Kansas Assignment of Personal Property

Description

How to fill out Assignment Of Personal Property?

You are capable of dedicating hours online attempting to locate the legal document format that meets the state and federal standards you require.

US Legal Forms offers thousands of legal templates that have been evaluated by experts.

It is easy to download or print the Kansas Assignment of Personal Property from your service.

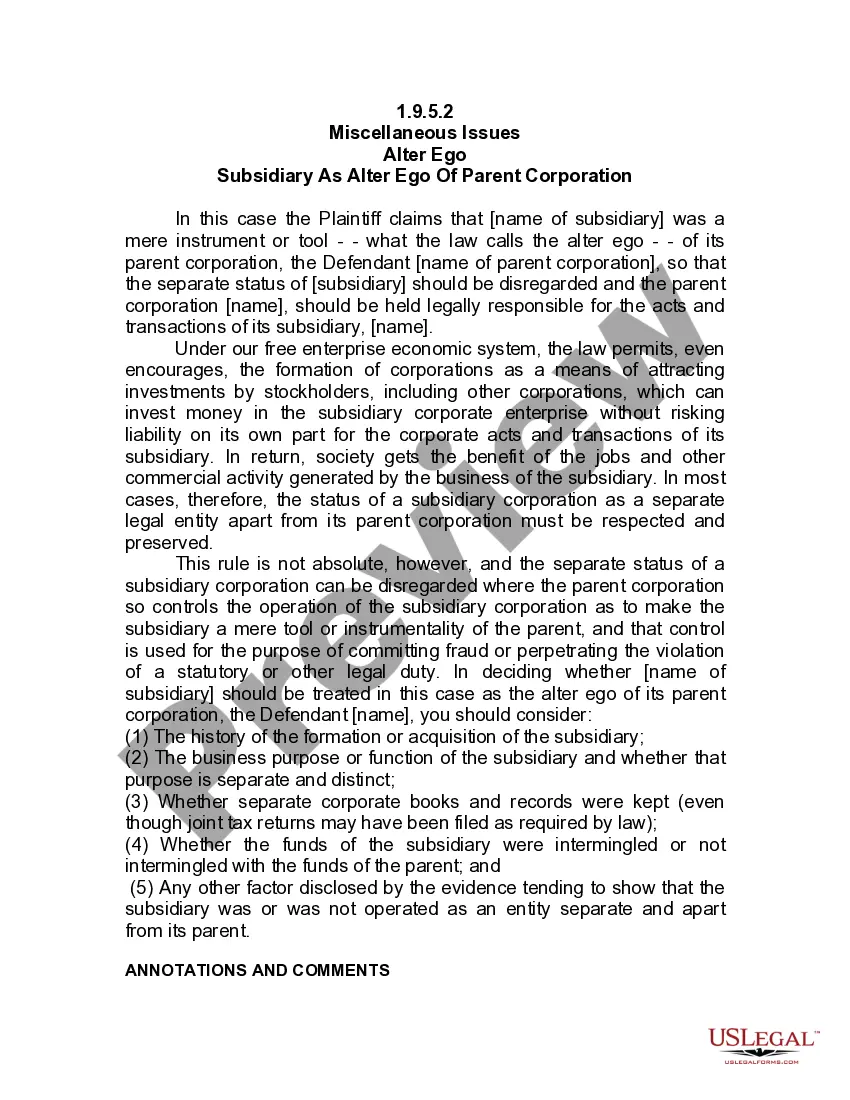

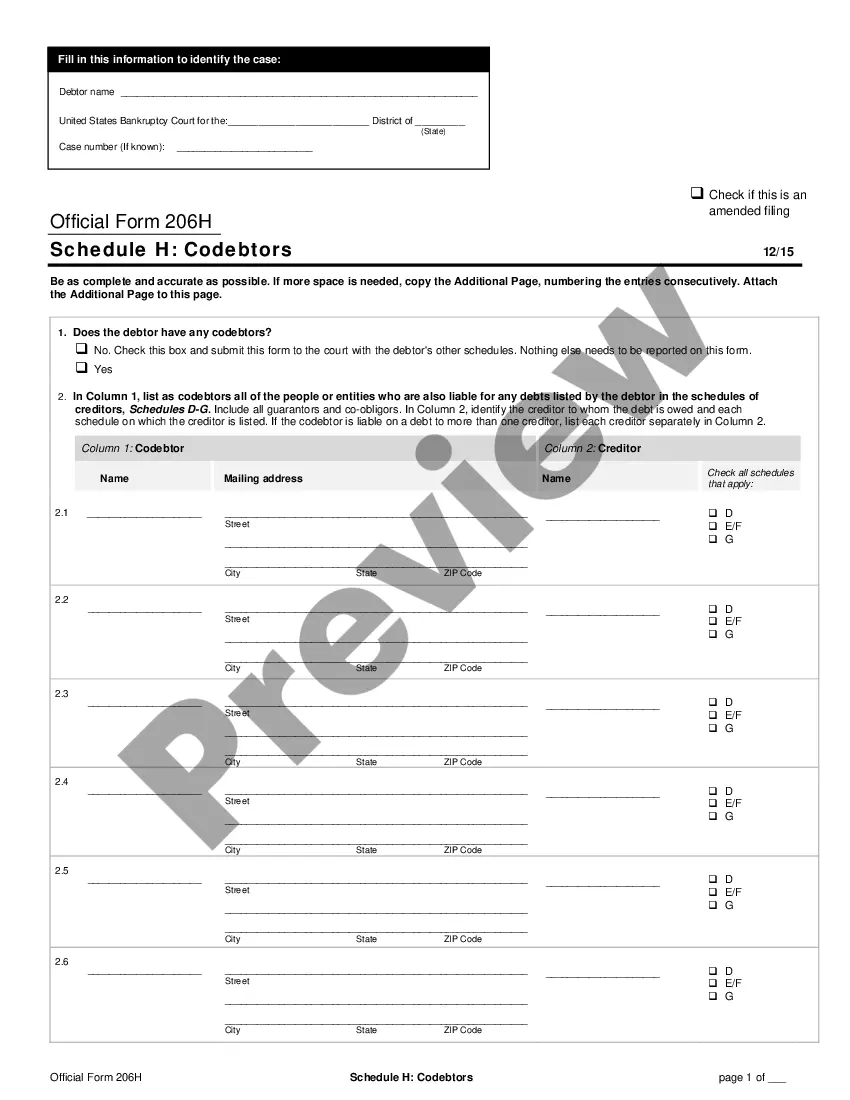

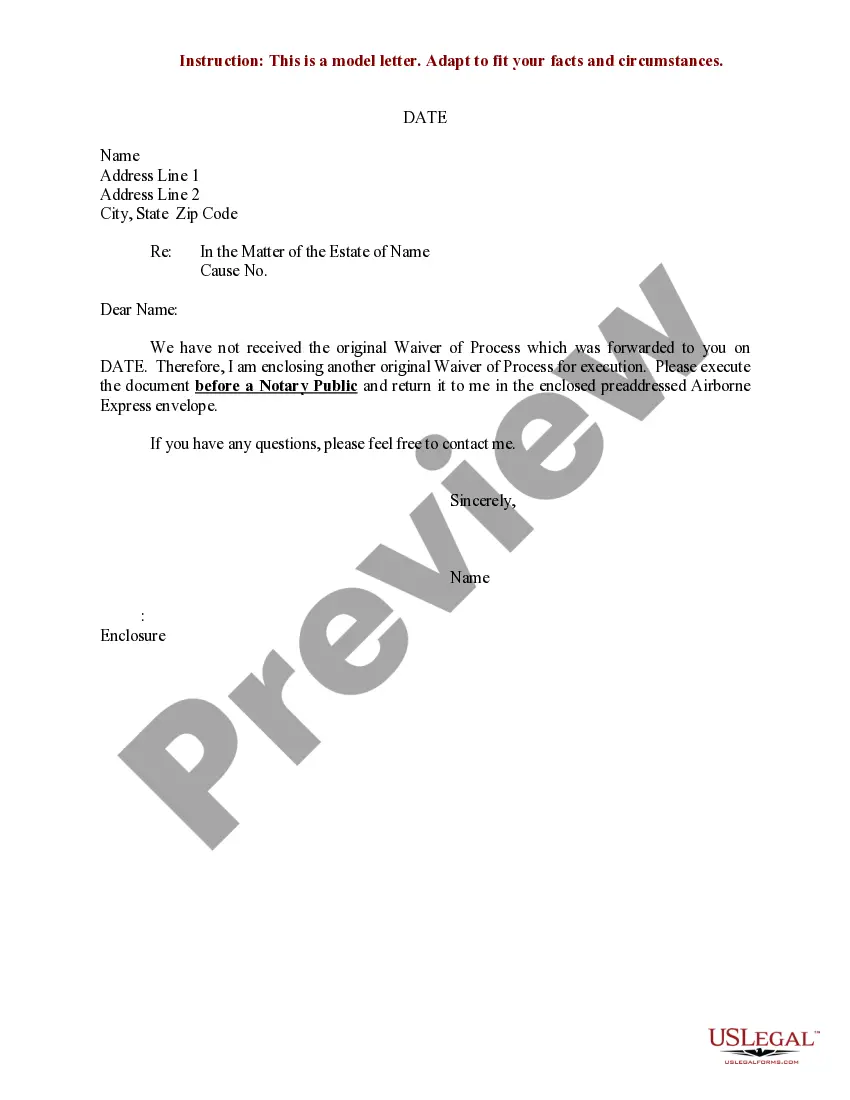

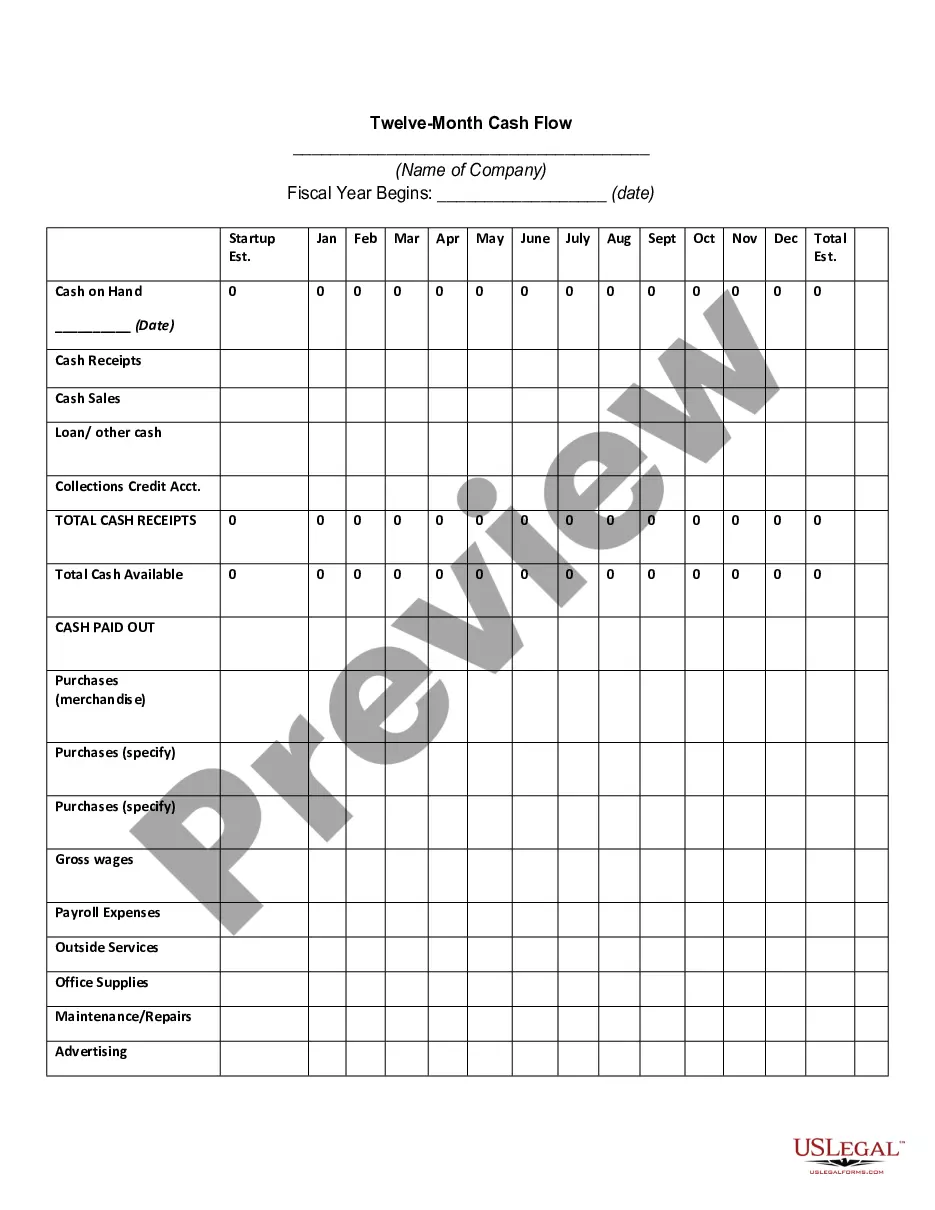

If available, use the Preview option to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- After that, you can complete, modify, print, or sign the Kansas Assignment of Personal Property.

- Every legal document format you buy is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have chosen the correct document format for the state/town of your choice.

- Check the form details to ensure you have selected the correct document.

Form popularity

FAQ

Property tax rates in Kansas can be high due to several factors, such as funding for local schools and infrastructure. Local governments depend on property taxes for essential services, which can increase the overall burden on property owners. Understanding these factors is key if you are considering a Kansas Assignment of Personal Property.

To obtain a personal property tax receipt in Missouri, you typically need to contact your local tax collector's office or visit their website. You can request your receipt by providing necessary details, such as your property account number and address. This process is straightforward and ensures you have the proper documentation, especially when discussing issues like a Kansas Assignment of Personal Property.

A form of ownership in which two or more persons share ownership of personal property or real estate as "joint tenants with rights of survivorship" so that when one owner dies, his or her interest passes on to the survivors by operation of law.

Both Kansas and Missouri offer tenancy in common and joint tenancy with the right of survivorship. However, only Missouri offers tenancy by the entireties. Tenancy by the entireties is only offered in about 20 states and that type of tenancy varies significantly among those states.

Kansas law requires that property be taxed uniformly and equally as to class, and unless otherwise specified, valued based upon its market value as of January 1st. Article 11, Section 1 of the Kansas Constitution places real property and personal property into separate classes.

Probate proceedings are usually only required if the deceased person owned any assets in their name only. Other assets, also known as non-probate property, can generally be transferred to the other owner without probate. Kansas has not adopted the Uniform Probate Code.

In Kansas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Kansas Summary: Under Kansas statute, where as estate is valued at less than $40,000, an interested party may issue a small estate affidavit to collect any debts owed to the decedent.

The estate must be valued at no more than $25,000 and only contains personal property.

2019 Statute (a) The executor or administrator appointed under the Kansas simplified estates act shall collect the decedent's assets, file an inventory and valuation, pay claims of creditors, and pay taxes owed by the decedent or the decedent's estate in the manner provided by law.