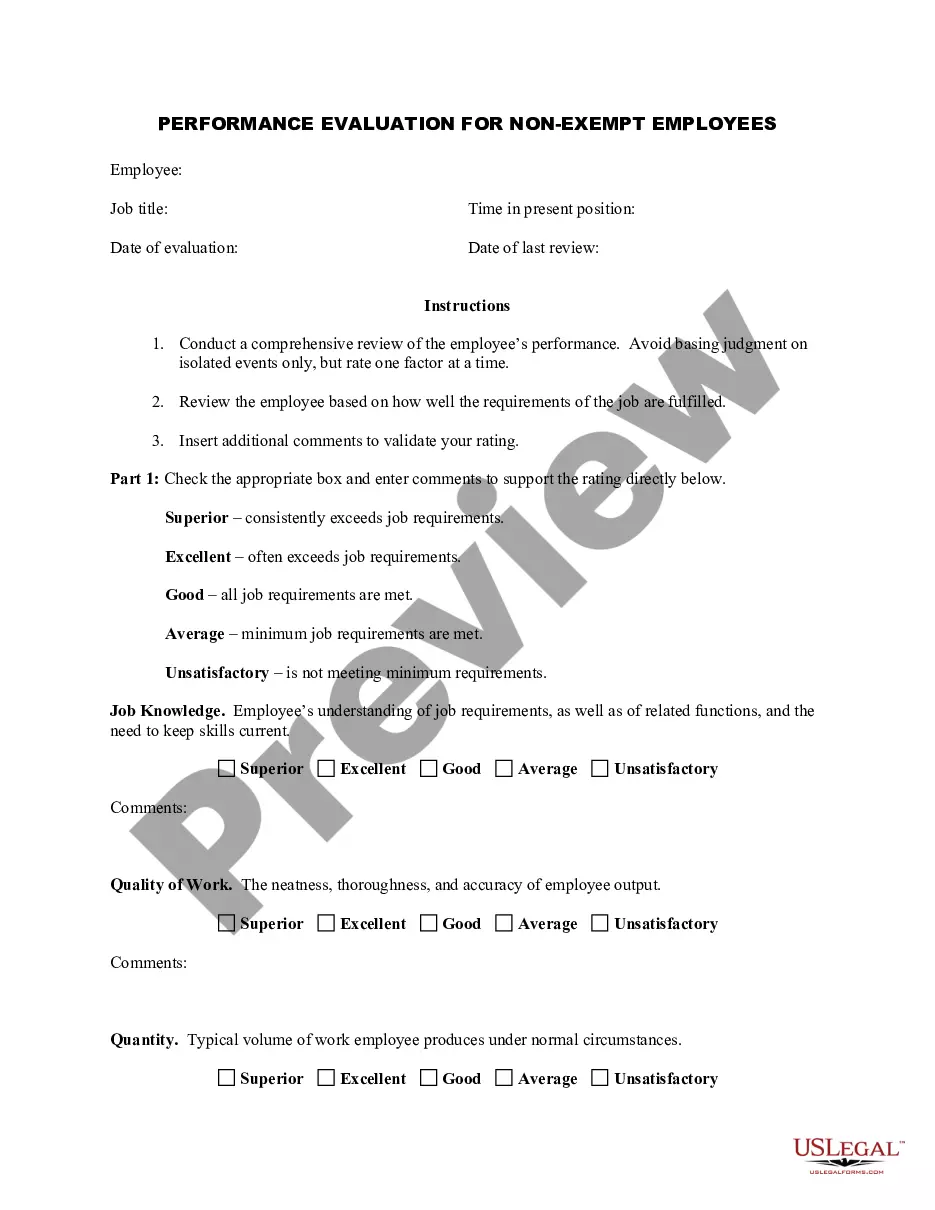

Kansas Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Selecting the appropriate legitimate document template can be quite a challenge.

Certainly, there are numerous designs available online, but how can you find the proper form you need.

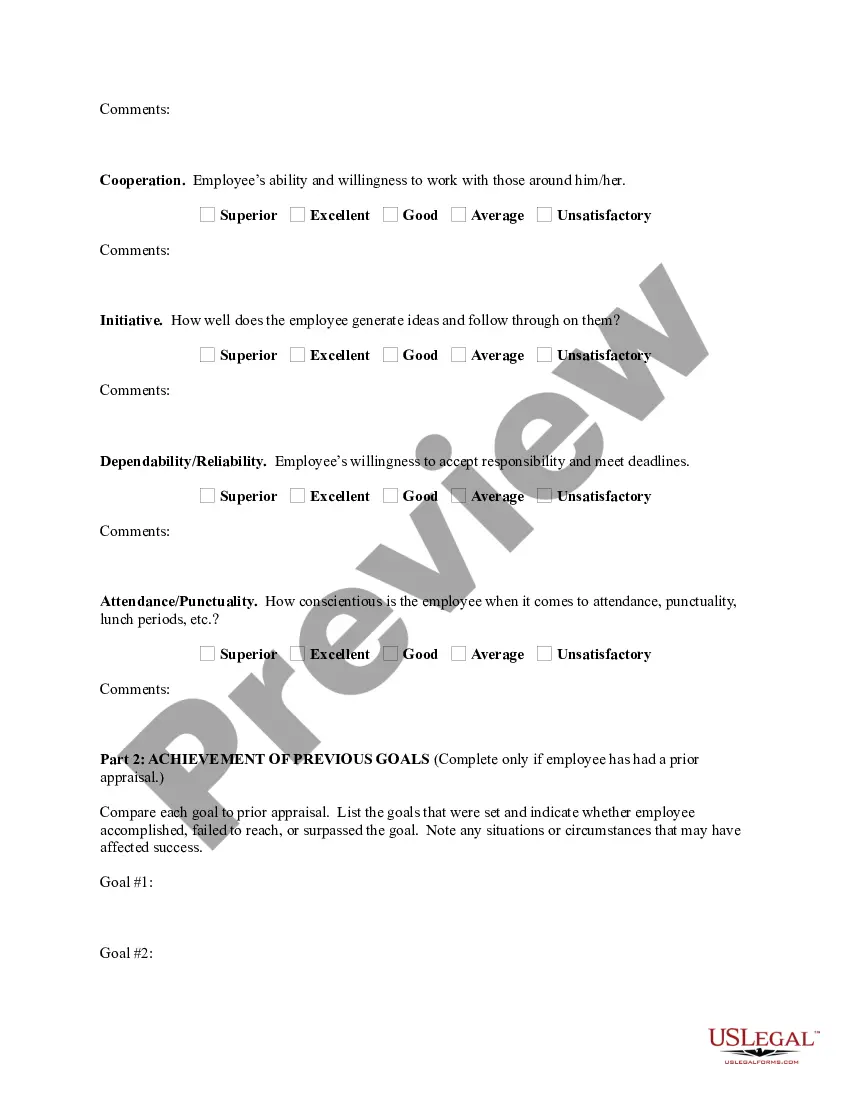

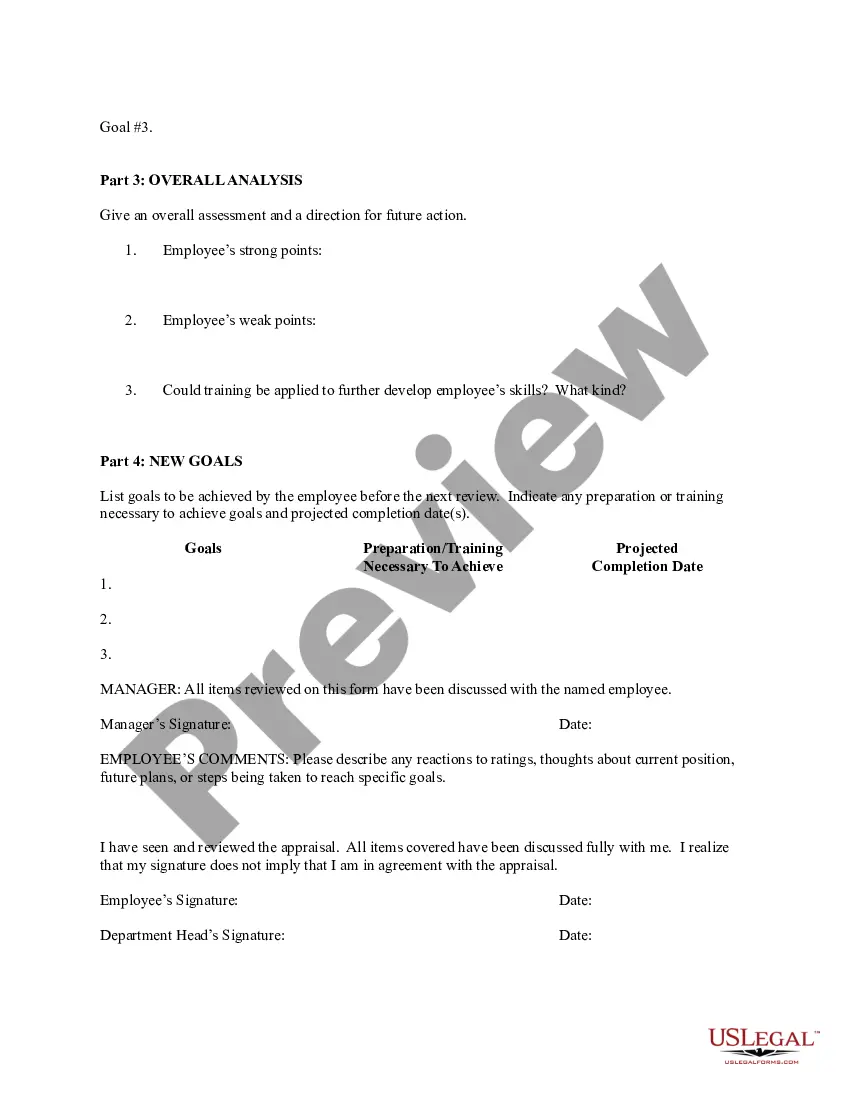

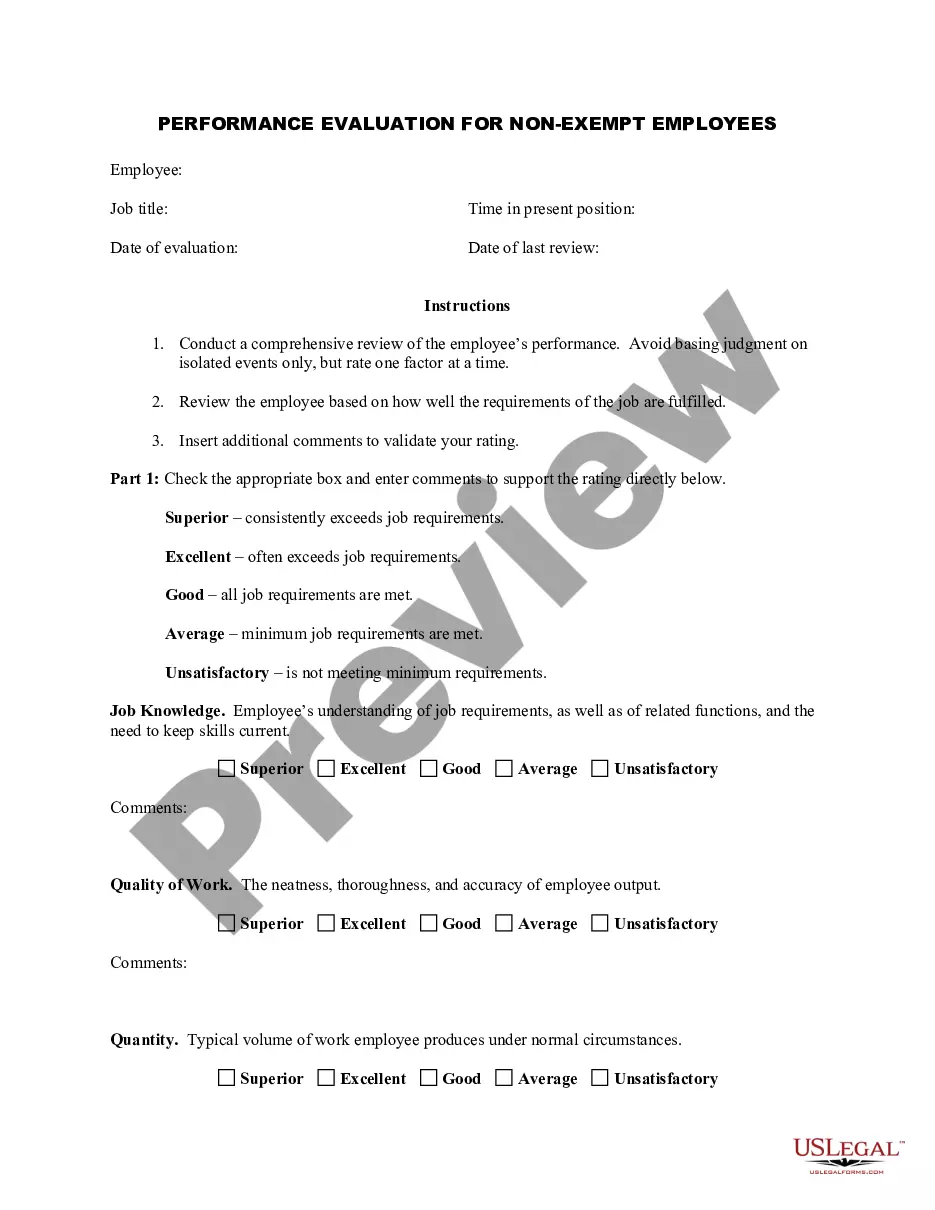

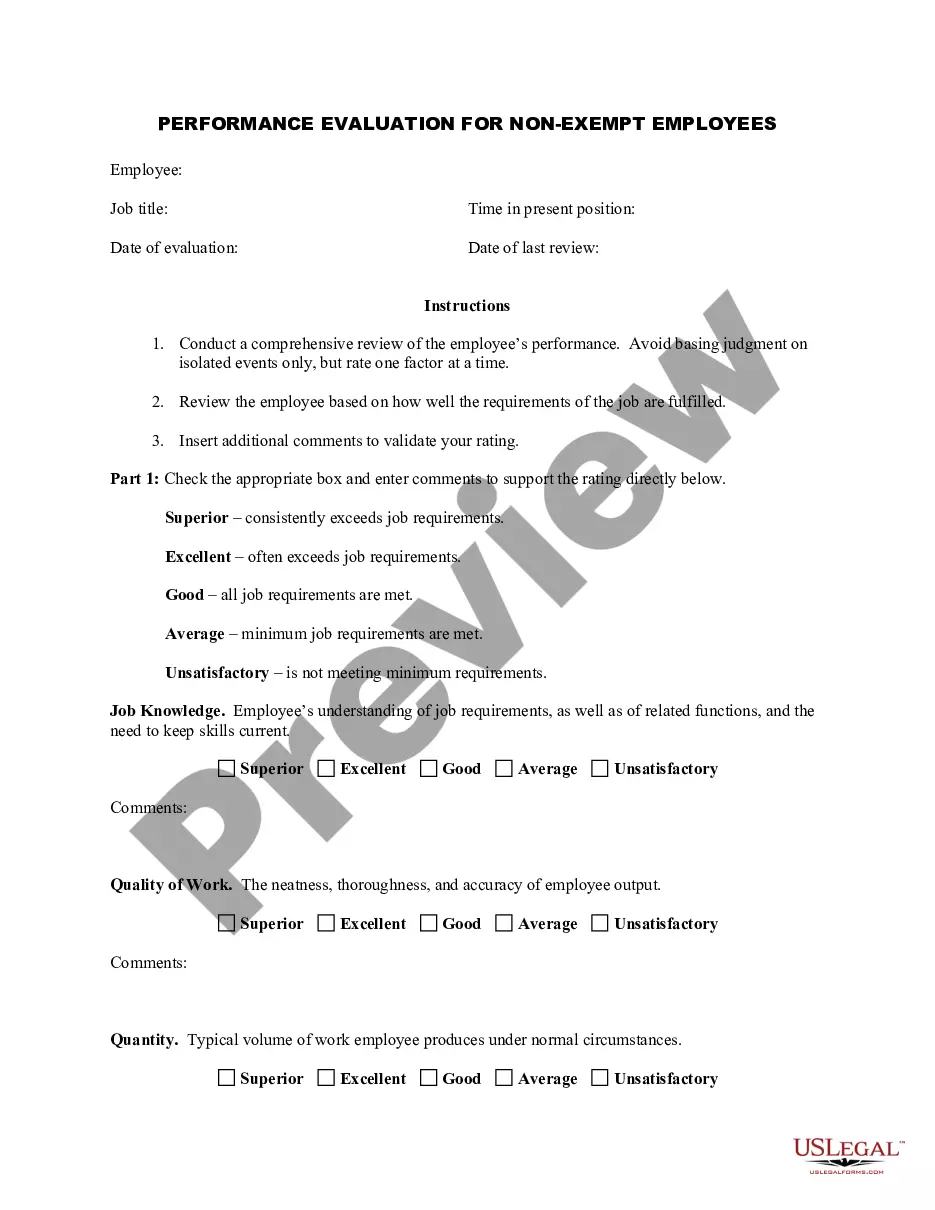

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Kansas Employee Evaluation Form for Sole Trader, that you can utilize for professional and personal purposes.

You can browse the form using the Preview button and review the form details to confirm it is the right one for you.

- All of the forms are vetted by experts and meet federal and state guidelines.

- If you are currently registered, Log In to your account and click on the Download button to obtain the Kansas Employee Evaluation Form for Sole Trader.

- Use your account to look through the legal forms you have previously acquired.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/region.

Form popularity

FAQ

Workers compensation insurance in Kansas is mandated by state law for most but not all employers. The premiums paid by the employers should be sufficient to cover the claims incurred by their insurance companies.

Yes. All employers, except those in certain agricultural pursuits or with a gross annual payroll of $20,000 or less, must provide Workers Compensation insurance for all employees (including family members, part and full-time workers, and leased employees).

To qualify for exempt status you must verify with the Kansas Department of Revenue that: 1) last year you had the right to a refund of all STATE income tax withheld because you had no tax liability; and 2) this year you will receive a full refund of all STATE income tax withheld because you will have no tax liability.

Most injuries that occur on the job are covered by workers' comp insurance, including accidents and illnesses caused by exposure to work activities, materials, and equipment. As soon as an employee suffers an occupational injury that is covered by workers' comp insurance, time is of the essence.

Liability Requirements Most employers liable for Kansas unemployment tax also are liable for the FUTA tax if: Employment is agricultural and you employ 10 or more workers in any portion of 20 different weeks in a calendar year, or have a payroll of $20,000 or more cash wages in any calendar quarter.

Background. State law generally requires employers to withhold state income tax based primarily on where an employee performs services, and secondarily where the employee resides.

Kansas law requires withholding on wages. If your cafeteria, 401K, profit sharing, or other employee plan is considered to be wages by the federal government and federal income tax withholding is required, Kansas withholding is also required.

Kansas requires employers to obtain a completed Form K-4, in addition to federal Form W-4, to assist employees in calculating the Kansas employer withholding tax rate.

In most cases, state withholding applies to state residents only. In Maine, Massachusetts, Montana, Nebraska, Oregon, and Wisconsin, state withholding also applies to individuals required to file a state tax return in that state.

In India, it's mandatory for all companies to ensure adequate compensation for its employees as per the Employee's Compensation Act, 1923 and Indian Fatal Accidents Act, 1855. A Workmens Compensation Policy helps the business owners in meeting these statutory requirements.