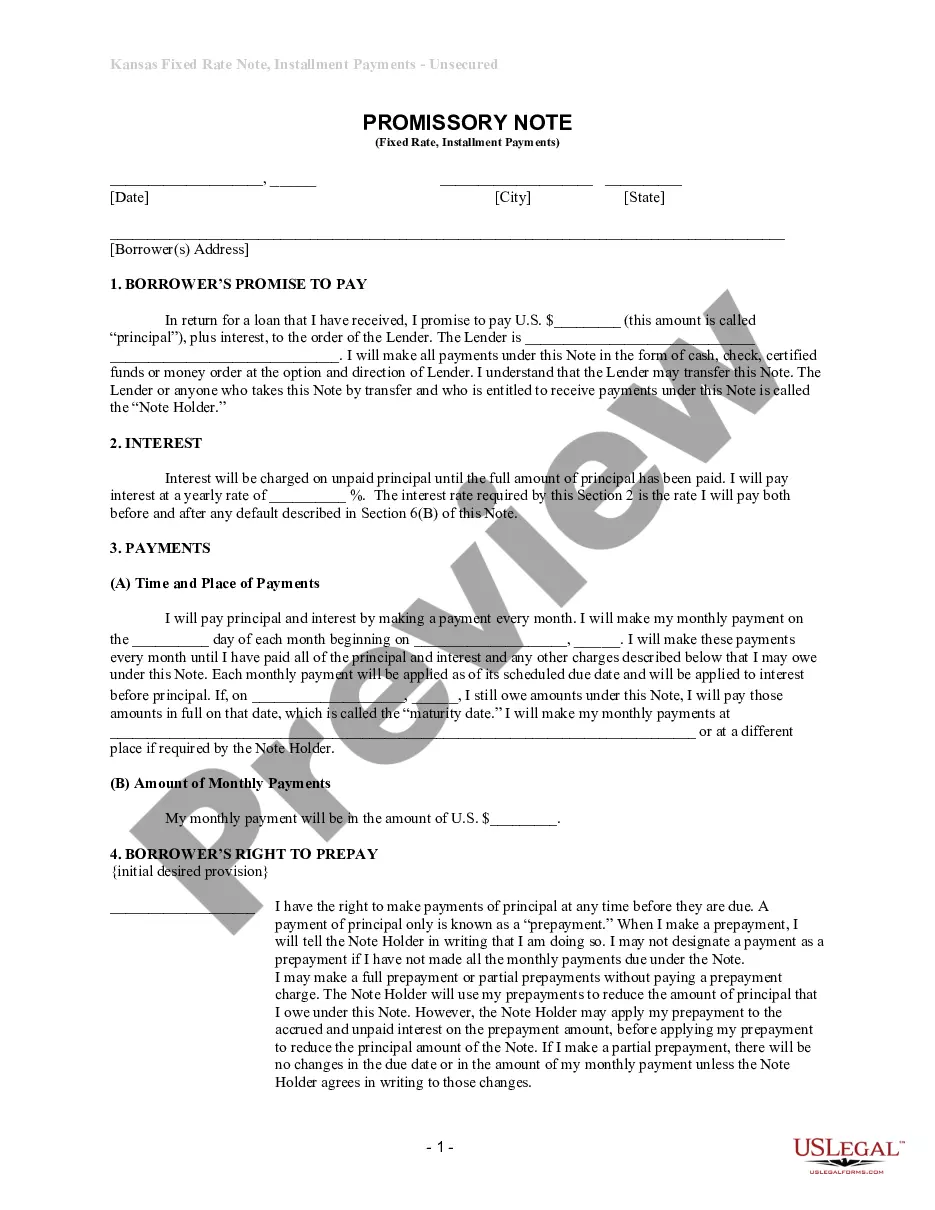

Kansas Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Kansas Unsecured Installment Payment Promissory Note For Fixed Rate?

Searching for Kansas Unsecured Installment Payment Promissory Note for Fixed Rate template and completing it could be challenging.

To conserve time, expenses, and energy, utilize US Legal Forms and locate the appropriate example tailored for your state in merely a few clicks.

Our attorneys create every document, so you simply need to fill them in. It is genuinely that straightforward.

Choose your plan on the pricing page and create an account. Select your payment method via credit card or PayPal. Save the form in your preferred format. Now you can print the Kansas Unsecured Installment Payment Promissory Note for Fixed Rate template or fill it out with any online editor. Don't worry about making mistakes, as your form can be utilized and submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to save the document.

- Your preserved samples are stored in My documents and are always available for future use.

- If you haven’t registered yet, you ought to enroll.

- Review our detailed guidance on how to obtain the Kansas Unsecured Installment Payment Promissory Note for Fixed Rate template in a few moments.

- To acquire a suitable form, verify its relevance to your state.

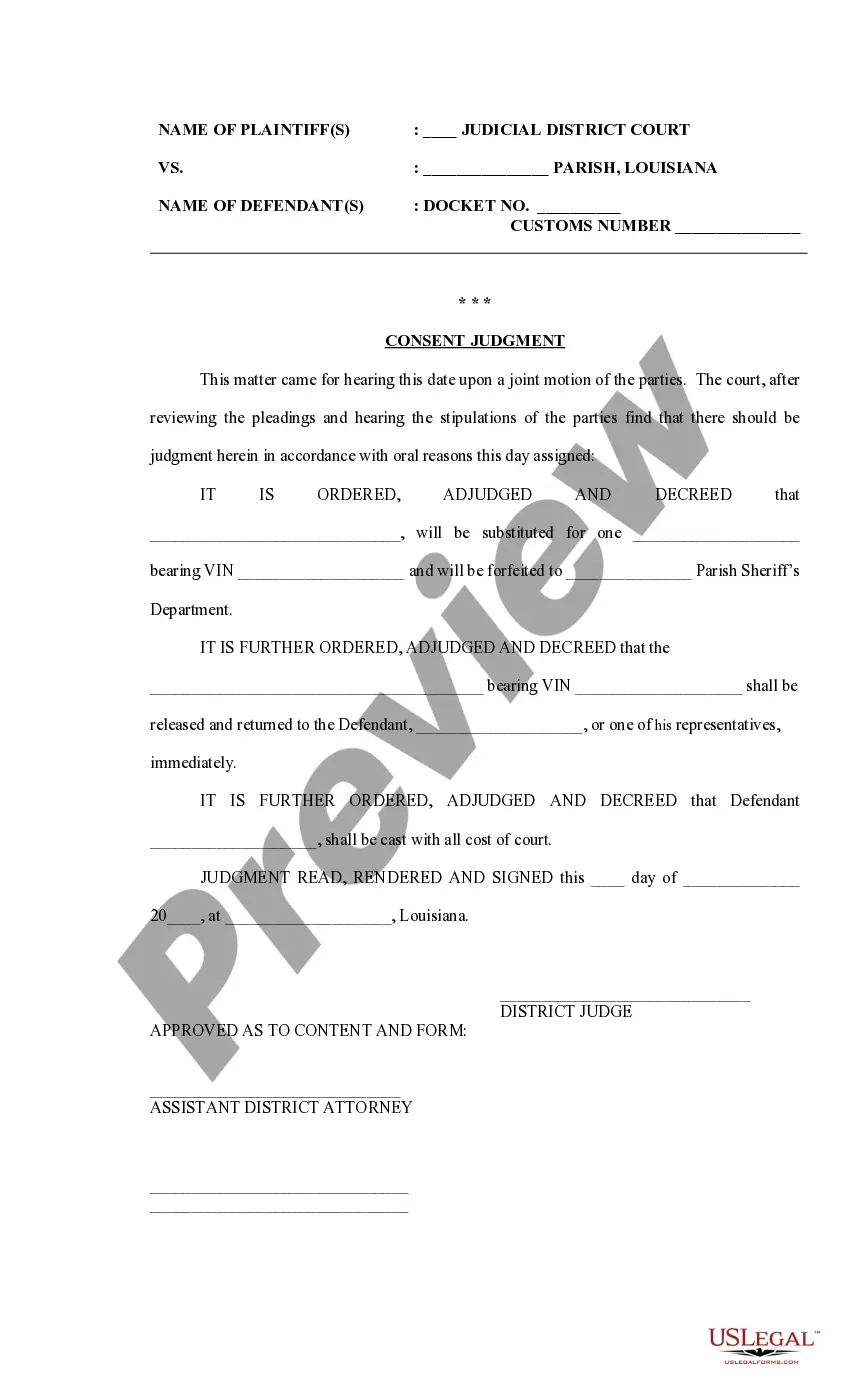

- Examine the sample using the Preview option (if available).

- If there's a description, read it to understand the particulars.

- Click on the Buy Now button if you have found what you are looking for.

Form popularity

FAQ

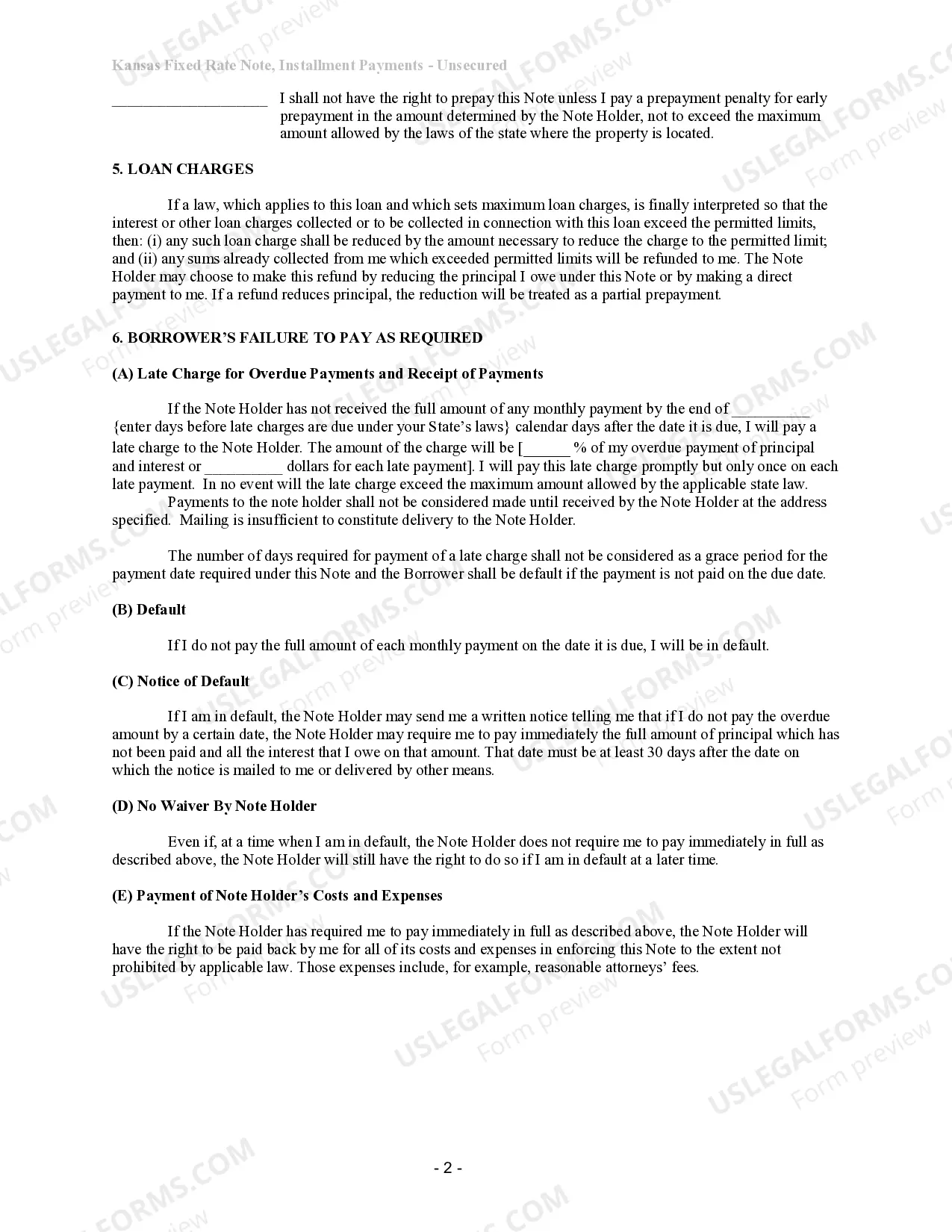

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment.A short-term unsecured promissory note is the type most often used when a relatively small amount of money is borrowed from a friend or relative.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest.However, there may be tax consequences to the Lender or Borrower if interest is charged but it is not a reasonable rate.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.