Kansas Loan Commitment Agreement

Description

How to fill out Loan Commitment Agreement?

Have you been within a placement where you will need files for either organization or personal purposes almost every day time? There are a variety of legal file web templates available on the net, but discovering types you can trust is not simple. US Legal Forms offers 1000s of kind web templates, much like the Kansas Loan Commitment Agreement, which are published in order to meet state and federal requirements.

When you are already acquainted with US Legal Forms internet site and also have an account, basically log in. Next, you can download the Kansas Loan Commitment Agreement design.

If you do not offer an account and would like to begin using US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is to the correct area/county.

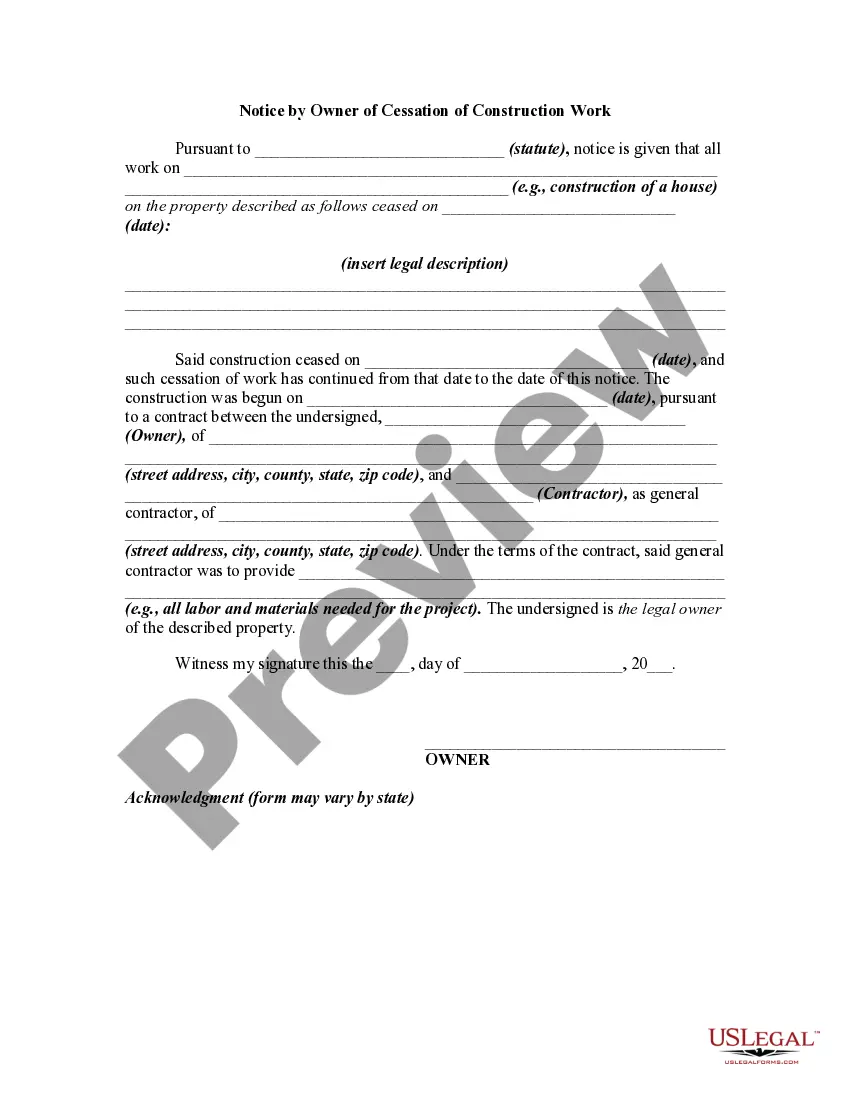

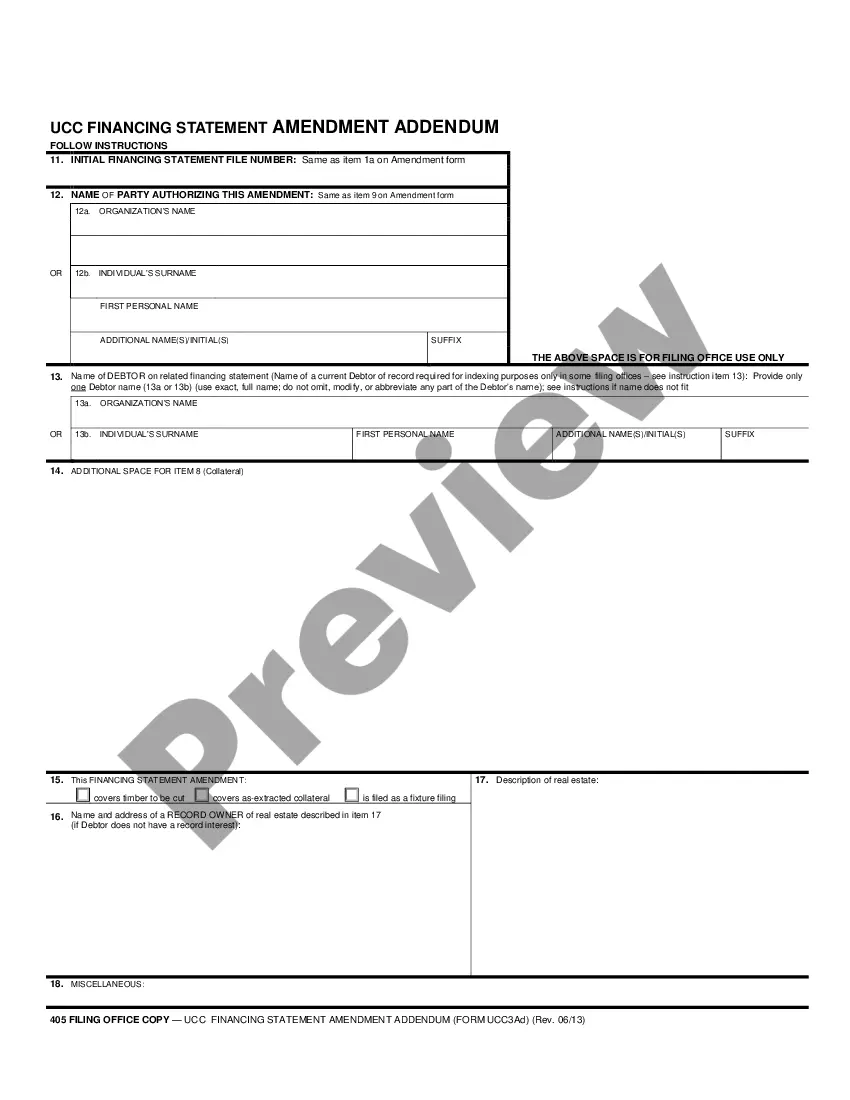

- Use the Review option to check the shape.

- Read the explanation to ensure that you have selected the proper kind.

- When the kind is not what you`re looking for, utilize the Search discipline to find the kind that fits your needs and requirements.

- Whenever you obtain the correct kind, click Acquire now.

- Pick the prices plan you need, complete the desired info to produce your money, and pay money for the transaction utilizing your PayPal or bank card.

- Select a convenient document file format and download your backup.

Locate every one of the file web templates you possess bought in the My Forms menus. You can get a additional backup of Kansas Loan Commitment Agreement at any time, if possible. Just go through the necessary kind to download or produce the file design.

Use US Legal Forms, one of the most considerable variety of legal varieties, to conserve some time and steer clear of mistakes. The support offers appropriately made legal file web templates which you can use for a selection of purposes. Make an account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

The qualification of the loan is dependent on the borrower's income and credit history. A loan commitment is when a financial institution makes an agreement to lend a certain amount of cash to an individual or business.

In your mortgage commitment letter, your lender will go over the underwriting conditions you'll need to meet to become clear to close. To determine that you've met these conditions, your lender may typically request: Current bank statements, tax returns, paycheck stubs and other verifications of your income and assets.

The average time to close a mortgage ranges from 45 to 60 days, but many will close in less ? about 30 days. This is the amount of time it takes from loan application to ?loan funding,? which is when the new home or refinance loan is officially a done deal.

A mortgage commitment letter includes the amount being borrowed, the interest rate, and the length of the loan. There will also be conditions attached, such as the requirement to carry homeowner's insurance. A lender can still deny a loan at closing if these conditions have not been met.

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. A loan commitment is useful for consumers looking to buy a home or a business planning to make a major purchase.