A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

If you wish to be thorough, acquire, or printing authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly search to find the files you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability in just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to each form you downloaded in your account. Visit the My documents section to select a form to print or download again.

Fill out and download, and print the Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms user, sign in to your account and click on the Download button to obtain the Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

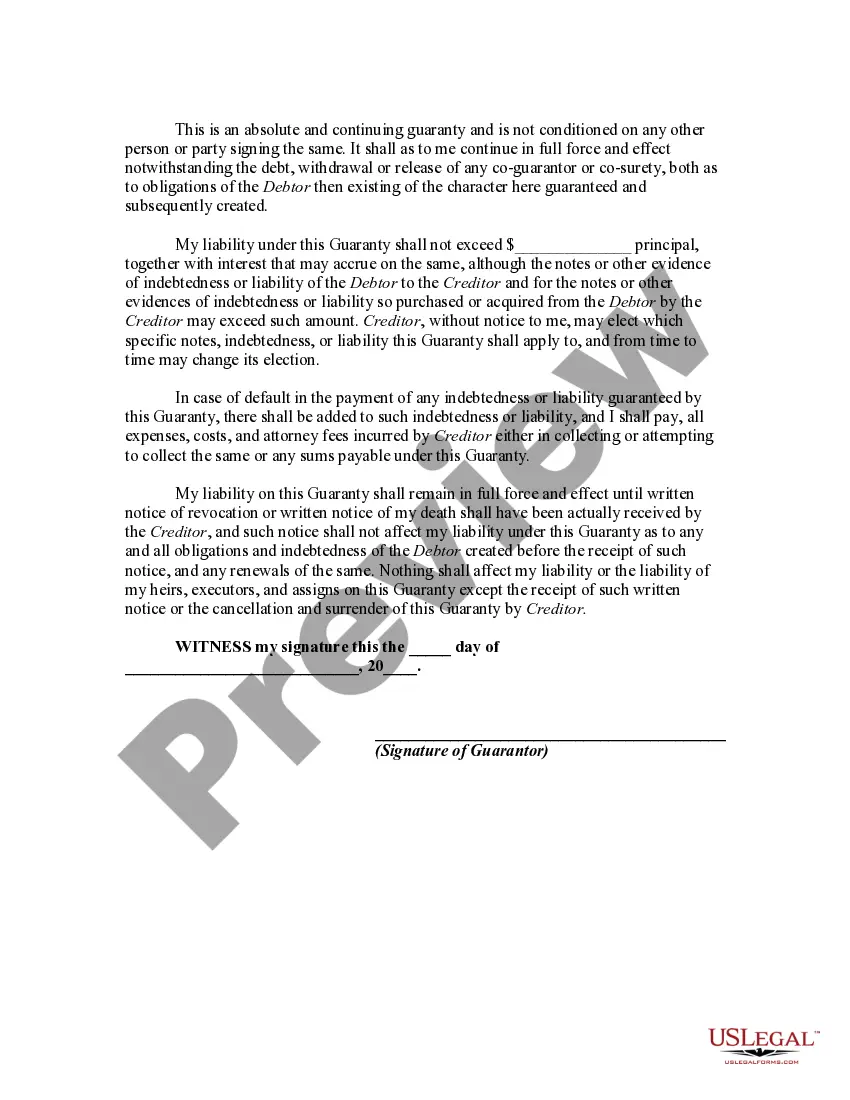

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to locate alternative templates of the legal form format.

- Step 4. Once you find the form you need, click the Get now button.

- Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

Form popularity

FAQ

The primary liability of a guarantor in a Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is to ensure that the debt is repaid should the borrower fail to do so. This liability may extend to legal fees and other costs associated with recovering the debt. Being aware of this responsibility allows guarantors to prepare appropriately. If you're looking for structured guidance, the uslegalforms platform can provide documents to clarify these obligations.

A guarantor offers a broad obligation to cover the full debt of the borrower, while a limited guarantor's responsibilities are restricted to specific conditions or amounts. In the context of a Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding this distinction is crucial. It affects financial exposure and risk management. Knowing your role can assist in making more informed financial decisions.

The three main types of guarantees include absolute guarantees, limited guarantees, and conditional guarantees. An absolute guarantee involves a full commitment to cover any default, while a limited guarantee restricts the amount the guarantor is liable for. Conditional guarantees depend on specific events occurring before the guarantor must act. Familiarizing yourself with these types can help navigate a Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability effectively.

In a Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, the guarantor assumes significant responsibilities. This includes the obligation to fulfill debts if the primary borrower defaults. Furthermore, a guarantor may face potential legal action if they fail to honor their commitments. It's essential to understand these liabilities to avoid unexpected financial burdens.

A guarantor is a broader term that refers to anyone who guarantees another party’s debt, while a personal guarantor specifically refers to an individual providing that guarantee. The distinction matters in terms of liability and the extent of financial risk. Understanding Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can clarify these roles and responsibilities.

To make a personal guarantee, you need to sign a written agreement that clearly states your commitment to cover the borrower’s debts if they default. It is crucial to understand what you are guaranteeing and the potential risks involved. You can seek guidance on Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability to ensure clarity in your obligations.

Guarantors can typically be classified into three categories: personal, corporate, and limited. Each type has its distinct characteristics and implications, especially regarding financial responsibility and liability. Learning about the Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability is crucial to choosing the right guarantor for your needs.

A guarantor can protect themselves by setting clear limits in the guarantee agreement and thoroughly reviewing the borrower’s financial status. Additionally, ensuring the guarantee has a defined scope can reduce exposure to significant liabilities. The Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability offers vital insights for safeguarding your interests.

A limited guarantor provides a guarantee that limits their exposure to a certain amount or specific terms. This type of guaranty can protect the guarantor’s personal assets and provides clarity on the obligations involved. Knowing more about Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can help you make informed decisions as a limited guarantor.

A personal guarantor is an individual who agrees to be responsible for the debt of a borrower, typically based on their personal assets. In contrast, a corporate guarantor is a business entity that takes on the responsibility for another company's debt. With Kansas Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, understanding these distinctions can help you navigate your financial responsibilities effectively.