Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

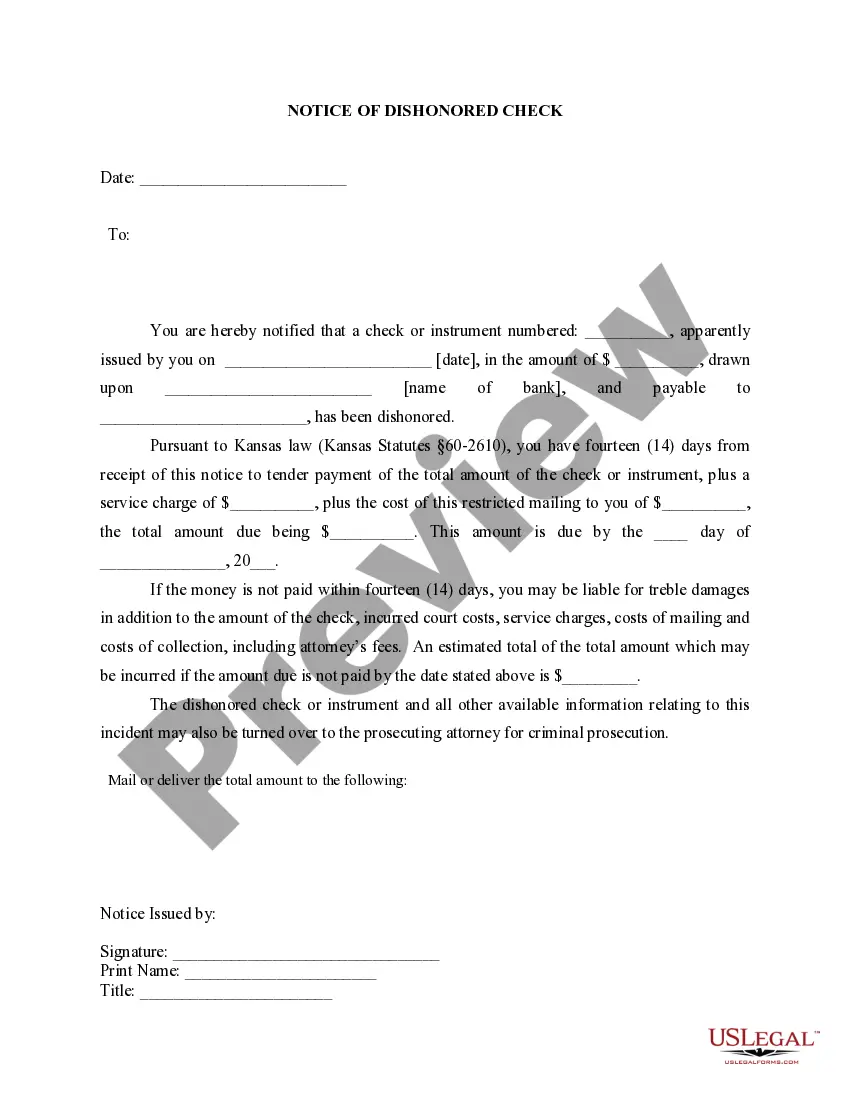

How to fill out Kansas Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Looking for Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check forms and completing them might be a task. To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks. Our lawyers prepare every document, so all you have to do is complete them. It truly is simple.

Log in to your account and return to the form's webpage to download the template. All your downloaded forms are saved in My documents and are accessible at any time for future use. If you haven't registered yet, now is the time to sign up.

Review our comprehensive instructions on how to obtain the Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check template within moments.

You can now print the Kansas Notice of Dishonored Check - Civil - Keywords: bad check, bounced check template or complete it using any online editor. Don’t worry about typos since your form can be utilized and submitted multiple times. Explore US Legal Forms to access over 85,000 state-specific legal and tax documents.

- To find a suitable template, ensure its accuracy for your state.

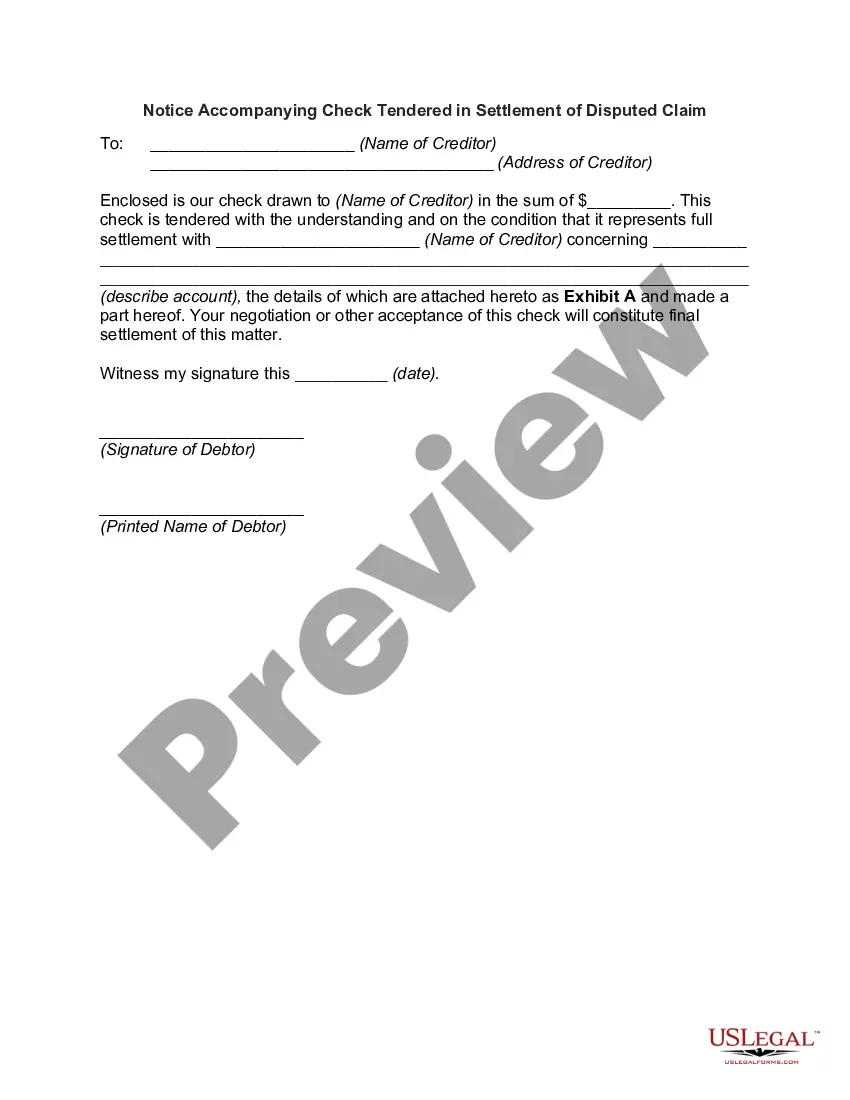

- Examine the sample using the Preview option (if available).

- If there’s a description, review it to grasp the key points.

- Click on the Buy Now button if you found what you’re looking for.

- Choose your plan on the pricing page and create an account.

- Indicate whether you want to pay by card or PayPal.

- Download the template in your chosen format.

Form popularity

FAQ

Contact the district attorney. Some states have a bad-check restitution program where the DA's office has someone contact the check writer and urge them to pay up. Work through a collection agency. Use a check recovery service. Take your customer to court if they refuse to resolve things.

If you don't pay the amount of a bounced check within the time frame your bank specifies, it can close your account.If your financial institution doesn't cover the check, it bounces and is returned to the depositor's bank. You'll likely be charged a nonsufficient funds fee, also known as an NSF or returned item fee.

If you are given a bad check, you can sue for the amount of the check plus bank fees. You can also add damages to your claim.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

When determining your bounced check fee, consider this: On average, a bank will charge YOU about $30 for a bad check, so you should charge a penalty of $35-$50. Why? Because it's likely you will be (or you should, anyway) immediately sending out notice to the tenant regarding the bad check.

Bouncing a check is usually a crime only if you intend to defraud the payee. In other words, the payee must be able to prove that you knew your check would bounce and therefore you intended to commit check fraud. Fortunately, most consumers don't wait long to repay bad checks and aren't charged with criminal penalties.

The amount of time merchants can allot for you to pay off a bounced check is rooted mainly in state laws. Familiarize yourself with your state's law and act accordingly in terms of paying of the bad check. In general, laws allow for bad check writers to be given anywhere from two to three years to pay their debt.

If a cheque bounces due to insufficient funds or any other technical reason, such as signature mismatch, their respective banks charges for both the defaulter and the payee. The penalty charges for cheque outward return are close to Rs. 300 for most banks, while charges for cheque inward return are about Rs. 100.

If the check amount exceeds certain thresholds, the crime may be treated as a felony. Civil penalties apply in all cases, with a common penalty amount equivalent to the check's face value, a multiple of the check amount with a cap, or the check amount plus court and attorney fees.