Kansas Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

Finding the appropriate legitimate document template can be somewhat challenging. Naturally, there are countless designs available online, but how can you identify the authentic version you need.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Kansas Contract with Independent Contractor - Contractor has Employees, suitable for both business and personal purposes.

All templates are verified by experts and comply with state and federal regulations.

If the form does not meet your needs, use the Search field to locate the appropriate document. Once you are sure the form is suitable, click the Purchase now button to acquire the form. Select the pricing plan you require and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Kansas Contract with Independent Contractor - Contractor has Employees. US Legal Forms is the largest repository of legal documents where you can find various document templates. Take advantage of the service to acquire professionally crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Obtain button to access the Kansas Contract with Independent Contractor - Contractor has Employees.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure that you have selected the correct form for your city/region.

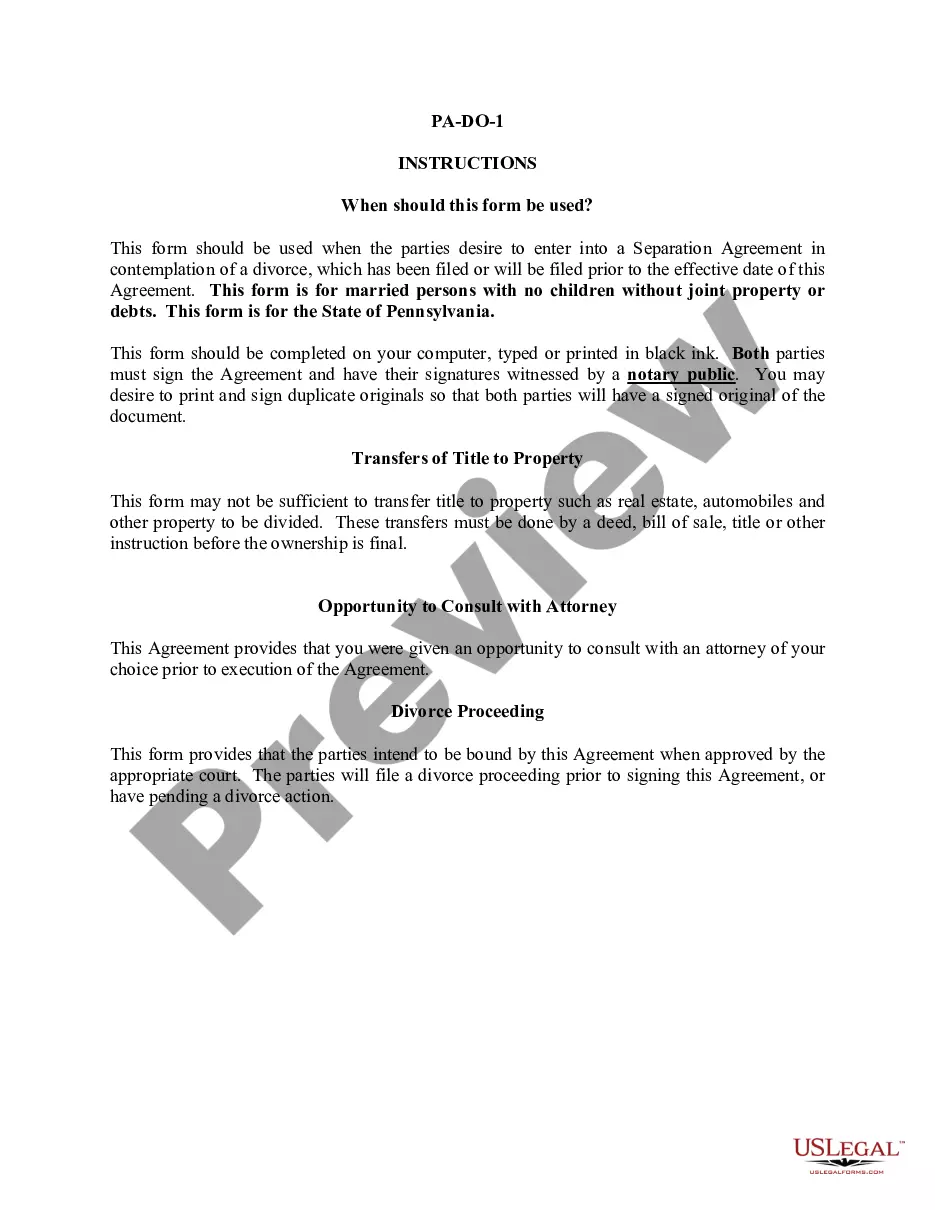

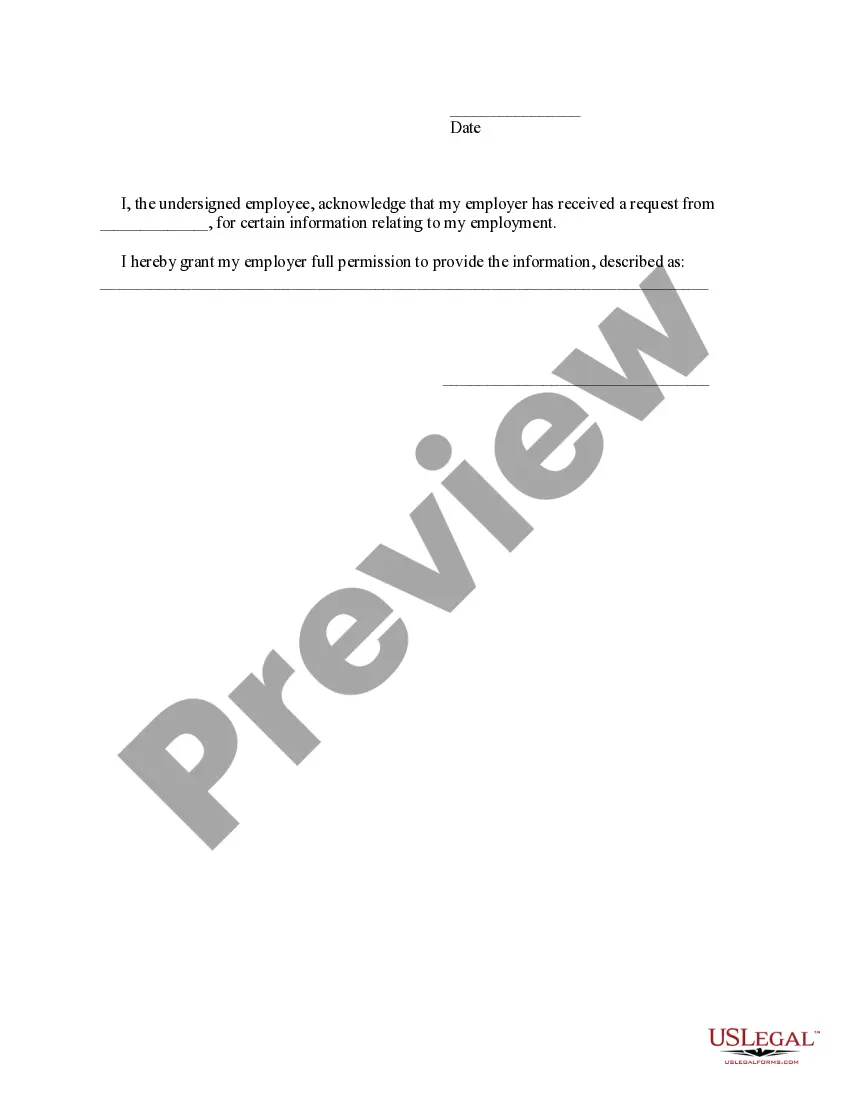

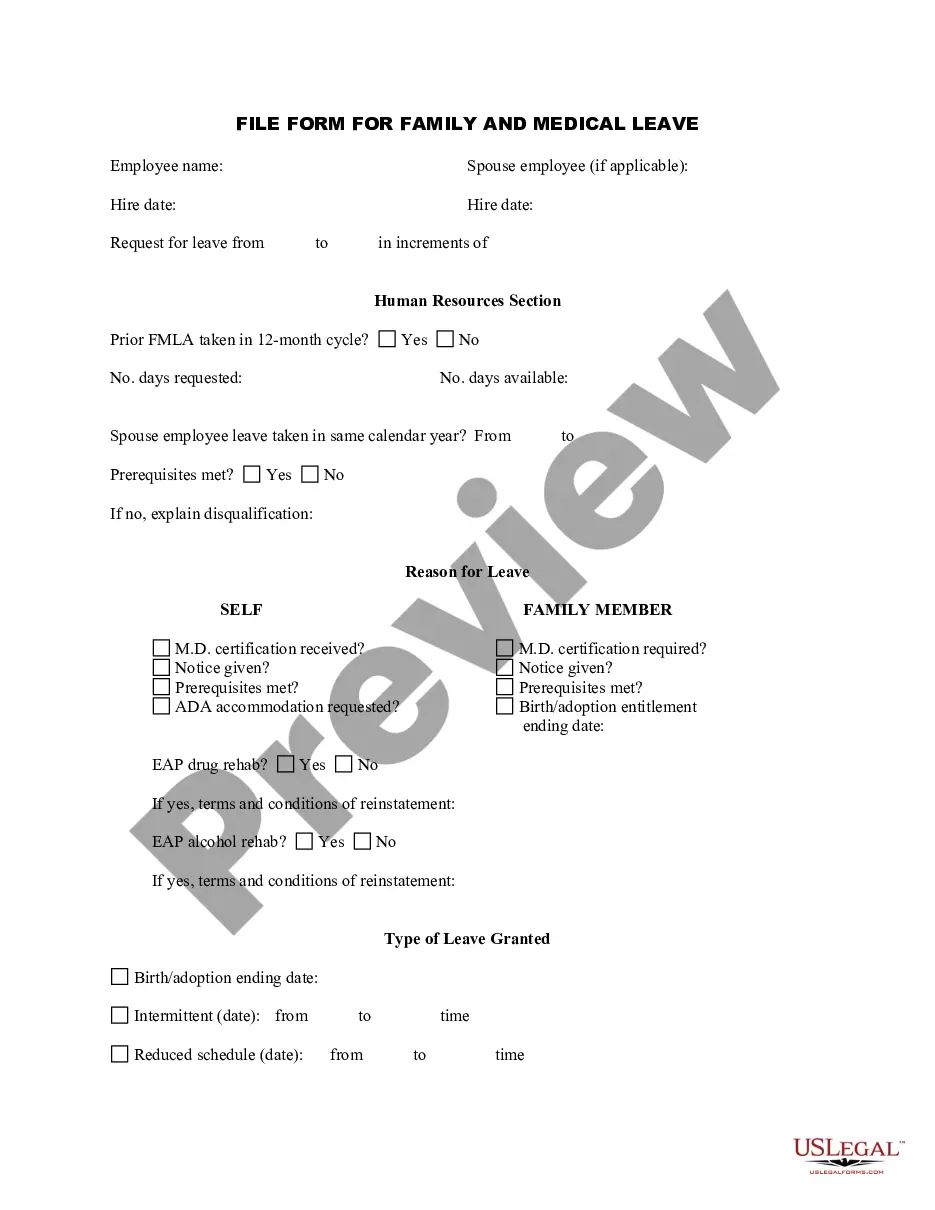

- You can preview the form with the Preview option and review the form description to confirm this is the correct one for you.

Form popularity

FAQ

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

A: Typically a worker cannot be both an employee and an independent contractor for the same company. An employer can certainly have some employees and some independent contractors for different roles, and an employee for one company can perform contract work for another company.

Financial controlIf the worker is paid a salary or guaranteed a regular company wage, they're probably classified as an employee. If the worker is paid a flat fee per job or project, they're more likely to be classified as an independent contractor.

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.