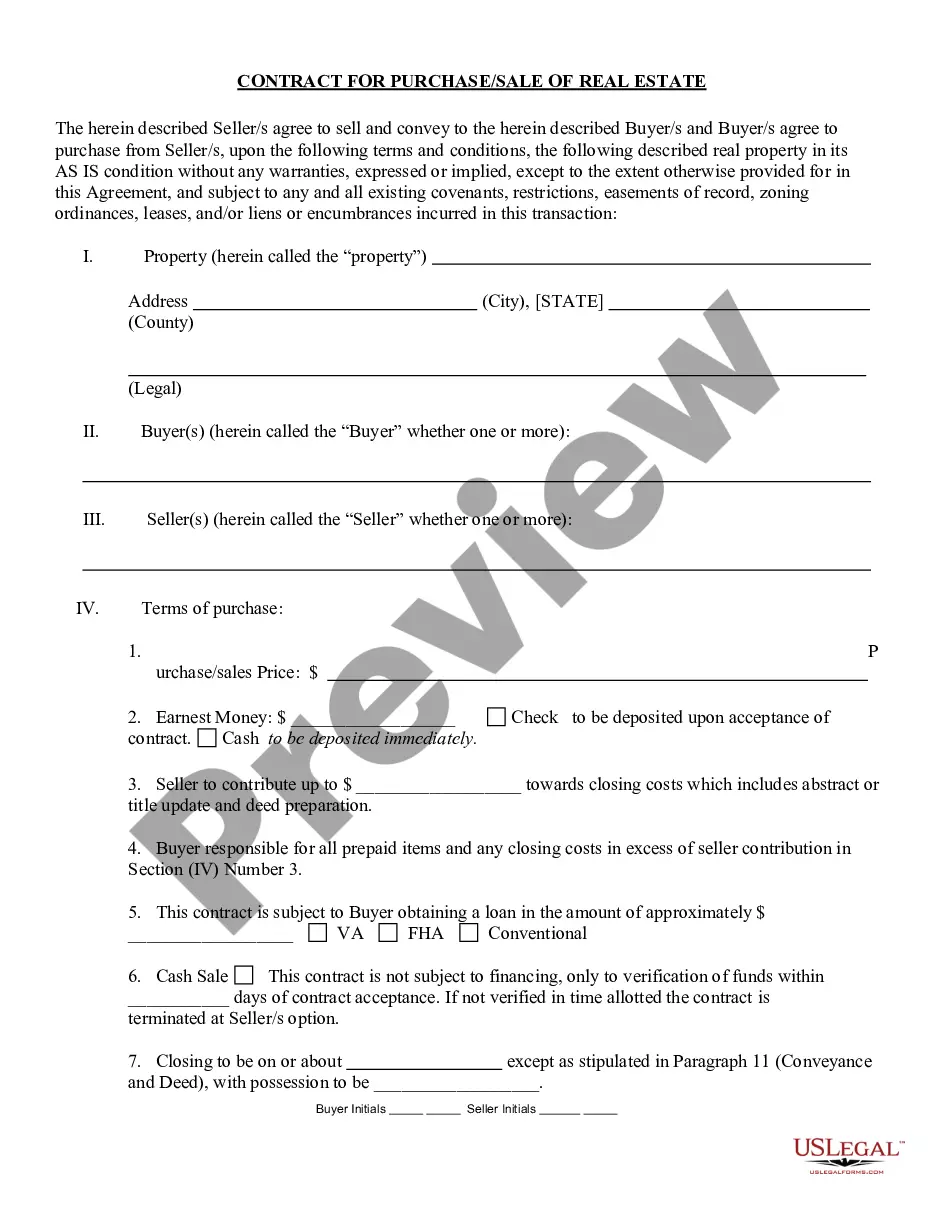

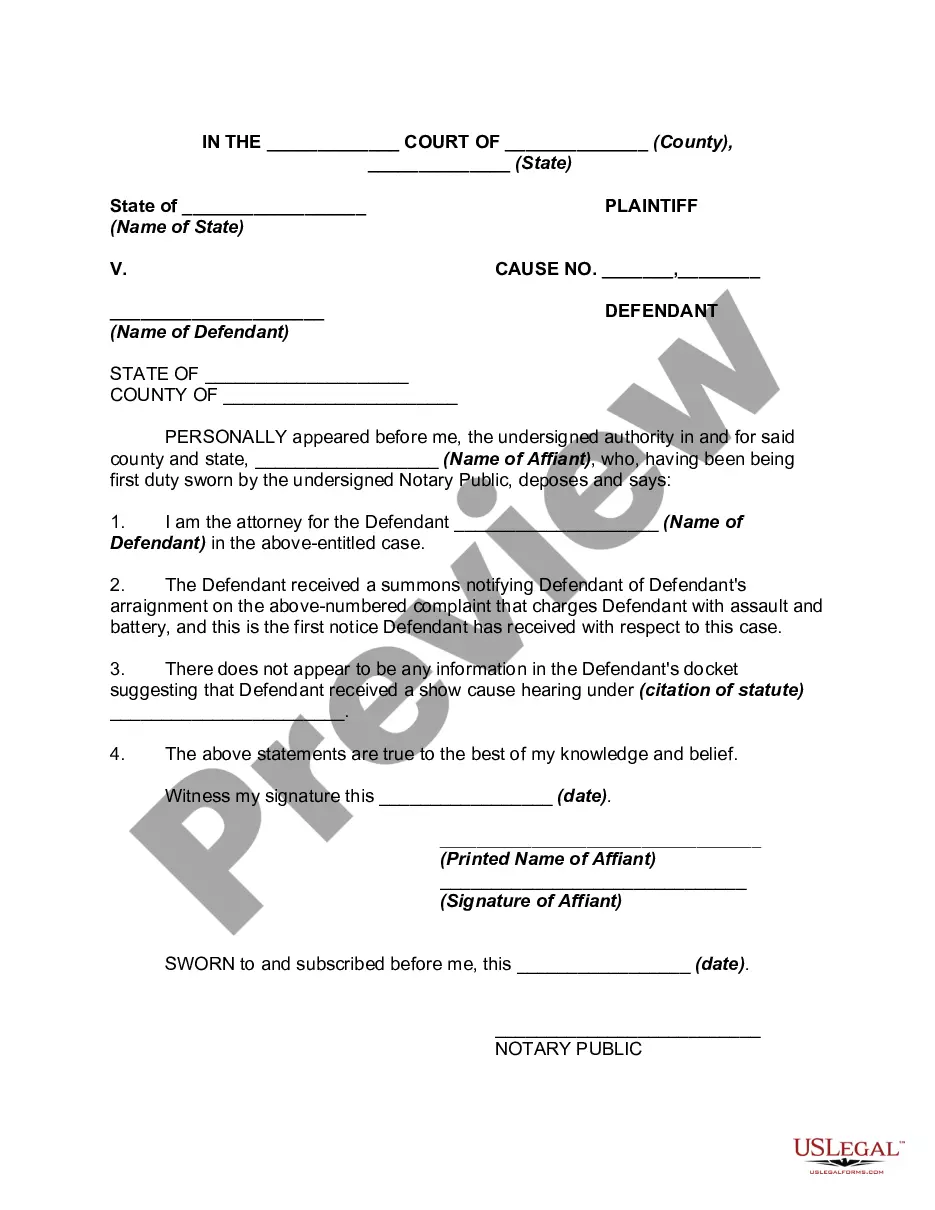

This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

Locating the appropriate official document format can be challenging. Clearly, there are numerous templates accessible online, but how do you secure the official version you need? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Kansas Trust Agreement for Minors Eligible for Annual Gift Tax Exemption - Multiple Trusts for Children, suitable for business and personal use. All templates are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to download the Kansas Trust Agreement for Minors Eligible for Annual Gift Tax Exemption - Multiple Trusts for Children. Use your account to view the official documents you have purchased previously. Visit the My documents section of your account to obtain another copy of the document you need.

US Legal Forms is the largest repository of official templates where you can explore diverse document formats. Take advantage of this service to download professionally crafted documents that comply with state regulations.

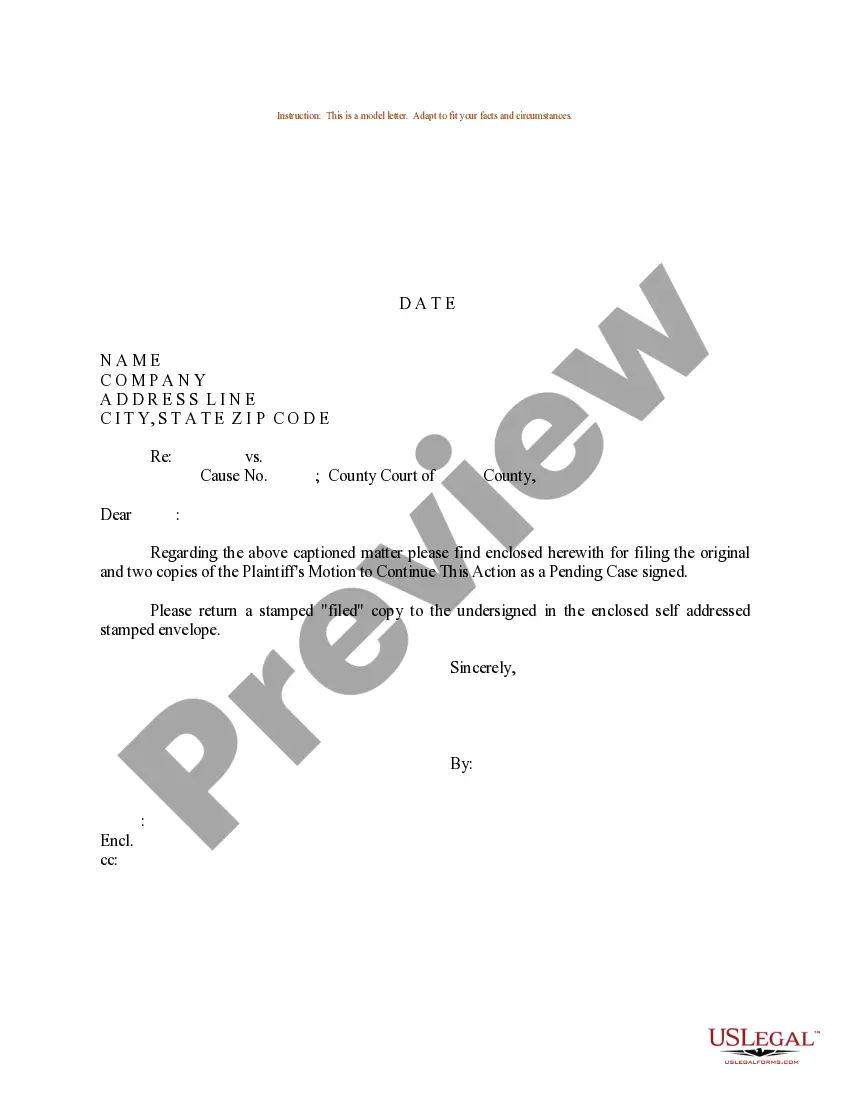

- Initially, confirm you have selected the correct template for your city/county. You can access the document with the Review button and examine the document details to ensure it fits your needs.

- If the document does not meet your requirements, use the Search box to locate the correct template.

- Once you are confident that the document is appropriate, click the Buy now button to purchase the template.

- Select the pricing plan you prefer and input the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the official document format to your device.

- Complete, edit, print, and sign the acquired Kansas Trust Agreement for Minors Eligible for Annual Gift Tax Exemption - Multiple Trusts for Children.

Form popularity

FAQ

Yes, there are various software solutions available for filing Form 709, which is the federal gift tax return. Platforms like UsLegalForms offer user-friendly tools to simplify the preparation of this form. Additionally, integrating a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can further assist in managing your gifting strategy efficiently.

Using the gift tax exclusion involves understanding the annual limit and ensuring that your gifts fall within that limit. When using a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can set up gifts on behalf of minors while safely excluding them from gift tax. This not only helps in efficient wealth transfer but also enables benefitting future generations.

You can gift someone up to $17,000 per year without incurring gift tax in Kansas, thanks to the annual exclusion. If you utilize multiple trusts, such as a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can strategically increase your gifting capacity across family members. This allows for significant financial support while optimizing tax benefits.

Kansas does not levy an inheritance tax, making it advantageous for heirs. Instead, if your estate exceeds the exemption limits, it may be subject to federal estate tax. Utilizing a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can protect assets and streamline the transfer process.

The gift tax on $10,000 depends on whether it exceeds the annual exclusion limit set by the IRS. As of now, individuals can gift up to $17,000 annually without incurring any gift tax. If you exceed this amount, a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can be structured to help you navigate these tax concerns efficiently.

Yes, TaxAct does include Form 709, accommodating those who make gifts that exceed the annual exclusion limits. If you're managing a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, using TaxAct can streamline the filing process, ensuring compliance with your tax obligations.

Gift splitting allows married couples to combine their annual gift exclusions. For example, if a couple gives $30,000 to their child, they can treat it as two separate gifts of $15,000 each. This strategy is relevant when setting up a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, maximizing the benefits under tax laws.

Yes, H&R Block software includes the ability to file Form 709. This feature is particularly useful for individuals dealing with a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. With H&R Block, you can easily ensure proper reporting of gifts and take advantage of the annual gift tax exclusion.

Various software options are available for filing Income Tax Returns (ITR) in the United States. Popular choices include TurboTax, H&R Block, and TaxAct. Each of these programs can help you effectively manage a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, allowing you to navigate tax regulations with ease and accuracy.

Yes, TurboTax provides the option to file Form 709, which is essential for reporting gifts made during the year. If you're considering a Kansas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, using TurboTax can simplify the reporting process. It guides you through the preparation and ensures that you meet all necessary tax requirements.