Kansas Acquisition, Merger, or Liquidation

Description

How to fill out Acquisition, Merger, Or Liquidation?

Discovering the right legitimate record template could be a battle. Obviously, there are a variety of layouts available on the Internet, but how do you obtain the legitimate kind you require? Take advantage of the US Legal Forms web site. The assistance delivers thousands of layouts, like the Kansas Acquisition, Merger, or Liquidation, that you can use for enterprise and personal requires. Each of the kinds are checked out by specialists and meet up with federal and state demands.

When you are already authorized, log in to the account and then click the Down load switch to get the Kansas Acquisition, Merger, or Liquidation. Make use of your account to search throughout the legitimate kinds you possess ordered previously. Go to the My Forms tab of your own account and acquire one more duplicate in the record you require.

When you are a brand new end user of US Legal Forms, listed here are simple recommendations for you to comply with:

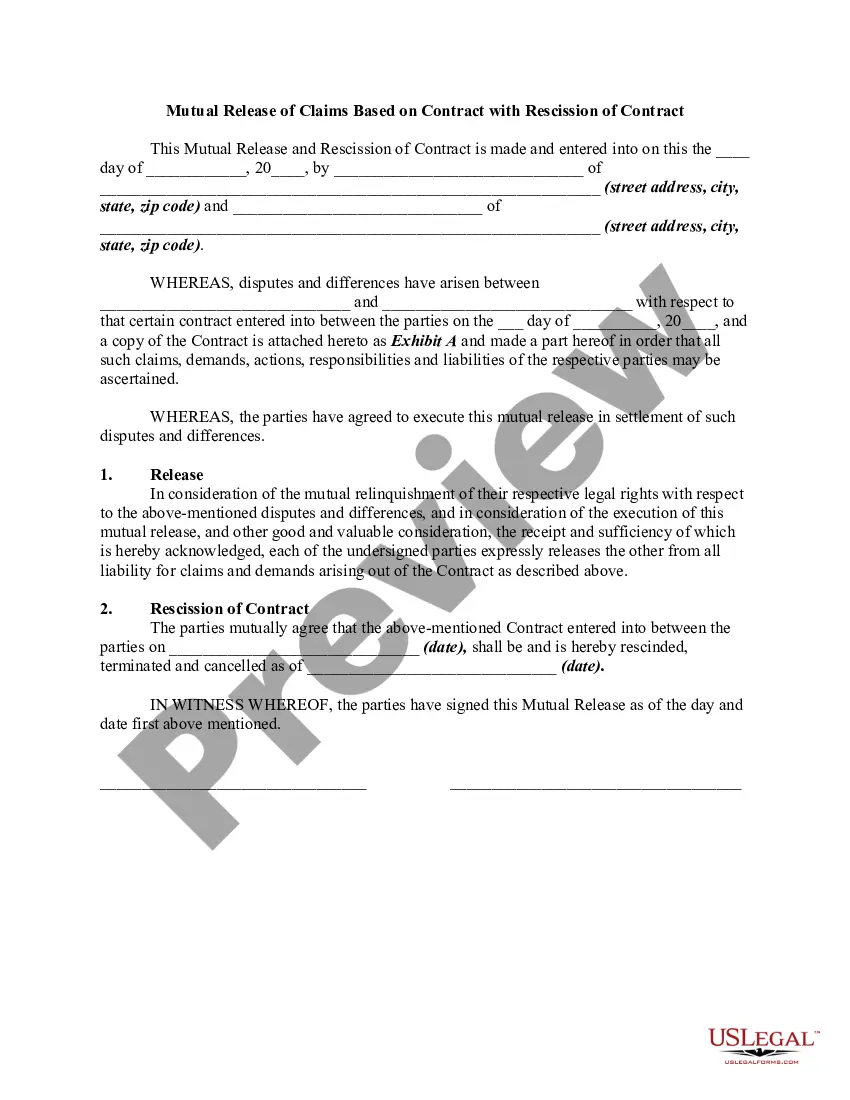

- Initially, be sure you have chosen the appropriate kind to your metropolis/area. You can look over the form while using Review switch and read the form description to guarantee it is the right one for you.

- In the event the kind will not meet up with your needs, utilize the Seach area to find the correct kind.

- When you are sure that the form is suitable, click the Buy now switch to get the kind.

- Choose the costs strategy you want and type in the needed information and facts. Design your account and purchase the transaction using your PayPal account or bank card.

- Select the data file file format and obtain the legitimate record template to the system.

- Comprehensive, revise and printing and indicator the acquired Kansas Acquisition, Merger, or Liquidation.

US Legal Forms may be the biggest local library of legitimate kinds in which you can find various record layouts. Take advantage of the company to obtain appropriately-created files that comply with express demands.

Form popularity

FAQ

Type C reorganization: A stock-for-asset deal, where the target company ?sells? all of its targets to the parent company in exchange for voting stock. Included in this transaction is a necessary amount of consideration that is not equity. This is known as a boot. The target company then liquidates (IRC § 368(a)(1)(C)).

and acquisitive Dreorganizations are both ?asset? reorgani zations and are both acquisitive in nature. Thus, the tax analysis of both of these types of reorganizations is very similar. A difference, however, is that reorgani zations have the solely for voting stock requirement and Dreorganizations do not.

Also, to qualify as a section 368(a) reorganization, a transaction generally must satisfy three nonstatutory requirements: business purpose, continuity of interest, and continuity of business enterprise.

Overview. In a D reorganization, one corporation transfers all or part of its assets to another corporation. Immediately after the transfer, the transferring corporation or one or more of its shareholders must be in control of the corporation that acquired the assets.

Using the method of ?upstream C with a drop? you can move assets within related entities without being taxed on it. The parent company acquires the subsidiary's assets through a reorganization of the subsidiary's assets under 26 U.S. Code § 368(a)(1)(C).

Overview. Practically speaking, a Type C reorganization is an asset-for-stock acquisition that is remarkably similar in result to an A reorganization. In an A reorganization, assets and liabilities of the target corporation are transferred to the acquiring corporation automatically by operation of statute.

Section 368(c) defines ?control? to mean the ownership of stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock of the corporation.

An upstream C with a drop involves a parent corporation acquiring a subsidiary's assets, followed by reincorporation of some of those subsidiary's assets.