Kansas Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

How to fill out Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

You are able to invest hrs on-line trying to find the lawful document design that suits the federal and state specifications you will need. US Legal Forms gives a huge number of lawful types which can be reviewed by professionals. You can actually acquire or print out the Kansas Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation from the assistance.

If you already have a US Legal Forms accounts, you may log in and click the Obtain switch. Afterward, you may complete, change, print out, or signal the Kansas Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation. Each lawful document design you buy is yours for a long time. To obtain yet another version of the bought kind, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site initially, follow the easy guidelines below:

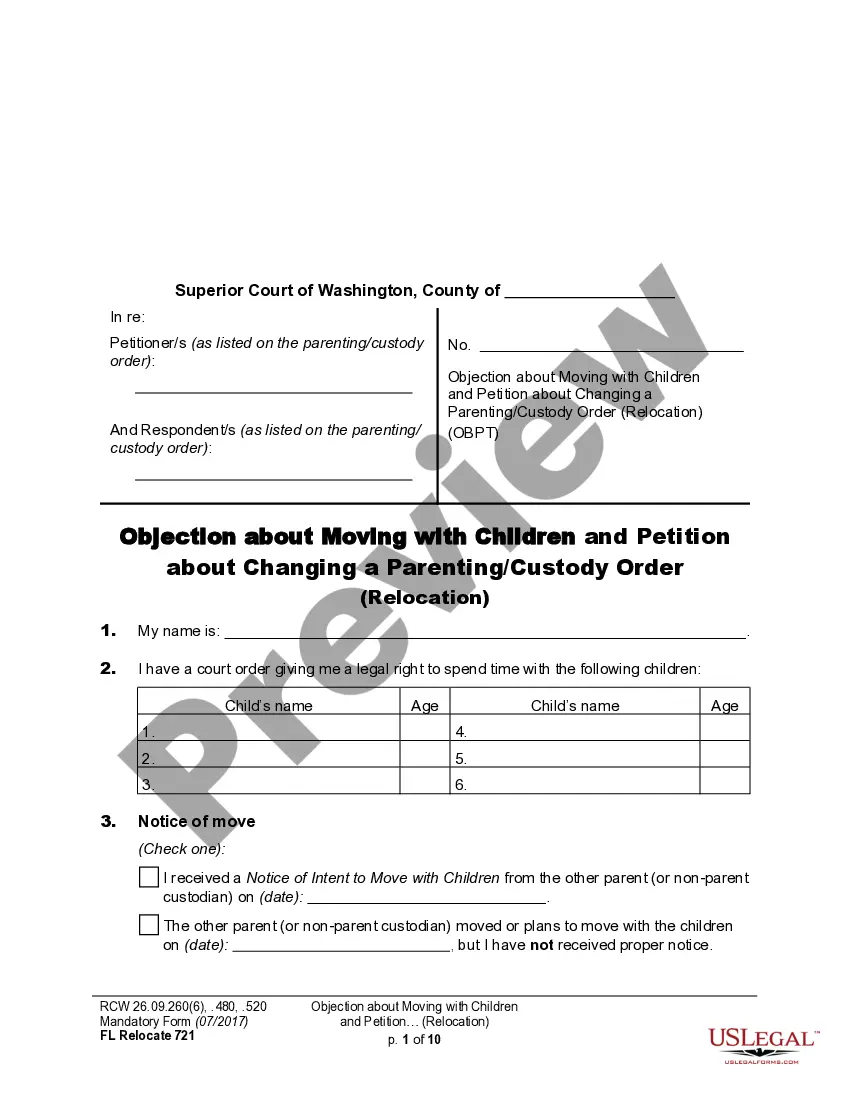

- First, ensure that you have chosen the best document design for your county/metropolis of your choice. See the kind outline to make sure you have chosen the correct kind. If readily available, utilize the Review switch to search throughout the document design at the same time.

- If you wish to get yet another model from the kind, utilize the Lookup discipline to find the design that meets your needs and specifications.

- Upon having located the design you would like, click Purchase now to carry on.

- Find the rates prepare you would like, enter your qualifications, and register for a free account on US Legal Forms.

- Complete the transaction. You can utilize your charge card or PayPal accounts to fund the lawful kind.

- Find the file format from the document and acquire it to your device.

- Make alterations to your document if needed. You are able to complete, change and signal and print out Kansas Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation.

Obtain and print out a huge number of document themes making use of the US Legal Forms Internet site, which provides the most important variety of lawful types. Use specialist and express-particular themes to deal with your company or person needs.