Kansas Transfer of Property under the Uniform Transfers to Minors Act

Description

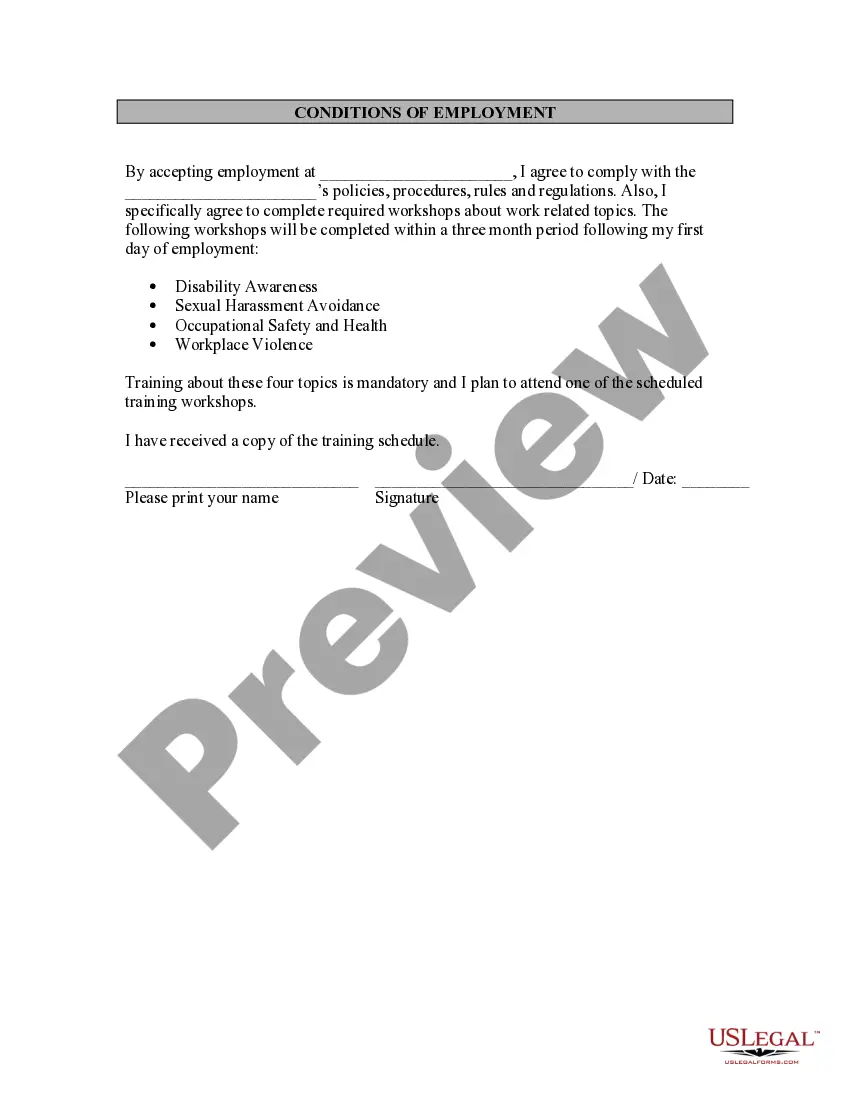

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

If you want to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and convenient search feature to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Kansas Transfer of Property under the Uniform Transfers to Minors Act.

Every legal document template you receive is yours to keep indefinitely. You will have access to all forms you saved in your account. Click the My documents section and choose a form to print or download again.

Complete and download, and print the Kansas Transfer of Property under the Uniform Transfers to Minors Act with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the Kansas Transfer of Property under the Uniform Transfers to Minors Act with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Get button to acquire the Kansas Transfer of Property under the Uniform Transfers to Minors Act.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/state.

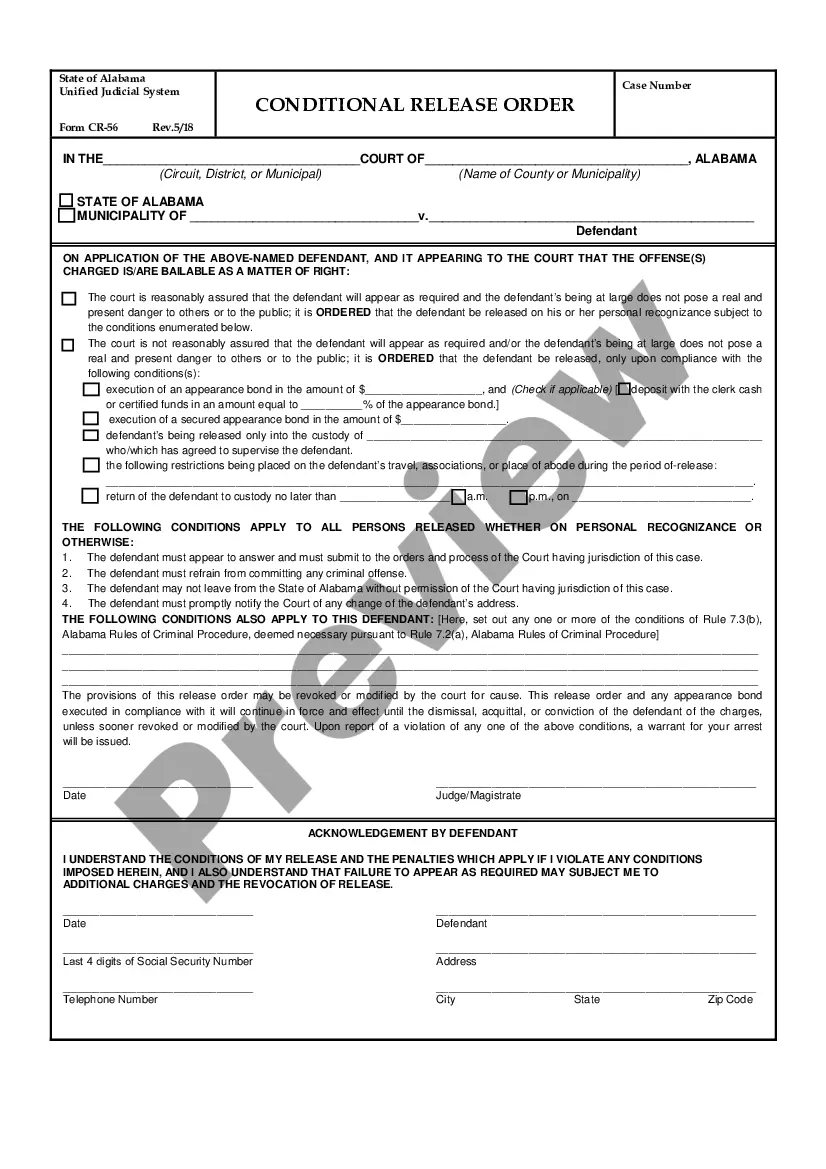

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of legal form templates.

Form popularity

FAQ

Both Kansas and Missouri have adopted a Uniform Transfer to Minors Act (UTMA), which provides a simplified way to irrevocably gift or transfer property to be held in custodianship for the benefit of a child.

How Do Taxes Work with a Custodial Account? The child beneficiary technically owns the custodial account ? not the custodian. It's the beneficiary's Social Security number that is attached to the account. Thus, the child is the one who technically needs to pay taxes.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

A portion (up to $1,250 in 2023) of any earnings from a custodial account may be exempt from federal income tax, and a portion (up to $1,250 in 2023) of any earnings in excess of the exempt amount may be taxed at the child's tax rate, which is generally lower than the parent's tax rate.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.

What are the tax rules for UTMA in 2023? In 2023, the first $1,250 of a child's unearned income from a UTMA account is tax-free. This is one of the main tax benefits of UTMA accounts. The next $1,250 is taxed at the child's rate, and income over $2,500 is taxed at the parent's rate.

UGMA and UTMA accounts are not tax-deferred assets. All gains on investment properties are taxed as normal, and the creator of the account may choose to pay these capital gains taxes on behalf of the recipient.

Because money placed in an UGMA/UTMA account is owned by the child, earnings are generally taxed at the child's?usually lower?tax rate, rather than the parent's rate. For some families, this savings can be significant. Up to $1,050 in earnings tax-free. The next $1,050 is taxable at the child's tax rate.