Kansas Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction

Description

How to fill out Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction?

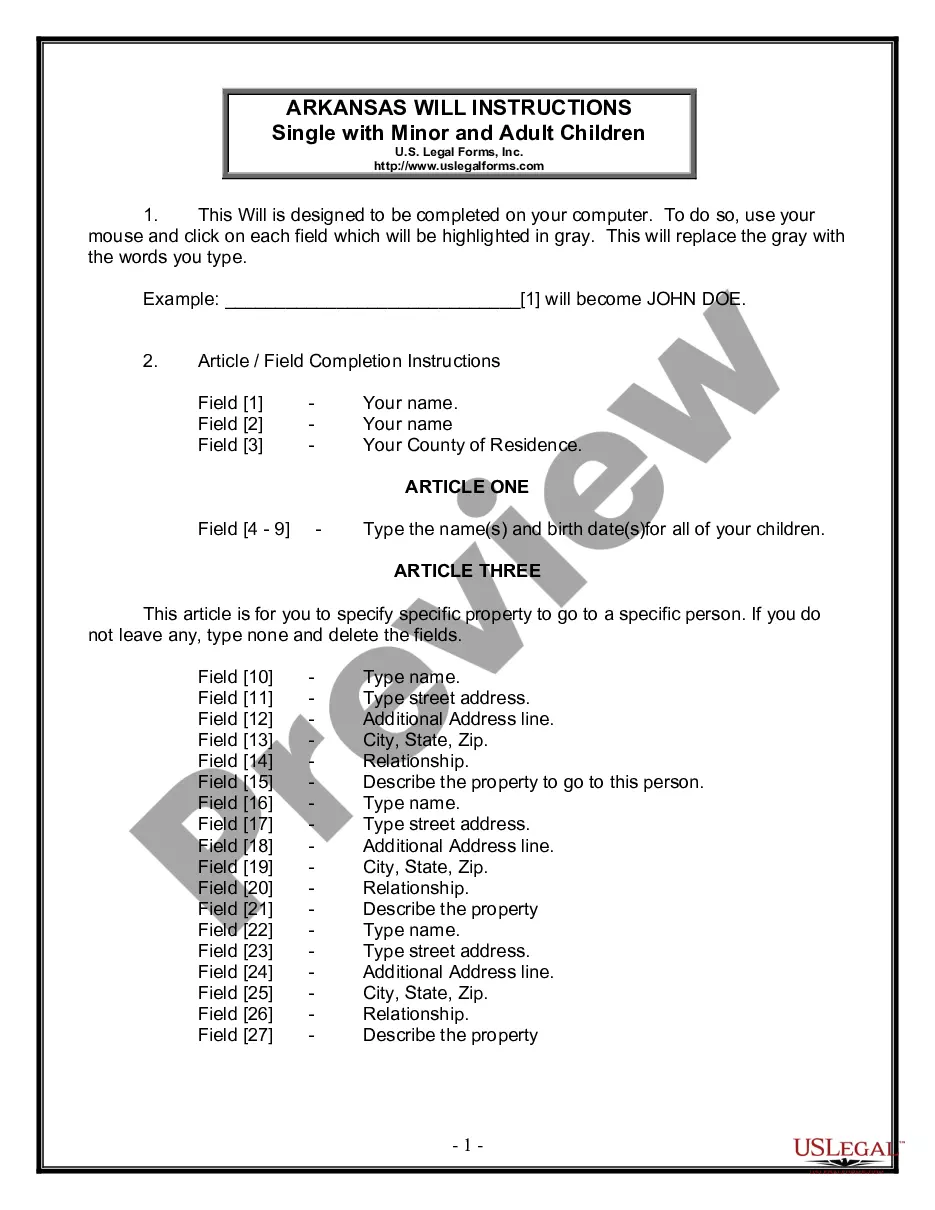

You may devote hrs on-line looking for the legitimate file web template that suits the state and federal specifications you require. US Legal Forms provides a huge number of legitimate forms which can be analyzed by specialists. It is simple to acquire or produce the Kansas Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction from our services.

If you have a US Legal Forms bank account, you can log in and click the Acquire key. Afterward, you can complete, revise, produce, or indicator the Kansas Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction. Every single legitimate file web template you get is the one you have eternally. To obtain yet another backup for any obtained kind, visit the My Forms tab and click the related key.

Should you use the US Legal Forms website the very first time, follow the simple directions beneath:

- Very first, ensure that you have chosen the proper file web template for that area/city of your liking. Read the kind outline to ensure you have picked the appropriate kind. If available, utilize the Preview key to look from the file web template too.

- If you wish to get yet another variation of your kind, utilize the Research area to get the web template that suits you and specifications.

- Upon having found the web template you want, click Get now to move forward.

- Find the costs strategy you want, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You should use your credit card or PayPal bank account to fund the legitimate kind.

- Find the formatting of your file and acquire it to your device.

- Make modifications to your file if possible. You may complete, revise and indicator and produce Kansas Jury Instruction - Evading Currency Transaction Reporting Requirement While Violating Another Law By Structuring Transaction.

Acquire and produce a huge number of file templates utilizing the US Legal Forms site, which offers the biggest selection of legitimate forms. Use professional and state-particular templates to handle your small business or person needs.

Form popularity

FAQ

This is called ?structuring.? Federal law makes it a crime to break up transactions into smaller amounts for the purpose of evading the CTR reporting requirement and this may lead to a required disclosure from the financial institution to the government.

Federal law requires financial institutions to report currency (cash or coin) transactions over $10,000 conducted by, or on behalf of, one person, as well as multiple currency transactions that aggregate to be over $10,000 in a single day. These transactions are reported on Currency Transaction Reports (CTRs).

Having an IRS Currency Transaction Report on your file increases your likelihood of being audited, which is one of the reasons even people who have nothing to hide try to avoid the CTR.

Illegally "structuring" a transaction means setting up (structuring) a large cash transaction so that it doesn't trigger the reporting requirements. The most common method for doing this is called ?smurfing,? breaking up a large cash deposit into a series of smaller deposits to avoid bank detection.

A currency transaction report (CTR) is a bank form used in the U.S. to help prevent money laundering. This form must be filled out by a bank representative whenever a customer attempts a currency transaction of more than $10,000. It is part of the banking industry's anti-money laundering (AML) responsibilities.

A completed CTR must be electronically filed with FinCEN within 15 calendar days after the date of the transaction.

A bank must electronically file a Currency Transaction Report (CTR) for each transaction in currency1 (deposit, withdrawal, exchange of currency, or other payment or transfer) of more than $10,000 by, through, or to the bank.