Kansas Profit Sharing Plan

Description

How to fill out Profit Sharing Plan?

You may invest hours on the Internet looking for the lawful record template which fits the federal and state needs you need. US Legal Forms gives thousands of lawful forms which can be evaluated by pros. You can actually obtain or printing the Kansas Profit Sharing Plan from our services.

If you have a US Legal Forms account, you may log in and click on the Obtain option. Afterward, you may full, modify, printing, or indication the Kansas Profit Sharing Plan. Each and every lawful record template you get is the one you have permanently. To get an additional copy of the acquired form, check out the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms internet site the first time, keep to the easy recommendations below:

- First, make certain you have chosen the best record template for your county/town of your choice. Read the form description to ensure you have chosen the proper form. If offered, take advantage of the Preview option to look throughout the record template also.

- If you want to find an additional model in the form, take advantage of the Search field to obtain the template that suits you and needs.

- Once you have identified the template you desire, simply click Buy now to proceed.

- Pick the pricing prepare you desire, type in your references, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can utilize your Visa or Mastercard or PayPal account to pay for the lawful form.

- Pick the formatting in the record and obtain it in your product.

- Make modifications in your record if required. You may full, modify and indication and printing Kansas Profit Sharing Plan.

Obtain and printing thousands of record layouts making use of the US Legal Forms Internet site, which provides the largest assortment of lawful forms. Use professional and status-distinct layouts to take on your company or person requires.

Form popularity

FAQ

The contributions your employer makes to a DPSP are a tax deductible expense, whereas RRSP contributions aren't. By putting this money into the DPSP, your employer will pay less tax, which means that they can put more money into your plan.

401(k) The key difference between a profit sharing plan and a 401(k) plan is that only employers contribute to a profit sharing plan. If employees can also make pre-tax, salary-deferred contributions, then the plan is a 401(k).

Employees do not pay tax on the contributions that are made to a DPSP for their benefit. The contributions and investment earnings accumulate tax-free while they are in a DPSP, but are included in income for tax purposes when withdrawn.

sharing plan accepts discretionary employer contributions. There is no set amount that the law requires you to contribute. If you can afford to make some amount of contributions to the plan for a particular year, you can do so. Other years, you do not need to make contributions.

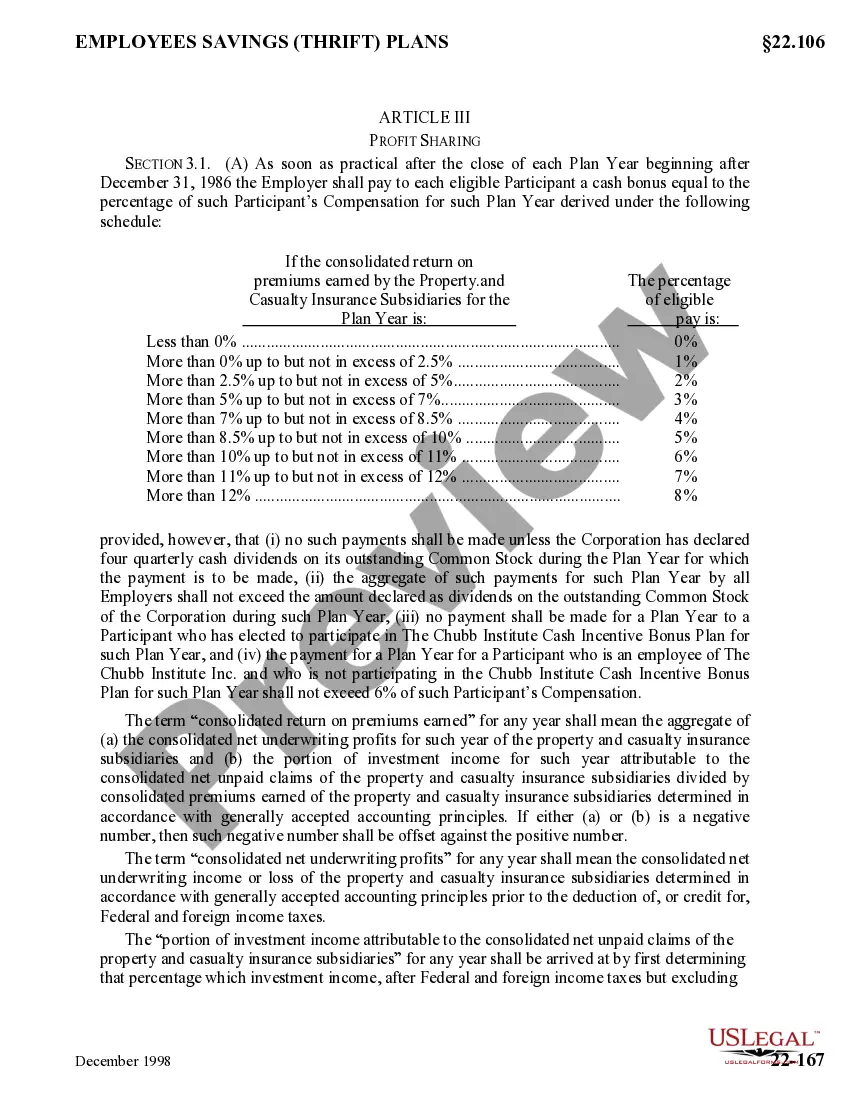

To calculate, divide each employee's salary by the total salary pool to determine their percentage, then multiply this figure by the total profit sharing allocation to determine contribution amounts.

How Does Profit-Sharing Plan Work? Employers make profit-sharing contributions to the plan on behalf of their employees, and these contributions are not taxable income to the employee. The contributions grow tax-deferred, just like contributions to a 401(k) plan.

What is a DPSP's withdrawal rule? You can only withdraw money from the DPSP after the vesting period is over, which is a maximum of two years. After this period, you can withdraw the money (and pay tax on it) or transfer the money to an annuity, RRSP or RRIF and defer the tax until you withdraw money when you retire.

How do taxes work for an EPSP? All of your employer's contributions ? and any investment income those contributions earn ? will be part of your taxable income. In other words, you'll be taxed as though your employer paid you a higher salary.