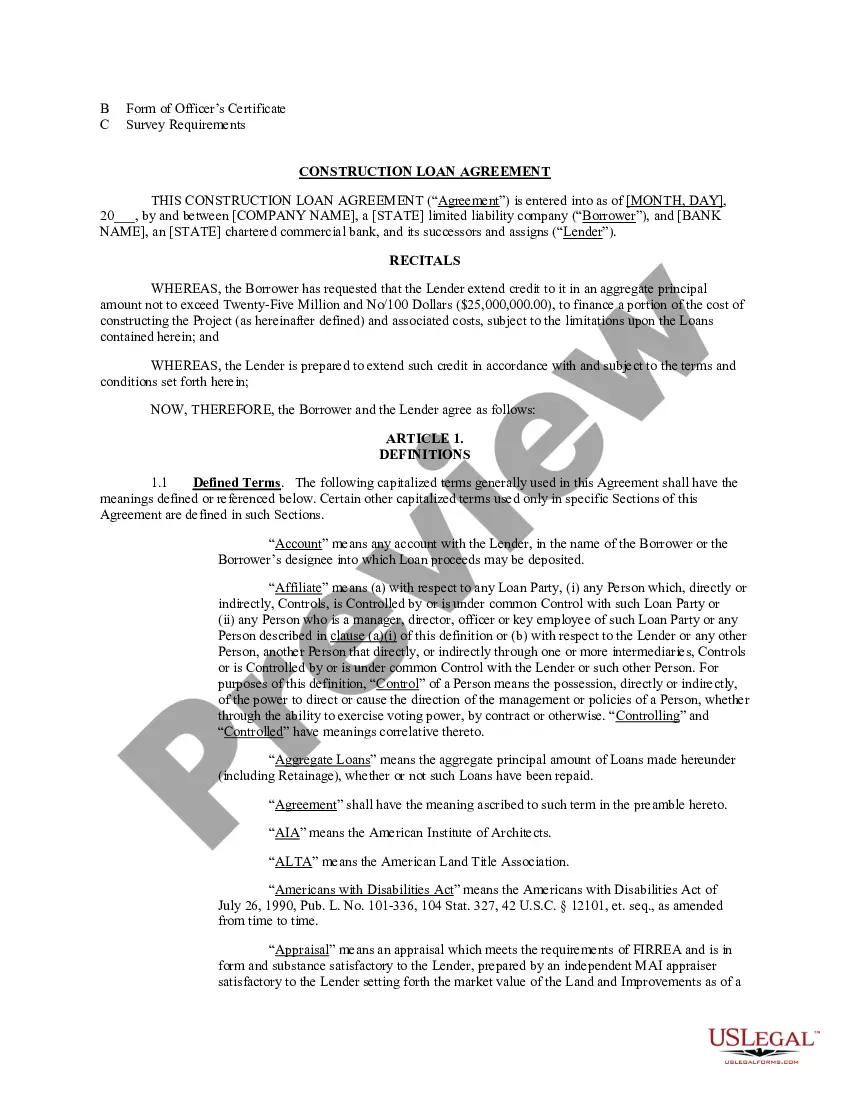

Kansas Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

Discovering the right authorized document format might be a have difficulties. Needless to say, there are a variety of themes available on the Internet, but how would you find the authorized kind you want? Use the US Legal Forms internet site. The assistance gives thousands of themes, including the Kansas Construction Loan Agreement, that can be used for organization and personal demands. Every one of the kinds are checked by professionals and fulfill state and federal specifications.

If you are currently registered, log in to your account and then click the Acquire button to have the Kansas Construction Loan Agreement. Use your account to look with the authorized kinds you possess bought formerly. Check out the My Forms tab of your respective account and have another version in the document you want.

If you are a new end user of US Legal Forms, listed below are basic guidelines that you should comply with:

- Initially, make certain you have selected the appropriate kind for your personal town/area. It is possible to look over the form utilizing the Review button and read the form explanation to make certain it will be the right one for you.

- When the kind fails to fulfill your preferences, use the Seach field to obtain the appropriate kind.

- Once you are positive that the form is suitable, select the Buy now button to have the kind.

- Pick the costs plan you need and type in the needed details. Design your account and purchase the transaction with your PayPal account or charge card.

- Opt for the submit file format and obtain the authorized document format to your system.

- Complete, revise and produce and signal the obtained Kansas Construction Loan Agreement.

US Legal Forms will be the greatest catalogue of authorized kinds that you can see various document themes. Use the service to obtain skillfully-manufactured files that comply with status specifications.

Form popularity

FAQ

- Lender typically issues final payment jointly to borrower and the builder, so that check cannot be cashed until all parties have endorsed it and have had the opportunity to resolve any problems that may have arisen.

Long-term liabilities are typically due more than a year in the future. Examples of long-term liabilities include mortgage loans, bonds payable, and other long-term leases or loans, except the portion due in the current year.

A construction loan (also known as a ?self-build loan") is a short-term loan used to finance the building of a home or another real estate project. The builder or home buyer takes out a construction loan to cover the costs of the project before obtaining long-term funding.

- When used in combination with a construction loan, a permanent loan is called a take-out loan. - It is common for a borrower to get a short-term construction loan from one lender and then get a permanent or take-out loan from another lender when the project is completed to pay off the original construction loan.

Each release of money is called a draw. These smaller disbursements help to keep the project moving along ing to schedule. Most construction loans have a five- to seven-draw schedule, although some projects require more. For instance, the first draw may cover getting the necessary permits and preparing the land.

Because long-term liabilities are payable beyond 12 months?often for many years?companies tend to use them to finance assets that are also enduring in nature, such as land, buildings and equipment.

These loans are generally paid off with permanent financing using the cash flow generated by the completed building. The money borrowed through a construction loan is disbursed in a series of advances or draws ing to a prearranged schedule or milestones.

Depending on the lender, you also may have the option to convert your construction loan into a mortgage after construction is complete. If this is not an option, you can apply for a mortgage?or end loan?to pay off your construction loan.

Typical long-term liabilities include bank loans, notes payable, bonds payable and mortgages.

Construction loans are short-term loans funded in increments over the project's construction. The borrower pays interest only on the outstanding balance, so interest charges grow as the project progresses.