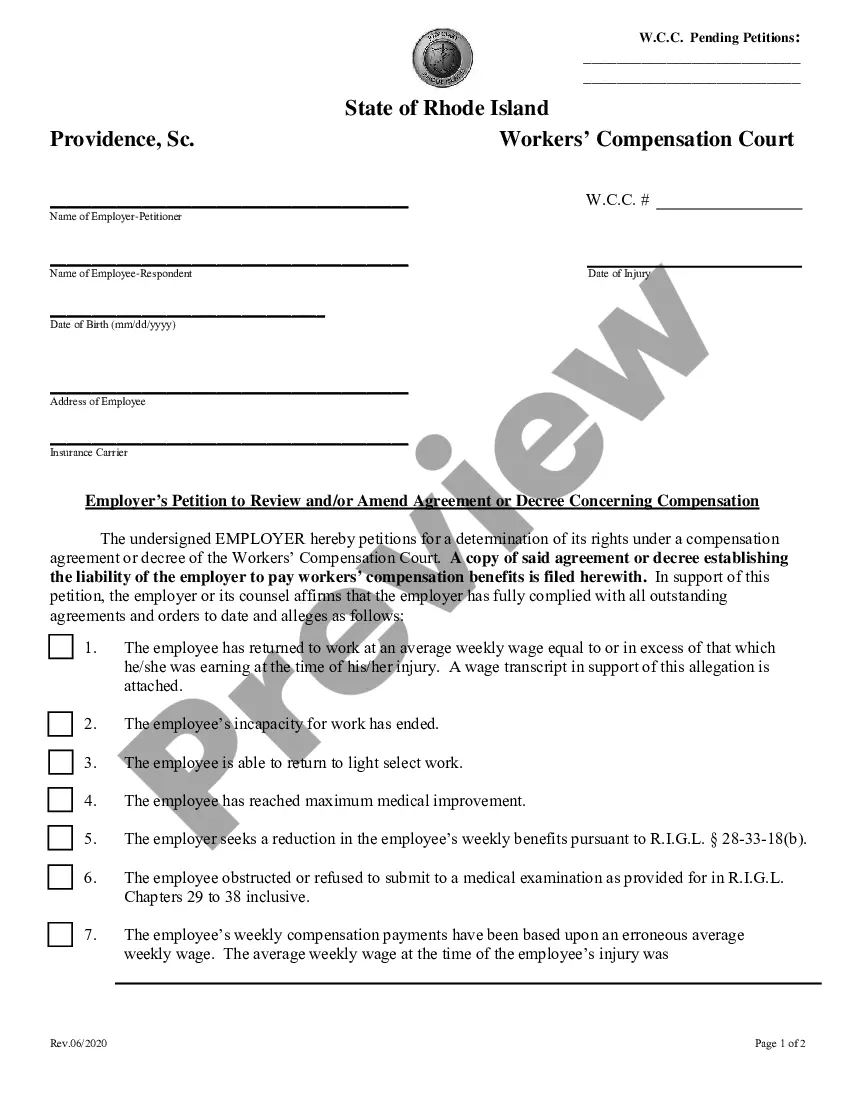

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Kansas Yearly Expenses by Quarter

Description

How to fill out Yearly Expenses By Quarter?

Are you in a situation where you need documents for both business or particular tasks nearly every day.

There are many legal document templates available online, but finding versions you can trust is not simple.

US Legal Forms offers a vast selection of form templates, including the Kansas Annual Expenses by Quarter, which are designed to meet federal and state regulations.

Once you find the correct form, click Purchase now.

Select the payment plan you want, provide the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Annual Expenses by Quarter template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review option to examine the form.

- Go through the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Every U.S. state other than Vermont has some form of balanced budget provision that applies to its operating budget. The precise form of this provision varies from state to state. Indiana has a state debt prohibition with an exception for "temporary and casual deficits," but no balanced budget requirement.

Into the following fiscal year. The divergence in revenues and spending left Kansas with an ending balance of just $89.1 million. With updated tax revenue projections, the Kansas state budget will not balance unless the state finds an additional $121 million.

Agriculture is the largest economic driver in Kansas, with a total contribution of $67 billion to the Kansas economy. The agriculture sector in Kansas supports more than 238,000 jobs through direct, indirect and induced effect careers, or about 12% percent of the entire workforce in the state.

Revenues come mainly from tax collections, licensing fees, federal aid, and returns on investments. Expenditures generally include spending on government salaries, infrastructure, education, public pensions, public assistance, corrections, Medicaid, and transportation.

Agriculture remains the largest economic and industrial driver in Kansas, generating more than $70 billion into the state's economy. The state remains in the top 10 for beef cattle, corn, hay, hogs, soybean, sunflower, sorghum and wheat.

Family-owned farms and ranches account for most of the state's approximately $20 billion agriculture industry. Kansas is a major producer of wheat, beef and grain sorghum, traditionally used for livestock feed and some ethanol plants.

Kansas is a major producer of wheat, beef and grain sorghum, traditionally used for livestock feed and some ethanol plants.

Meatpacking and dairy industries are major economic activities, and the Kansas City stockyards are among the nation's largest. Food processing ranked as the state's third largest industry in the 1990s. The two leading industries are the manufacture of transportation equipment and industrial and computer machinery.