Kansas NQO Agreement

Description

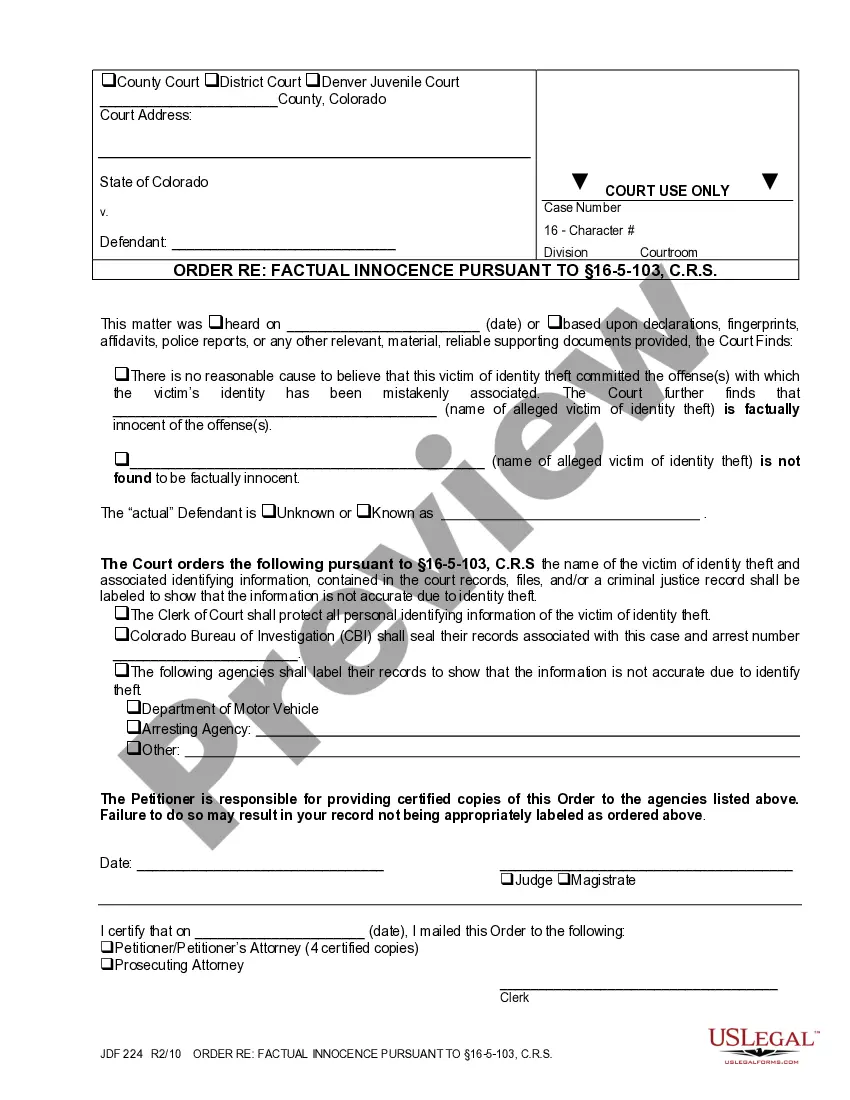

How to fill out NQO Agreement?

Are you presently in a position in which you need papers for both company or person functions nearly every day time? There are a lot of authorized papers web templates available on the Internet, but finding kinds you can trust is not straightforward. US Legal Forms provides a huge number of form web templates, just like the Kansas NQO Agreement, which can be published to fulfill federal and state needs.

Should you be currently acquainted with US Legal Forms site and get your account, simply log in. Following that, you are able to acquire the Kansas NQO Agreement format.

If you do not offer an account and need to start using US Legal Forms, follow these steps:

- Find the form you need and ensure it is to the correct city/county.

- Take advantage of the Review button to examine the shape.

- Read the explanation to ensure that you have selected the right form.

- If the form is not what you are looking for, take advantage of the Research area to obtain the form that fits your needs and needs.

- If you discover the correct form, click on Purchase now.

- Choose the pricing prepare you would like, complete the required info to create your money, and pay for your order using your PayPal or charge card.

- Decide on a convenient file formatting and acquire your backup.

Get each of the papers web templates you have bought in the My Forms menu. You can obtain a more backup of Kansas NQO Agreement any time, if required. Just select the essential form to acquire or produce the papers format.

Use US Legal Forms, the most substantial assortment of authorized types, in order to save some time and steer clear of mistakes. The support provides appropriately manufactured authorized papers web templates that you can use for a variety of functions. Generate your account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

Personal Exemptions Wearing apparel of every person, pick-up truck shells, sailboards, etc. Land used exclusively as graveyards. All real property upon which surface mining operations were conducted prior to January 1, 1969, but which has been reclaimed and returned to productive use. Exemption is for 5 years. Property Tax Exemptions - Kansas Department of Revenue ksrevenue.gov ? pvdptexemptions ksrevenue.gov ? pvdptexemptions

The Tax Cuts and Jobs Act Reform of 2017, S. 2254-115th Congress lowered the value of the federal personal exemptions to $0 until 2025. The value of the Kansas personal exemption for 2019 is $2250. Income Tax Considerations Section A - Dependent's Exemption and Child ... kscourts.org ? KSCourts ? media ? KsCourts kscourts.org ? KSCourts ? media ? KsCourts

Kansas taxpayers can claim a personal exemption of $2,250 for themselves, their spouse, and each of their dependents. ( Sec. 79-32,121(a), K.S.A.) The state allows an additional exemption allowance of $2,250 for taxpayers who have a filing status of head of household, effective for tax years beginning before 2023.

Income tax rates in Kansas are 3.10%, 5.25% and 5.70%. There are no local income taxes on wages in the state, though if you have income from other sources, like interest or dividends, you might incur taxes at the local level.

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

How does Kansas's tax code compare? Kansas has a graduated individual income tax, with rates ranging from 3.10 percent to 5.70 percent. There are also jurisdictions that collect local income taxes. Kansas has a 4.00 percent to 7.00 percent corporate income tax rate. Kansas Tax Rates & Rankings taxfoundation.org ? location ? kansas taxfoundation.org ? location ? kansas

$3,500 Under current law, the standard deduction for the calculation of Kansas income taxes is set at $3,500 for single individual taxpayers, $8,000 for married filing status, and $6,000 for head of household. Division of the Budget March 1, 2023 The Honorable Adam Smith ... kslegislature.org ? fisc_note_hb2384_00_0000 kslegislature.org ? fisc_note_hb2384_00_0000

To qualify for exempt status you must verify with the Department of Revenue that: 1) last year you had the right to a refund of all State taxes withheld because you had no tax liability; or, 2) this year you will receive a full refund of all State income tax withheld because you will have no tax liability.