Kansas Right of First Refusal to Purchase Real Estate

Description

How to fill out Right Of First Refusal To Purchase Real Estate?

Are you situated in the location where you require documents for both commercial and personal purposes nearly every day.

There is a plethora of legal document templates accessible online, but finding reliable versions is challenging.

US Legal Forms offers thousands of template options, including the Kansas Right of First Refusal to Purchase Real Estate, designed to meet state and federal criteria.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

This service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Kansas Right of First Refusal to Purchase Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Get the document you require and ensure it is for the correct location/region.

- Use the Preview button to review the form.

- Verify the information to make sure you have selected the appropriate document.

- If the form is not what you are looking for, use the Lookup box to find a document that meets your needs and preferences.

- Once you locate the correct form, click on Purchase now.

- Select the pricing option you desire, fill in the necessary information to set up your account, and complete your order using PayPal or a credit card.

- Choose a convenient document format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Kansas Right of First Refusal to Purchase Real Estate any time, if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

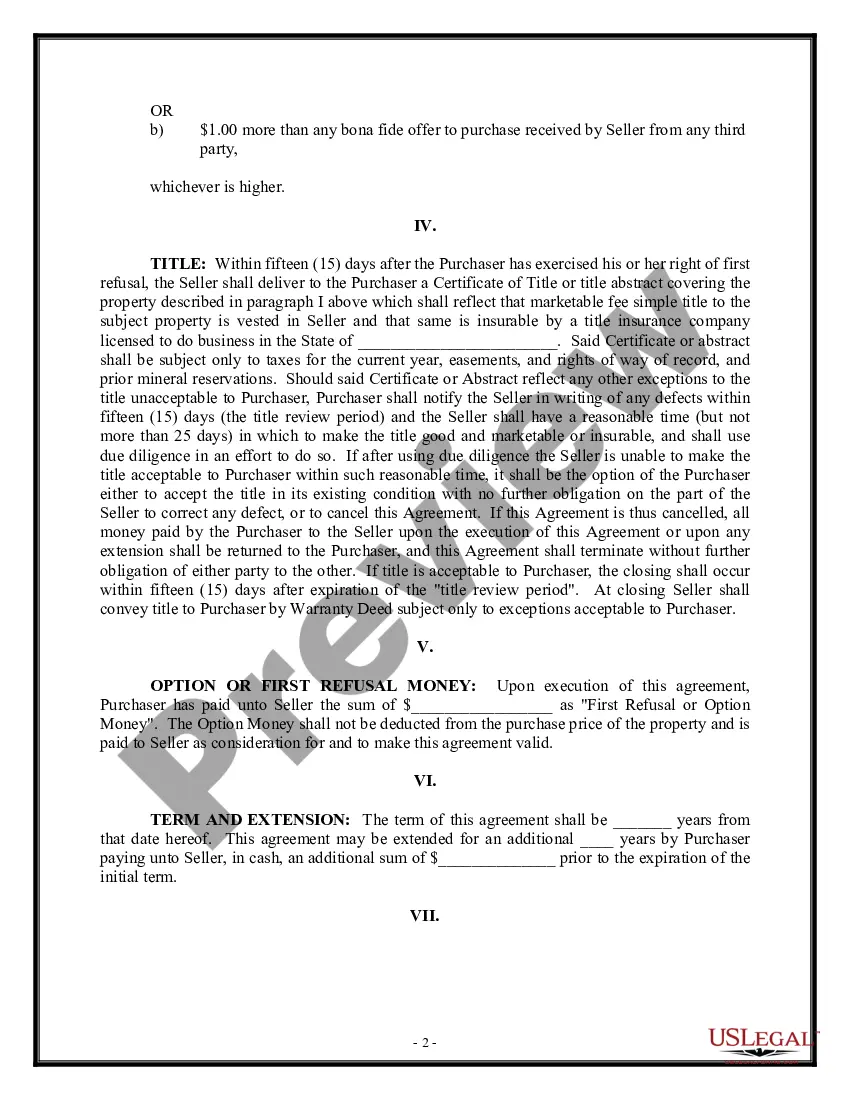

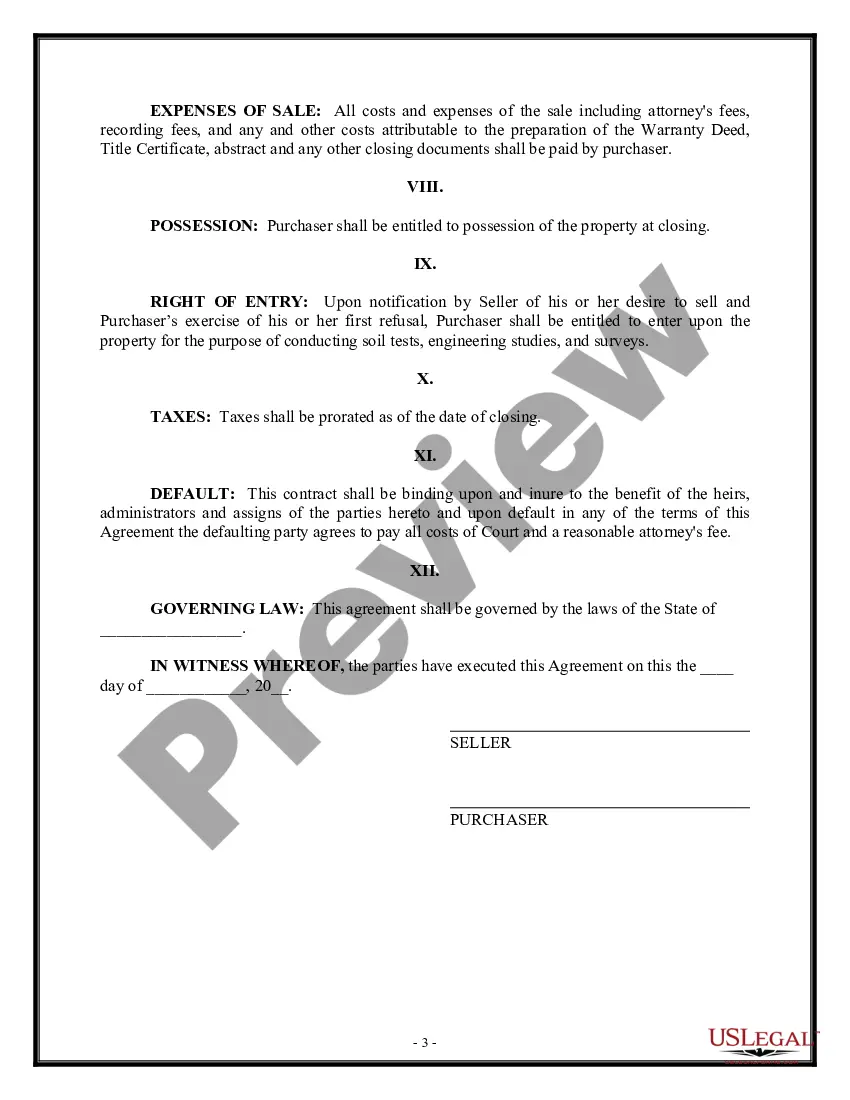

The right of first refusal in the Multiple Listing Service (MLS) refers to an agreement that allows a buyer to match any offer received by the seller, before the seller accepts another offer. This feature can provide a competitive edge for serious buyers in the Kansas real estate market. It is essential for buyers to understand how this right works to make the most of their purchasing power. Engaging with a platform like uslegalforms can help clarify these rights and streamline the process.

A right of first refusal in Kansas typically gets triggered when a property owner decides to sell their real estate. This right gives the holder the first chance to buy the property before the owner can sell to another buyer. It is an important clause often included in lease agreements or property contracts. Understanding these triggers can help you navigate your options more effectively.

A first right of refusal is a contractual right granted to a person to purchase land before the proprietor enters into an agreement to sell the land to a third party. In effect, the right grants to the person an opportunity to buy the land before any other person.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

People often talk about giving or getting a Right of First Refusal ("ROFR") in real estate transactions. But what is a ROFR? A simple definition might be: If the owner of the property decides to sell the property, then the person holding the ROFR gets the opportunity to buy the property on the same terms first.

Duration: The ROFR may expire after a certain amount of time or after an event occurs, such as the expiration of a lease. After the specified time, the property owner may enter into a transaction without notifying the holder of the ROFR.

ROFR is a contractual obligation that binds both a prospective real estate buyer for example, a potential homeowner looking for an apartment, condo, or single-family residence and real estate seller.

The right of first refusal applies to sales as well as rentals. And with any sale or rental, the board has the opportunity to exercise its right of first refusal or to waive that right.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

A right of first refusal ("ROFR") is a contractual entitlement of a party to enter into a business transaction with the counterparty (to a contract) which such counterparty is desirous of executing with a third party.