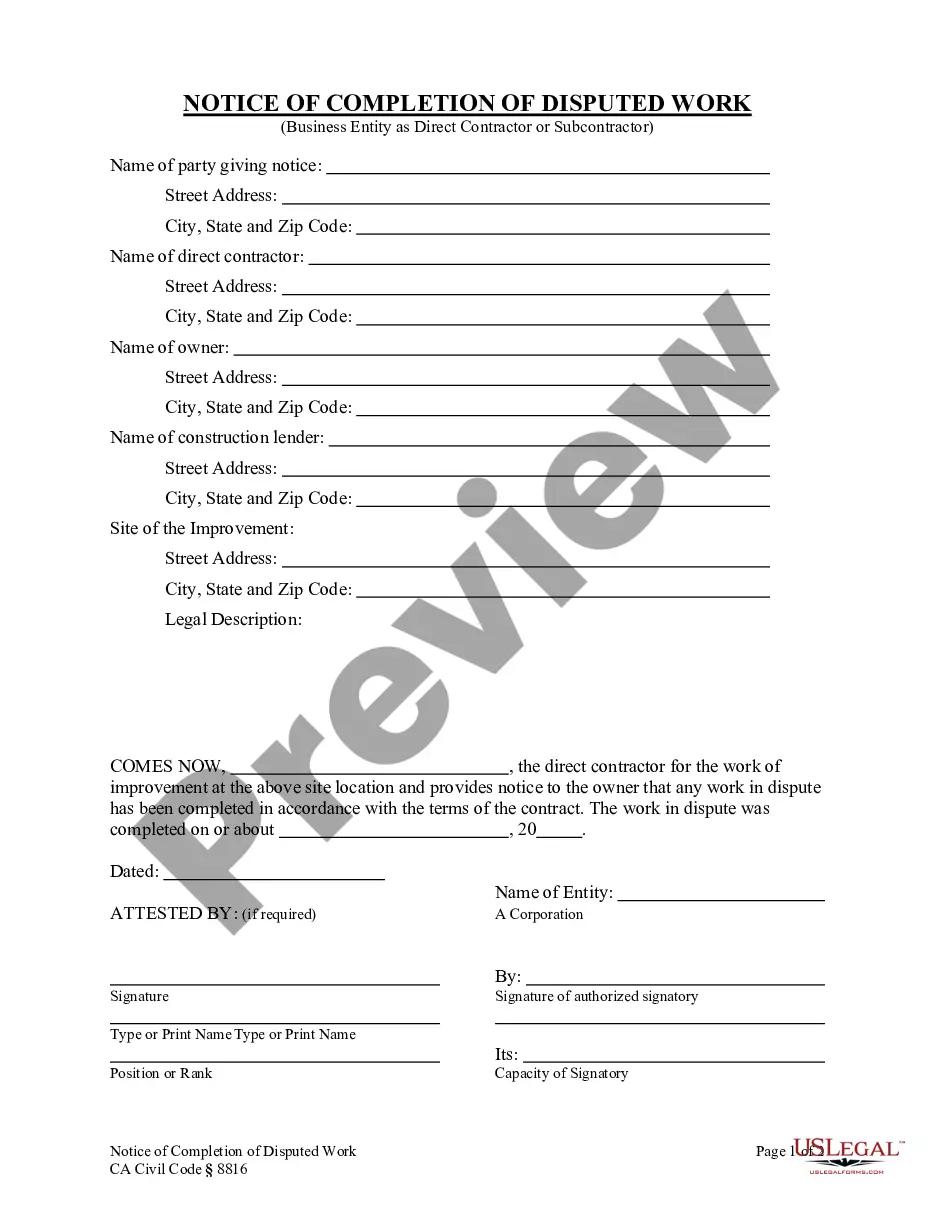

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

California Sample Letter for Change of Venue and Request for Homestead Exemption

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

You can spend hours online trying to find the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by professionals.

You can easily download or print the California Sample Letter for Change of Venue and Request for Homestead Exemption from the services.

- If you already have a US Legal Forms account, you may Log In and click the Download option.

- After that, you can complete, edit, print, or sign the California Sample Letter for Change of Venue and Request for Homestead Exemption.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of choice.

- Check the form description to confirm you have chosen the right form.

- If available, use the Review option to browse through the document template as well.

- If you wish to find another version of the form, use the Lookup field to find the template that meets your needs and requirements.

- Once you find the template you want, click Purchase now to proceed.

- Select the pricing plan you want, enter your information, and register for your account on US Legal Forms.

- Complete the transaction.

- You can use your Visa or Mastercard or PayPal account to purchase the legal form.

- Choose the format of the document and download it to your device.

- Make changes to your document if necessary.

- You can complete, edit, sign, and print the California Sample Letter for Change of Venue and Request for Homestead Exemption.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal templates.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Removing a homestead exemption in California typically involves recording a new declaration that states your intention to revoke the existing exemption. This process ensures that your property is no longer protected under the homestead laws. For assistance with drafting the necessary documents, consider using a California Sample Letter for Change of Venue and Request for Homestead Exemption to streamline your efforts.

To establish a declaration of homestead in California, you do not need to meet specific requirements like filing a notice in advance. However, you must occupy the property as your primary residence. If you are unsure about the process, utilizing a California Sample Letter for Change of Venue and Request for Homestead Exemption can help clarify your obligations and protect your home.

In California, you can benefit from two types of homestead exemptions: the regular homestead exemption and the senior or disabled persons exemption. The regular exemption protects a portion of your home equity from creditors, while the senior exemption offers increased protection for those aged 65 and over or disabled individuals. To learn more about how these exemptions apply to your situation, consider using a California Sample Letter for Change of Venue and Request for Homestead Exemption to address your legal needs.

You file motions in the court where your case is currently pending. This is important because the court has the authority over the case until a change is granted. If you are filing a motion for a change of venue, consider utilizing a California Sample Letter for Change of Venue and Request for Homestead Exemption for clarity. Always check with the court's guidelines to ensure compliance with local rules.

Yes, a plaintiff can file a motion to transfer venue if they believe that a different location would be more suitable for the case. The motion must outline the reasons for the request, and including a California Sample Letter for Change of Venue and Request for Homestead Exemption can strengthen their case. The court will consider the motion and decide if the transfer is justified. It's essential to follow the correct procedures to ensure a smooth process.

You file a motion to change venue in the court where your case is currently being heard. This is crucial because the court retains jurisdiction until a venue change is granted. Including a California Sample Letter for Change of Venue and Request for Homestead Exemption can help clarify your request. After filing, the court will review your motion and determine whether to approve it based on the reasoning provided.

To change venue in Colorado, you must file a motion with the court, similar to the process in California. This motion should provide valid reasons for the change, and you may consider including a California Sample Letter for Change of Venue and Request for Homestead Exemption if it applies to your situation. The court will evaluate the motion, and if it agrees, it will transfer the case to the appropriate venue. Always check local court rules for specific requirements.

When an attorney requests a change of venue, they are asking the court to move the case to a different jurisdiction. This request often occurs when the attorney believes that a fair trial cannot be conducted in the original location. A California Sample Letter for Change of Venue and Request for Homestead Exemption is usually prepared to support the motion with relevant facts and legal arguments. This action aims to ensure a more impartial environment for all parties involved.

To change venue in California family law, you need to file a motion in the court where your case is currently pending. This motion should include a California Sample Letter for Change of Venue and Request for Homestead Exemption to clearly explain your reasons for the request. The court will review the motion, and if it finds valid grounds, it may grant the change of venue to a more appropriate location. Always ensure that you follow the specific procedures outlined by the court to avoid delays.