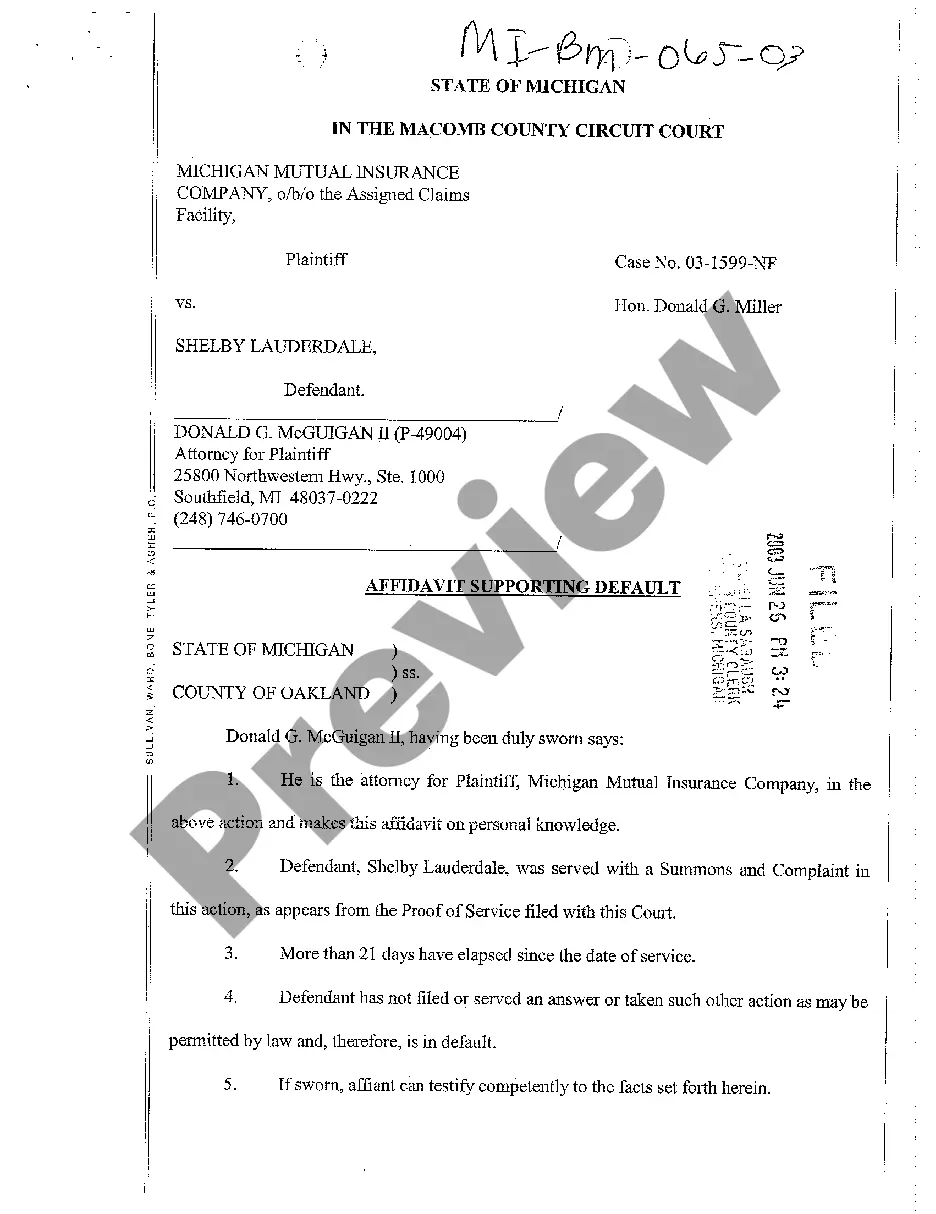

Michigan Affidavit Supporting Default

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

A03 Affidavit Supporting Default: An A03 affidavit supporting default is a legal document used in the United States to assert that one party in a legal agreement or contract has failed to comply with its terms. This affidavit is typically filed in civil court cases where one party seeks to obtain a default judgment against the defendant who has failed to respond to a legal claim within the stipulated time.

Step-by-Step Guide

- Gather Necessary Information: Collect all relevant documents and evidence proving the breach of contract or non-compliance by the defendant.

- Prepare the Affidavit: Draft the affidavit outlining the specific details of the default by the defendant. Include dates, contractual obligations, and the nature of the breach.

- Notarization: Have the affidavit notarized to verify its authenticity. This step is crucial as it legally validates the document.

- File with the Court: Submit the affidavit to the court where the original case was filed or intended to be filed. Attach all supporting documents.

- Serve the Defendant: Legally serve the defendant with a copy of the affidavit and the court notice, if applicable.

- Attend Court Hearings: Be prepared to attend court hearings to present the case for a default judgment based on the affidavit.

Risk Analysis

- Legal Risks: Incorrect or fraudulent information in an A03 affidavit can lead to penal actions or dismissal of the case.

- Ethical Risks: Misrepresenting facts in the affidavit can damage credibility and reputation legally and professionally.

- Financial Risks: If a default judgment is overturned due to errors in the affidavit, the applicant may be liable for costs or damages.

Pros & Cons

- Pros:

- Facilitates a quicker resolution in case of non-response by the defendant.

- Can result in a favorable judgment without the need for a trial.

- Cons:

- Risks associated with incorrect filing.

- Dependent on thorough and accurate documentation.

Best Practices

- Ensure all information in the affidavit is accurate and supported by documents.

- Consult with a legal professional to review the affidavit before submission.

- Keep records of all communications and attempts to resolve the issue outside of court.

Common Mistakes & How to Avoid Them

- Failing to properly serve the defendant: Ensure that the defendant is served according to state laws, which may prevent procedural delays or dismissals.

- Submitting incomplete documents: Double-check that all necessary supporting documentation is attached before filing the affidavit.

How to fill out Michigan Affidavit Supporting Default?

Obtain any variation of 85,000 legal documents including the Michigan Affidavit Supporting Default via US Legal Forms online. Each template is created and revised by state-certified attorneys.

If you already possess a subscription, sign in. Once on the form’s page, press the Download button and navigate to My documents to access it.

If you haven't subscribed yet, adhere to the instructions below.

Once your reusable form has been downloaded, print it or save it to your device. With US Legal Forms, you’ll consistently have immediate access to the necessary downloadable template. The service offers you access to documents and categorizes them for easier searching. Utilize US Legal Forms to quickly and effortlessly obtain your Michigan Affidavit Supporting Default.

- Review the specific state requirements for the Michigan Affidavit Supporting Default you intend to utilize.

- Examine the description and preview the sample.

- Once you confirm that the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment through one of two suitable methods: by credit card or via PayPal.

- Select a format to download the file in; you can choose between two options (PDF or Word).

- Download the file to the My documents section.

Form popularity

FAQ

To respond to an entry of default, the defendant must file a motion to set aside the default judgment promptly. In Michigan, this often involves presenting a Michigan Affidavit Supporting Default alongside compelling reasons and evidence for the court's consideration. Acting quickly is vital to protect your rights and possibly challenge the default outcome.

An affidavit, including a Michigan Affidavit Supporting Default, carries significant legal weight. It is a sworn statement, meaning that providing false information can lead to serious consequences, including penalties for perjury. Therefore, always ensure the accuracy and integrity of the information included in any affidavit you file.

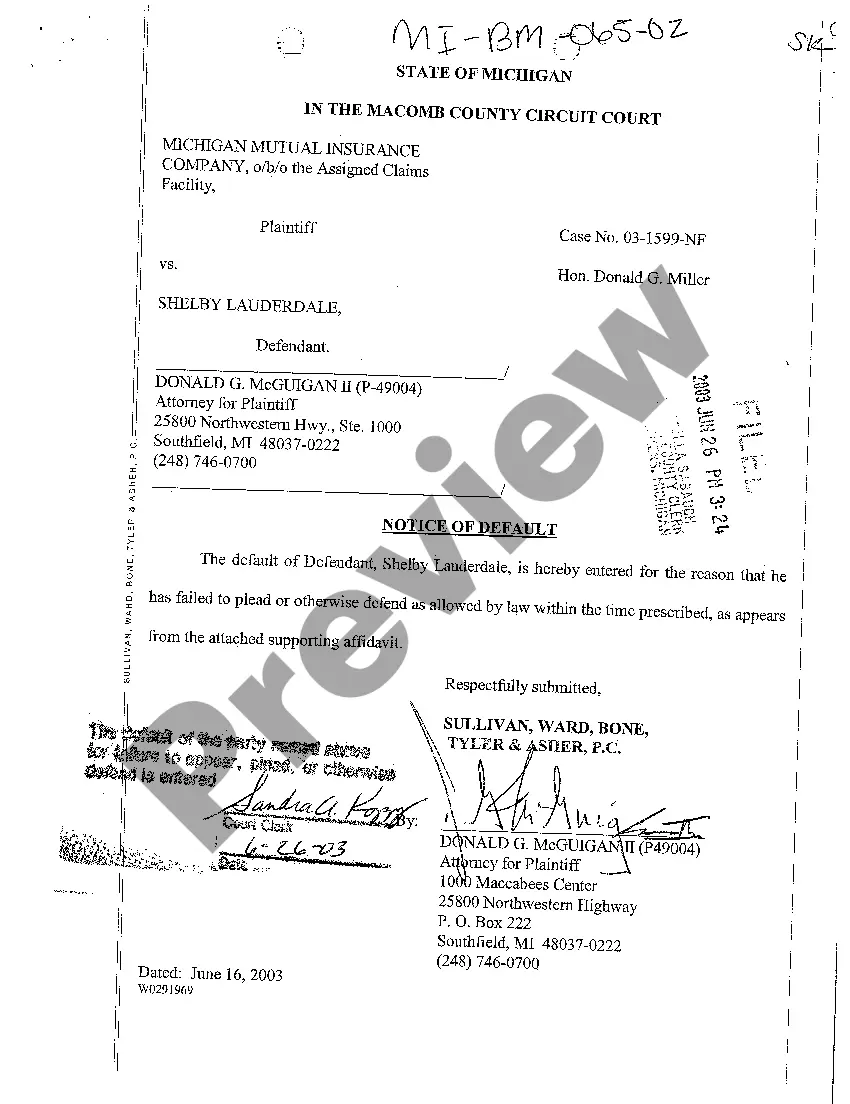

A motion for entry of default in Michigan is a formal request by the plaintiff to obtain a default judgment when the defendant fails to respond. This motion typically accompanies a Michigan Affidavit Supporting Default, establishing that the defendant did not contest the claims. It's a crucial step in moving a legal matter forward when opposition is absent.

A valid reason to set aside a default judgment in Michigan might include a lack of proper notice about the court proceedings. Another good reason may involve mistakes or misunderstandings that prevented the defendant from participating. It's essential to provide evidence that supports your claim for the court to consider your request.

The main purpose of a Michigan Affidavit Supporting Default is to verify facts in a legal proceeding, especially regarding default situations. By providing sworn statements, it helps ensure that the court acts based on accurate and truthful information. This document serves as a critical tool for enforcing legal rights.

In Michigan, if a default occurs, the plaintiff can move forward by filing a Michigan Affidavit Supporting Default. This document enables the court to proceed with the case, often resulting in a default judgment in favor of the plaintiff. Consequently, the defendant may lose their right to contest the issue or present their side.

A Michigan Affidavit Supporting Default is a legal document created when a party fails to respond to a lawsuit or court action. It establishes that one side did not participate, allowing the other party to seek a default judgment. This affidavit helps streamline the legal process by formally recording the absence of response.

The entry of default is a formal recognition by the court that the opposing party has not responded to the legal complaint within the required time limit. This entry is crucial as it allows the other party to proceed with a request for default judgment. Understanding its significance can enhance your strategy when dealing with legal disputes. If you need assistance navigating this process, the US Legal platform offers tools and resources for handling Michigan Affidavit Supporting Default efficiently.

To fill out a request for entry of default, you will need to gather necessary information such as the case number and names of all involved parties. Complete the form by clearly stating that the opposing party has failed to respond or appear in court. Finally, submit the request to the court and consider using resources like the US Legal platform to ensure your request meets all local requirements.

Writing a motion for default judgment begins with drafting a document that states the reasons why you believe you deserve the judgment. Clearly outline the facts of your case, detail the relief you seek, and include a copy of the entry of default. After completing your motion, file it with the court and ensure you follow up with the necessary supporting documentation to strengthen your position.