New Hampshire Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Locating the appropriate legal document template can be quite a challenge. Of course, there are numerous designs accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the New Hampshire Bill of Transfer to a Trust, which can be used for business and personal needs.

All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the New Hampshire Bill of Transfer to a Trust. Use your account to search through the legal documents you have purchased previously. Visit the My documents section of your account to retrieve another copy of the documents you need.

Select the file format and download the legal document template to your device. Finally, complete, revise, print, and sign the acquired New Hampshire Bill of Transfer to a Trust. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to obtain properly crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your city/region.

- You can examine the form using the Preview option and review the form summary to ensure it is right for you.

- If the form does not satisfy your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Buy now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary details.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

While placing your home in a trust has many benefits, there are some drawbacks to consider. For instance, you may face administrative costs and ongoing maintenance for the trust. Additionally, if you use a New Hampshire Bill of Transfer to a Trust, you might encounter potential complications if your circumstances change. We recommend weighing these concerns against the advantages to make an informed decision.

Transferring property to a trust generally does not trigger immediate tax liability. However, the specifics can depend on various factors, including the type of trust and your overall financial situation. Using a New Hampshire Bill of Transfer to a Trust highlights the importance of proper documentation, which can help clarify tax responsibilities. Always consider consulting a tax professional for personalized advice.

When considering the best trust for your home, a revocable living trust often stands out. This type of trust provides flexibility, allowing you to manage your assets while you're alive, and it simplifies the transfer process upon death. Using a New Hampshire Bill of Transfer to a Trust can facilitate a smooth transition of property into the trust. Be sure to evaluate your unique situation, as the best choice may vary based on your goals.

Determining whether your parents should put their assets in a trust depends on their financial situation and goals. A trust can help manage their assets, avoid probate, and potentially reduce taxes. Using a New Hampshire Bill of Transfer to a Trust can simplify the transfer process and ensure their wishes are followed after their passing. Encouraging them to consult a legal professional can provide tailored advice based on their unique circumstances.

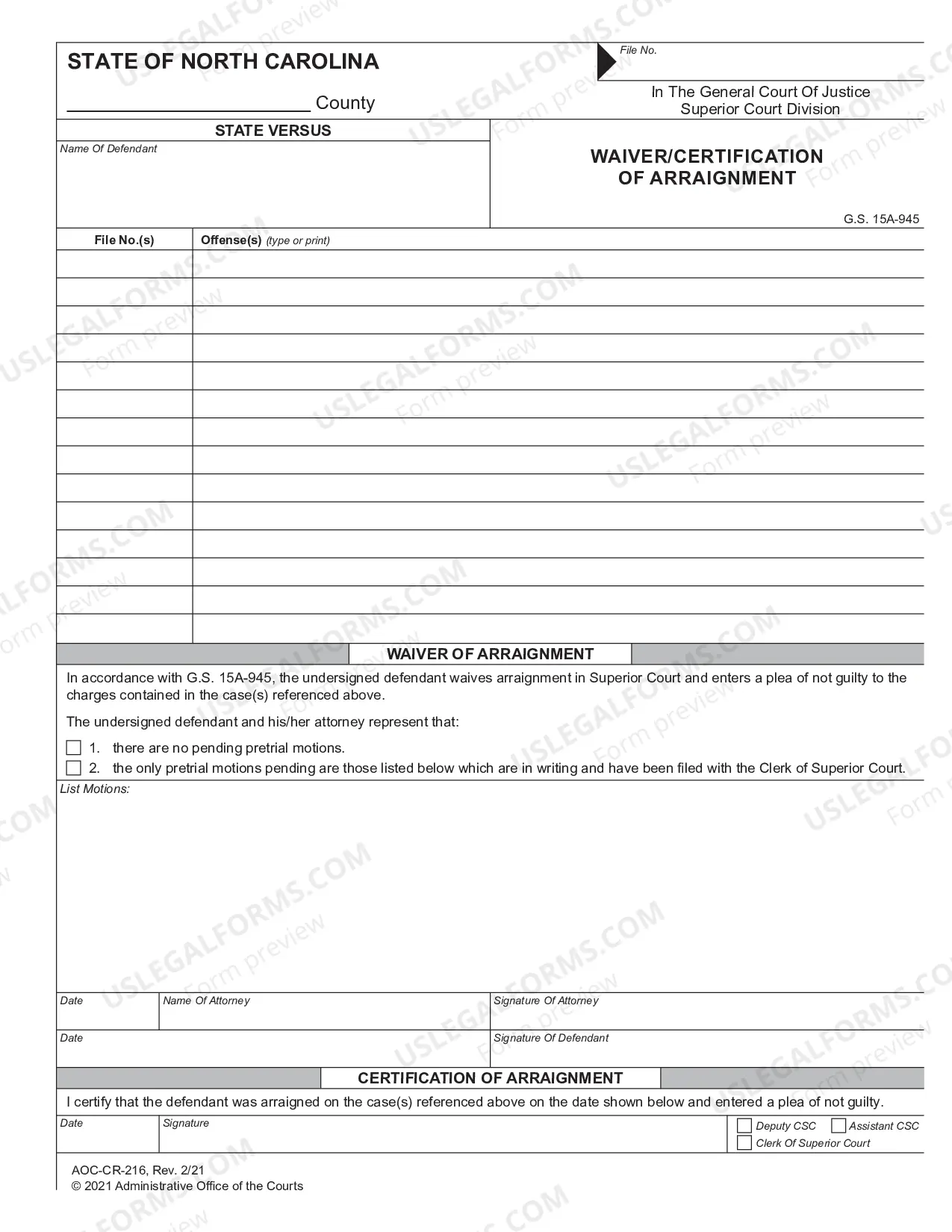

A bill of transfer in a trust is a legal document that officially transfers ownership of assets to the trust. This ensures that the trust holds the legal title to the property, which is vital for correctly managing and distributing those assets as per the trust's terms. In New Hampshire, utilizing a New Hampshire Bill of Transfer to a Trust streamlines this process and reinforces the trust's legal framework. It's advisable to work with a professional when drafting this important document.

Trust funds, while beneficial, are not without risks. Issues may arise if the trust is not managed properly or if there are changes in laws that affect trust laws. Furthermore, if the New Hampshire Bill of Transfer to a Trust is not drafted accurately, it can lead to disputes among beneficiaries. Regular reviews and updates of the trust can mitigate these risks and help maintain its effectiveness.

A notable downside of putting assets in a trust is the potential loss of control over those assets. Once placed in a trust, you can’t access them in the same way you would outside of the trust. It’s crucial to use the New Hampshire Bill of Transfer to a Trust correctly, ensuring that your wishes are respected while maintaining some level of accessibility if needed. Balancing ownership and control is key to successful estate planning.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms and purpose of the trust. This can lead to confusion and conflict among beneficiaries. It's essential to use a New Hampshire Bill of Transfer to a Trust that accurately reflects your intentions and provides detailed plans for asset distribution. Proper planning helps ensure the trust achieves its desired goals.

To put your house in a trust in New Hampshire, you must first create a trust document that outlines the terms and conditions. After establishing your trust, you need to execute a New Hampshire Bill of Transfer to a Trust. This document transfers the property title from you to the trust, ensuring the trust is the legal owner. Consulting with a legal expert can help guide you through this process and ensure all documents are properly filed.

In New Hampshire, a bill of sale is not strictly necessary to transfer title of personal property, but it is highly recommended for clarity and record-keeping. A New Hampshire Bill of Transfer to a Trust can provide a formal documentation of this transfer, ensuring that all parties have a clear understanding of the transaction. When creating a bill of sale, you establish a legal record that may protect you from disputes in the future. Utilizing platforms like US Legal Forms can simplify this process, providing you with the right templates to create a professional Bill of Transfer.