Kansas Florist Services Contract - Self-Employed

Description

How to fill out Florist Services Contract - Self-Employed?

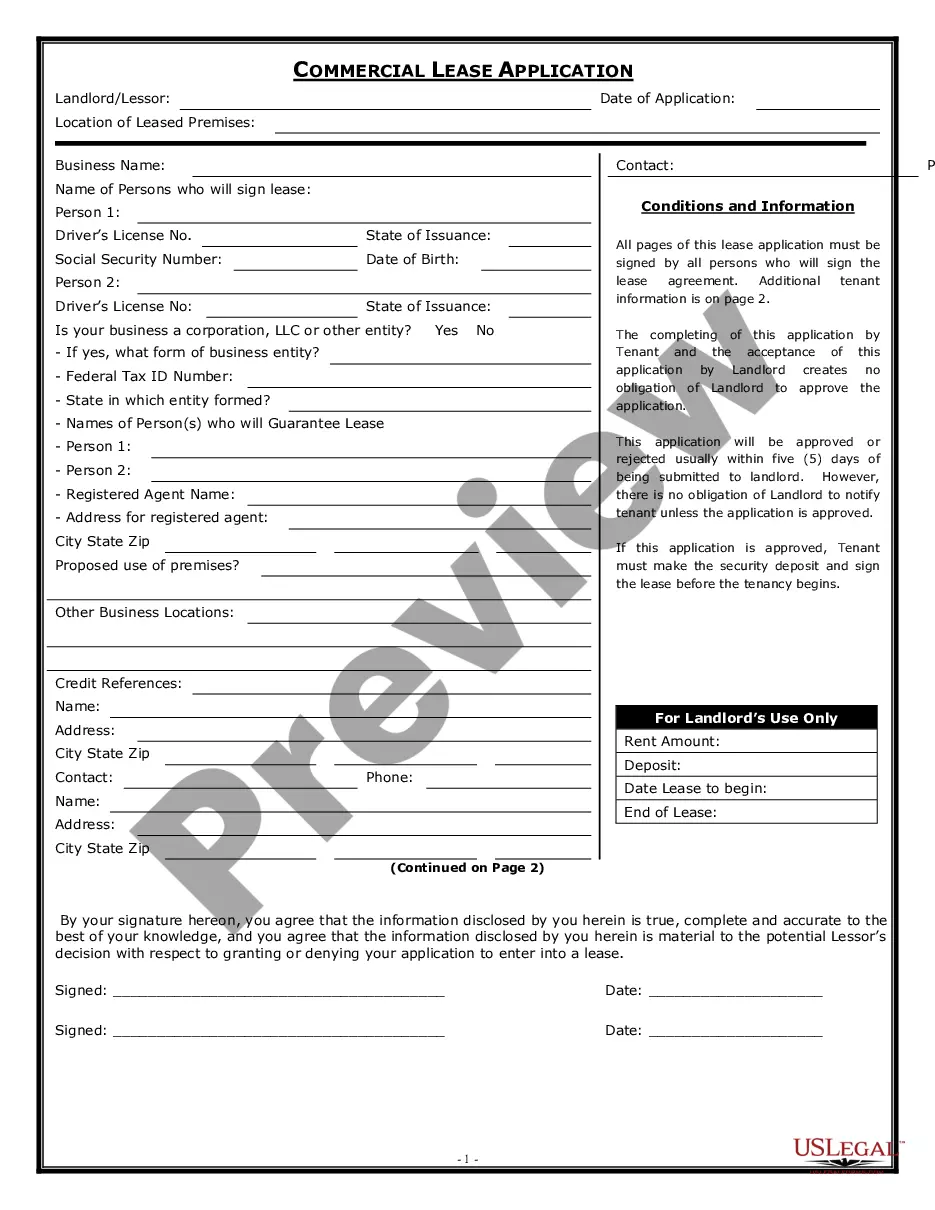

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can purchase or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Kansas Florist Services Contract - Self-Employed in just a few minutes.

If you have a monthly subscription, Log In and download the Kansas Florist Services Contract - Self-Employed from the US Legal Forms repository. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

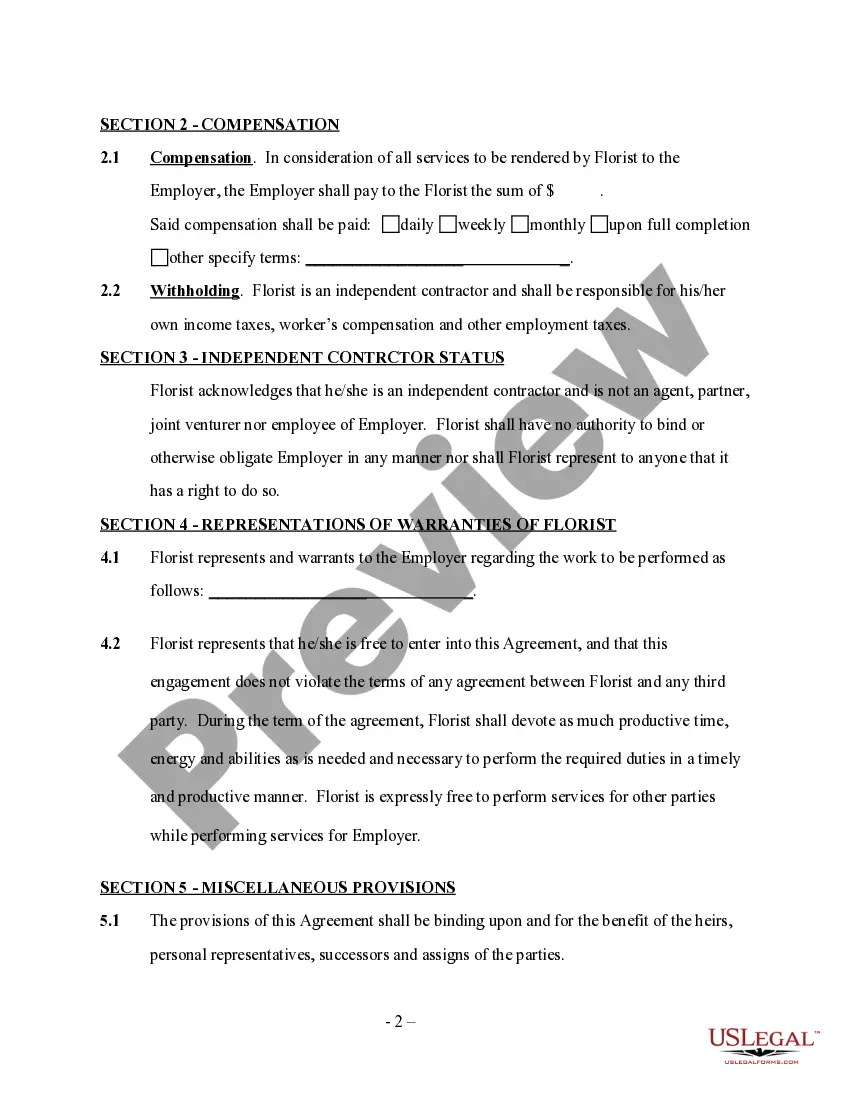

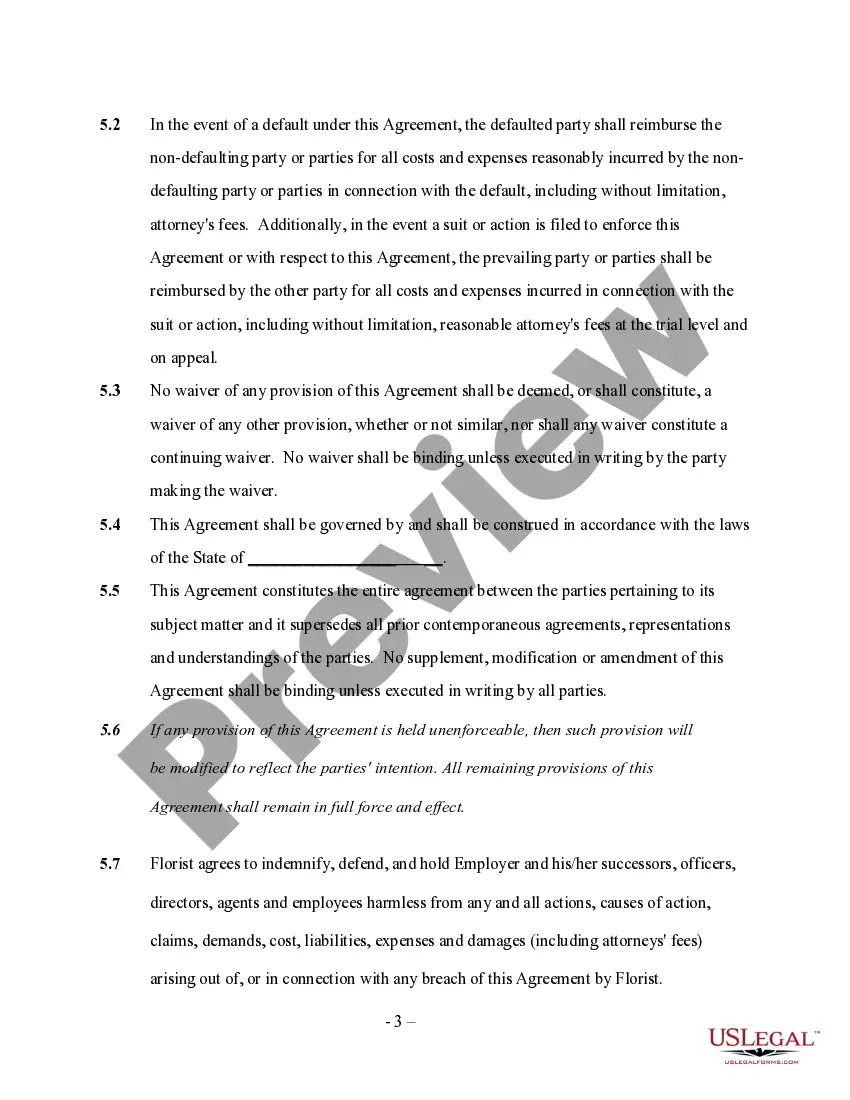

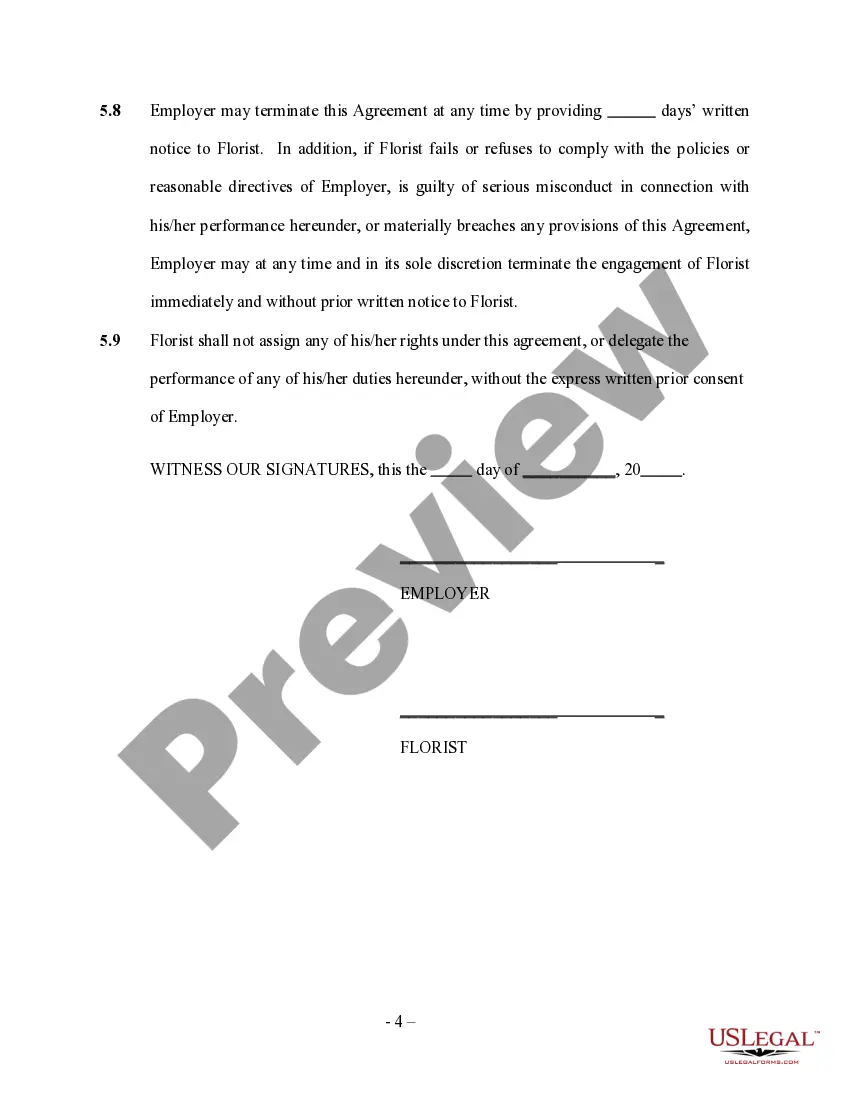

Choose the file format and download the form to your device. Make modifications. Complete, edit, print, and sign the saved Kansas Florist Services Contract - Self-Employed. Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Kansas Florist Services Contract - Self-Employed with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a wide array of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/region.

- Click the Review button to inspect the form's content.

- Read the form description to confirm that you have picked the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

While it is not mandatory to register a sole proprietorship in Kansas, doing so is highly beneficial. Registration can provide legal protection for your business name and establish your brand identity. This is especially important when entering into agreements like the Kansas Florist Services Contract - Self-Employed, as it adds professionalism and trustworthiness to your business.

Filing a DBA, or 'Doing Business As', in Kansas is a straightforward process. You must complete the application through your county's register of deeds. This step allows you to operate under a business name different from your legal name, which can be particularly useful for your Kansas Florist Services Contract - Self-Employed. Using uslegalforms can guide you through the paperwork efficiently.

In Kansas, labor services are generally not taxable unless they are related to the sale of tangible personal property. However, it’s important to understand the specific regulations that may apply to your Kansas Florist Services Contract - Self-Employed. Consulting with a tax professional or using resources from uslegalforms can clarify your responsibilities and ensure compliance.

Yes, if you plan to operate as a sole proprietor in Kansas, registration is recommended. This process helps protect your business name and provides legal recognition. Additionally, having a registered business can enhance your credibility with clients and suppliers, especially when you provide Kansas Florist Services Contract - Self-Employed.

You do not need to send a 1099 to corporations, other than those providing legal and medical services. Additionally, individuals working as employees under a standard employment contract do not qualify for a 1099 either. Being informed about these rules will facilitate better management of your Kansas Florist Services Contract - Self-Employed.

Yes, a florist may receive a 1099 form if they are self-employed and earn at least $600 in a calendar year for their services. This form serves to report income to the IRS. As you establish your floral business under a Kansas Florist Services Contract - Self-Employed, keeping track of such documents is essential for smooth tax filing.

Typically, you do not need to send a 1099 form for products purchased, such as flowers and supplies. The 1099 form mainly applies to services rendered. However, understanding the nuances of this requirement is vital when operating under a Kansas Florist Services Contract - Self-Employed.

To become a self-employed florist, start by gaining experience in floral design. You should then develop a solid business plan that outlines your services and target market. Finally, consider drafting a Kansas Florist Services Contract - Self-Employed to formalize your business agreements and streamline your operations.

Certain individuals and organizations may be exempt from issuing a 1099 form. Generally, you do not need to issue a 1099 for payments made to corporations, unless they're providing legal or medical services. If you're operating under a Kansas Florist Services Contract - Self-Employed, it’s crucial to be aware of these exemptions to ensure compliance.

Yes, a Kansas LLC must file a tax return, but the specifics depend on its tax classification. If your LLC is treated as a sole proprietorship, you report earnings on your personal tax return. For LLCs structured differently, such as partnerships or corporations, additional filings are necessary. Understanding tax obligations is vital when operating under a Kansas Florist Services Contract - Self-Employed, and utilizing resources like uslegalforms can simplify your compliance.