Kansas Indemnification Agreement for a Trust

Description

How to fill out Indemnification Agreement For A Trust?

If you need to total, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms that can be accessed online.

Make use of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you acquire is your property indefinitely.

You will have access to each form you obtained in your account. Select the My documents section and choose a form to print or download again. Be proactive and download, and print the Kansas Indemnification Agreement for a Trust with US Legal Forms. There are numerous professional and state-specific forms available for your business or individual needs.

- Utilize US Legal Forms to get the Kansas Indemnification Agreement for a Trust in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Kansas Indemnification Agreement for a Trust.

- You can also find forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

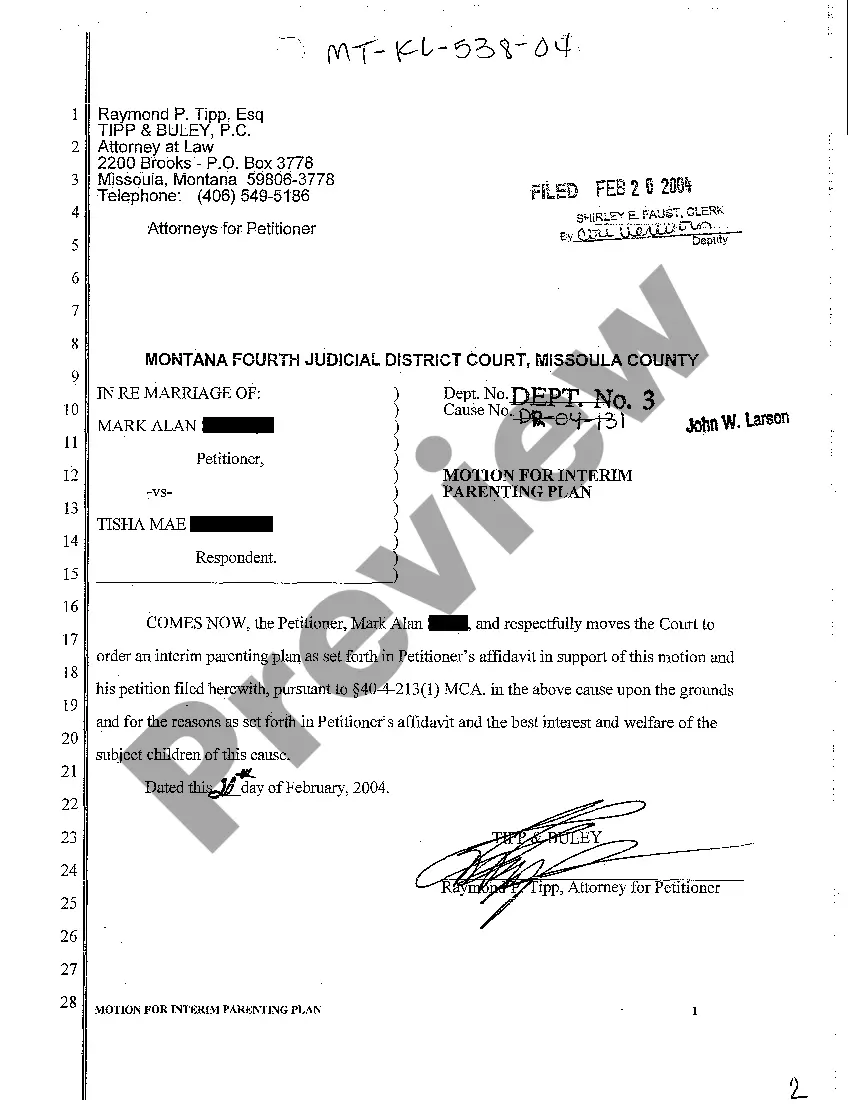

- Step 2. Utilize the Review option to assess the form’s content. Don’t forget to examine the details.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you’ve found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kansas Indemnification Agreement for a Trust.

Form popularity

FAQ

The right to indemnity for a trustee allows the trustee to seek reimbursement for expenses incurred while managing the trust. This means if you are a trustee and face legal claims or financial responsibilities as part of your duties, you can be compensated. A Kansas Indemnification Agreement for a Trust provides clear terms for this right. It ensures that trustees can perform their roles without fearing financial loss.

The trustee cannot grant legitimate and reasonable requests from one beneficiary in a timely manner and deny or delay granting legitimate and reasonable requests from another beneficiary simply because the trustee does not particularly care for that beneficiary. Invest trust assets in a conservative manner.

This means that a trustee has a claim on the trust assets for the debts which it has incurred as trustee. In order to satisfy such a claim, the trustee has a right of indemnity which is secured by an equitable lien on the trust assets.

The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

A beneficiary can override a trustee using only legal means at their disposal and claiming a breach of fiduciary duty on the Trustee's part. If the Trustee stays transparent and lives up to the trust document, there is no reason to override the Trustee.

A trustee may ask a beneficiary to sign a piece of paper indemnifying the trustee prior to making a distribution of trust assets. First, let's talk about what indemnification means? Indemnification is a legal term. It literally means that one person is going to pay for any loss or harm suffered by another person.

Classic Requirements for a Valid TrustCertainty of Intention. The word 'trust' is not necessary to satisfy an indication of intention neither are technical words needed as 'equity looks to the intent rather than the form'.Certainty of Subject Matter.Certainty of Object.

Commonly indemnities limit the liability of the new/recipient trustees to the value of the trust fund at the time of the transfer or from time to time, subject to such onward indemnities being required where there are further distributions or a subsequent change of trustee.

A trustee is personally liable for a breach of his or her fiduciary duties. The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties. The duty of loyalty requires that the trustee administer the trust solely in the interest of the beneficiaries.

Modern trust instruments usually confer an express power upon the new trustees to give indemnities; in the absence of that express power, the new trustees could give an indemnity that is enforceable as a matter of contract law.