The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

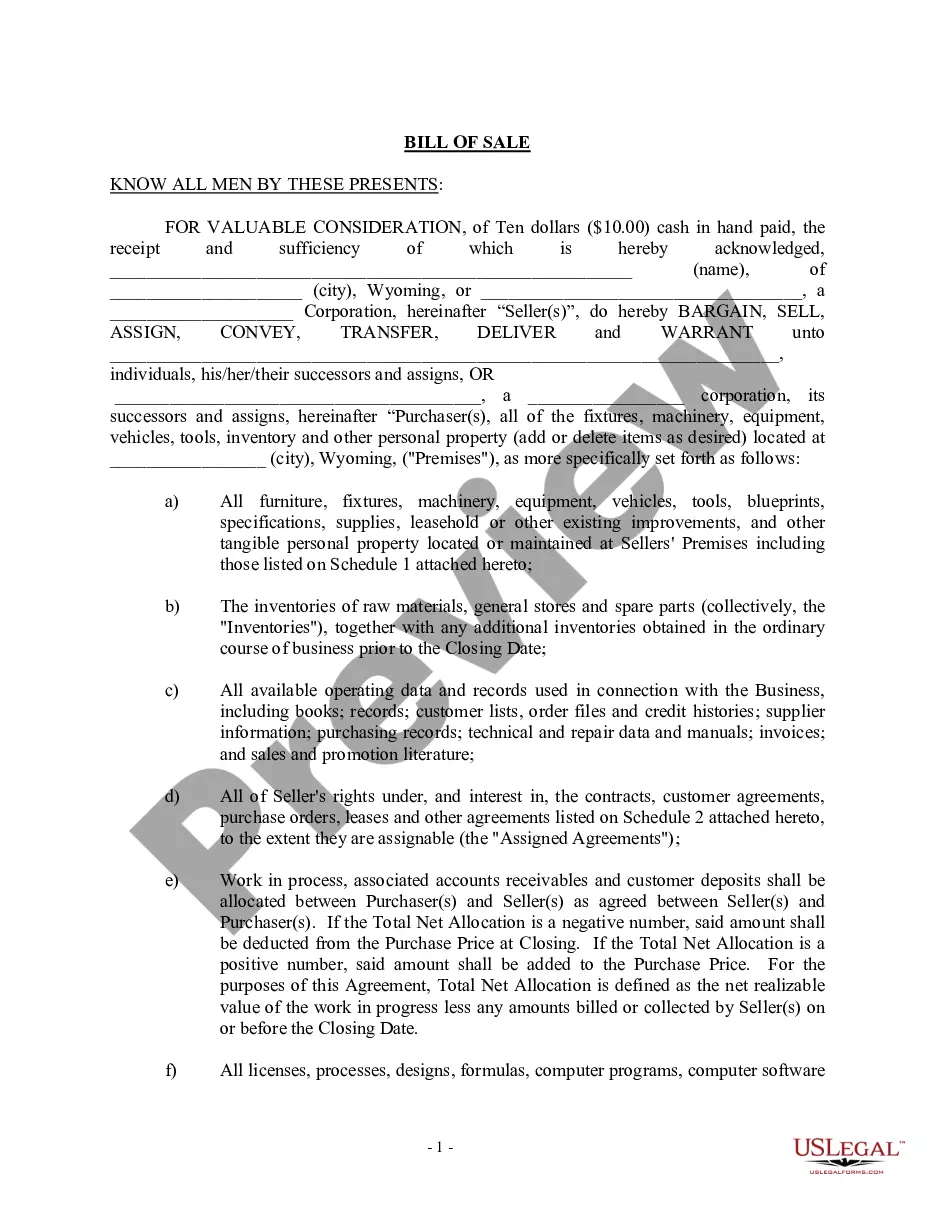

Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse selection of legal forms that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account within moments.

If you possess a membership, Log In and download Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account from the US Legal Forms library. The Download button will be visible on each form you view. You will have access to all previously downloaded forms in the My documents section of your account.

Every template you have added to your account does not expire and is yours indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and select the form you require.

Gain access to the Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your locality. Click the Preview button to examine the form's contents. Review the form description to make certain you have chosen the right one.

- If the form does not fulfill your needs, utilize the Search bar at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase Now button. Then, select the payment plan you desire and provide your information to register for an account.

- Proceed with the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make amendments. Complete, edit, print, and sign the downloaded Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

Form popularity

FAQ

A trust can indeed be classified as an eligible designated beneficiary, particularly if it meets certain requirements. A Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can ensure smooth asset transfer while providing tax advantages. Consult with professionals in estate planning to confirm that your trust structure fulfills all criteria, securing the best outcome for your loved ones.

Yes, a trust can be the beneficiary of a retirement account, including a Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. This option allows for flexible management of the retirement assets after the account holder's death. It is crucial to ensure that the trust complies with all IRS regulations to avoid any tax complications for the beneficiaries.

Naming a trust as a beneficiary, like the Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, provides several advantages. It enables continued asset management even after you are gone, ensuring that funds are used in alignment with your intentions. Furthermore, it can safeguard your beneficiaries from mismanaging the inheritance, especially for minors or those with special needs.

Yes, you can indeed designate a trust, such as a Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, as a beneficiary. This arrangement allows you to control how the assets are distributed after your passing. Designating a trust can also provide logistical benefits and ensure that your heirs are protected and supported according to your wishes.

An eligible designated beneficiary for a special needs trust typically includes individuals who have disabilities and require assistance managing their financial affairs. The Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can be particularly beneficial, as it allows for tailored distribution that won't interfere with other benefits. If you are considering this route, it's essential to consult with a legal expert to ensure compliance with all regulations and the specific needs of the benefactor.

While there are advantages to naming a trust as an IRA beneficiary, there are also important considerations. A Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can trigger complex tax implications for your heirs. Furthermore, if not set up correctly, a trust may disqualify your beneficiaries from stretching distributions over their lifetimes, potentially leading to higher tax burdens. It's crucial to consult with a financial advisor or estate planner to evaluate the best options for your situation.

Naming a trust as a beneficiary of your IRA is completely permissible. Many individuals choose this route to ensure that their retirement assets are managed according to their specific plans. By establishing a Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can facilitate a structured distribution that aligns with your financial and estate planning goals. This approach can provide tax benefits and simplify the inheritance process for your loved ones.

Yes, you can designate a trust as a beneficiary of your accounts, including an Individual Retirement Account (IRA). This option allows for better control over how your assets are distributed after your death. When you establish a Kansas Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, it ensures that your intended beneficiaries receive the funds according to your wishes. Additionally, trusts can potentially provide protections and benefits that direct beneficiaries may not have.

It is typically not advisable to place retirement accounts, like IRAs or 401(k)s, directly into a Kansas Irrevocable Trust. Doing so can create immediate tax liabilities and disrupt the tax-deferred status of these accounts. Additionally, personal assets that require daily management, such as a primary residence, may be better held outside of the trust to maintain flexibility and ease of access.

Naming a Kansas Irrevocable Trust as the beneficiary of an IRA can be a strategic move to provide for your loved ones while controlling how assets are managed and distributed. This option can help protect assets from creditors and can ensure that funds are used for specific purposes, such as education. However, be sure to consult with a qualified professional to evaluate your individual circumstances and avoid pitfalls.