Kansas Telemarketing Agreement - Self-Employed Independent Contractor

Description

How to fill out Telemarketing Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of many largest libraries of authorized types in the States - gives a wide range of authorized document web templates you can obtain or print out. Using the site, you will get a large number of types for business and person uses, categorized by classes, suggests, or search phrases.You will find the latest variations of types like the Kansas Telemarketing Agreement - Self-Employed Independent Contractor in seconds.

If you already have a registration, log in and obtain Kansas Telemarketing Agreement - Self-Employed Independent Contractor through the US Legal Forms collection. The Download switch can look on each and every form you look at. You have accessibility to all previously delivered electronically types inside the My Forms tab of your own account.

If you wish to use US Legal Forms the very first time, listed here are easy recommendations to get you started:

- Be sure you have chosen the best form to your metropolis/state. Click the Review switch to review the form`s articles. See the form outline to actually have selected the correct form.

- If the form doesn`t match your requirements, use the Look for area near the top of the display screen to obtain the the one that does.

- In case you are happy with the shape, validate your option by visiting the Acquire now switch. Then, opt for the prices plan you prefer and offer your accreditations to sign up on an account.

- Method the purchase. Use your Visa or Mastercard or PayPal account to accomplish the purchase.

- Find the file format and obtain the shape on your product.

- Make modifications. Complete, edit and print out and indication the delivered electronically Kansas Telemarketing Agreement - Self-Employed Independent Contractor.

Each and every web template you included in your bank account does not have an expiry time and is yours eternally. So, in order to obtain or print out another backup, just proceed to the My Forms portion and then click around the form you need.

Obtain access to the Kansas Telemarketing Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most considerable collection of authorized document web templates. Use a large number of professional and status-certain web templates that meet up with your company or person requirements and requirements.

Form popularity

FAQ

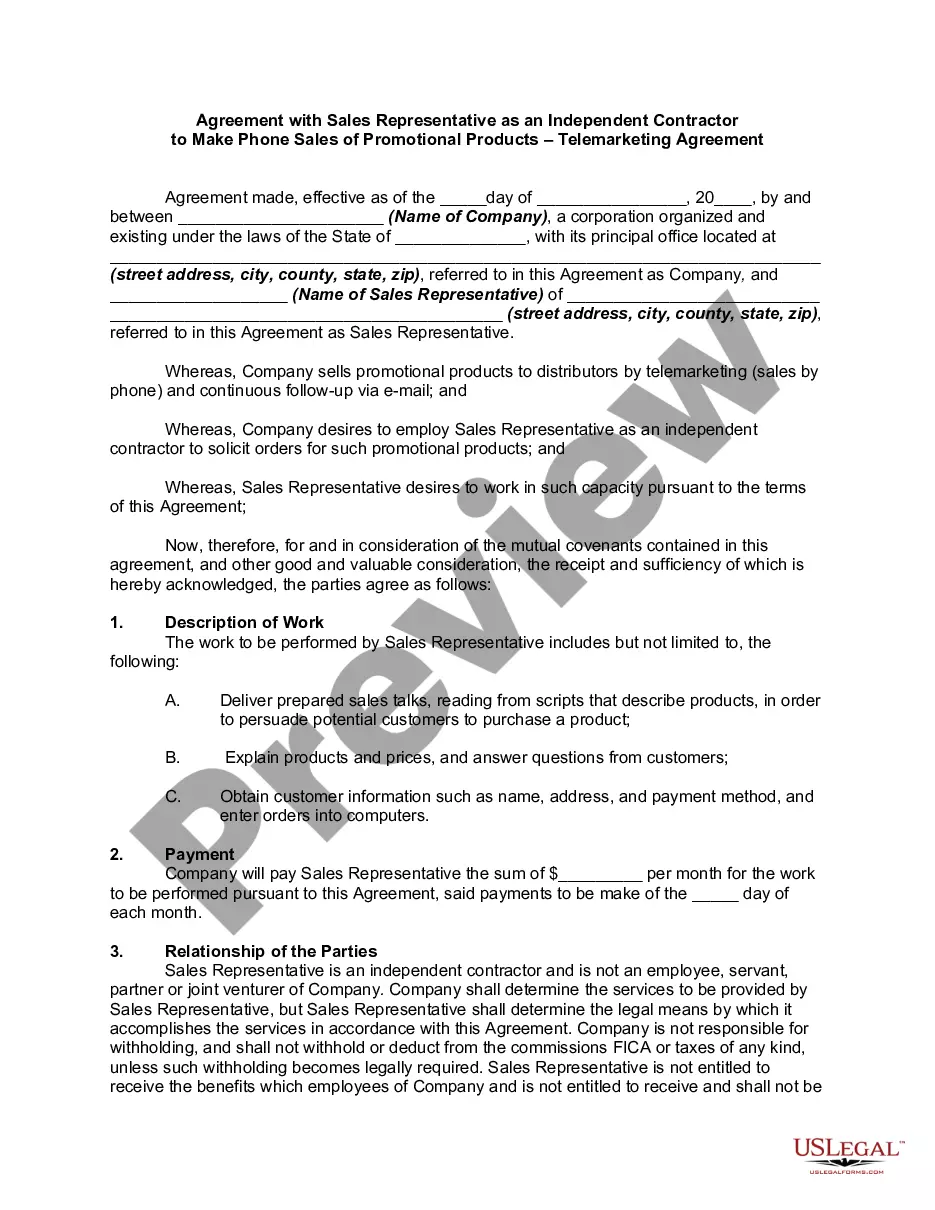

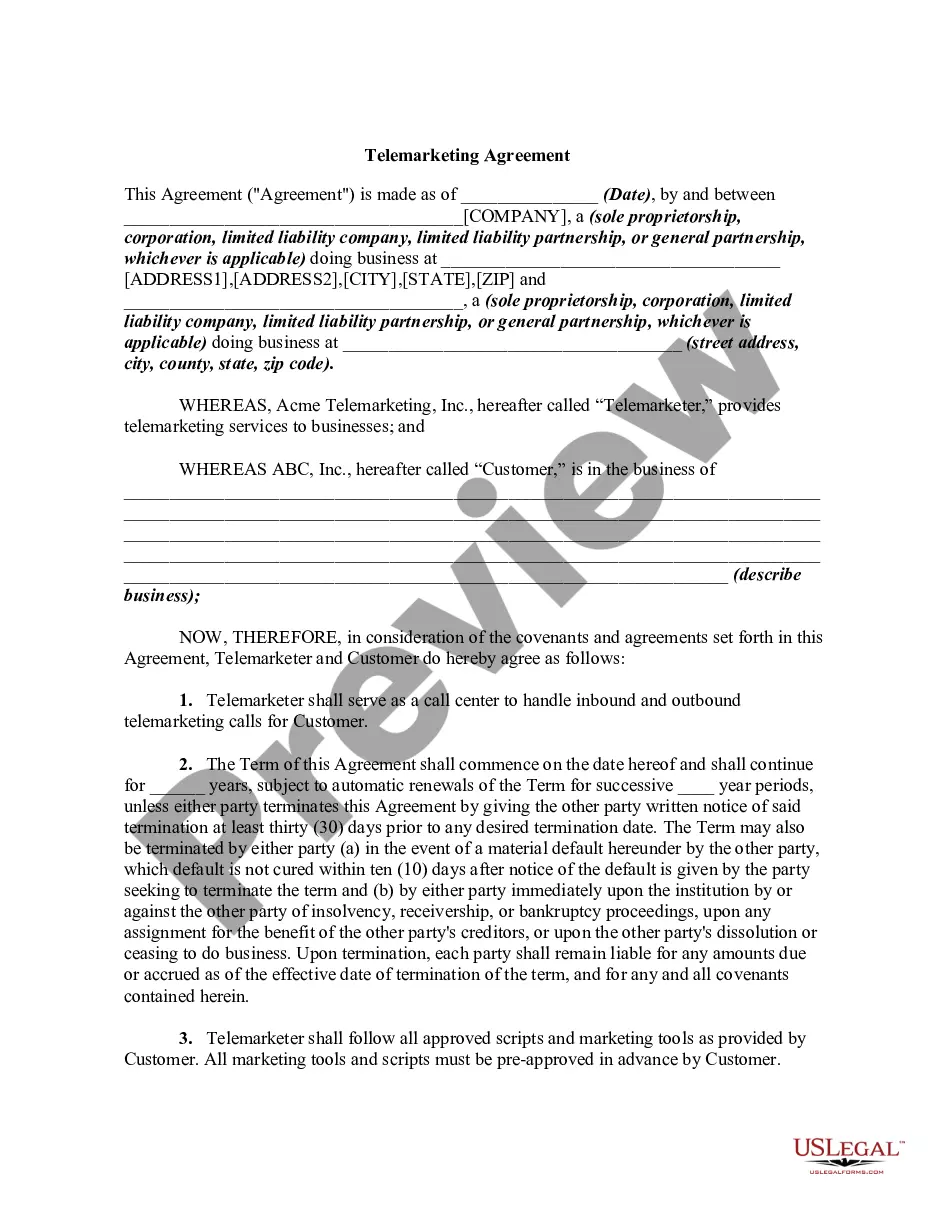

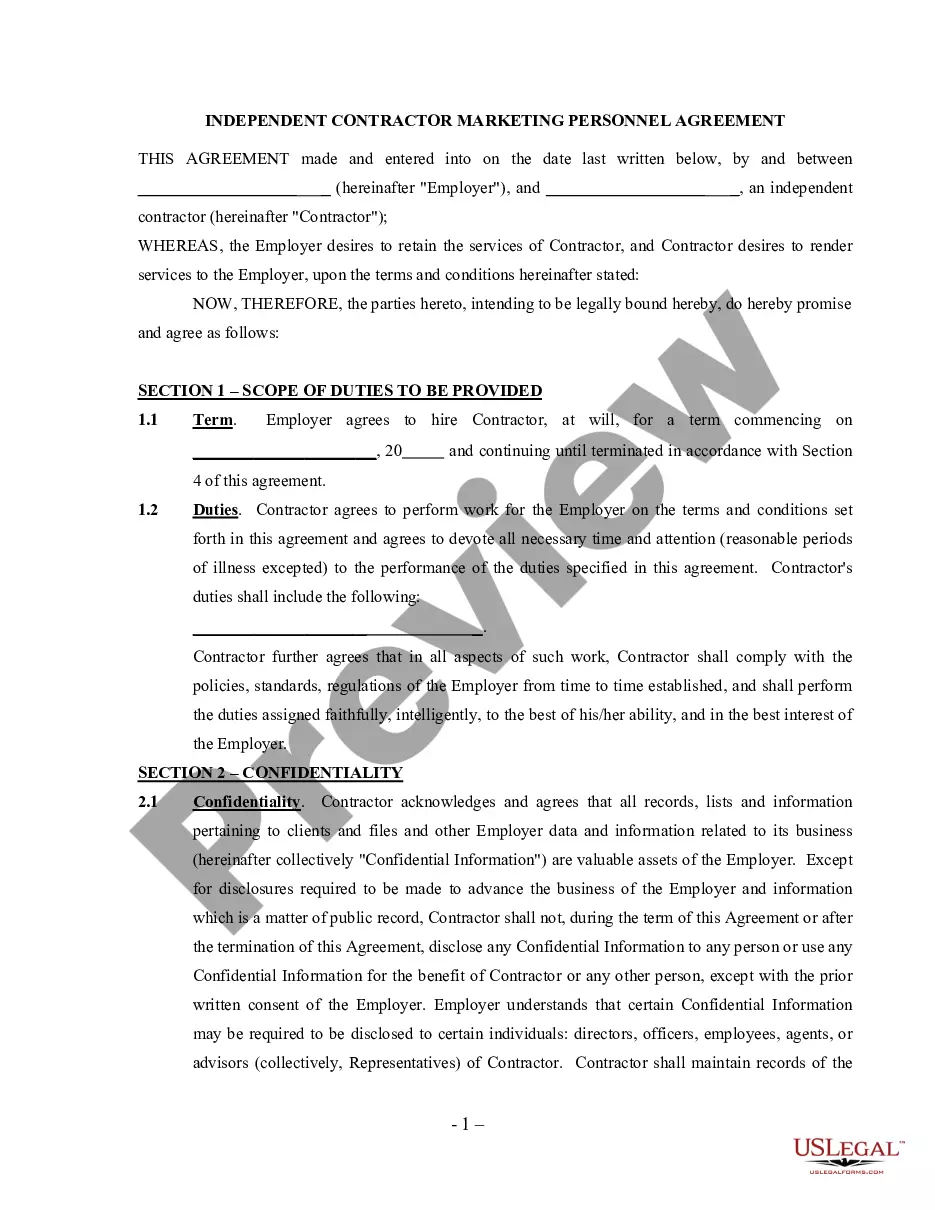

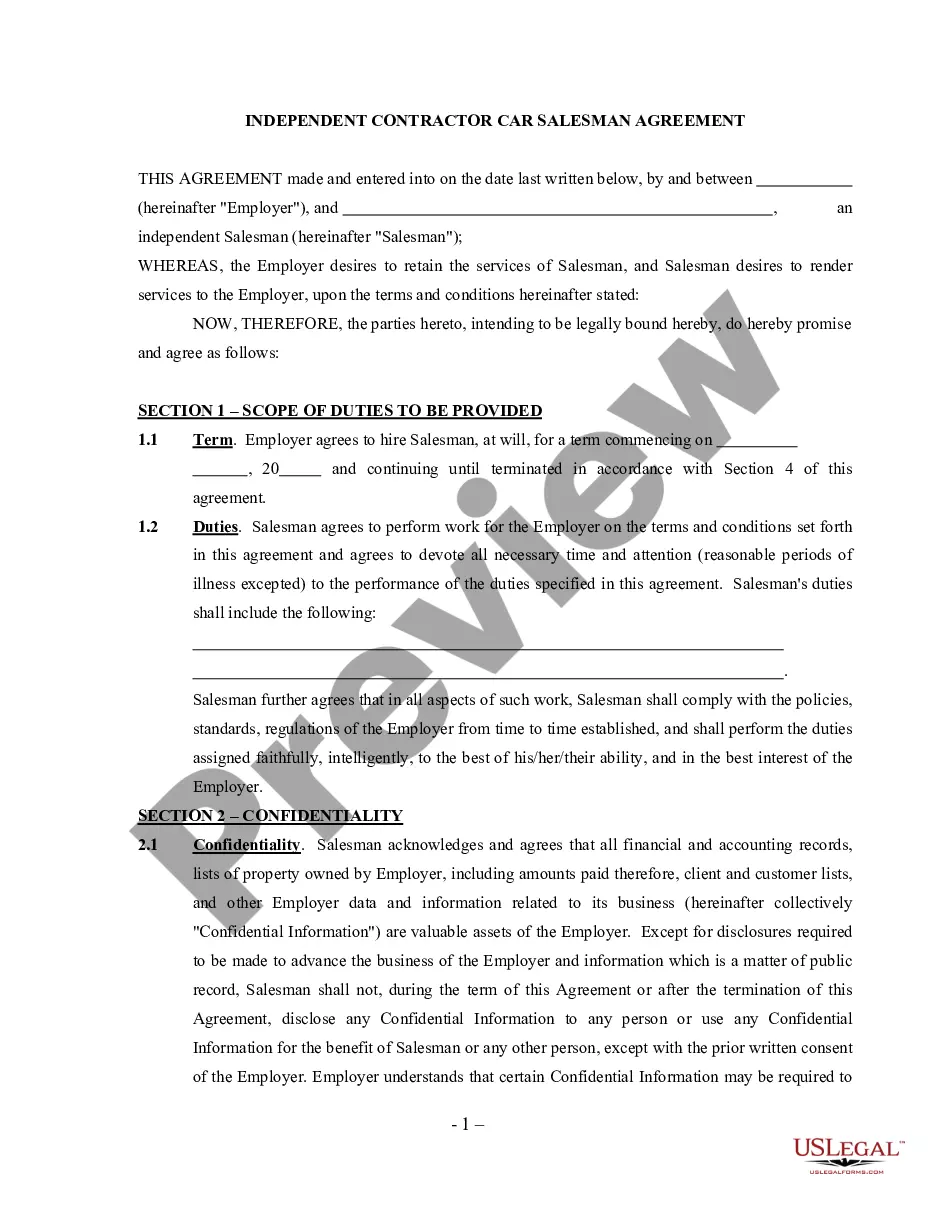

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

INDEPENDENT CONTRACTORS LIMITED AUTHORITY TO BIND COMPANY. Independent Contractor does not have authority to enter into any business transactions or contracts on behalf of the Company unless specifically authorized in writing in accordance with the provisions set forth herein.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Here are eight questions you should be ready to answer about contract work:How long is the contract?What are the company and position like?What are the typical hours?Is this a temp-to-hire position?How much is the contract pay rate?Are there benefits available?How will this position help me professionally?More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

5 Things 1099 Employees Need to Know About TaxesYou're Responsible for Paying Quarterly Income Taxes.You're Responsible for Self-Employment Tax.Estimate How Much You'll Need to Pay.Develop a Bulletproof Savings Plan.Consider Software & Tax Pros.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.