Kansas Self-Employed Route Sales Contractor Agreement

Description

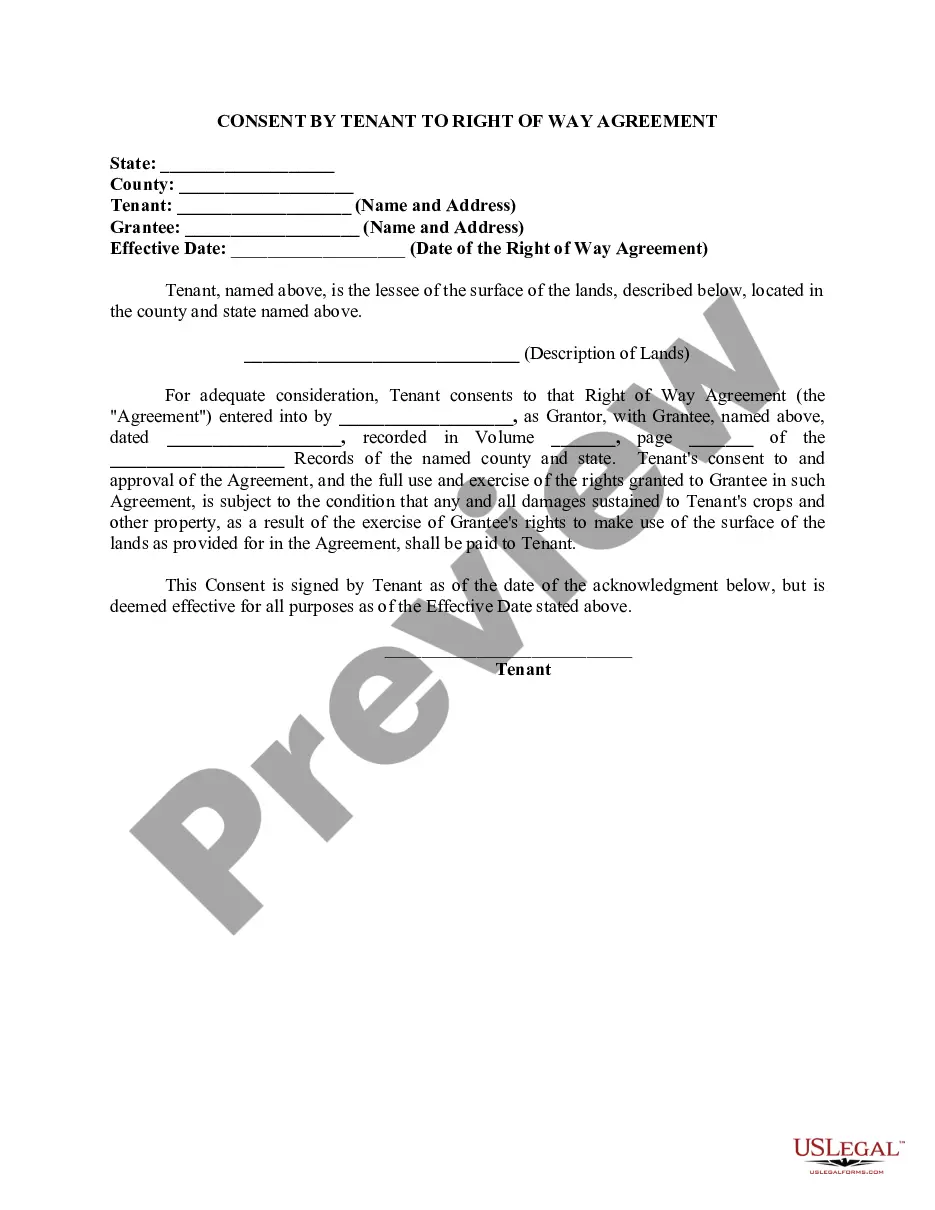

How to fill out Self-Employed Route Sales Contractor Agreement?

Selecting the ideal legal document template can be challenging. It goes without saying that there are numerous formats accessible online, but how do you obtain the legal template you need? Utilize the US Legal Forms website. The service offers a vast array of formats, such as the Kansas Self-Employed Route Sales Contractor Agreement, which can be utilized for both business and personal requirements. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Kansas Self-Employed Route Sales Contractor Agreement. Use your account to browse through the legal forms you have previously obtained. Navigate to the My documents section of your account to retrieve another copy of the document you desire.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and examine the form details to ensure it is suitable for you. If the form does not fulfill your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print, then sign the acquired Kansas Self-Employed Route Sales Contractor Agreement.

- US Legal Forms is the largest collection of legal forms that offers numerous document templates.

- Utilize the service to obtain properly crafted paperwork that comply with state requirements.

- All forms are validated by professionals.

- Access a variety of layouts for both business and personal use.

- Ensure compliance with both state and federal regulations.

- Easily manage and retrieve your previously acquired forms.

Form popularity

FAQ

Most states do not legally mandate an operating agreement for LLCs, including Kansas. However, some states encourage or recommend having one for clarity and structure. If you are engaged in a Kansas Self-Employed Route Sales Contractor Agreement, it is wise to have an operating agreement regardless of state requirements. Utilizing uslegalforms can help you navigate the nuances of operating agreements across different states.

Yes, an LLC can exist without an operating agreement in Kansas, but it is not advisable. Without this document, state laws will dictate the management structure, which may not align with your business goals. For those involved in a Kansas Self-Employed Route Sales Contractor Agreement, having an operating agreement ensures that your specific business requirements are met. Consider using uslegalforms to draft an agreement tailored to your LLC.

While not mandatory, having an operating agreement is highly beneficial for LLCs in Kansas. It lays out the management structure and operational guidelines, which can prevent misunderstandings among members. Additionally, a well-drafted operating agreement can enhance the credibility of your Kansas Self-Employed Route Sales Contractor Agreement. By using uslegalforms, you can easily create an operating agreement that fits your business needs.

Kansas does not legally require an operating agreement for LLCs. However, having a clear operating agreement can help define the roles and responsibilities of members. It can also provide clarity on how to handle disputes or changes within the company. For those entering into a Kansas Self-Employed Route Sales Contractor Agreement, an operating agreement can strengthen your business structure.

Creating an independent contractor agreement involves several key steps. First, define the scope of work, payment terms, and deadlines. Including a Kansas Self-Employed Route Sales Contractor Agreement template can provide a solid foundation for this document. For ease, consider using US Legal Forms, which offers customizable templates to help you draft a comprehensive agreement that protects both parties.

Kansas does not legally require an operating agreement for an LLC. However, having one is highly beneficial as it outlines the management structure and operating procedures of your business. A well-crafted Kansas Self-Employed Route Sales Contractor Agreement can serve as your operating agreement, helping to clarify roles and responsibilities. Utilizing platforms like US Legal Forms can simplify this process, ensuring your agreement meets state requirements.

Typically, the independent contractor agreement is drafted by the hiring party, but both parties should review and agree on its terms. It's important to ensure that the agreement protects the interests of both sides. If you're looking for a solid foundation, the Kansas Self-Employed Route Sales Contractor Agreement from US Legal Forms can provide you with a well-structured document that meets legal requirements.

To fill out an independent contractor form, start by entering the names and addresses of both parties involved. Include the scope of work, payment details, and any relevant deadlines. The Kansas Self-Employed Route Sales Contractor Agreement available on the US Legal Forms platform can serve as a comprehensive resource, helping you ensure that no crucial details are overlooked.

Filling out an independent contractor agreement requires you to input detailed information about the contractor, including their contact details and payment structure. Be sure to specify the project timeline and any performance expectations. For a seamless experience, consider using the Kansas Self-Employed Route Sales Contractor Agreement from US Legal Forms, which guides you through each step.

Writing a self-employed contract involves outlining the specific services to be provided and the terms of compensation. Ensure you include provisions for confidentiality and dispute resolution. Utilizing the Kansas Self-Employed Route Sales Contractor Agreement from US Legal Forms can simplify this process, offering you a reliable framework tailored for your needs.