A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

In the event that you need to compile, download, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Employ the site's user-friendly and convenient search feature to find the documents you need.

A variety of templates for business and personal use are categorized by type and state, or by keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Kansas Guaranty of Payment by Limited Partners of Notes Created by General Partner for Limited Partnership in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Kansas Guaranty of Payment by Limited Partners of Notes Created by General Partner for Limited Partnership.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

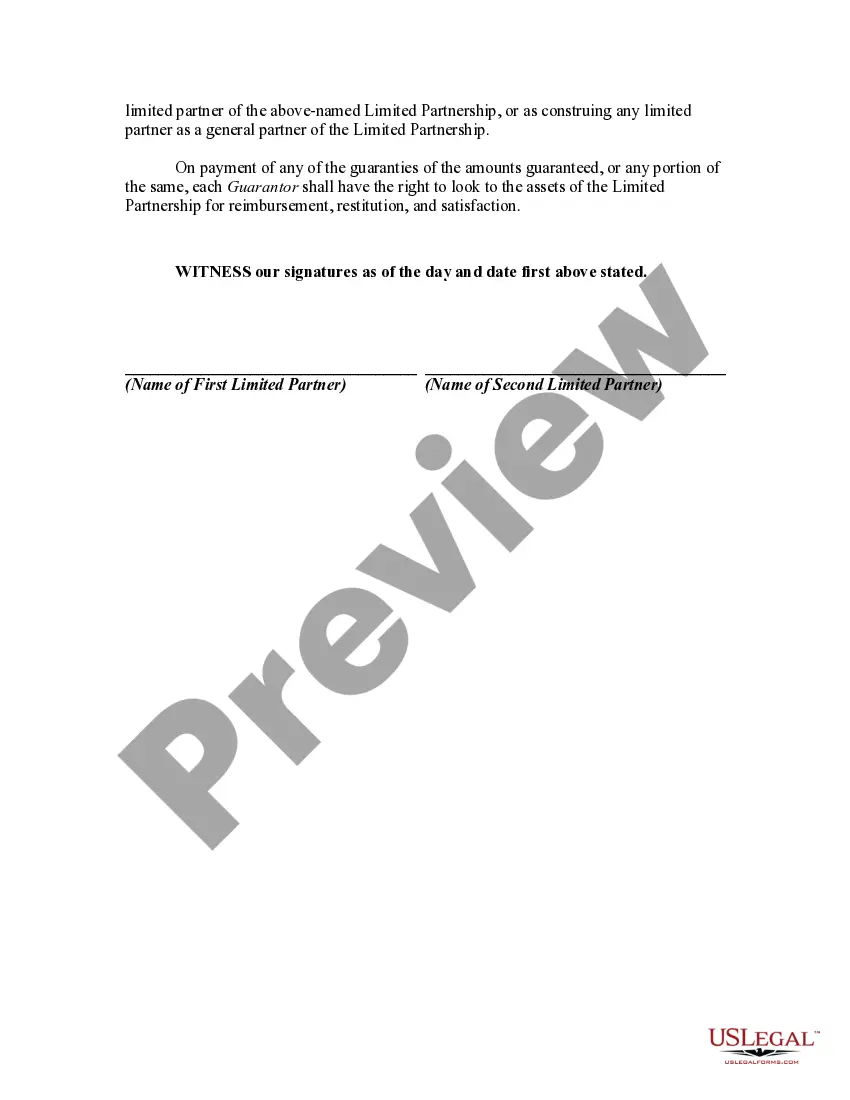

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to look for other versions of the legal form template.

Form popularity

FAQ

Yes, a general partner is indeed liable for the debts of a limited partnership. This unlimited liability means that general partners can be held responsible for the financial obligations of the partnership, which can significantly impact their personal finances. Understanding the implications of the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership can help mitigate potential risks.

To file as a foreign entity in Kansas, you need to complete the necessary application process. This involves filling out the appropriate forms and submitting them to the Kansas Secretary of State. It is essential to comply with the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership when establishing your business's legal standing.

In a limited partnership, a general limited partner has full liability for the debts and obligations of the partnership. This means that if the partnership faces financial difficulties, the general partner's personal assets may be at risk. Therefore, understanding the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is crucial for anyone taking on this role.

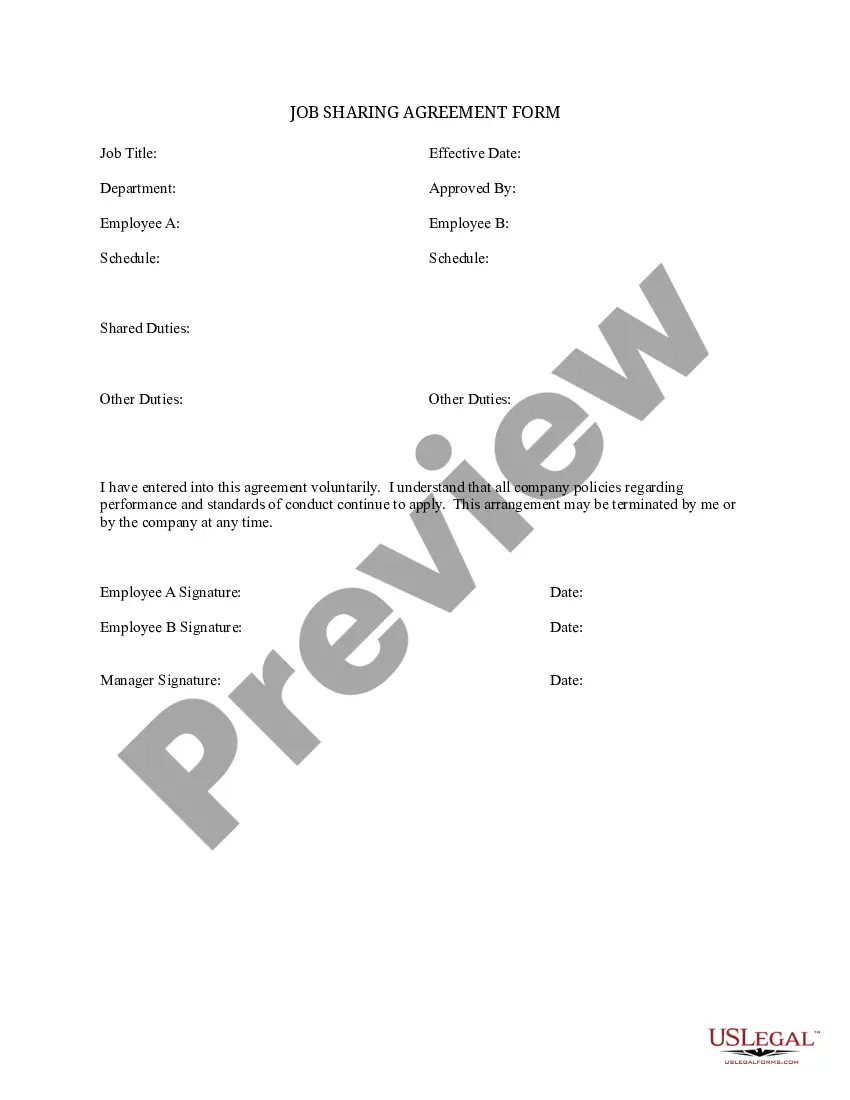

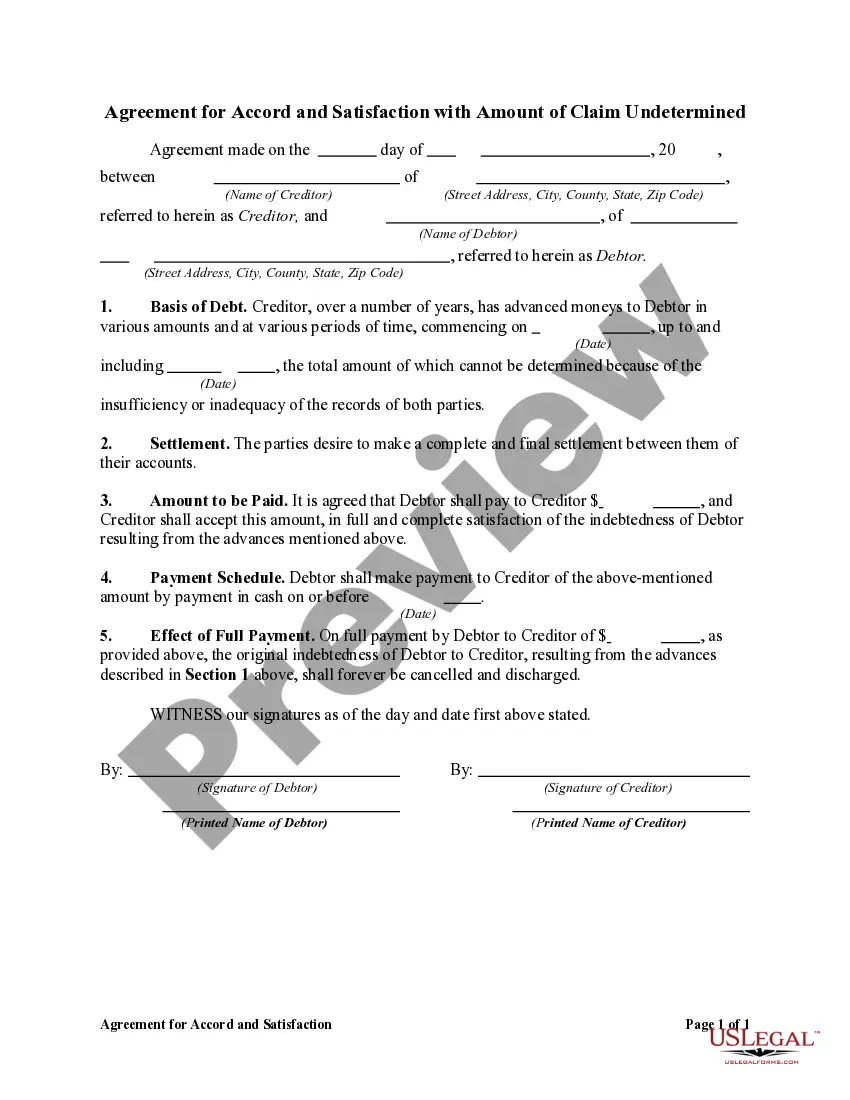

Creating a partnership form involves drafting a partnership agreement that specifies the roles, contributions, and profit-sharing arrangements of each partner. You can manually draft this document or use templates designed for this purpose. Ensuring that your form complies with the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership helps eliminate potential legal issues. Resources from USLegalForms can simplify this process significantly.

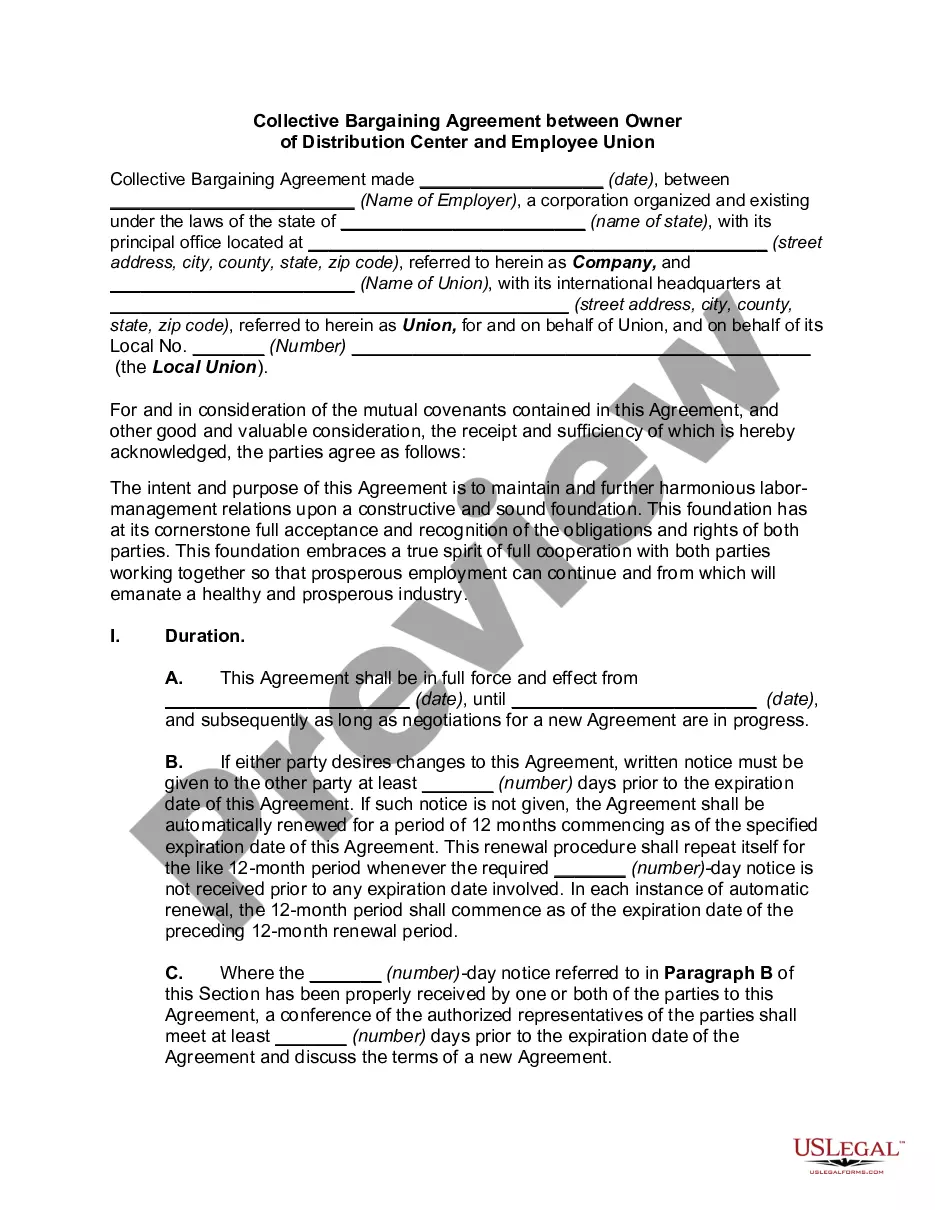

A general partner manages the day-to-day operations of the limited partnership and assumes full responsibility for its debts and obligations. They make key decisions and negotiate contracts, driving the business towards its objectives. Recognizing the implications of the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is vital for managing risk and obligations. USLegalForms can help create the necessary documentation for clarity.

To form a partnership, you need a partnership agreement that delineates the roles, responsibilities, and contributions of each partner. It is also important to register your business name and obtain any necessary licenses or permits. Understanding the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is beneficial for defining liability and financial commitments. Using templates from USLegalForms can expedite this process.

In Kansas, domestic partnerships generally require two individuals who share a domestic life but are not married. To qualify, both parties must register their partnership with the state and meet specific eligibility criteria. Familiarizing yourself with the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership can provide clarity on how these rules affect your partnership's financial obligations. USLegalForms offers resources to help you navigate these regulations.

Yes, Kansas requires nonresident withholding for partnerships. When a partnership distributes income to a nonresident partner, it must withhold taxes on that income. Understanding these requirements is crucial to fulfill the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, ensuring compliance and avoiding penalties. Consulting legal resources or USLegalForms can simplify this process.

Forming a partnership in Kansas requires at least two individuals or entities willing to collaborate under a common goal. You should draft a partnership agreement outlining roles, responsibilities, and profit-sharing arrangements. To ensure compliance with Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, consider using templates provided by USLegalForms for a smooth formation process.

In a limited partnership, general partners hold full liability for the partnership's debts and obligations. Limited partners, on the other hand, are only liable to the extent of their investment in the business unless they take on management roles. It's essential to understand these distinctions to navigate the Kansas Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership effectively. Legal structures can safeguard your interests, and USLegalForms can help you implement the necessary agreements.