Kansas Concrete Contractor Agreement - Self-Employed

Description

How to fill out Concrete Contractor Agreement - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a broad selection of legal file templates you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the Kansas Concrete Contractor Agreement - Self-Employed within moments. If you have a subscription, Log In and download the Kansas Concrete Contractor Agreement - Self-Employed from the US Legal Forms library.

The Download button will appear on every form you view. You gain access to all previously downloaded forms from the My documents section of your account. To use US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/county. Click on the Review button to examine the form's content. Read the form description to confirm you have chosen the appropriate form.

Every template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Kansas Concrete Contractor Agreement - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

- Make edits. Fill out, modify, print, and sign the downloaded Kansas Concrete Contractor Agreement - Self-Employed.

Form popularity

FAQ

Yes, certain contractors in Kansas need to be licensed, depending on the type of work they perform. While specific licensing is not necessary for all concrete work, having a license can enhance credibility and signify professionalism in your Kansas Concrete Contractor Agreement - Self-Employed. Always check your local regulations to determine specific licensing requirements for your field and stay compliant with state laws.

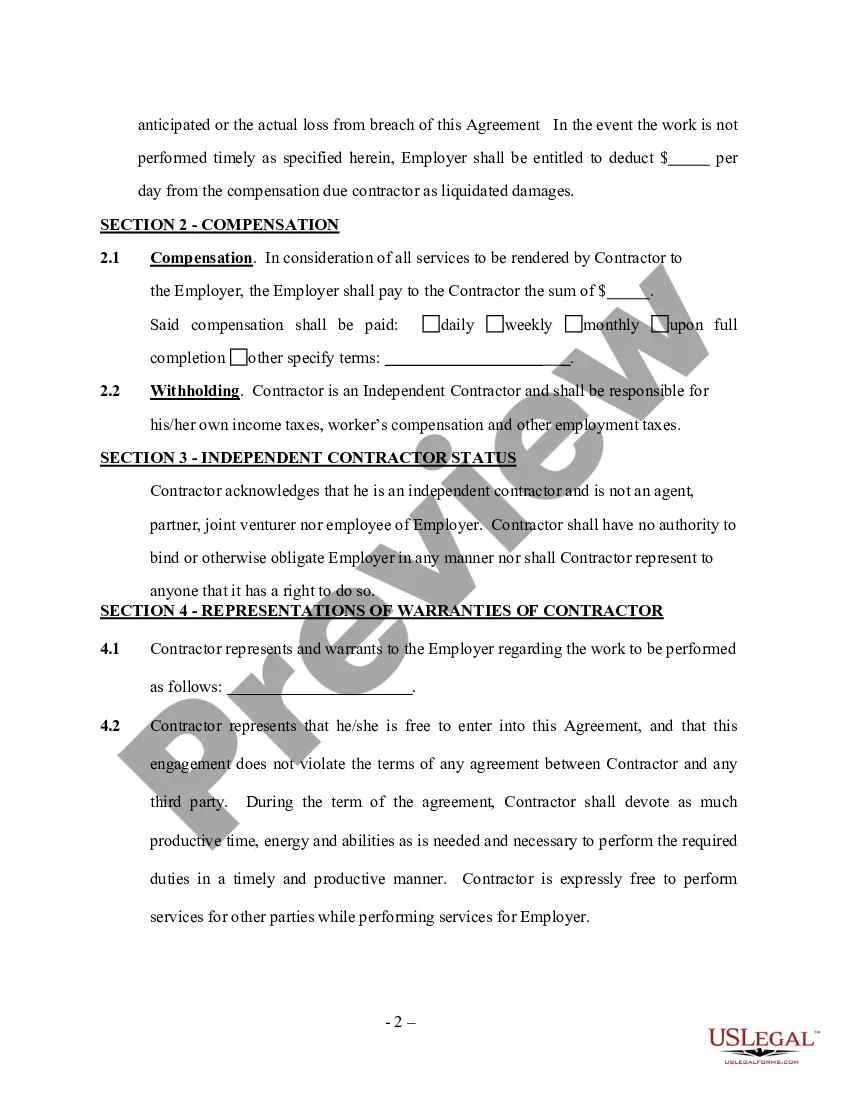

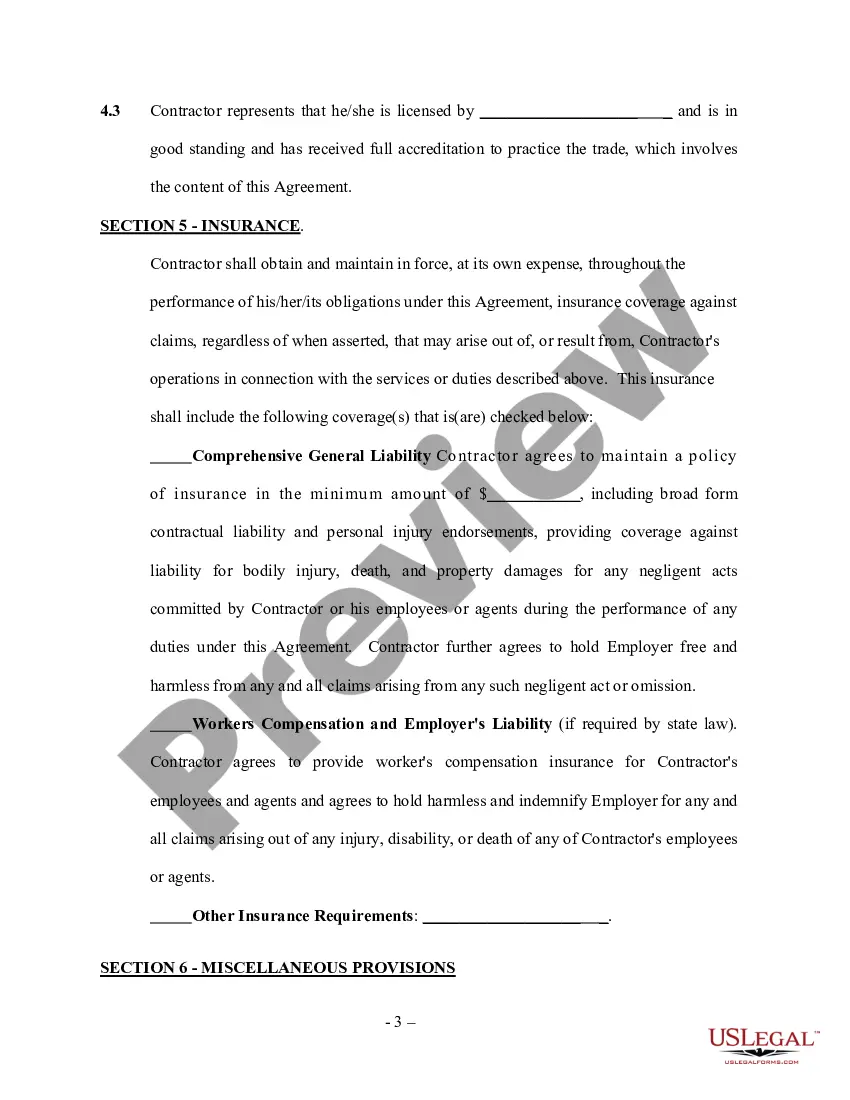

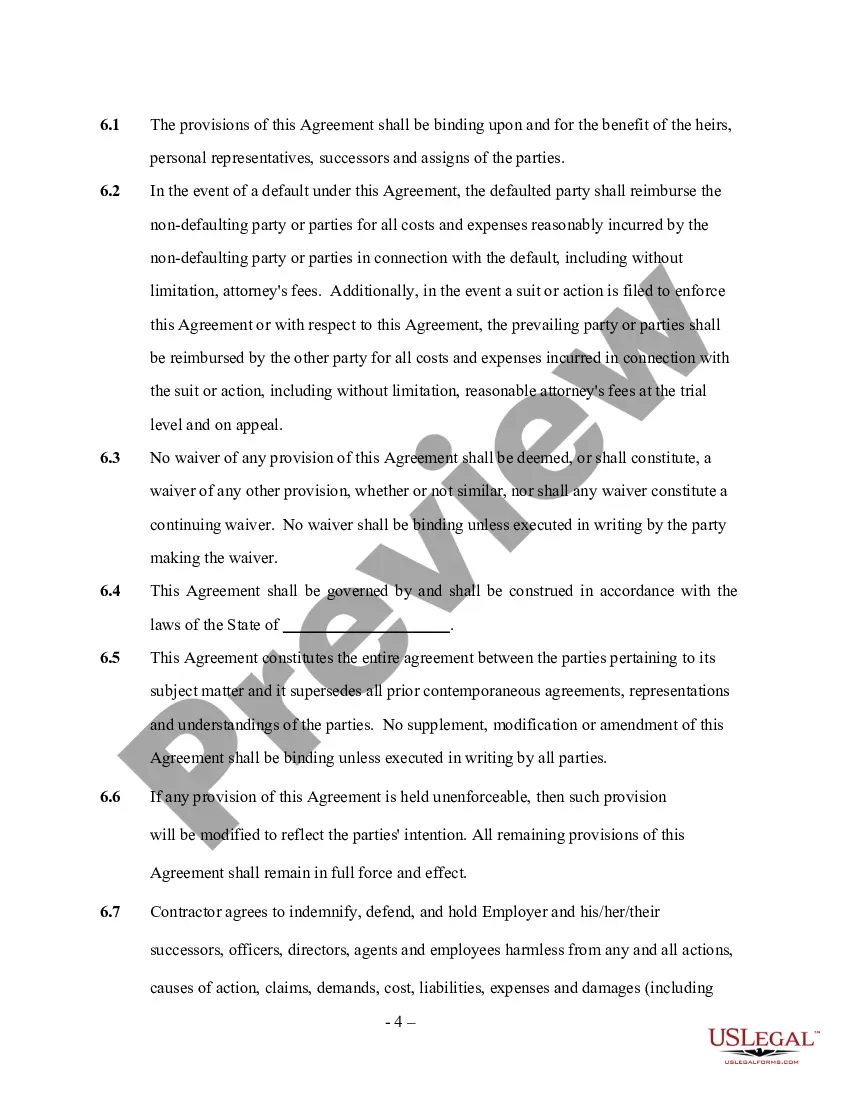

Writing an independent contractor agreement involves outlining specific tasks, compensation, and timelines clearly. Start by defining the scope of work you will provide under your Kansas Concrete Contractor Agreement - Self-Employed. Include payment terms, confidentiality clauses, and termination conditions to protect both parties. Additionally, consider using platforms like uslegalforms to simplify the drafting process and ensure legal compliance.

Kansas does not legally require an operating agreement for limited liability companies (LLCs), but it is highly recommended. An operating agreement outlines the structure and management of your LLC, which can be beneficial for your Kansas Concrete Contractor Agreement - Self-Employed. By having this document, you establish clear roles and responsibilities among members, helping you operate smoothly and professionally.

Yes, construction labor is taxable in Kansas. As a self-employed contractor, you should be aware that the state taxes most services related to construction, including materials and labor. Therefore, when setting up your Kansas Concrete Contractor Agreement - Self-Employed, it's vital to factor in the tax implications. This helps you maintain compliance and avoid unexpected liabilities.

When creating a Kansas Concrete Contractor Agreement - Self-Employed, it is essential to include several key components. Start with the names and contact information of both parties, followed by a clear description of the work to be performed. Additionally, specify payment terms, including rates and deadlines, as well as any necessary permits and licenses. By including these elements, you ensure clarity and protection for all involved.

To fill out an independent contractor agreement, start with the names and addresses of both the contractor and the hiring party. Clearly describe the services to be provided, including deadlines and compensation details. Templates available on US Legal Forms can guide you through this process, especially for a Kansas Concrete Contractor Agreement - Self-Employed, making it straightforward and compliant.

Writing an independent contractor agreement involves outlining key aspects like the project's scope, payment terms, and timelines. Be sure to define the relationship clearly to avoid any misunderstandings. If you're unsure about the language or structure, a customizable template for a Kansas Concrete Contractor Agreement - Self-Employed from US Legal Forms can be a great asset.

To set up as a self-employed contractor, you should first choose a suitable business structure and register your business. It's critical to obtain the necessary licenses and permits for your work in Kansas. Additionally, consider drafting a Kansas Concrete Contractor Agreement - Self-Employed to formalize your relationships with clients, ensuring clarity and protection.

Filling out an independent contractor form begins with gathering information such as both parties' names, contact details, and the scope of work. It's essential to specify payment terms and deadlines. Using a structured form from US Legal Forms can simplify this process and help you create a comprehensive Kansas Concrete Contractor Agreement - Self-Employed.

Typically, the business or individual hiring the contractor drafts the independent contractor agreement. This agreement should outline the terms, responsibilities, and expectations of both parties clearly. If you're using a tool like US Legal Forms, you can find templates specifically for a Kansas Concrete Contractor Agreement - Self-Employed to ensure compliance with local regulations.