Kansas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

Are you inside a place where you will need paperwork for both company or personal purposes just about every day? There are a lot of legitimate papers themes available on the net, but getting versions you can trust is not effortless. US Legal Forms offers a huge number of form themes, such as the Kansas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, which can be created in order to meet federal and state requirements.

If you are already informed about US Legal Forms website and also have an account, basically log in. Next, you are able to obtain the Kansas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage format.

If you do not provide an bank account and want to begin to use US Legal Forms, adopt these measures:

- Get the form you require and make sure it is for the right area/county.

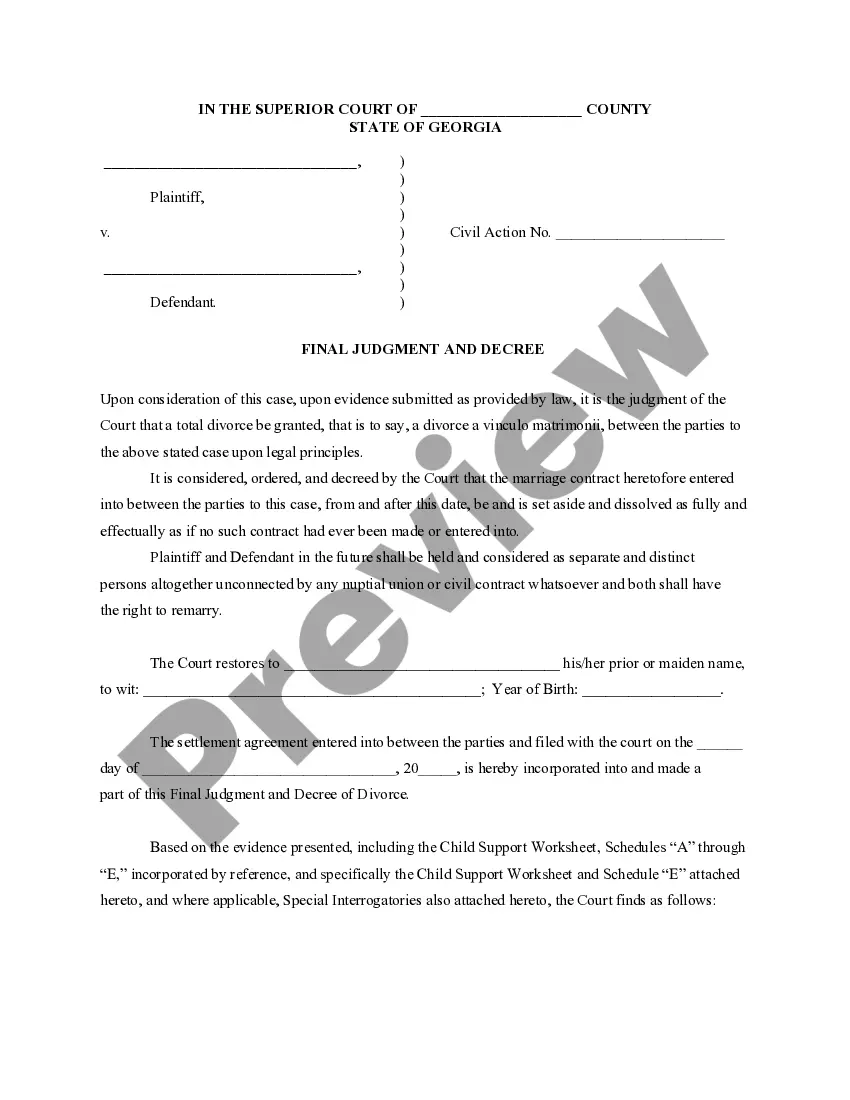

- Take advantage of the Review button to analyze the form.

- Read the outline to ensure that you have selected the proper form.

- In the event the form is not what you`re searching for, make use of the Research area to obtain the form that meets your needs and requirements.

- Whenever you obtain the right form, click on Buy now.

- Select the costs strategy you need, fill in the necessary details to generate your money, and pay for the transaction using your PayPal or credit card.

- Pick a convenient data file formatting and obtain your copy.

Locate all the papers themes you have purchased in the My Forms food list. You can obtain a further copy of Kansas Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage any time, if necessary. Just go through the necessary form to obtain or printing the papers format.

Use US Legal Forms, by far the most extensive collection of legitimate varieties, to save lots of time as well as avoid mistakes. The service offers appropriately made legitimate papers themes that you can use for an array of purposes. Generate an account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

Grounds For an Annulment in Kansas Generally, your marriage may be annulled based on any of the following grounds: incest- spouses are first cousins or closer in relation. bigamy - one spouse has a previous spouse they never divorced. Insanity - one spouse was incapable of understanding they were getting married.

Meaning of annulment in English an official announcement that something such as a law, agreement, or marriage no longer exists, or the process of making this announcement: Judges only grant marriage annulments in exceptional circumstances.

In Kansas, there is not a mandatory period of separation prior to divorce. As long as you have been a resident of the state for sixty days prior to filing the petition for divorce, you are not required to live separately before or after the petition has been filed.

There is no time limit, minimum or maximum, for an annulment in Georgia. You just have to meet one of the requirements for an annulment under Georgia statute, which are fairly narrow. Can We Get an Annulment If We Were Only Married for a Short Time/Failed to Consummate the Marriage?

Based on the Family Code, the grounds for annulment are lack of parental consent, insanity/psychological incapacity; fraud, force, intimidation, or undue influence; impotence; and sexually transmissible diseases.

23-2702. Grounds for annulment. (a) The district court shall grant a decree of annulment of any marriage for either of the following grounds: (1) The marriage is void for any reason; or (2) the contract of marriage is voidable because it was induced by fraud.

As of July 1, 2011, the Kansas state courts require a filing fee of $179.50 for an initial action (divorce, annulment, separate maintenance and other initial actions) and $64 to file any motion to change legal custody, modify residential placement or parenting time, change child support, or revise any other existing ...