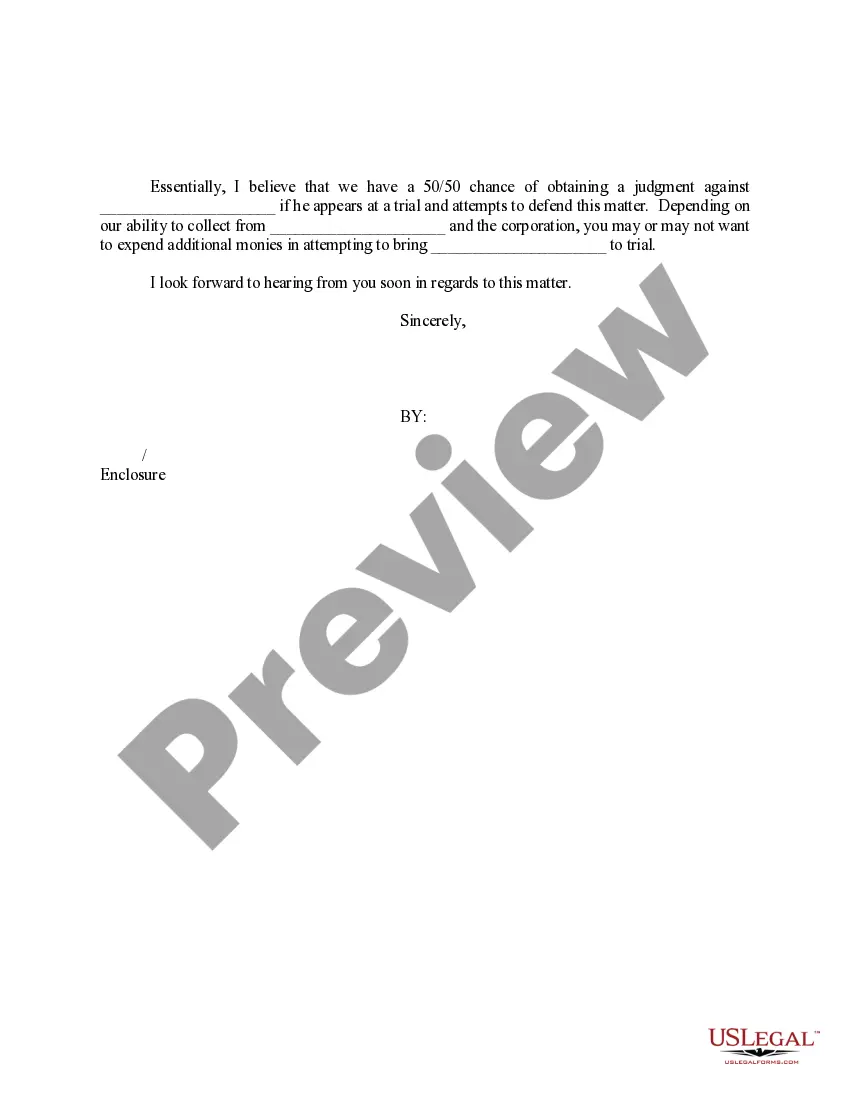

This form is a sample letter in Word format covering the subject matter of the title of the form.

Kansas Sample Letter for Collection Efforts

Description

How to fill out Sample Letter For Collection Efforts?

You might spend hours online looking for the official document template that complies with the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily download or print the Kansas Sample Letter for Collection Efforts from my service.

If available, utilize the Preview button to browse through the document template as well. If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Kansas Sample Letter for Collection Efforts.

- Every legal document template you buy is yours forever.

- To obtain another copy of the purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your region/area of interest.

- Review the form details to ensure you have chosen the right one.

Form popularity

FAQ

To write a letter to collect something, start by clearly stating what you are collecting and the reasons behind it. Outline any relevant details, such as deadlines or payment options. A Kansas Sample Letter for Collection Efforts can serve as a helpful template, ensuring your letter is professional and effective in communicating your needs.

In Kansas, the statute of limitations for most debts is typically three years. After this period, the debt may become uncollectible, meaning creditors cannot legally pursue repayment. Understanding these timeframes is crucial, and using resources like a Kansas Sample Letter for Collection Efforts can help you act promptly when collecting debts.

Writing a letter to a collection company involves stating your account information and the purpose of your communication. Clearly express your concerns or intentions regarding the debt. To ensure you are following best practices, consider using a Kansas Sample Letter for Collection Efforts, which provides a solid framework for your message.

When writing a letter for collection, emphasize clarity and professionalism. Begin by addressing the recipient correctly, and then clearly outline the debt details. Utilizing a Kansas Sample Letter for Collection Efforts can guide you in crafting a letter that is both effective and respectful, increasing the chances of successful recovery.

To write an effective collection letter, start with a clear and polite introduction. State the amount owed and provide details about the debt, such as the due date. It's helpful to include a Kansas Sample Letter for Collection Efforts as a reference. This ensures your letter maintains a professional tone and structure.

To write a letter of collection, begin with a polite introduction, followed by a clear statement of the debt owed. Include important details like the due date and your contact information for any questions. Referencing a Kansas Sample Letter for Collection Efforts can help you format your letter correctly and convey your message effectively.

A properly written collection letter should be clear and concise, stating the amount owed and any relevant due dates. Additionally, it must include the contact information where the debtor can reach you for further discussion. Utilizing a Kansas Sample Letter for Collection Efforts can help ensure that your letter meets these essential requirements.

To answer a summons for debt collection in Kansas, carefully read the document and note the deadlines for your response. It is essential to prepare a written answer that addresses each allegation in the summons. For assistance, consider using resources like a Kansas Sample Letter for Collection Efforts, which can provide templates and guidance on crafting your response.

To write a collection letter, start with a clear subject line and a courteous greeting. Follow with a straightforward explanation of the debt, including the amount owed and the due date, and maintain a respectful tone throughout. A Kansas Sample Letter for Collection Efforts can serve as a helpful guide to structure your letter effectively.

When disputing a collection, it is best to state your position clearly and factually. You can mention any discrepancies in the amount owed or the validity of the debt. Using a Kansas Sample Letter for Collection Efforts can guide you in articulating your dispute in a professional manner, ensuring your concerns are taken seriously.