower agrees to provide the lender with something of value, like money or goods and services.