Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

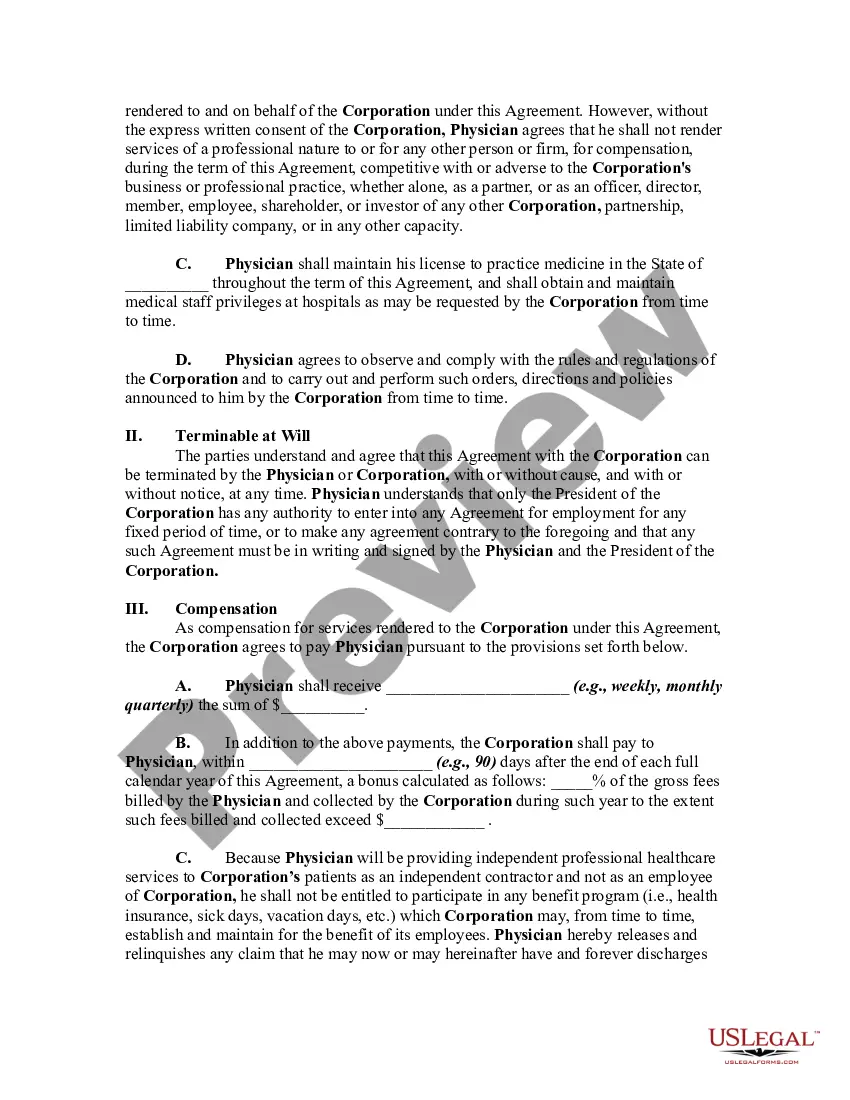

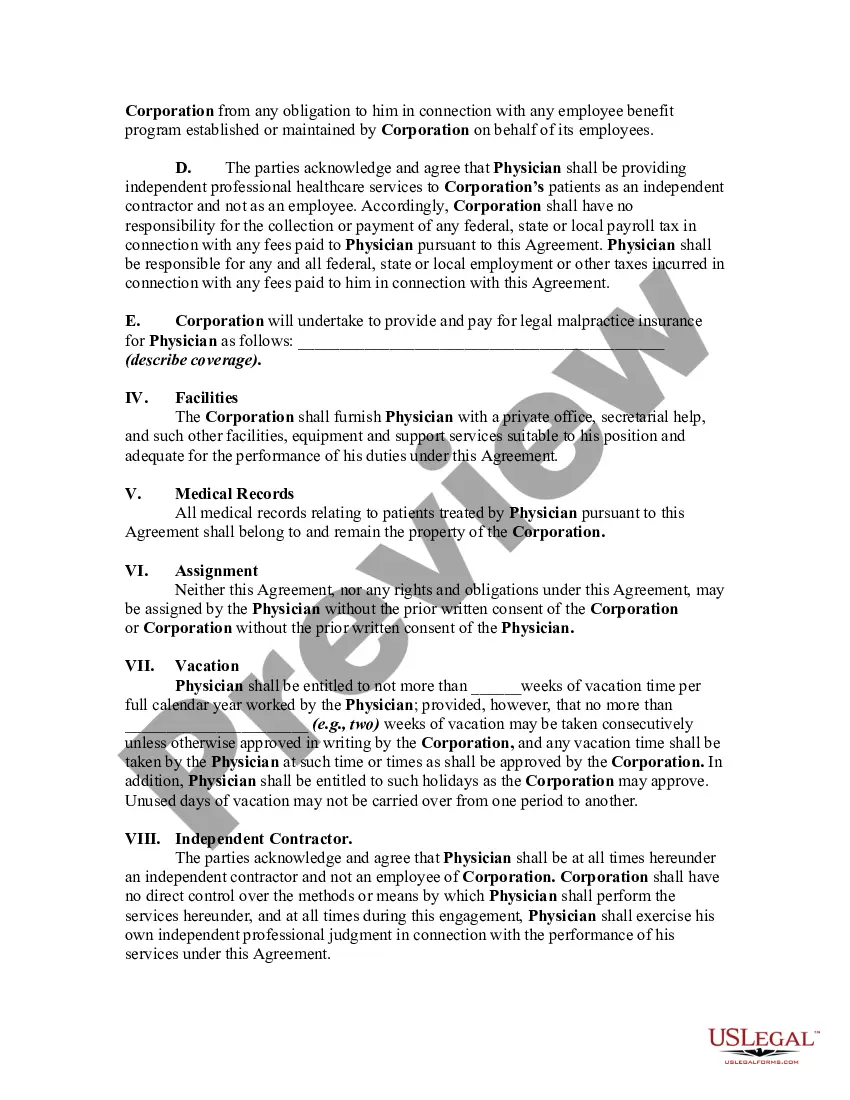

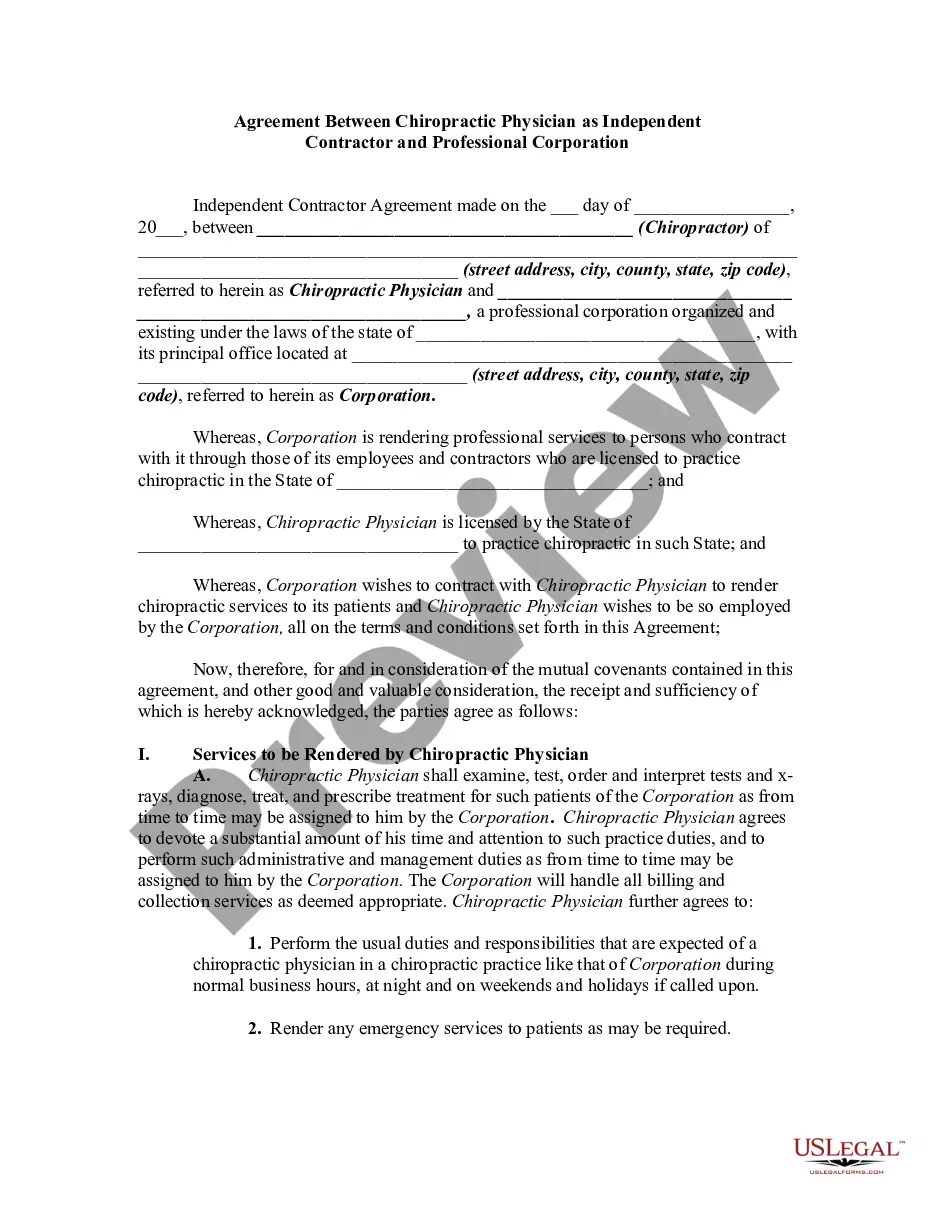

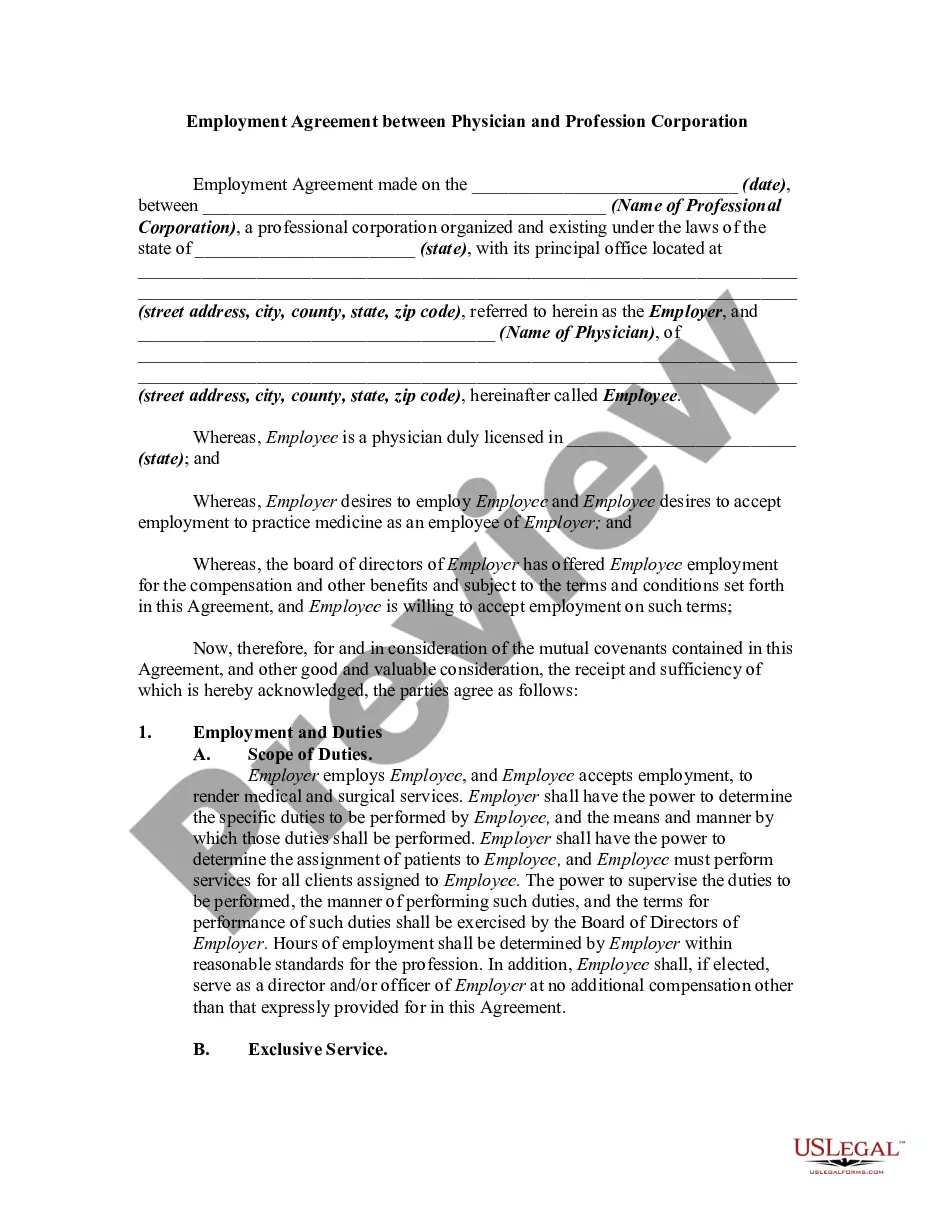

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

If you want to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's simple and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you want and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to retrieve the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation within a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to obtain the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the correct form for your specific city/state.

- Step 2. Utilize the Preview feature to review the content of the form. Don’t forget to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate other variations of the legal document format.

Form popularity

FAQ

Being classified as an independent contractor means you operate your own business and provide services to clients independently. This classification impacts your tax responsibilities, benefits eligibility, and how you manage your work schedule. Under the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, you gain flexibility in your professional engagements. Understanding this classification helps you navigate your business relationships effectively.

As an independent contractor, you will need to complete specific documentation that outlines the terms of your work. This includes the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which specifies your responsibilities and compensation. You should also provide necessary tax forms, such as a W-9, to ensure proper tax handling. Prior to starting your contract, make sure to review all agreements to clarify your rights and obligations.

The agreement between a contractor and a company typically outlines the scope of work, payment structure, and terms of service. This contract is essential for establishing a clear professional relationship and protecting both parties. For example, the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation provides a solid framework for such agreements in the healthcare sector, ensuring clarity and compliance.

An independent contractor in South Africa refers to a self-employed individual who provides services to clients under a contract. They operate independently, without a long-term employment relationship with the client. Understanding global contexts, including the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, helps clarify rights and duties between contractors and their clients.

Begin a simple contract agreement by clearly identifying the parties involved and the purpose of the contract. Include essential terms, such as what services will be provided, payment details, and the duration of the contract. Referencing the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can guide you in structure and expectations.

An independent contractor is typically a professional working under a contract to perform services for another entity without being an employee. For instance, a physician who operates their practice through a professional corporation can be considered an independent contractor if they contract their services. This relationship can often be formalized through a Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation.

To write an independent contractor agreement, start by outlining the roles and responsibilities of each party. Include details such as payment terms, duration of the agreement, and specific services to be provided. Be sure to reference the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation for clarity on professional expectations.

A professional is typically someone who has specialized knowledge and qualifications in their field, providing services to clients. A contractor, while also a professional, operates independently, often on a per-project basis under a contract. The Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation helps clarify these roles, ensuring that both parties understand their expectations and legal protections.

An independent contractor agreement is a legal document that outlines the relationship between a contractor and a client. This document specifies the services to be provided, payment terms, and other essential details. In the context of the Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, this agreement is crucial for safeguarding the interests of both the physician and the corporation.

An independent contractor is a self-employed individual who provides services to clients under terms specified in a contract. They maintain control over how they perform their work and are not subject to the same control as regular employees. A Kansas Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation clearly delineates these terms, ensuring both parties understand their roles and responsibilities.