Kansas Overtime Report

Description

How to fill out Overtime Report?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal templates you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms like the Kansas Overtime Report within minutes.

If you already hold a monthly subscription, Log In and download the Kansas Overtime Report from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Kansas Overtime Report. Each form you add to your account does not expire and is yours indefinitely. Therefore, to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the Kansas Overtime Report with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

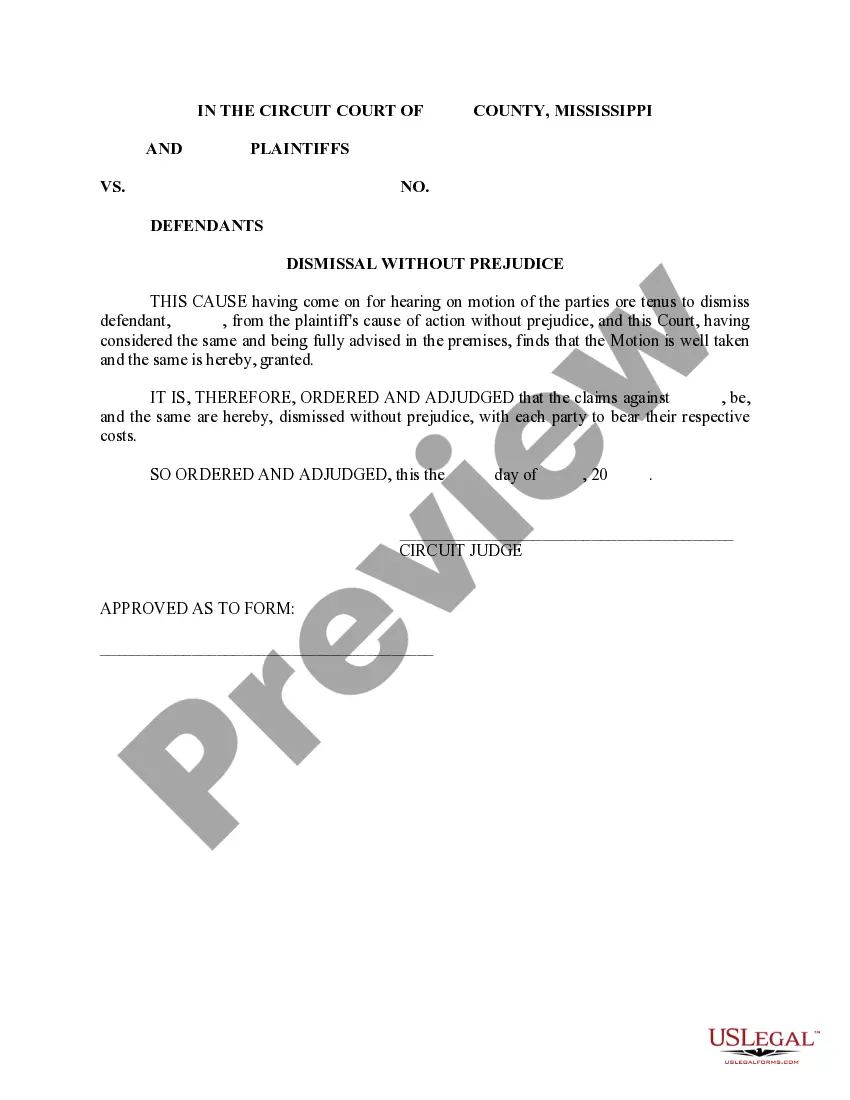

- Click the Preview button to review the form's content.

- Check the form details to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Under Kansas's overtime law, an employer must pay each employee overtime in the amount of 11/2 times the employee's regular rate for hours worked in excess of 46 in a workweek (KS Stat. Sec.

Overtime is reached once an employee has worked beyond the 40-hour maximum allowable hours in a given workweek. Compensation for overtime hours must be paid at the one and one-half time rate to non-exempt employees for any hours worked in excess of 40 hours in any given week.

Kansas Department of Labor's Workers Compensation DivisionKansas Department of Labor's Workers Compensation Division. Contact at (785) 296-4000 or kdol.wc@ks.gov.Note: The links below are to other federal or state agencies.

What is the maximum number of hours per day my employer can make me work? Theoretically your employer can make you work 24 hours a day unless you are under the age of 16. If you are under 16 you cannot work more than three hours on a school day and eight hours on a non-school day.

For minimum wage workers in Kansas, the overtime pay rate amounts to $10.88 per hour (1.5 x $7.25). An employer doesn't violate overtime laws by requiring employees to work overtime, (ie mandatory overtime), as long as they are properly compensated at the premium rate required by law.

Kansas Overtime: What you need to know Under Kansas's overtime law, an employer must pay each employee overtime in the amount of 11/2 times the employee's regular rate for hours worked in excess of 46 in a workweek (KS Stat. Sec. 44-1204).

Neither state nor federal law requires overtime pay for hours worked in excess of 8 per day or on weekends or holidays. Kansas law exempts anyone employed in a bona fide executive, administrative, professional, or outside sales capacity from overtime pay requirements.

Overtime is reached once an employee has worked beyond the 40-hour maximum allowable hours in a given workweek. Compensation for overtime hours must be paid at the one and one-half time rate to non-exempt employees for any hours worked in excess of 40 hours in any given week.

For minimum wage workers in Kansas, the overtime pay rate amounts to $10.88 per hour (1.5 x $7.25). An employer doesn't violate overtime laws by requiring employees to work overtime, (ie mandatory overtime), as long as they are properly compensated at the premium rate required by law.