Kansas Assignment of Overriding Royalty Interest For A Term of Years

Description

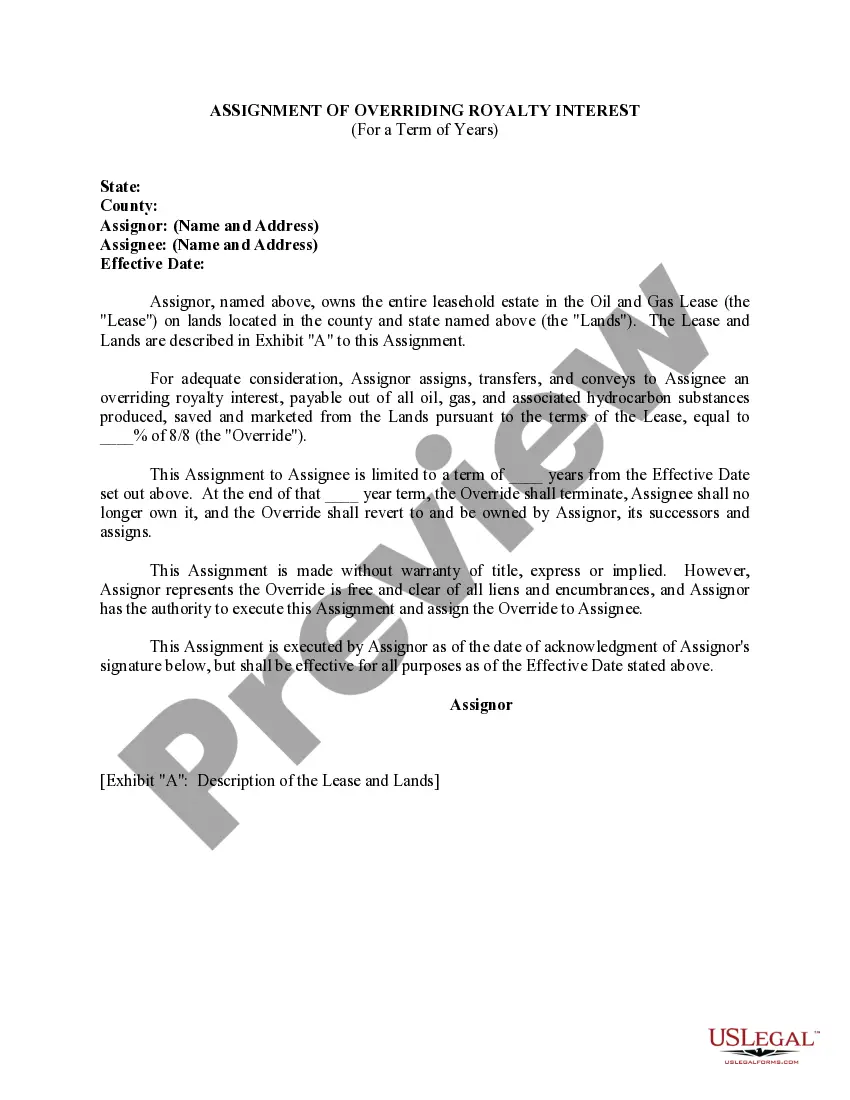

How to fill out Assignment Of Overriding Royalty Interest For A Term Of Years?

US Legal Forms - one of the biggest libraries of legitimate types in the USA - delivers a variety of legitimate record templates you may down load or print. Using the web site, you will get a large number of types for enterprise and personal functions, categorized by types, suggests, or keywords.You will discover the newest types of types much like the Kansas Assignment of Overriding Royalty Interest For A Term of Years within minutes.

If you currently have a membership, log in and down load Kansas Assignment of Overriding Royalty Interest For A Term of Years from the US Legal Forms collection. The Acquire button can look on each and every form you perspective. You get access to all in the past downloaded types in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed here are easy instructions to obtain started off:

- Be sure you have picked out the correct form for your personal metropolis/region. Go through the Preview button to examine the form`s articles. See the form description to ensure that you have selected the correct form.

- In the event the form doesn`t satisfy your specifications, take advantage of the Search area near the top of the display to find the one which does.

- In case you are pleased with the shape, affirm your option by clicking the Buy now button. Then, opt for the rates plan you favor and provide your references to sign up for an accounts.

- Procedure the financial transaction. Use your charge card or PayPal accounts to accomplish the financial transaction.

- Find the formatting and down load the shape on the system.

- Make adjustments. Fill out, edit and print and sign the downloaded Kansas Assignment of Overriding Royalty Interest For A Term of Years.

Each and every design you put into your account does not have an expiration date and is also yours for a long time. So, in order to down load or print another duplicate, just visit the My Forms portion and click on on the form you need.

Get access to the Kansas Assignment of Overriding Royalty Interest For A Term of Years with US Legal Forms, probably the most extensive collection of legitimate record templates. Use a large number of expert and express-specific templates that satisfy your company or personal requirements and specifications.

Form popularity

FAQ

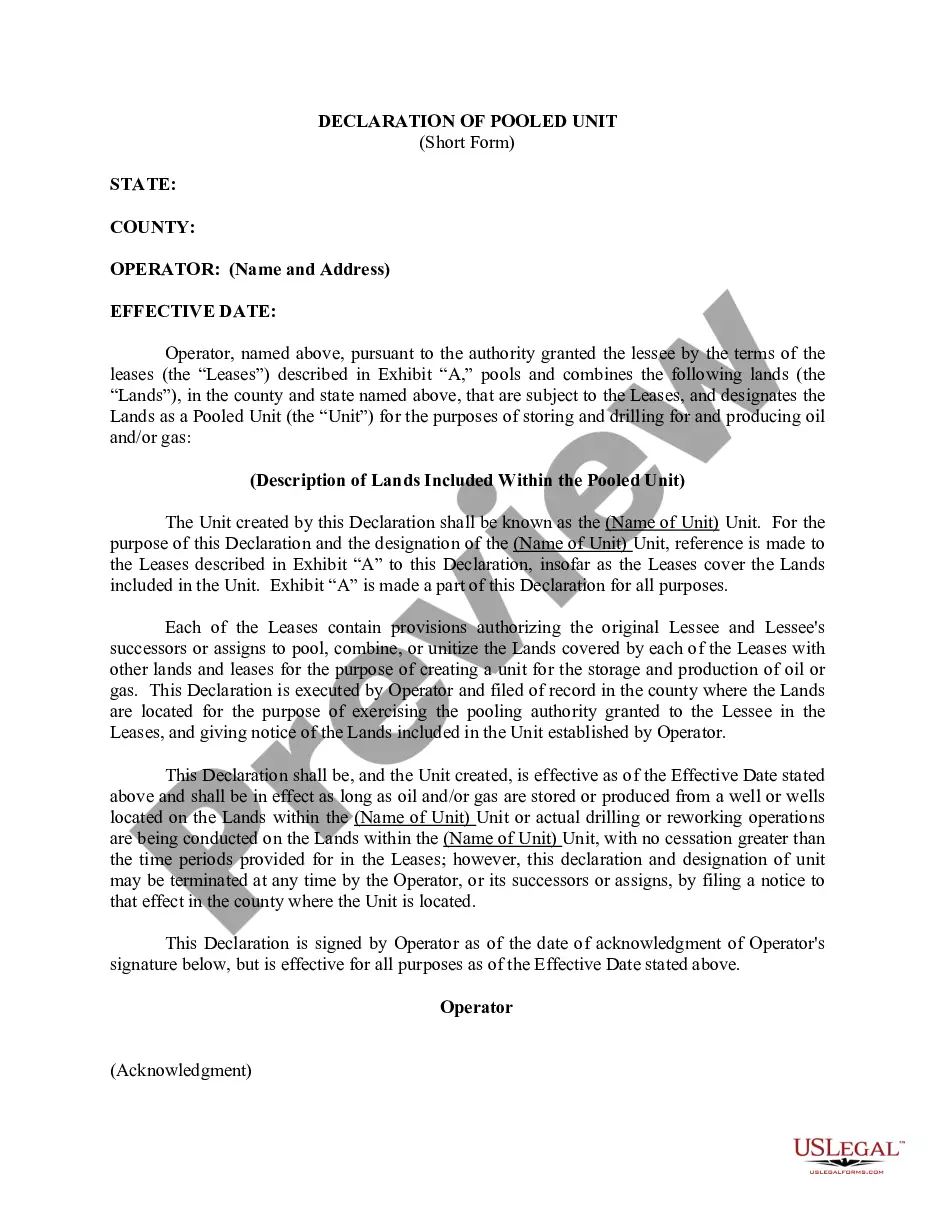

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.