This form expresses the intent of the assignor in this assignment to assign and convey to assignee, subject to all the stated reservations and conditions in this assignment, all of assignor's rights, title, and interests on the Effective Date, in and to the oil and gas leases and lands that are the subject of this assignment, regardless, as to the descriptions, of the omission of any lease or leases, errors in description, any incorrect or misspelled names or any transcribed or incorrect recording references.

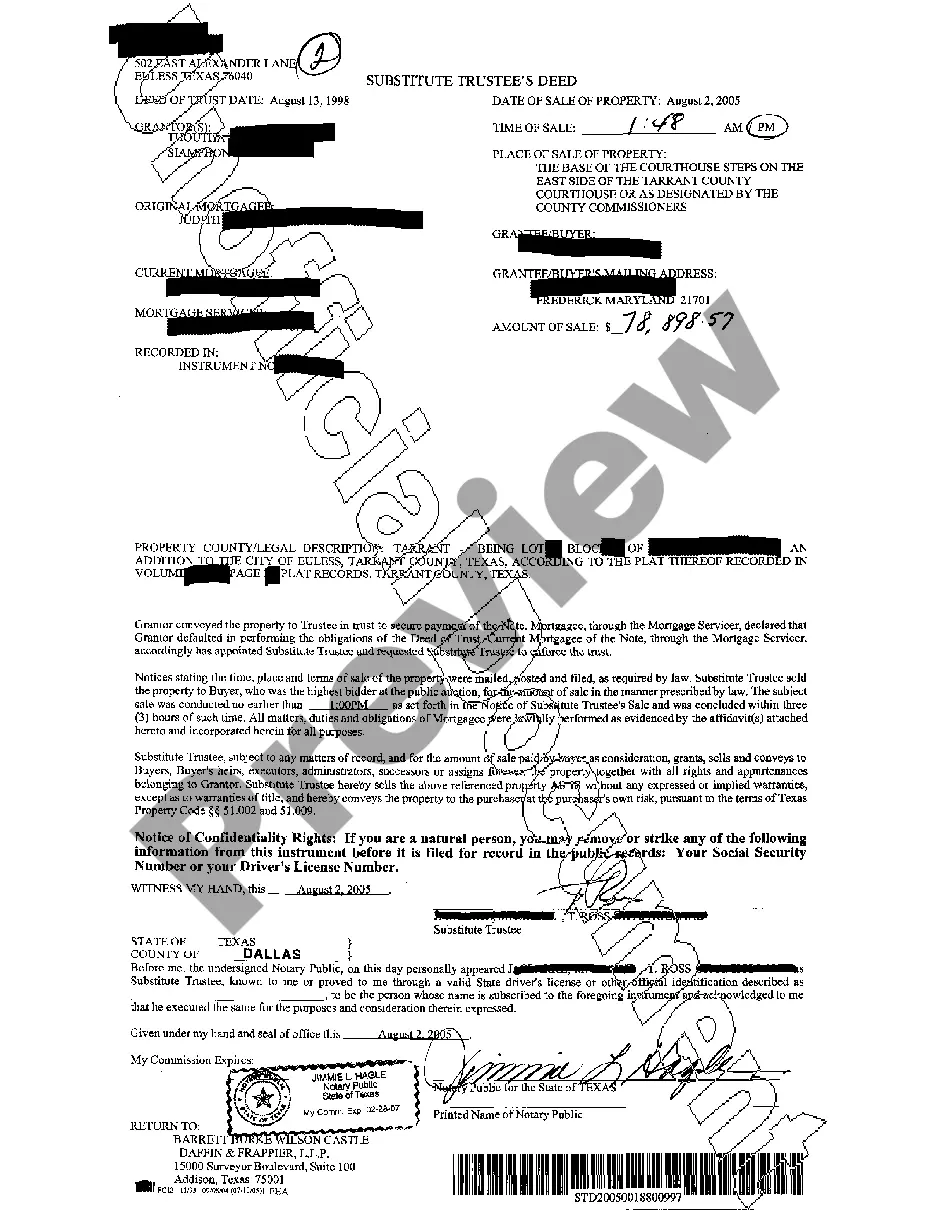

Kansas Entire Interest Assigned

Description

How to fill out Entire Interest Assigned?

Discovering the right legal record template can be quite a have difficulties. Obviously, there are a lot of web templates available online, but how would you obtain the legal kind you require? Take advantage of the US Legal Forms internet site. The service gives thousands of web templates, for example the Kansas Entire Interest Assigned, that can be used for organization and personal requires. Every one of the varieties are inspected by professionals and satisfy state and federal needs.

If you are previously listed, log in in your bank account and click the Obtain button to find the Kansas Entire Interest Assigned. Make use of bank account to check through the legal varieties you have bought earlier. Proceed to the My Forms tab of the bank account and have one more version in the record you require.

If you are a whole new end user of US Legal Forms, listed below are straightforward recommendations that you should stick to:

- Initial, make sure you have selected the right kind for your area/area. You may look through the form using the Preview button and look at the form information to guarantee this is the right one for you.

- In the event the kind will not satisfy your preferences, make use of the Seach discipline to get the right kind.

- When you are certain that the form is suitable, click on the Acquire now button to find the kind.

- Pick the rates plan you want and enter the needed details. Design your bank account and pay for an order with your PayPal bank account or Visa or Mastercard.

- Select the submit format and acquire the legal record template in your system.

- Total, revise and print out and signal the received Kansas Entire Interest Assigned.

US Legal Forms will be the most significant library of legal varieties where you will find a variety of record web templates. Take advantage of the service to acquire professionally-manufactured files that stick to condition needs.

Form popularity

FAQ

If you were a Kansas resident for the entire year, you must file a Kansas individual income tax return if: 1) you are required to file a federal income tax return; or, 2) your Kansas adjusted gross income is more than the total of your Kansas standard deduction and exemption allowance.

The state will impose a penalty of 1% of the total tax due for each month that you're behind in filing or paying, up to a maximum of 24%. Kansas Sales Tax Information, Sales Tax Rates, and Deadlines accuratetax.com ? resources ? kansas accuratetax.com ? resources ? kansas

PART-YEAR RESIDENTS. You are considered a part-year resident of Kansas if you were a Kansas resident for less than 12 months during the tax year. As a part-year resident, you must include the dates that you were a resident in Kansas on Form K-40 and complete Part B of Schedule S. Kansas Form K-40 Instructions - eSmart Tax esmarttax.com ? tax-forms ? kansas-form-k-... esmarttax.com ? tax-forms ? kansas-form-k-...

Kansas Income Tax Brackets and Rates: Single, Head of Household, or Married Filing Separately For the portion of your Kansas taxable income that's over:But not over:Your tax rate for the 2021 tax year is:$0$2,5000%$2,500$15,0003.10%$15,000$30,0005.25%$30,000?5.70%1 more row

You must show intent to remain in Kansas indefinitely. There are things that can strengthen your case but won't make you a resident by themselves. They are Kansas driver's license, voter registration in Kansas, car registration in Kansas, owning a home in Kansas, etc.

Kansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 4.25 percent, and an average combined state and local sales tax rate of 8.66 percent. Kansas's tax system ranks 25th overall on our 2023 State Business Tax Climate Index. Kansas Tax Rates & Rankings taxfoundation.org ? location ? kansas taxfoundation.org ? location ? kansas

Don't confuse part-year residency with nonresidency. Part-year residents are usually those who actually lived in the state for a portion of the year, although there are some exceptions to this rule. A nonresident simply made income in the state without maintaining a home there.