Kansas Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

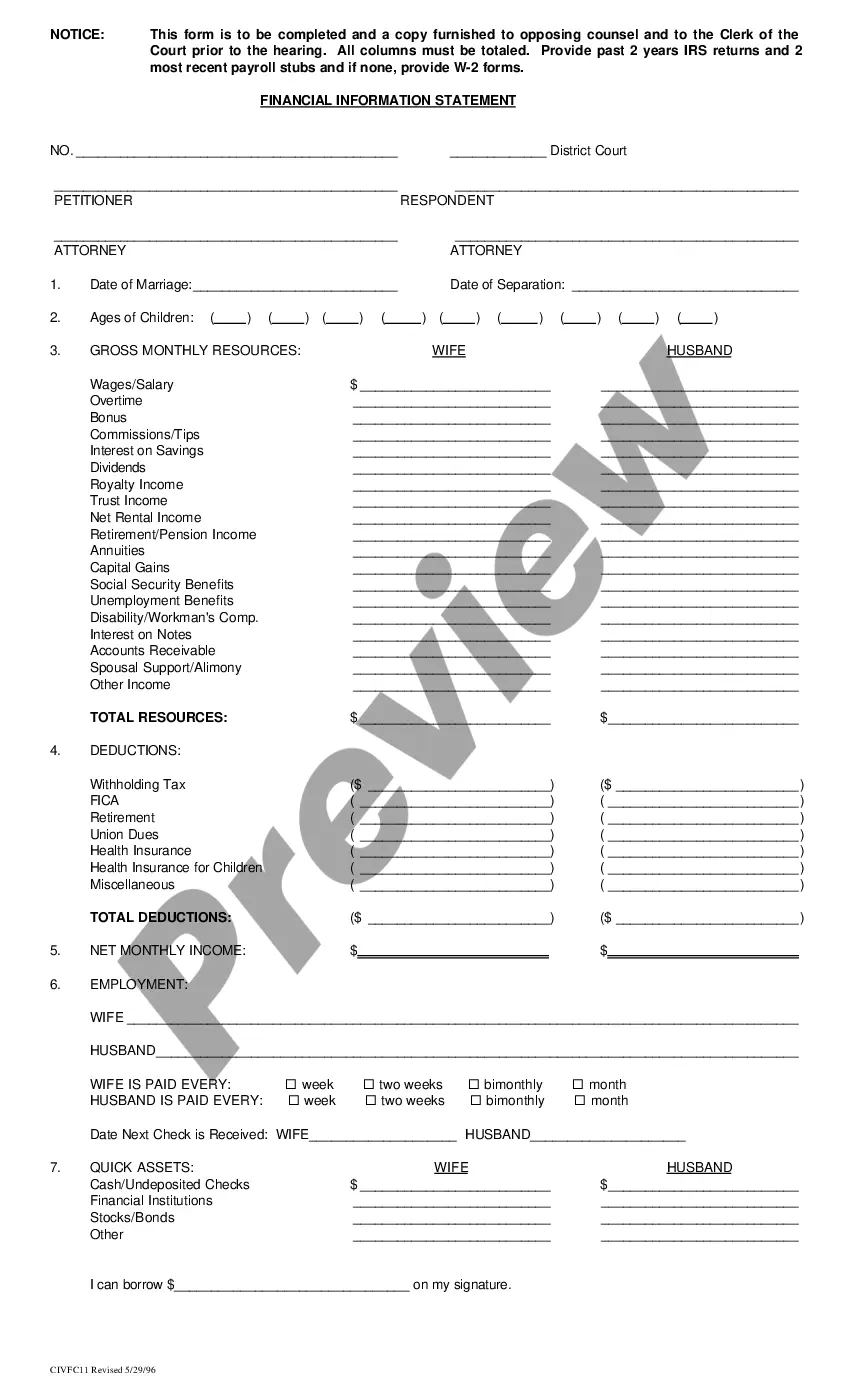

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

US Legal Forms - one of several most significant libraries of authorized forms in the United States - delivers an array of authorized document themes you are able to acquire or produce. Making use of the site, you can get 1000s of forms for organization and person uses, categorized by groups, states, or search phrases.You will discover the most up-to-date variations of forms like the Kansas Sample Letter regarding Information for Foreclosures and Bankruptcies in seconds.

If you already have a registration, log in and acquire Kansas Sample Letter regarding Information for Foreclosures and Bankruptcies from your US Legal Forms library. The Download option can look on every single form you see. You have accessibility to all previously downloaded forms in the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, here are easy guidelines to obtain started:

- Be sure to have picked out the right form to your city/area. Click the Preview option to examine the form`s information. Read the form explanation to ensure that you have chosen the proper form.

- In case the form does not match your demands, utilize the Look for field on top of the screen to get the one that does.

- Should you be pleased with the form, confirm your choice by clicking on the Purchase now option. Then, choose the prices prepare you prefer and give your references to sign up to have an accounts.

- Process the purchase. Make use of bank card or PayPal accounts to accomplish the purchase.

- Select the formatting and acquire the form in your system.

- Make changes. Fill out, revise and produce and indication the downloaded Kansas Sample Letter regarding Information for Foreclosures and Bankruptcies.

Every single format you added to your account does not have an expiration date which is yours eternally. So, if you want to acquire or produce another duplicate, just visit the My Forms portion and then click around the form you will need.

Get access to the Kansas Sample Letter regarding Information for Foreclosures and Bankruptcies with US Legal Forms, probably the most comprehensive library of authorized document themes. Use 1000s of specialist and condition-certain themes that meet up with your business or person demands and demands.

Form popularity

FAQ

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process.

If, after proper showing, the court finds that the total outstanding amount of all mortgages or liens is less than 1/3 of the market value of the property, the court shall order a redemption period of 12 months.

Redeeming the Property One way to stop a foreclosure is by "redeeming" the property. To redeem, you have to pay off the full amount of the loan before the foreclosure sale.

If, after proper showing, the court finds that the total outstanding amount of all mortgages or liens is less than 1/3 of the market value of the property, the court shall order a redemption period of 12 months.

In Kansas, lenders may foreclose on a mortgage in default by using the judicial foreclosure process. The judicial process of foreclosure, which involves filing a lawsuit to obtain a court order to foreclose, is used when no power of sale is present in the mortgage or deed of trust.

It takes about 4 or 5 months to foreclose on a Kansas property. All Kansas property foreclosures are judicial foreclosures. Therefore, the exact timeframe for a foreclosure depends on the court's actions and schedule.

The redemption period for a federal tax lien is 120 days from the date of the sale; the redemption period for a federal judgment lien is one year from the date of sale.