Kansas Nonrecourse Assignment of Account Receivables

Description

How to fill out Nonrecourse Assignment Of Account Receivables?

You may commit time online searching for the lawful papers design that fits the federal and state needs you require. US Legal Forms provides 1000s of lawful varieties which are analyzed by experts. You can actually download or printing the Kansas Nonrecourse Assignment of Account Receivables from our service.

If you already have a US Legal Forms profile, you are able to log in and click the Down load button. Following that, you are able to total, change, printing, or indicator the Kansas Nonrecourse Assignment of Account Receivables. Every single lawful papers design you buy is yours forever. To have an additional copy associated with a obtained type, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website the very first time, follow the straightforward instructions below:

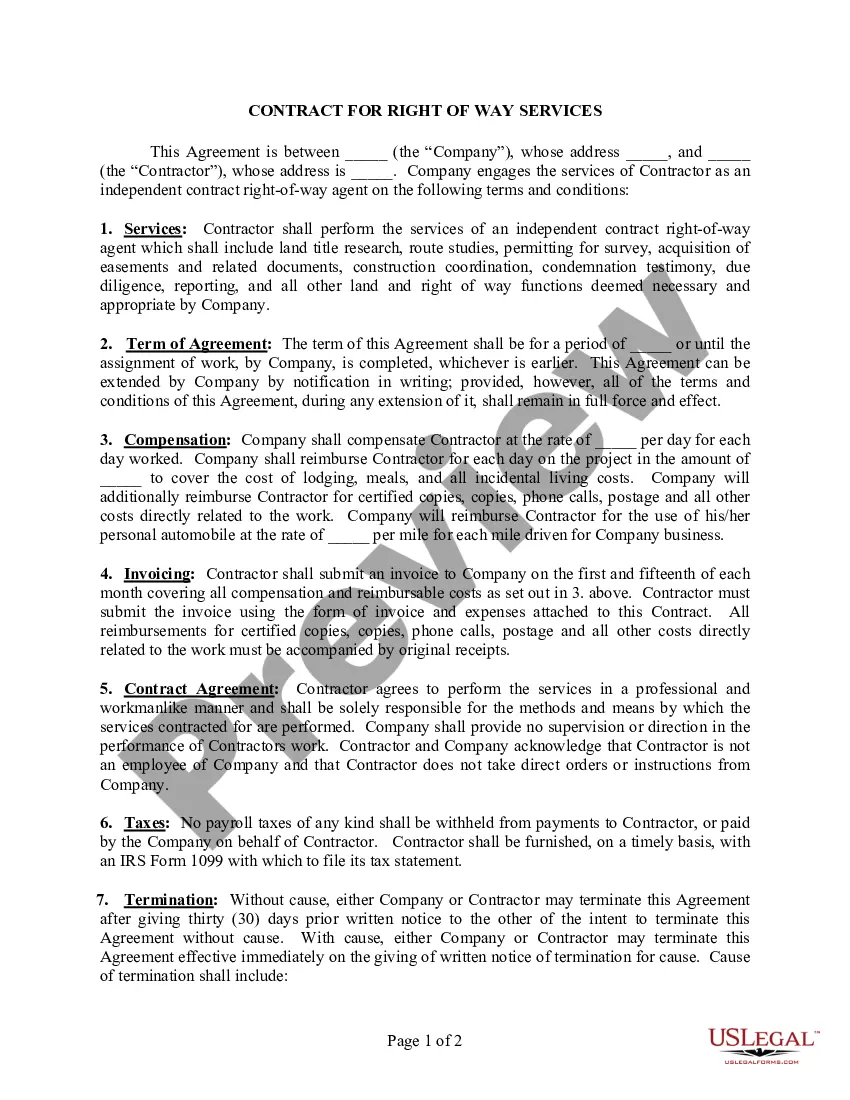

- Initial, ensure that you have selected the best papers design for your area/metropolis of your choice. See the type description to make sure you have picked out the appropriate type. If accessible, utilize the Preview button to appear with the papers design at the same time.

- In order to find an additional variation of your type, utilize the Search industry to obtain the design that fits your needs and needs.

- Upon having discovered the design you want, just click Acquire now to continue.

- Pick the pricing strategy you want, type your references, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal profile to fund the lawful type.

- Pick the structure of your papers and download it in your product.

- Make changes in your papers if necessary. You may total, change and indicator and printing Kansas Nonrecourse Assignment of Account Receivables.

Down load and printing 1000s of papers themes using the US Legal Forms Internet site, which provides the largest assortment of lawful varieties. Use specialist and state-particular themes to deal with your company or personal demands.

Form popularity

FAQ

Example of the Assignment of Accounts Receivable ABC Corp. approaches XYZ Bank to obtain financing using its accounts receivable as collateral. XYZ Bank agrees to provide a loan of 85% of the total accounts receivable value, which amounts to $170,000 (85% of $200,000).

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

A factoring agreement can be used to transfer an account receivable referenced in the underlying sale contract, whilst assignment can also apply to accounts receivable resulting from loan agreements, business co-operation agreements, and the like.

What is the appropriate treatment for receivable assignment transaction? In a receivables financing transaction, the assignment of the debt by the seller to the financier is treated as a true sale: it does not secure payment or performance of an obligation.

In the accounts receivable assignment process, a company assigns receivables to a lending institution to borrow money. The borrower pays interest plus additional fees. The borrowing company retains ownership of the accounts receivable and collects payment from its customers.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

With factoring accounts receivables without recourse, the factoring company assumes the credit risk on invoices when there's non-payment because of the debtor's insolvency, effectively insulating the client from this credit risk.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.