Kansas Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al

Description

How to fill out Sample Partnership Interest Purchase Agreement Between Franklin Covey Company, Daytracker.com, Et Al?

Finding the right lawful document format could be a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how can you discover the lawful develop you want? Take advantage of the US Legal Forms internet site. The assistance delivers 1000s of templates, for example the Kansas Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al, that can be used for business and private needs. Every one of the types are checked by experts and meet state and federal specifications.

When you are already listed, log in in your bank account and then click the Download option to obtain the Kansas Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al. Make use of bank account to check throughout the lawful types you might have acquired formerly. Check out the My Forms tab of the bank account and have yet another version from the document you want.

When you are a brand new end user of US Legal Forms, listed below are straightforward instructions that you should adhere to:

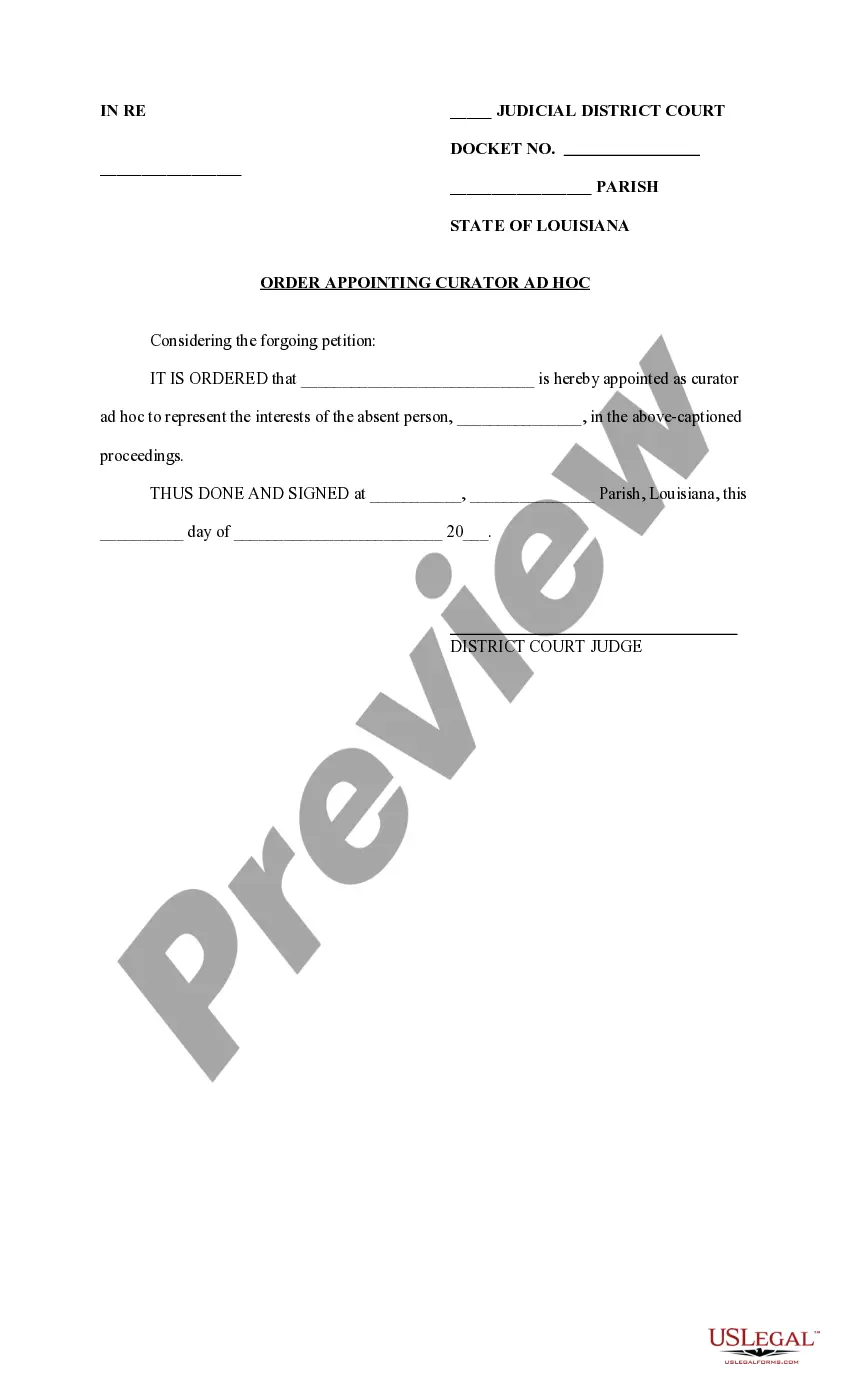

- Initially, make certain you have chosen the right develop for your personal area/county. It is possible to look over the form while using Review option and browse the form outline to ensure it will be the best for you.

- In case the develop does not meet your preferences, take advantage of the Seach industry to discover the correct develop.

- When you are positive that the form would work, go through the Get now option to obtain the develop.

- Choose the pricing plan you desire and type in the needed information and facts. Create your bank account and pay for your order making use of your PayPal bank account or charge card.

- Select the file formatting and acquire the lawful document format in your device.

- Comprehensive, edit and print out and indication the received Kansas Sample Partnership Interest Purchase Agreement between Franklin Covey Company, Daytracker.com, et al.

US Legal Forms is the most significant collection of lawful types in which you will find numerous document templates. Take advantage of the company to acquire appropriately-produced papers that adhere to state specifications.

Form popularity

FAQ

Assignment of interest in LLCs happens when a member communicates to other members his/her intention to transfer part or all of his ownership rights in the LLC to another entity. The assignment is usually done as a means for members to provide collateral for personal loans, settle debts, or leave the LLC.

What is Partner's Interest in the Partnership? This refers to the partner's share of the profits and losses, based on the terms of the partnership agreement.

The sale of a partnership interest is generally treated as the sale of a capital asset.

? If a partner is selling his entire partnership interest, then his share of partnership liabilities will be reduced to zero and thus his amount realized will increase by at least the entire amount of his former share of partnership liabilities.

The assignee generally gains only the right to receive profits or deduct losses. You can restrict a partner's right to assign or sell his or her partnership interest by including a restrictive provision in the written partnership agreement.

The adjusted basis of a partner's interest in a partnership is determined without regard to any amount shown in the partnership books as the partner's ?capital?, ?equity?, or similar account. For example, A contributes property with an adjusted basis to him of $400 (and a value of $1,000) to a partnership.

There are two parties in the assignment of interest: assignor and assignee. The assignor is the business partner who is transferring their rights in the partnership in exchange for compensation. The assignee is a new partner who purchases the previous partner's interest in the partnership.

What is Partner's Interest in the Partnership? This refers to the partner's share of the profits and losses, based on the terms of the partnership agreement.

Transferring Interest ing to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

As such, assuming an investor does not hold a controlling financial interest, a general partnership interest is generally accounted for under the equity method of accounting.