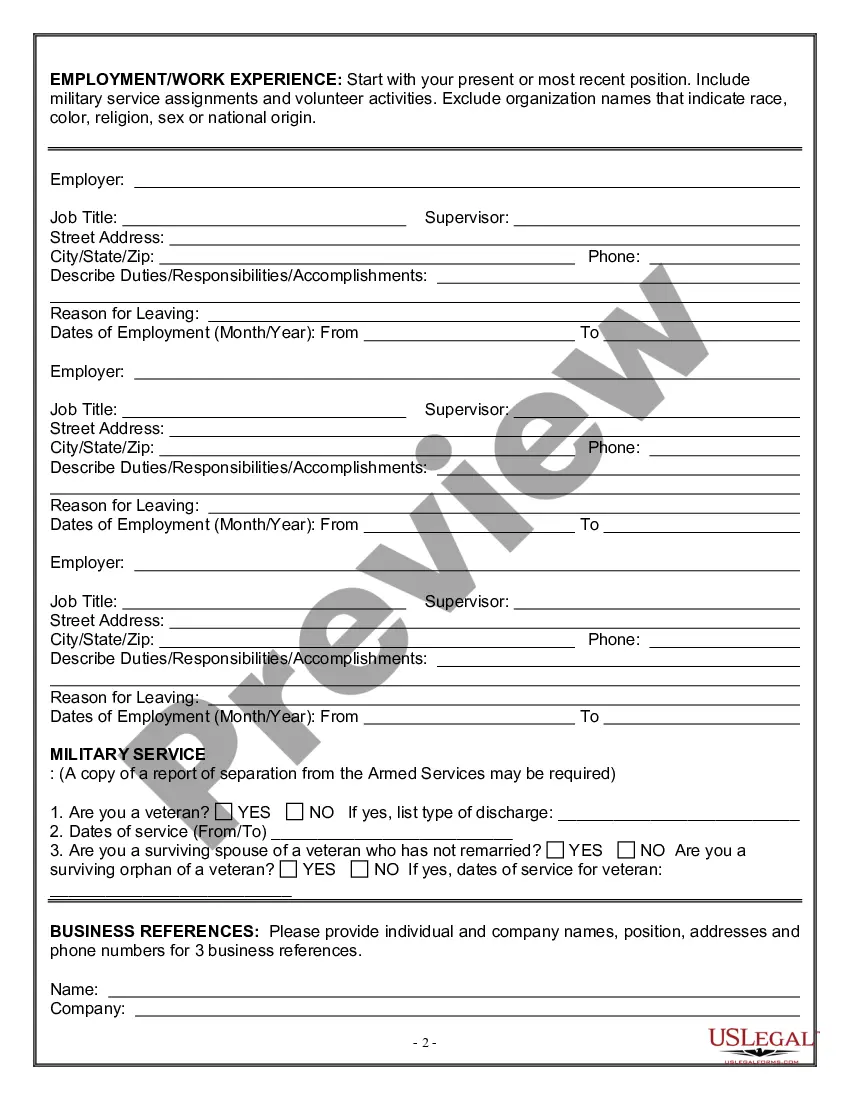

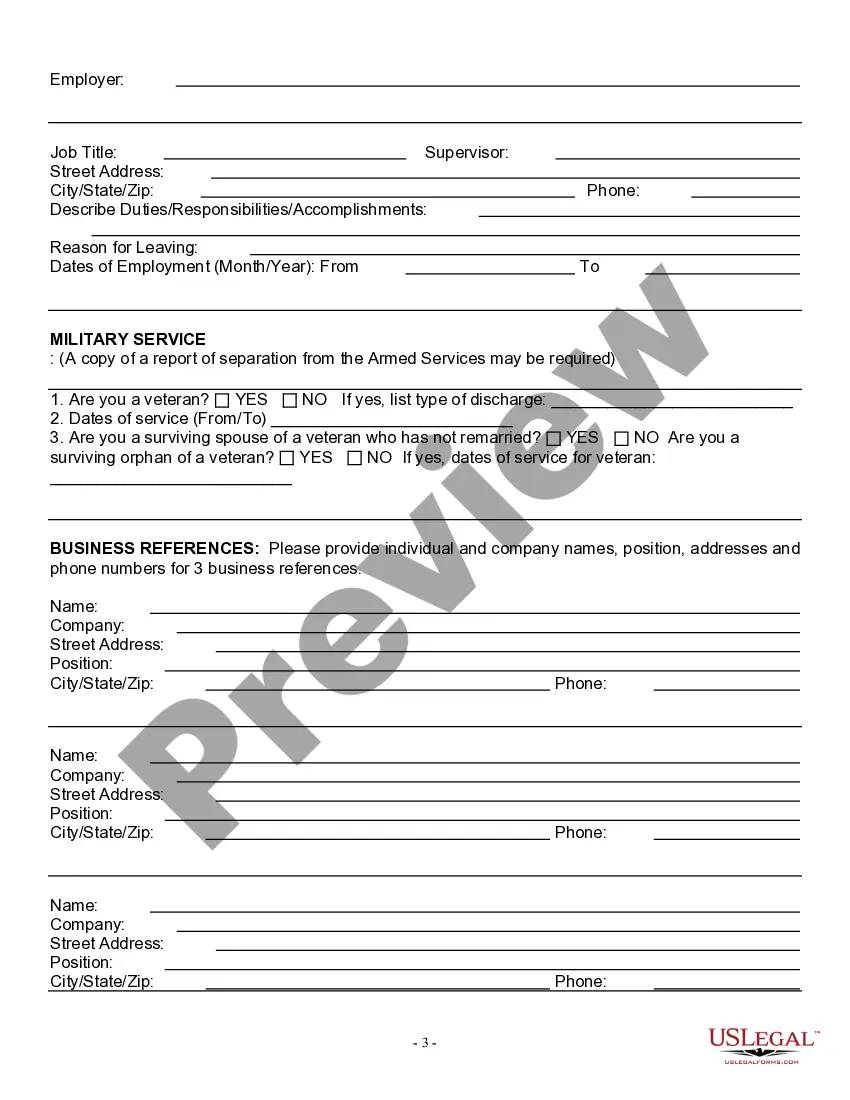

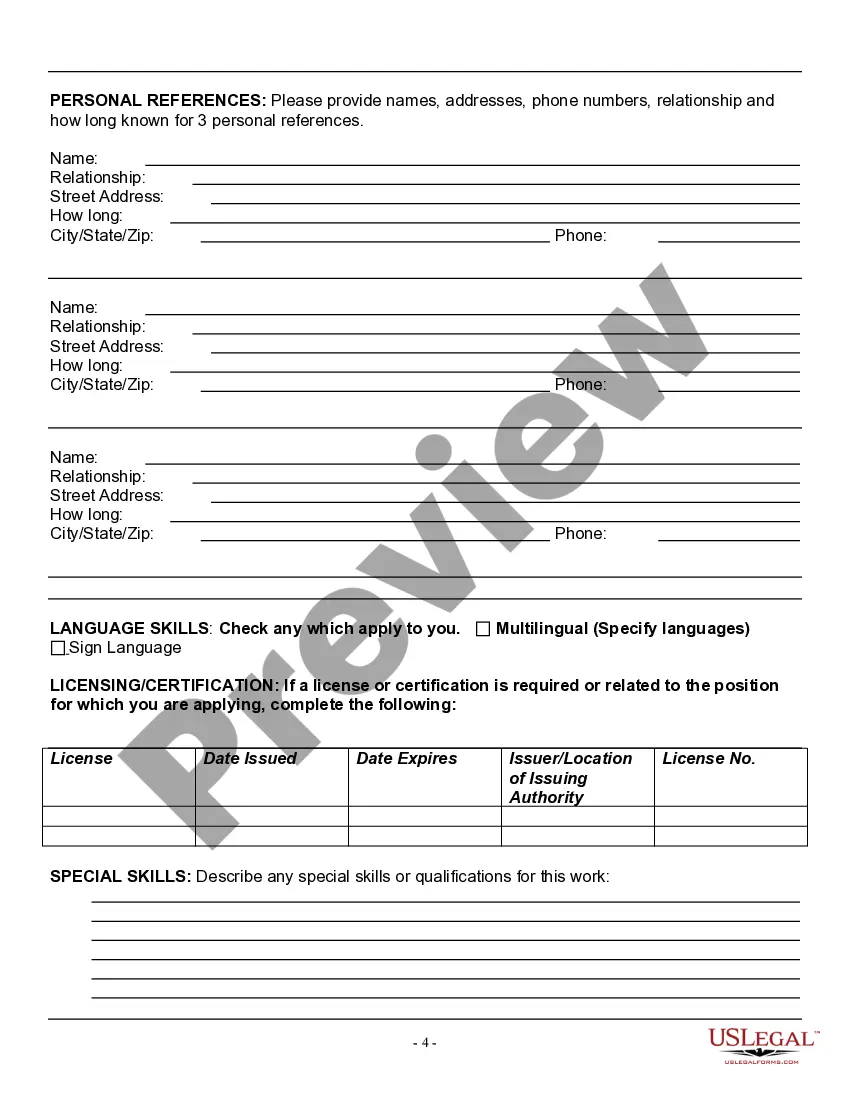

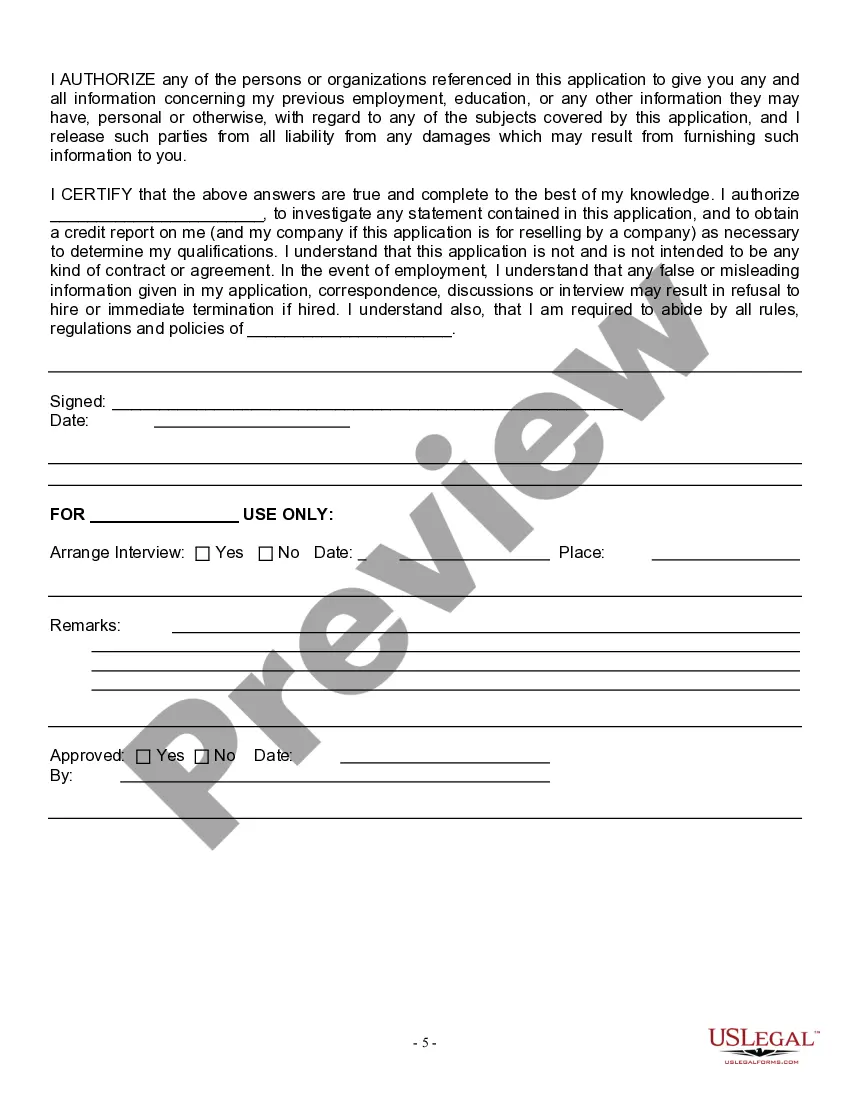

Kansas Employment Application for Secretary

Description

How to fill out Employment Application For Secretary?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast selection of legal templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal uses, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Kansas Employment Application for Secretary within minutes.

If the document does not meet your needs, use the Search feature at the top of the screen to find the one that does.

If you are satisfied with the document, confirm your selection by clicking the Buy now button. Then, choose your pricing plan and provide your information to register for the account.

- If you already have a subscription, Log In to download the Kansas Employment Application for Secretary from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct document for your city/state. Click the Review button to check the document's contents.

- Review the details of the document to confirm that you have selected the right one.

Form popularity

FAQ

Once your state unemployment claim has a zero balance, you can apply for PEUC on our website at . PEUC applications can only be filed online at this time.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Kansas law requires that claimants generally serve a one-week waiting period before being eligible for benefits. This week will be the first week in which you meet all unemployment requirements for payment of benefits and for which you filed a weekly claim.

Go to GetKansasBenefits.gov and click to file an online application for unemployment insurance if:You are filing a new application for unemployment.You need to open your claim again and you have worked since the last time you filed.Follow the instructions found there carefully.

If you quit your job, you will be disqualified from receiving unemployment benefits unless you had good cause relating to your work. In general, good cause means that your reason for leaving the position was job-related and was so compelling that you had no other choice than to leave.

Please send your completed forms to KDOL.UICC@ks.gov. You may also send by mail or fax. All required forms should be completed and returned to the Kansas Unemployment Contact Center as indicated on the form. Many of the forms can be completed online and submitted by using the "Submit" button at the bottom of the form.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services.

Steps to Hiring your First Employee in KansasStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.