A conditional sales contract is sometimes used in commercial finance, whereby the seller retains title to the goods through a purchase money security interest. Ownership passes to the purchaser when the installments are fully paid.

Kansas Conditional Sales Contract

Description

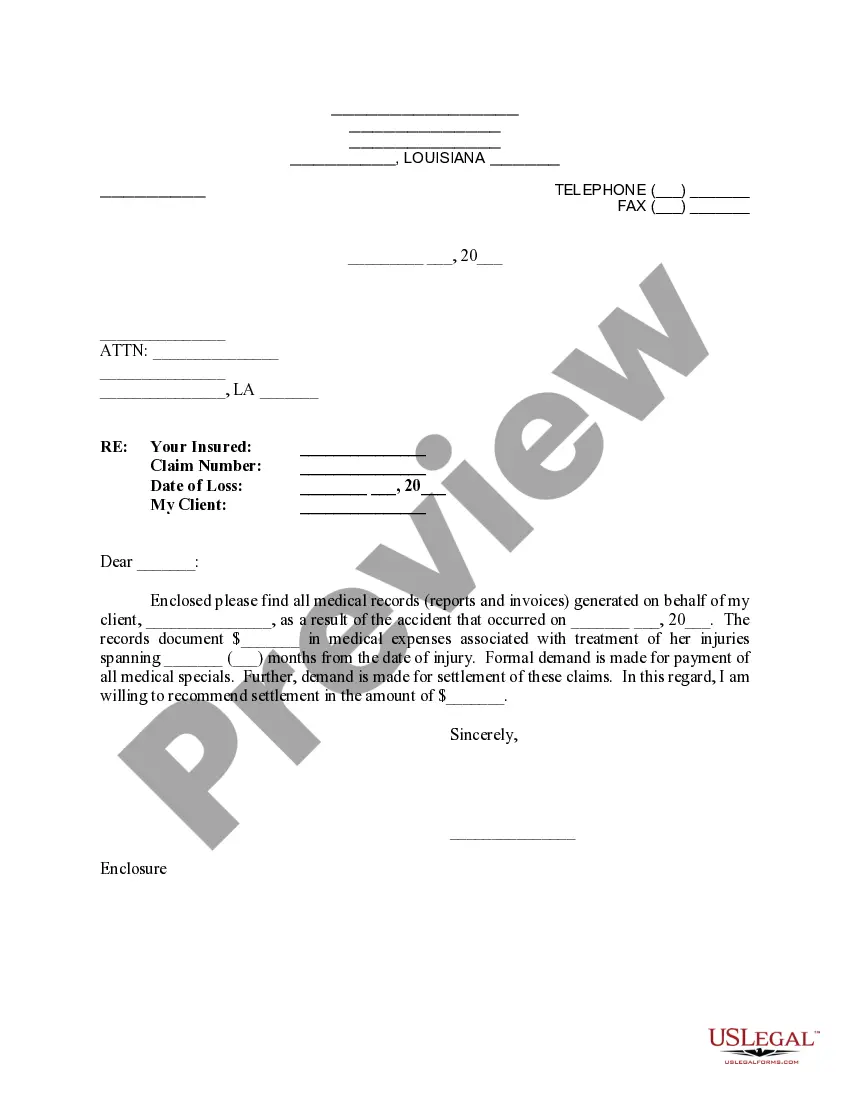

How to fill out Conditional Sales Contract?

It is feasible to invest hours online looking for the authentic document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of authentic forms that have been evaluated by experts.

You can easily download or print the Kansas Conditional Sales Contract from our service.

To acquire another version of the form, utilize the Search field to find the template that matches your needs and requirements. Once you have located the template you desire, click Purchase now to proceed. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction using your credit card or PayPal account to purchase the authentic form. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Kansas Conditional Sales Contract. Download and print a vast selection of document layouts through the US Legal Forms website, which offers the largest variety of authentic forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you may complete, edit, print, or sign the Kansas Conditional Sales Contract.

- Every authentic document template you acquire becomes your permanent property.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form outline to guarantee you have chosen the right one.

Form popularity

FAQ

A conditional offer in Alberta refers to a proposal where certain terms must be met for the agreement to be valid. It often includes conditions such as financing approvals or property inspections. Understanding conditional offers is crucial for anyone involved in a Kansas Conditional Sales Contract, as they can affect the finalization of the sale. Legal guidance can also help navigate these nuances to protect your interests.

A conditional sales contract means a buyer can obtain property by making payments, while the seller retains the title until payment completion. This arrangement offers security for both parties involved. Specifically, with a Kansas Conditional Sales Contract, businesses can secure assets without large upfront costs. It’s a strategy that balances risk and access, making it a favorable choice for many buyers.

A conditional sales contract in Alberta is an agreement where the seller retains ownership of the goods until the buyer fulfills their payment obligations. This type of contract protects the seller while allowing the buyer to use the goods upfront. If you’re dealing with a Kansas Conditional Sales Contract, understanding its implications in different jurisdictions, like Alberta, can help you make informed decisions.

In Alberta, parties can enforce a conditional sales contract under certain conditions, including seizure of collateral when payments are in default. If you encounter issues with a Kansas Conditional Sales Contract in Alberta, it’s essential to understand your legal rights and options. The laws surrounding conditional sales contracts can be complex, so consulting with a legal professional can provide clarity and guidance tailored to your situation.

A conditional sales contract is often confused with a financing lease, but they are distinct. While both involve financing purchases, a Kansas Conditional Sales Contract specifically transfers ownership to the buyer once they complete their payment obligations. This differs from a financing lease, where ownership may not transfer at the end of the term. Understanding these differences can help you choose the right option for your financial needs.

Yes, a seller can also pull out of a Kansas Conditional Sales Contract under certain circumstances. If the buyer violates the terms of the agreement, the seller has the right to terminate the contract. It is essential for sellers to document such violations carefully to ensure they are legally justified in pulling out. Utilizing resources like US Legal Forms can facilitate this process by providing clear templates and guidance.

Yes, a buyer can pull out of a Kansas Conditional Sales Contract, but there are specific conditions that apply. Typically, if the contract includes a cancellation clause, the buyer must follow the outlined steps to terminate the agreement legally. It's crucial for buyers to read the contract thoroughly to understand their rights and obligations. If needed, consulting legal advice can help clarify any uncertainties.

The sales tax nexus threshold in Kansas is currently set at $100,000 in annual sales or 200 separate transactions within the state. This means that businesses reaching these metrics are responsible for registering and collecting sales tax. Knowing this threshold is vital, especially when entering agreements through a Kansas Conditional Sales Contract, as it impacts your tax obligations.

Income tax nexus in Kansas is often triggered by various factors, such as a physical presence, substantial sales volume, or the presence of employees. If your company conducts business activities that reach or exceed the legal thresholds set by Kansas, you should prepare for nexus implications. This is an essential consideration when dealing with a Kansas Conditional Sales Contract to avoid potential legal issues and ensure proper tax compliance.

Sales tax nexus in Kansas generally requires a business to have a significant connection to the state, which may include a physical store, warehouse, or even employees. When your business sells goods or services and meets certain sales or transaction thresholds, you may need to collect sales tax from customers. This is particularly relevant when executing a Kansas Conditional Sales Contract, as it defines the financial responsibilities involved.