Delaware Series Seed Preferred Stock Purchase Agreement

Description

Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

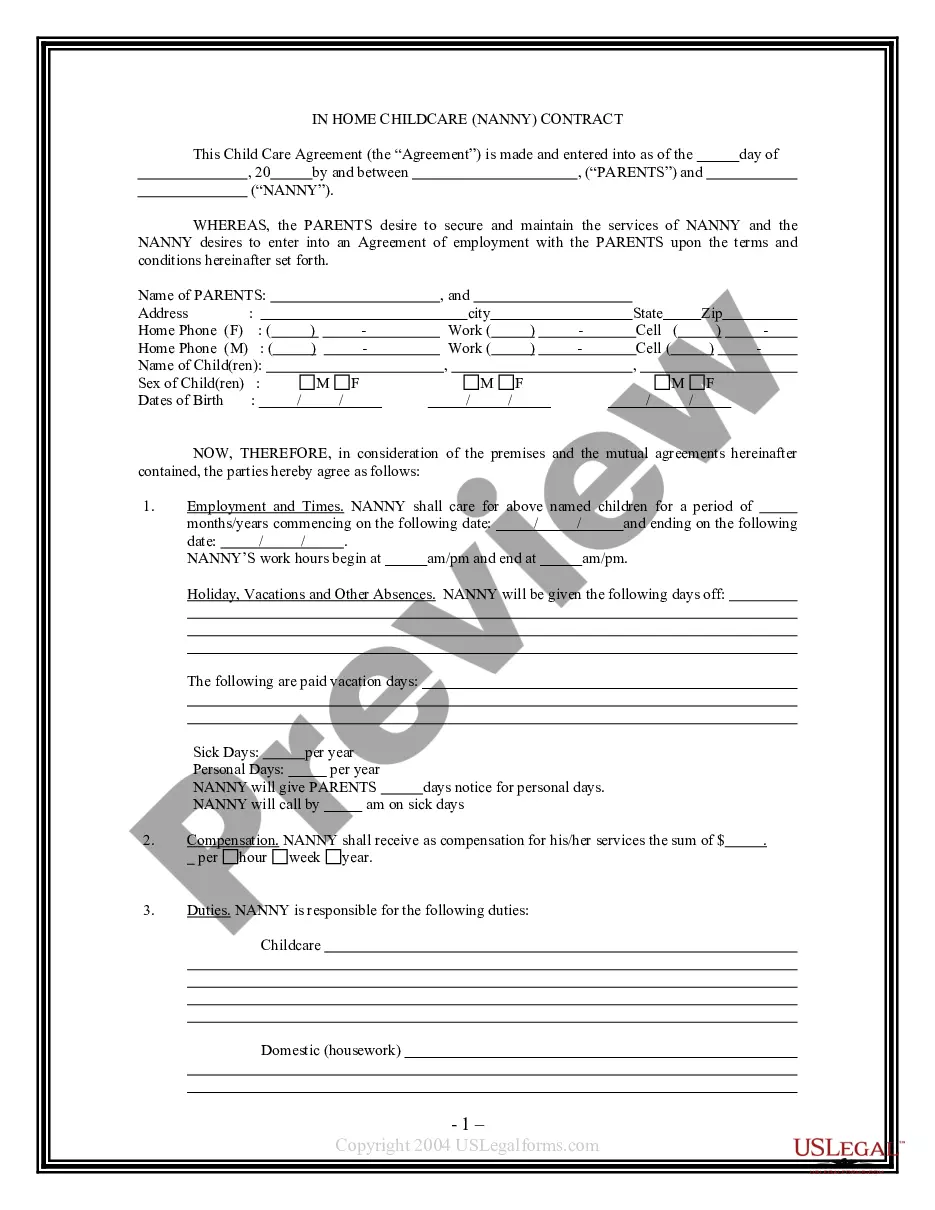

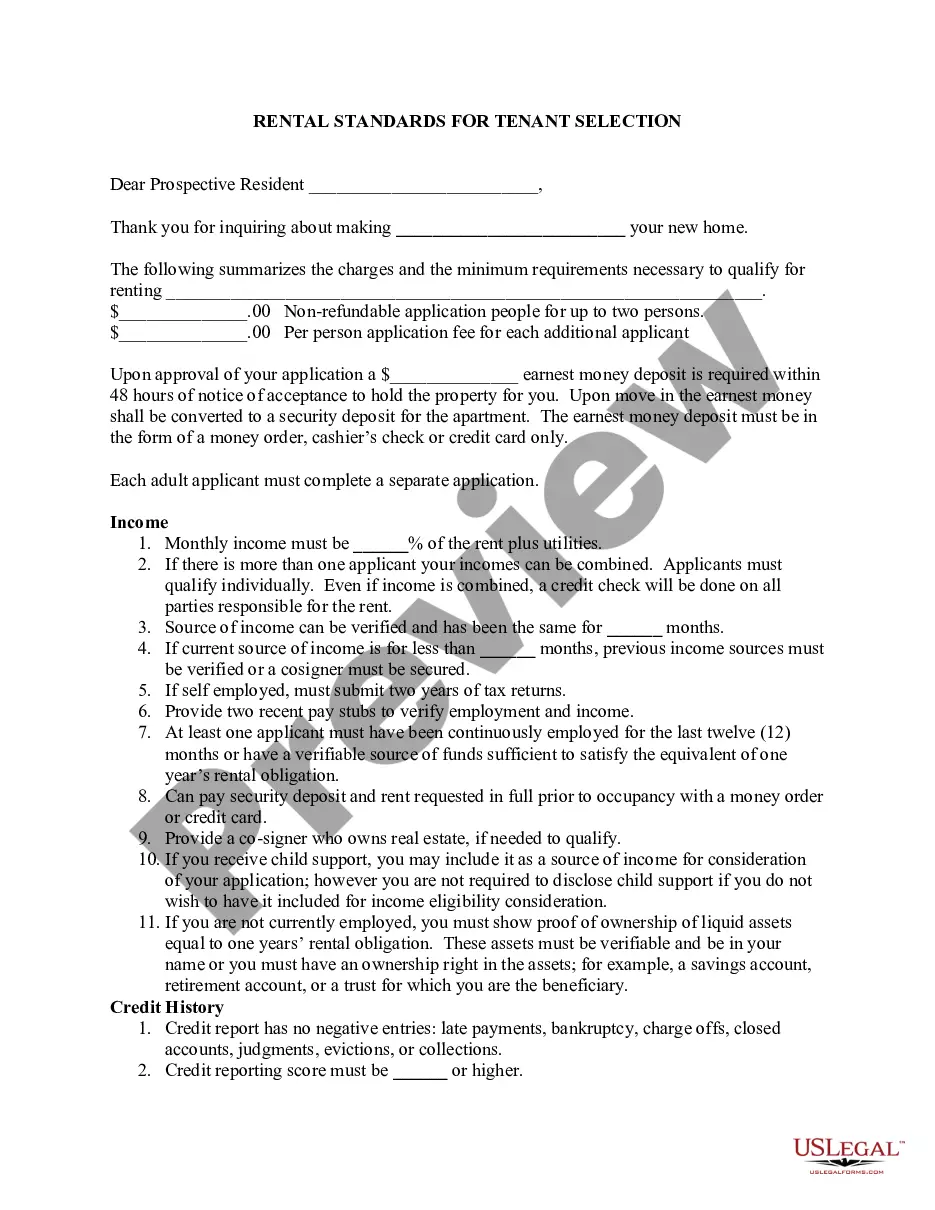

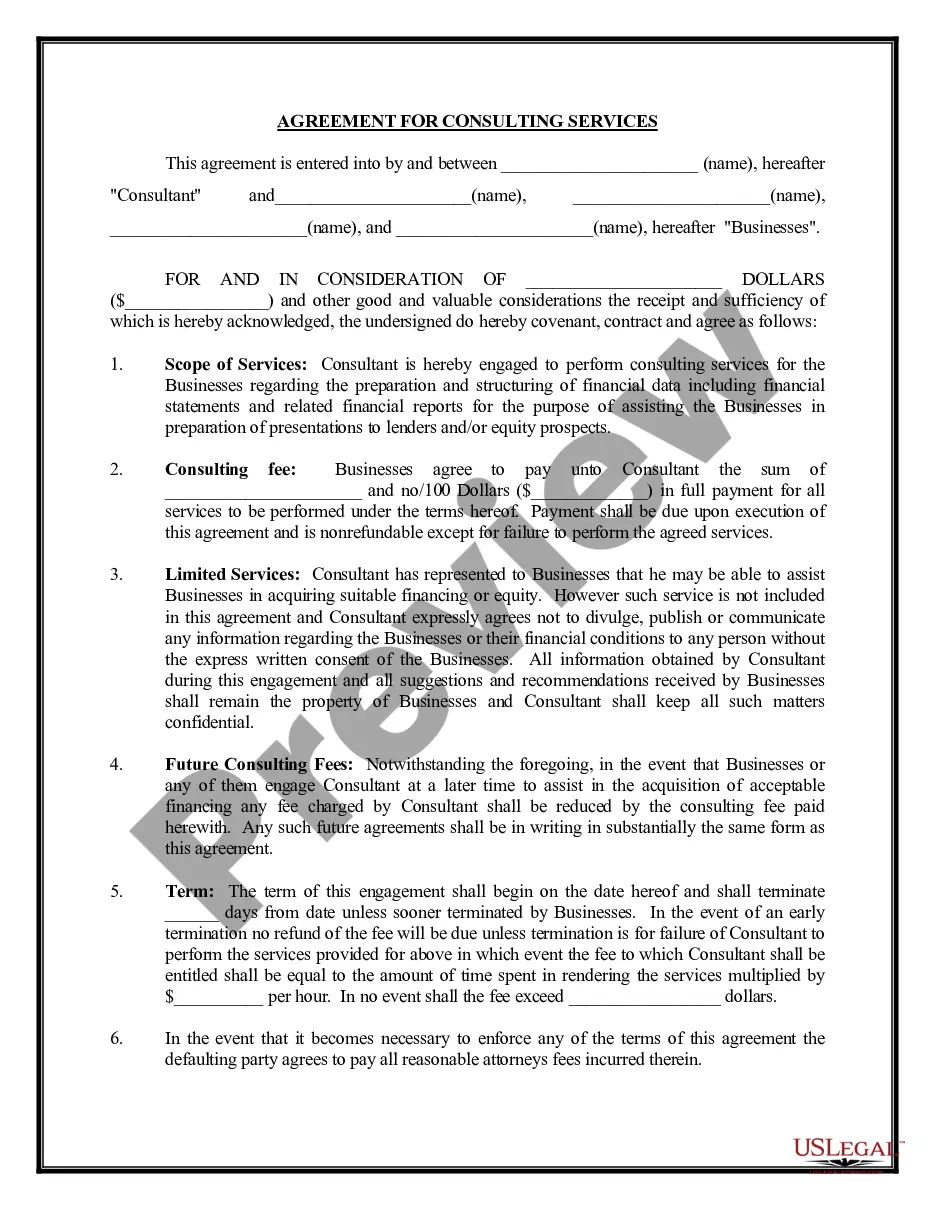

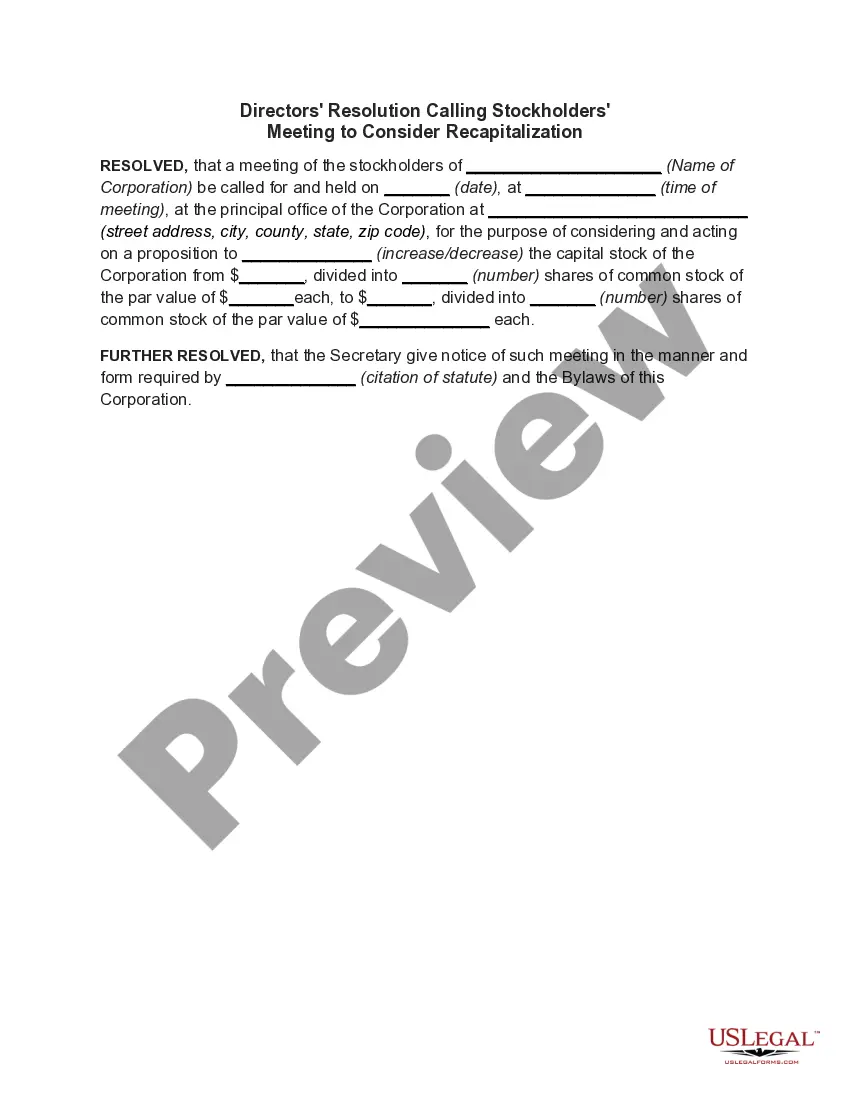

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

How to fill out Series Seed Preferred Stock Purchase Agreement?

US Legal Forms - one of many biggest libraries of legitimate types in the United States - delivers an array of legitimate record themes it is possible to obtain or print out. While using website, you can find 1000s of types for enterprise and specific purposes, categorized by categories, states, or key phrases.You will find the newest versions of types much like the Delaware Series Seed Preferred Stock Purchase Agreement in seconds.

If you already possess a membership, log in and obtain Delaware Series Seed Preferred Stock Purchase Agreement from your US Legal Forms library. The Down load button will appear on each kind you look at. You have accessibility to all in the past delivered electronically types in the My Forms tab of your profile.

In order to use US Legal Forms initially, listed here are basic recommendations to obtain started:

- Ensure you have selected the right kind for your city/area. Click the Review button to analyze the form`s articles. Browse the kind description to ensure that you have chosen the correct kind.

- In case the kind doesn`t fit your specifications, use the Look for area on top of the screen to get the one which does.

- If you are content with the form, verify your option by simply clicking the Get now button. Then, pick the rates plan you want and give your qualifications to register for the profile.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal profile to perform the financial transaction.

- Choose the file format and obtain the form on the gadget.

- Make alterations. Load, change and print out and indication the delivered electronically Delaware Series Seed Preferred Stock Purchase Agreement.

Each and every format you added to your account does not have an expiry time which is the one you have permanently. So, if you want to obtain or print out yet another version, just go to the My Forms portion and click on on the kind you require.

Obtain access to the Delaware Series Seed Preferred Stock Purchase Agreement with US Legal Forms, by far the most comprehensive library of legitimate record themes. Use 1000s of professional and condition-specific themes that fulfill your business or specific needs and specifications.

Form popularity

FAQ

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

In a preferred stock financing, the Stock Purchase Agreement contains the terms of the stock purchase, representations and warranties of both the issuing company and the purchaser and conditions to closing.

A Series AA Round is a round of startup financing using a class of preferred stock called the ?Series AA Preferred Shares.? Series AA is also known as ?Seed? because it comes before Series A. Series AA terms are usually not as onerous as Series A terms, and the valuation is typically lower.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

Series Seed Preferred Shares means the Series Seed Preferred Shares of the Company, par value US$0.001 per share, with the rights, preferences, and privileges as set forth in the Memorandum and Articles. Series Seed Preferred Shares means the Company's Series Seed Preferred Shares, par value US$0.000005 per share.

Like bonds, preferred stock is offered for sale with a set ?face value,? often referred to as par value. This value is how much the issuer will pay back to the owner of the security when it is called or at maturity. Unlike bonds, preferred stock may not have a maturity date, and can be issued in perpetuity.