Kansas Partnership Agreement for Home Purchase

Description

How to fill out Partnership Agreement For Home Purchase?

Are you presently in a scenario where you require documentation for either business or personal reasons almost every day.

There is a multitude of legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Kansas Partnership Agreement for Home Purchase, designed to comply with both federal and state regulations.

Once you've found the correct form, click Get now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Kansas Partnership Agreement for Home Purchase template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct state/region.

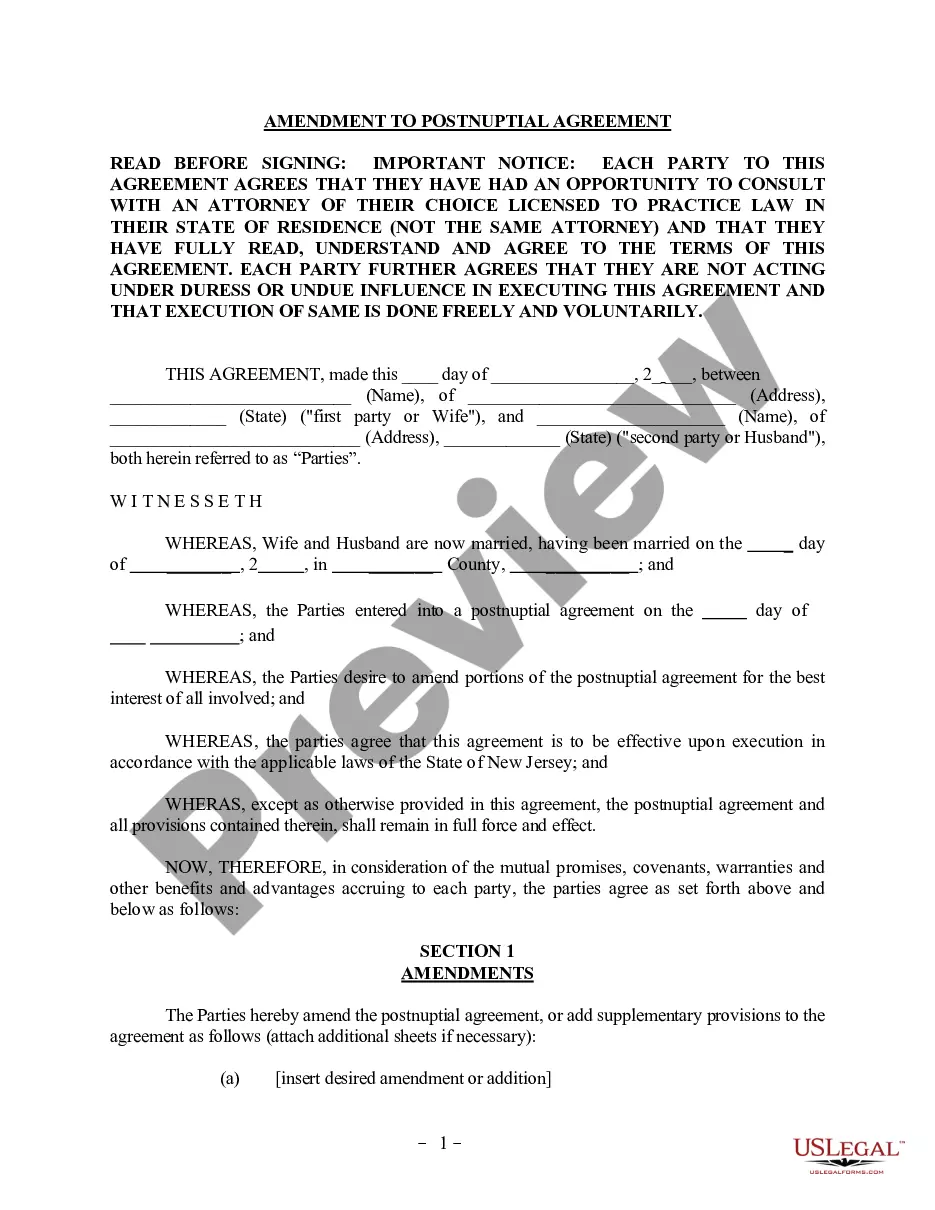

- Utilize the Preview option to review the form.

- Read the description to ensure you’ve selected the appropriate form.

- If the form does not meet your requirements, utilize the Look for section to locate a form that matches your needs.

Form popularity

FAQ

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

In Kansas, most partnerships are required to register with the state, pay a filing fee, and file the required paperwork.

Partnerships have specific attributes, which are defined by Kansas Statutes. All partners share equally in the right and responsibility to manage the business. of State. The filings are optional and not mandatory.

A partnership deed normally contains the following clauses:Name of the firm.Nature of the firm's business.The principal place of business.Duration of partnership, if any.Amount of capital to be contributed by each partner.The amount which can be withdrawn by each partner.The profit-sharing ratio.More items...?

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

A partnership agreement is a foundational document and is legally binding on all partners. The agreement outlines the business's day-to-day operations and the rights and responsibilities of each partner. In this way, the document is not unlike a set of corporate bylaws.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. Agreement is the essential part of partnership business. It secure the right of both party.