Artwork in tangible form is personal property. Transfer of title can therefore be made by a Bill of Sale. A Bill of Sale also constitutes a record of the transaction for both the artist and the person buying the artwork. It can provide the seller with a record of what has been sold, to whom, when, and for what price. The following form anticipates that the seller is the artist and therefore reserves copyright and reproduction rights.

Kansas Bill of Sale for Artwork or Work of Art or Painting

Description

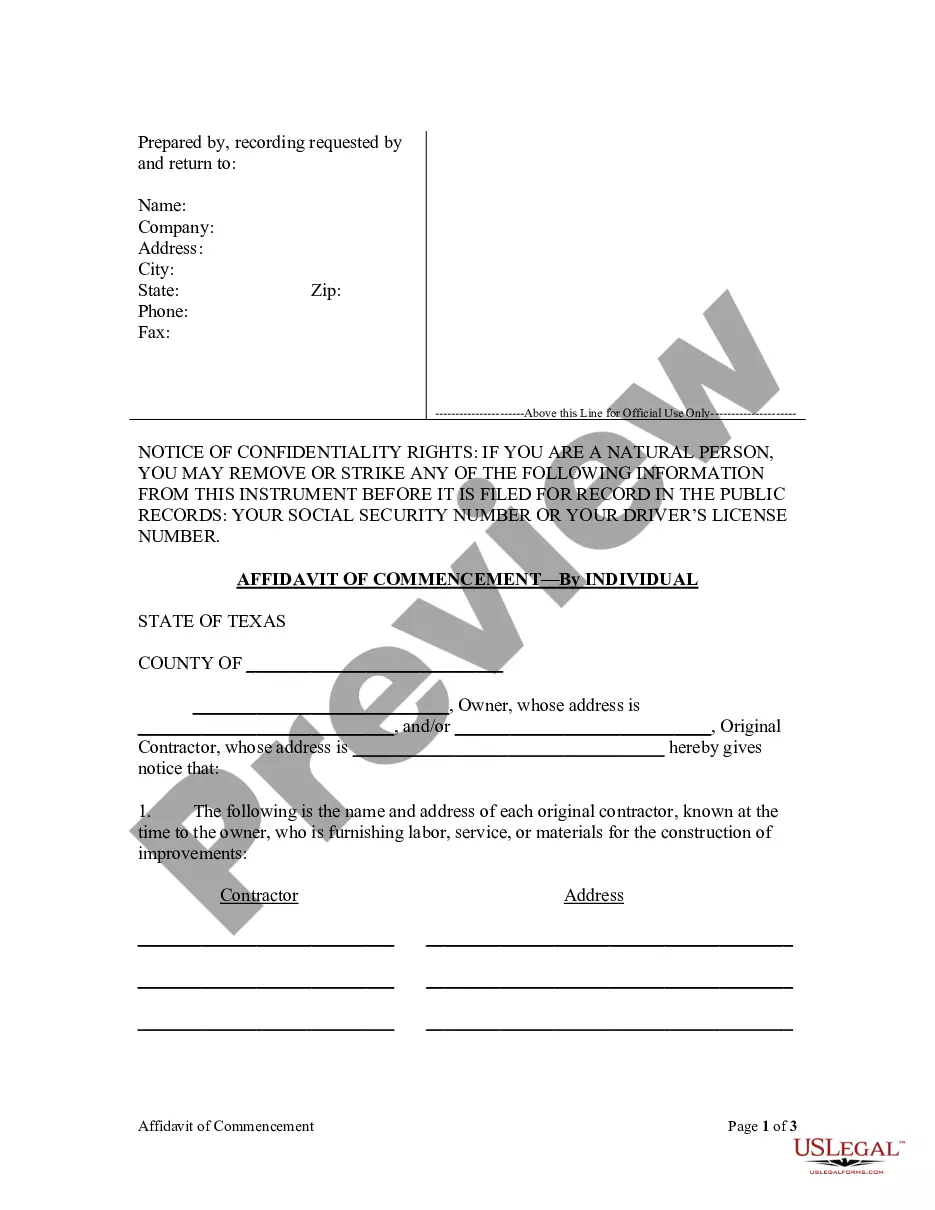

How to fill out Bill Of Sale For Artwork Or Work Of Art Or Painting?

Identifying the appropriate legal document template can be quite a challenge.

Naturally, there are numerous templates available online, but how do you locate the specific legal form you require.

Utilize the US Legal Forms website.

If you are a new client of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the appropriate form for your city/region. You can view the form using the Preview button and read the form description to confirm it is suitable for your needs.

- The service offers a multitude of templates, such as the Kansas Bill of Sale for Artwork or Work of Art or Painting, suitable for both business and personal purposes.

- All forms are verified by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Acquire button to access the Kansas Bill of Sale for Artwork or Work of Art or Painting.

- Use your account to browse the legal forms you have acquired previously.

- Visit the My documents section of your account and download an additional copy of the document you require.

Form popularity

FAQ

A commodity can refer to any item that holds value and is traded in the market, such as goods and services. Art, real estate, and even stocks can be classified as commodities if they are exchanged for monetary value. When it comes to selling artwork, using a Kansas Bill of Sale for Artwork or Work of Art or Painting ensures that you are properly documenting the exchange and following legal protocols.

Indeed, art is considered a commodity in many contexts, particularly in auctions and galleries. Because of its intrinsic value, artworks can be bought and sold, necessitating a Kansas Bill of Sale for Artwork or Work of Art or Painting for formal transactions. This document acts as protection for both buyers and sellers, ensuring the transaction is valid and recognized.

Art typically falls under the category of personal property, which includes tangible items owned by individuals. When selling or transferring ownership of art, a Kansas Bill of Sale for Artwork or Work of Art or Painting is crucial for documenting the transfer. Thus, you establish a concrete record for future reference or legal purposes.

Selling art from an estate involves several steps, beginning with an appraisal to determine its value. Afterward, you can create a Kansas Bill of Sale for Artwork or Work of Art or Painting to solidify the transaction with potential buyers. Utilizing platforms like uslegalforms can assist in drafting legally binding sales documents, simplifying the selling process.

Yes, artwork is often viewed as a commodity within the market. It holds value that buyers and sellers exchange, especially through instruments like a Kansas Bill of Sale for Artwork or Work of Art or Painting. This legal document ensures a clear transfer of ownership, making art transactions more secure and transparent.

To sell a piece of art, start by assessing its value and preparing high-quality images. You can sell through various channels such as galleries, online platforms, or art fairs. When finalizing a sale, using a Kansas Bill of Sale for Artwork or Work of Art or Painting will protect both you and the buyer, ensuring a smooth and secure transaction.

The 1/3 rule in art refers to the principle of composition where the artwork is visually balanced by dividing it into thirds. This technique can enhance the aesthetic appeal, making it more engaging for viewers. While creating a Kansas Bill of Sale for Artwork or Work of Art or Painting, understanding such principles can help you convey the value of your artwork to potential buyers effectively.

Valuing a piece of art involves several factors such as the artist's reputation, the artwork's condition, provenance, and current market demand. Conducting market research and consulting art appraisers can provide you with a well-rounded assessment. When you prepare a Kansas Bill of Sale for Artwork or Work of Art or Painting, having an accurate valuation ensures transparency and fairness in your transaction.

Yes, you can sell art without a license in most cases. However, local regulations may require specific permits or registrations. Always check your state and local laws to ensure compliance, especially when completing a Kansas Bill of Sale for Artwork or Work of Art or Painting. Proper documentation not only helps you in legal matters but also establishes trust with buyers.

The sale of artwork may be subject to sales tax in Kansas, depending on the circumstances of the transaction. In most cases, both the seller and the buyer should be aware that profits from such sales might require reporting as income. It’s wise to consult a tax professional for specific tax advice related to your Kansas Bill of Sale for Artwork or Work of Art or Painting to understand all obligations.