Kansas Assignment of Assets

Description

How to fill out Assignment Of Assets?

If you need to thorough, acquire, or produce authentic document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Employ the site’s simple and convenient search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Buy now option. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to quickly find the Kansas Assignment of Assets.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to access the Kansas Assignment of Assets.

- You can also retrieve forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have selected the form for the correct area/state.

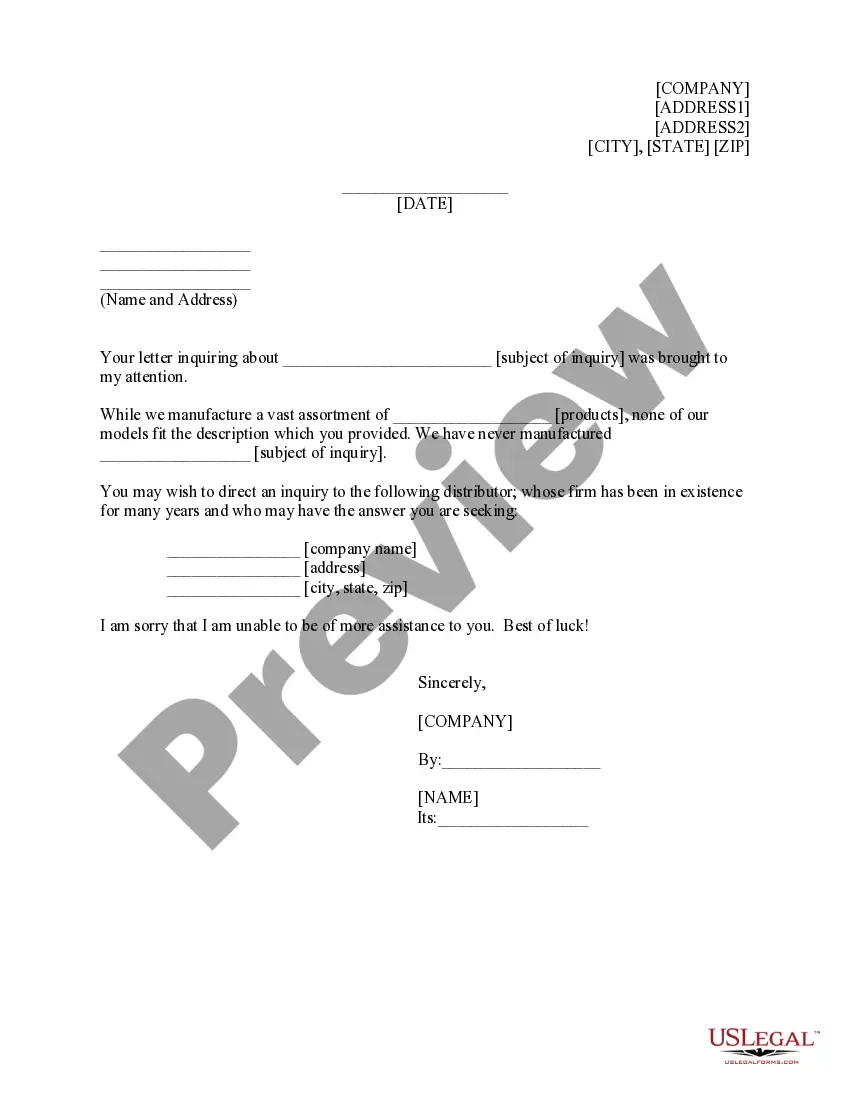

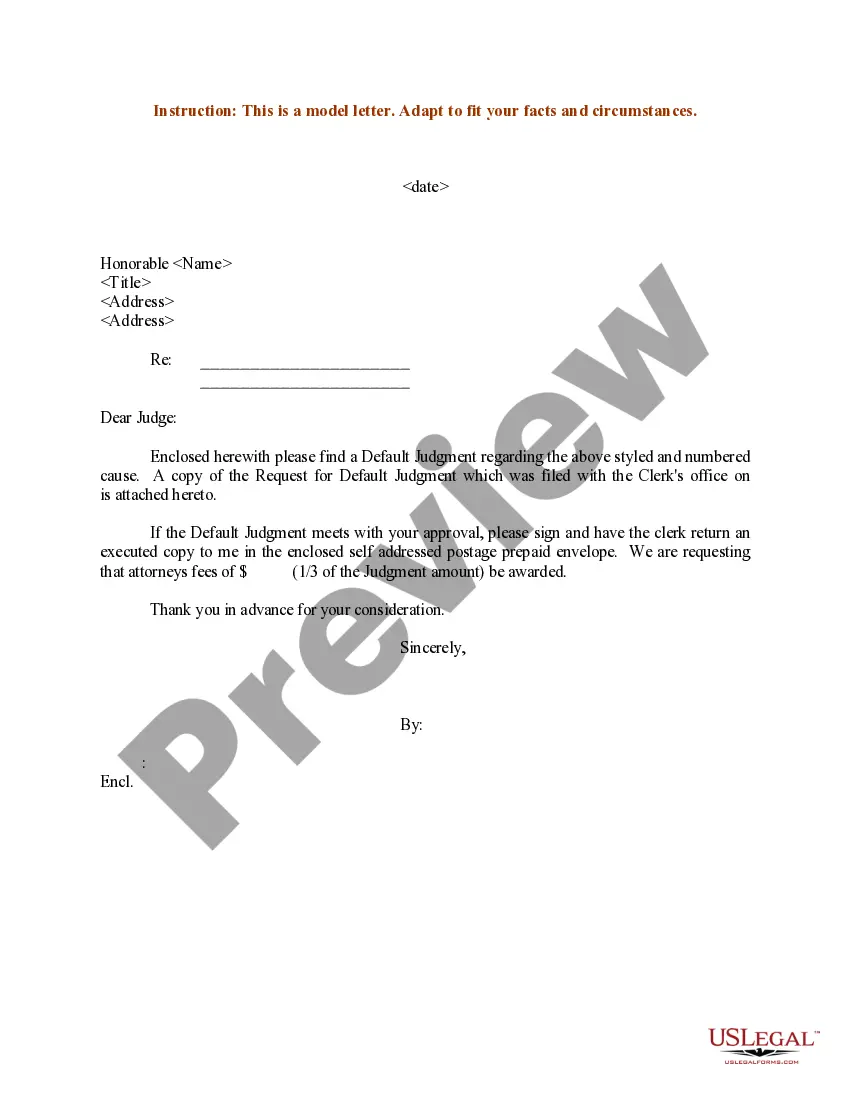

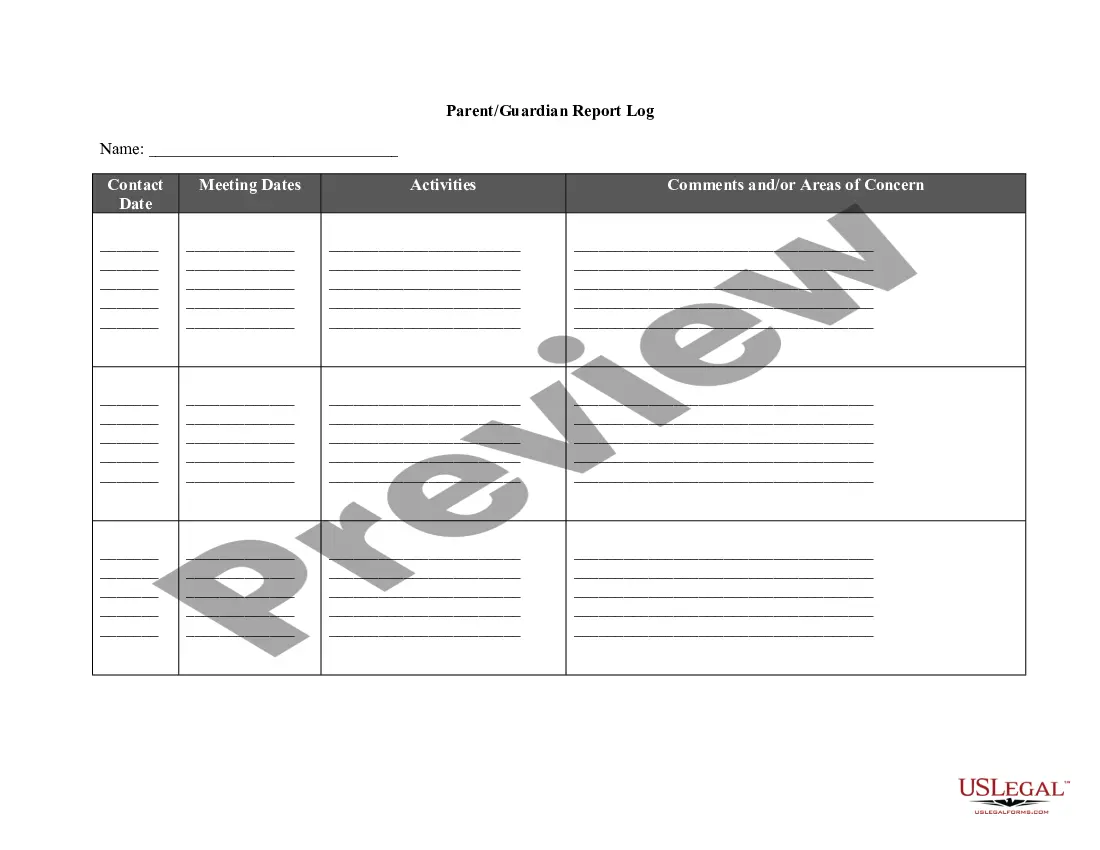

- Step 2. Use the Review option to inspect the form’s details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other options in the legal form template.

Form popularity

FAQ

The division of assets for Medicaid eligibility in Kansas involves assessing a person's financial resources to determine their qualification for assistance. Certain assets may be exempt, while others must be disclosed and evaluated to meet stringent Medicaid guidelines. By understanding the Kansas Assignment of Assets, you can make informed decisions about managing your assets to maximize eligibility and benefits.

A general assignment of assets is a legal document that transfers a person's assets to another party, often to satisfy debts or obligations. This process can simplify the management and distribution of assets in various situations, including bankruptcy or divorce. Utilizing the Kansas Assignment of Assets ensures that all steps are legally sound and organized, providing clarity to all parties involved.

In Kansas, assets acquired during the marriage are typically divided equitably during a divorce. This means that while the division is not always equal, it aims to be fair based on various factors. Important considerations include the length of the marriage, each spouse's financial situation, and contributions made to the marital estate. Understanding the Kansas Assignment of Assets can help you navigate this process smoothly.

An assignment agreement outlines the terms and conditions under which one party transfers their assets to another. This legal document protects the interests of both parties by clearly stating their responsibilities and rights. In the context of Kansas Assignment of Assets, having a solid agreement is crucial for ensuring that all transactions are legally binding and transparent.

Yes, Kansas is a Transfer on Death (TOD) state, allowing property owners to designate beneficiaries who will receive their property automatically upon their death. This can streamline the process, making it easier for heirs to inherit without going through probate. Familiarizing yourself with Kansas Assignment of Assets, including TOD designations, can simplify estate management.

To transfer a property deed in Kansas, you should prepare a new deed that includes the names of the current owner and the new owner, along with a legal description of the property. After signing, the deed needs to be recorded with the local county clerk's office to establish the new ownership officially. Engaging with Kansas Assignment of Assets professionals ensures that the process meets all legal requirements.

To assign assets means to designate specific property or financial resources to another party, allowing them to manage or use those assets. This assignment often requires legal documentation to ensure clarity and protection for both parties involved. In Kansas, understanding the mechanics of assigning assets is essential for effective asset management.

An example of the assignment of property could be when a homeowner assigns their rights to receive rent payments from a rental property to another individual. This often occurs in business contexts where ownership needs to be transferred without selling the property. Knowing how Kansas Assignment of Assets works can help in leveraging property efficiently.

While both terms involve the movement of property rights, a transfer usually implies a straightforward change of ownership. An assignment can involve rights being granted to another party for a particular purpose, often retaining some responsibility for the assignor. Clarity on these terms is crucial for effective Kansas Assignment of Assets.

In Kansas, a small estate affidavit is generally not required if the total value of the estate qualifies as a small estate. However, specific circumstances may still require court intervention. Understanding whether or not to file can save time and resources. The Kansas Assignment of Assets can simplify this process.