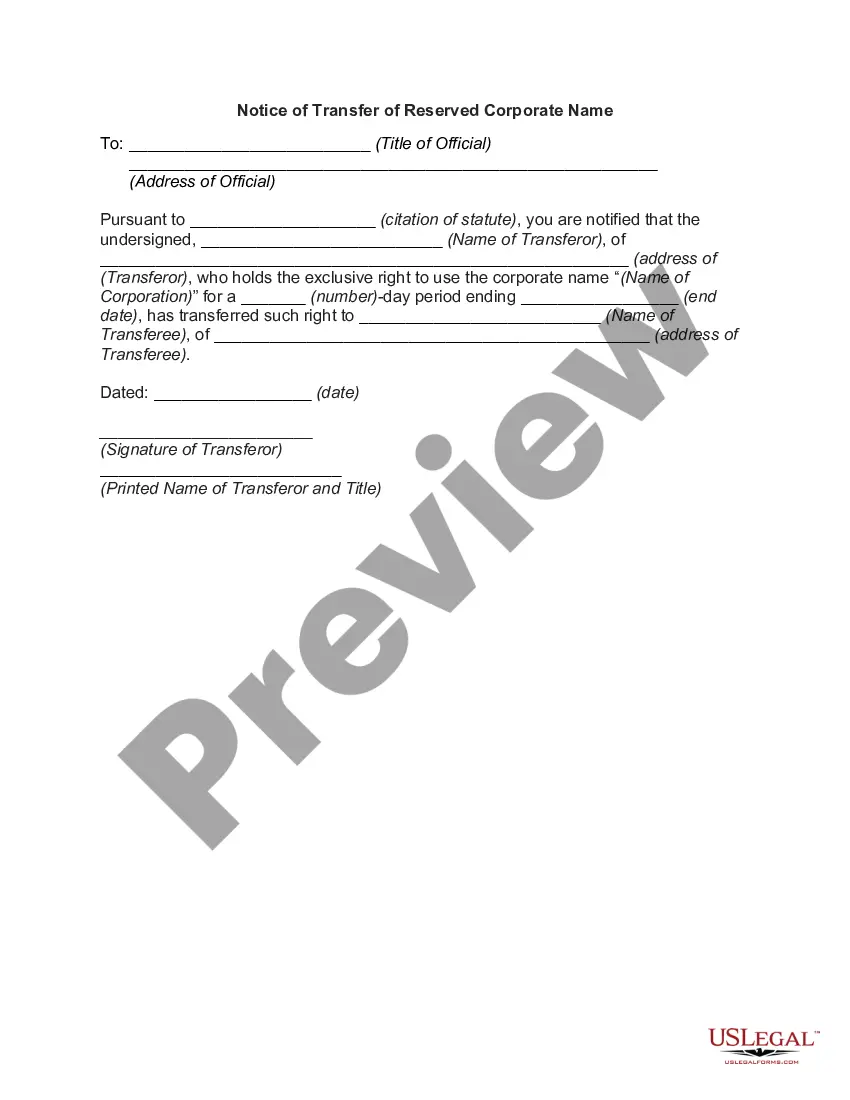

Kansas Notice of Transfer of Reserved Corporate Name

Description

How to fill out Notice Of Transfer Of Reserved Corporate Name?

Finding the right lawful papers format might be a have a problem. Of course, there are a lot of layouts available on the net, but how will you discover the lawful type you need? Take advantage of the US Legal Forms web site. The assistance delivers a huge number of layouts, for example the Kansas Notice of Transfer of Reserved Corporate Name, which you can use for business and private requires. All of the kinds are checked by professionals and satisfy state and federal requirements.

In case you are previously registered, log in to the accounts and then click the Obtain button to get the Kansas Notice of Transfer of Reserved Corporate Name. Make use of accounts to check through the lawful kinds you may have bought formerly. Check out the My Forms tab of your respective accounts and get yet another duplicate of your papers you need.

In case you are a fresh consumer of US Legal Forms, listed below are easy recommendations so that you can stick to:

- Very first, make sure you have selected the appropriate type for the area/region. You may look over the shape making use of the Preview button and study the shape information to make certain it is the right one for you.

- In case the type is not going to satisfy your needs, utilize the Seach industry to get the appropriate type.

- Once you are positive that the shape is suitable, go through the Buy now button to get the type.

- Select the rates strategy you desire and enter the essential information and facts. Design your accounts and purchase an order making use of your PayPal accounts or credit card.

- Pick the document file format and obtain the lawful papers format to the product.

- Comprehensive, change and print and signal the obtained Kansas Notice of Transfer of Reserved Corporate Name.

US Legal Forms is the largest library of lawful kinds where you will find a variety of papers layouts. Take advantage of the company to obtain appropriately-made papers that stick to condition requirements.

Form popularity

FAQ

Two Ways to Start A New Business in Kansas Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Kansas Secretary of State. Get your business licenses. Set up a business bank account.

If you submit the forms by mail, the processing fee is $165. Are DBAs and trademarks the same thing? A DBA and a trademark are entirely different things. A DBA allows business owners to use a fictitious business name that is not its legal name in most states.

The State of Kansas has no formal process for registration of a DBA on the state level, so DBA registration usually occurs on the local or county level. Each county also determines if a DBA filing is required.

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

Your LLC must file a IRS Form 1065 and a Kansas Partnership Return (Form K-120S). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Kansas Department of Revenue to pay your Kansas income tax. Check with your accountant to make sure you file all the correct documents.

The State of Kansas has no formal process for registration of a DBA on the state level, so DBA registration usually occurs on the local or county level. Each county also determines if a DBA filing is required.

To revive or reinstate your Kansas LLC, you'll need to submit the following to the Kansas Secretary of State: a completed Certificate of Reinstatement of Limited Liability Company. all past due annual reports. the $35 filing fee plus fees for late annual reports, if needed.

You can use the Kansas Business Entity Search System to check if your business name is available. You can also check the Name Availability Status through the Kansas Business Filing Center. You may also contact the Kansas Business Filing Center or Secretary of State if you need help with your name search.