If you wish to total, download, or printing legitimate document web templates, use US Legal Forms, the greatest assortment of legitimate types, that can be found on the Internet. Utilize the site`s simple and handy search to find the files you will need. Different web templates for enterprise and person purposes are categorized by groups and states, or keywords. Use US Legal Forms to find the Kansas Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust in a number of mouse clicks.

If you are already a US Legal Forms consumer, log in to your account and click on the Down load option to have the Kansas Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust. You may also accessibility types you in the past acquired from the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions under:

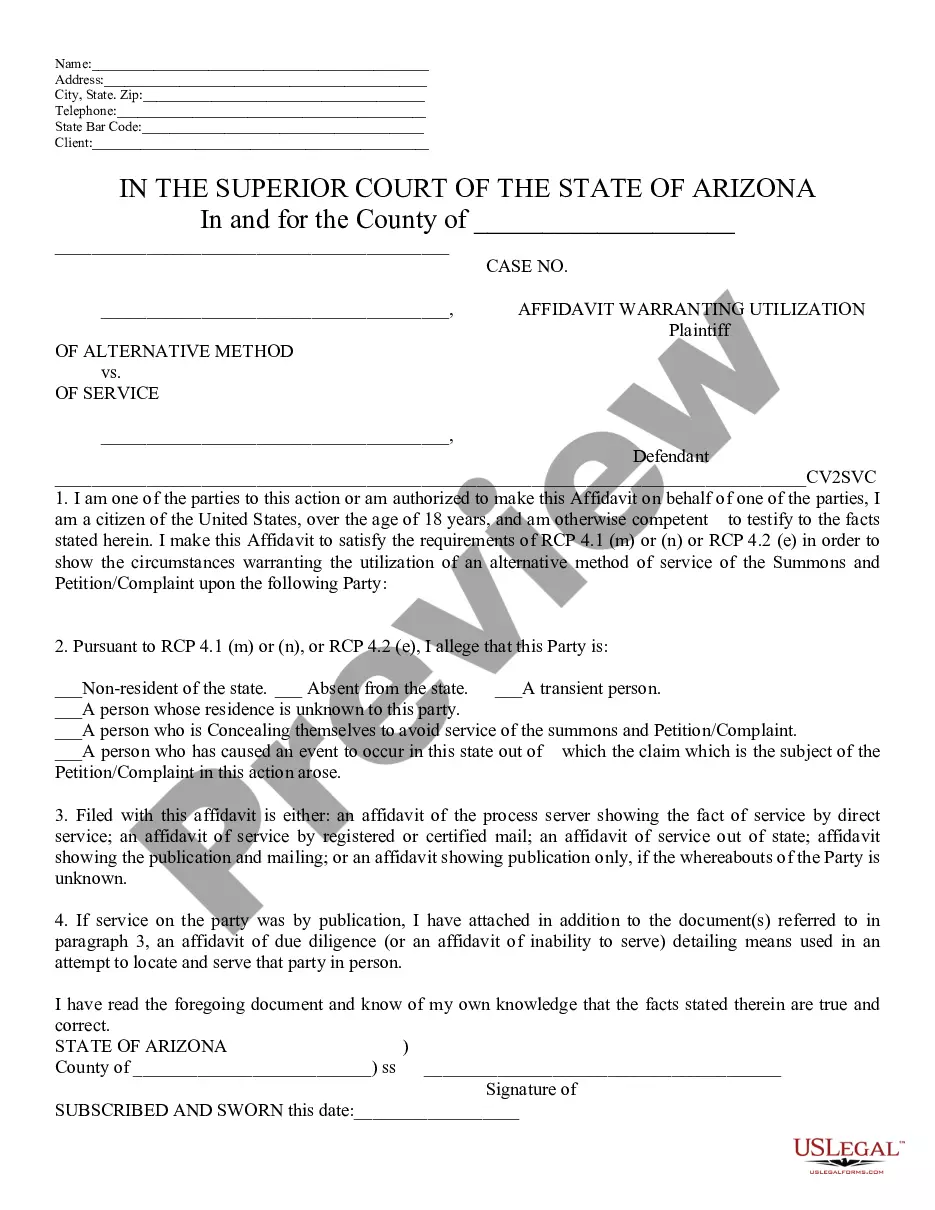

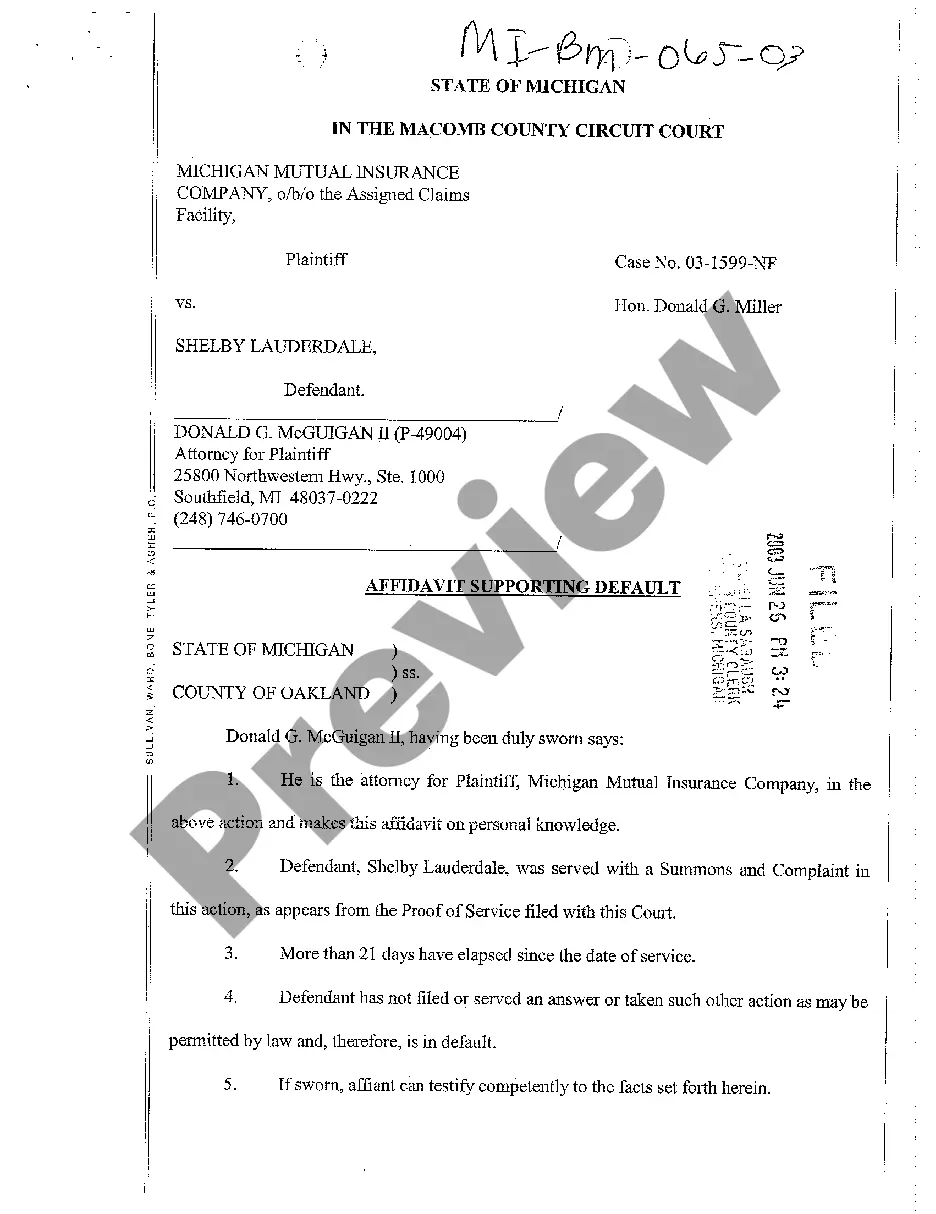

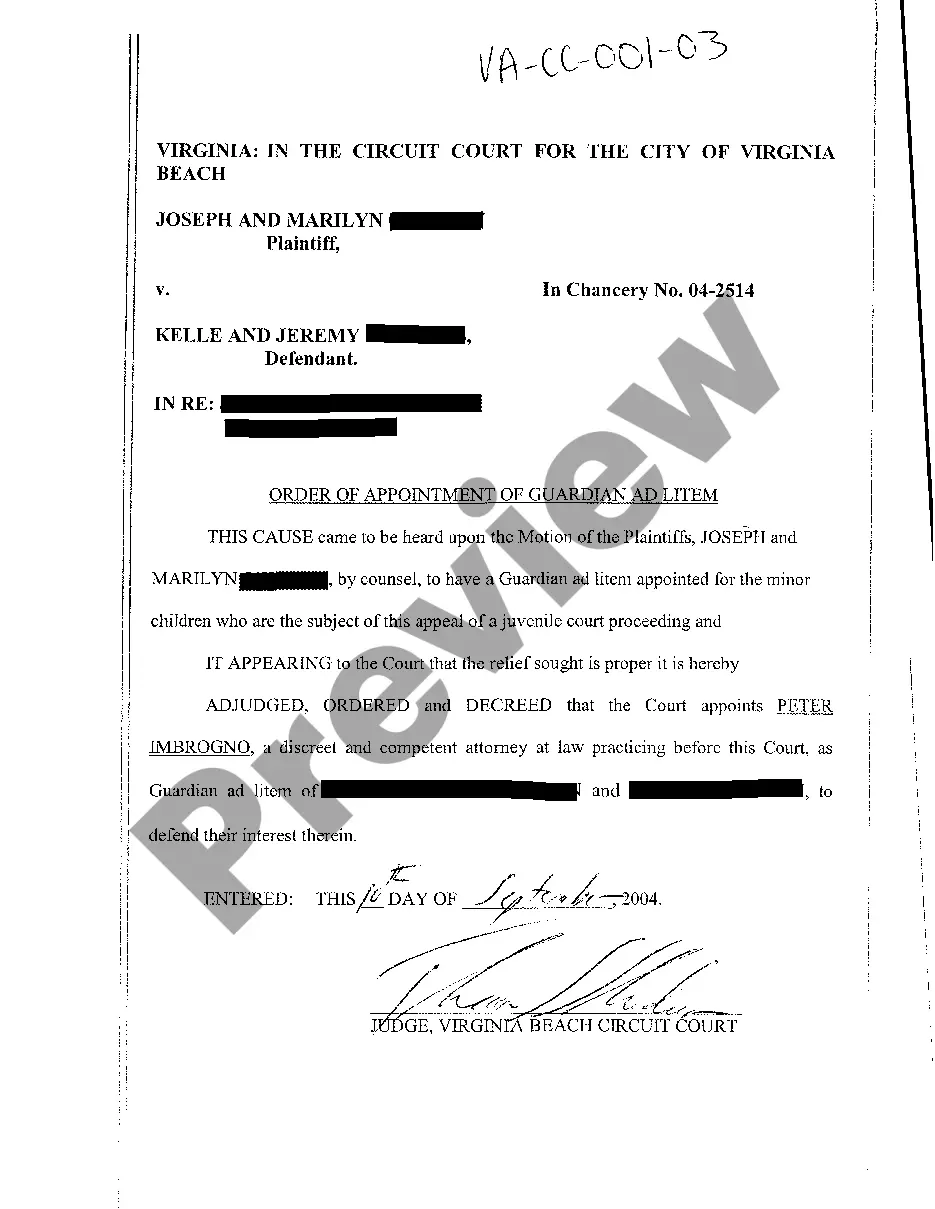

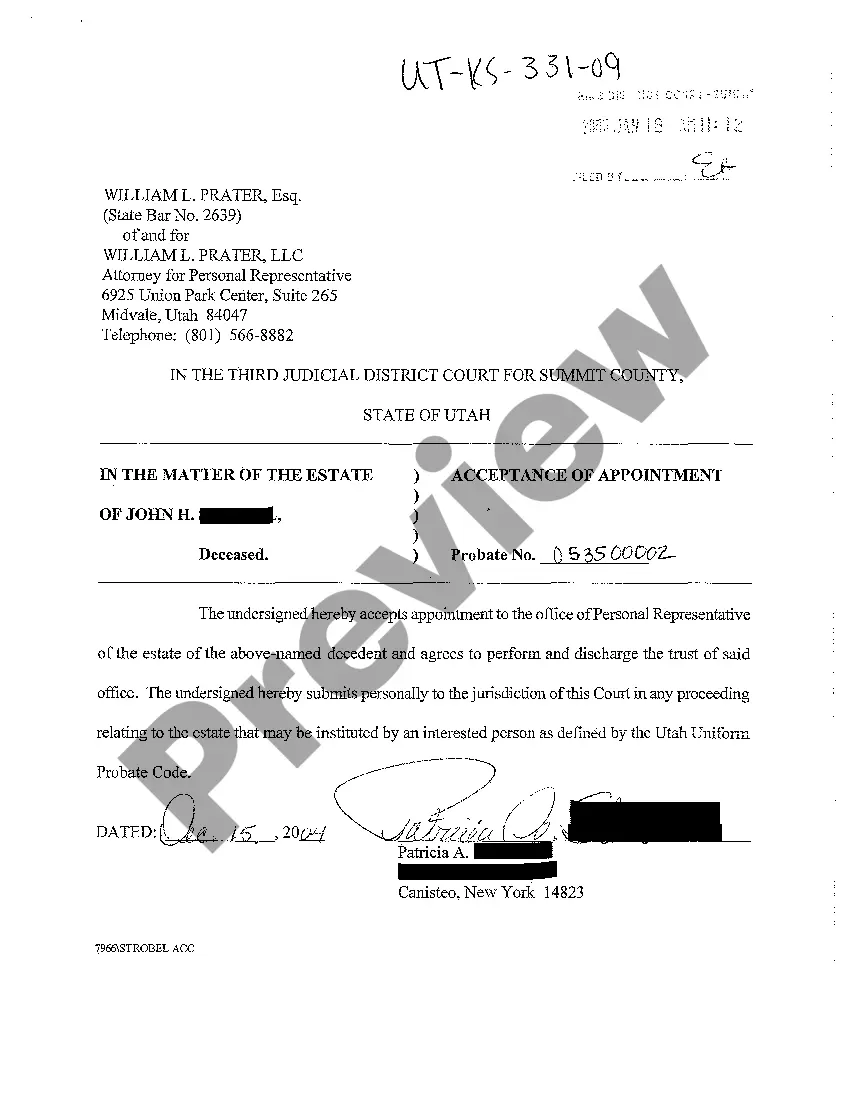

- Step 1. Ensure you have selected the form for your proper town/country.

- Step 2. Make use of the Preview method to check out the form`s content. Never forget about to learn the description.

- Step 3. If you are unsatisfied using the develop, use the Look for area towards the top of the monitor to get other types of your legitimate develop format.

- Step 4. When you have identified the form you will need, select the Acquire now option. Choose the prices strategy you like and add your references to sign up for the account.

- Step 5. Process the deal. You can utilize your charge card or PayPal account to accomplish the deal.

- Step 6. Select the structure of your legitimate develop and download it on your own product.

- Step 7. Comprehensive, edit and printing or signal the Kansas Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust.

Every legitimate document format you acquire is yours for a long time. You have acces to each develop you acquired in your acccount. Click the My Forms portion and decide on a develop to printing or download once more.

Remain competitive and download, and printing the Kansas Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust with US Legal Forms. There are millions of professional and condition-distinct types you can utilize to your enterprise or person requirements.