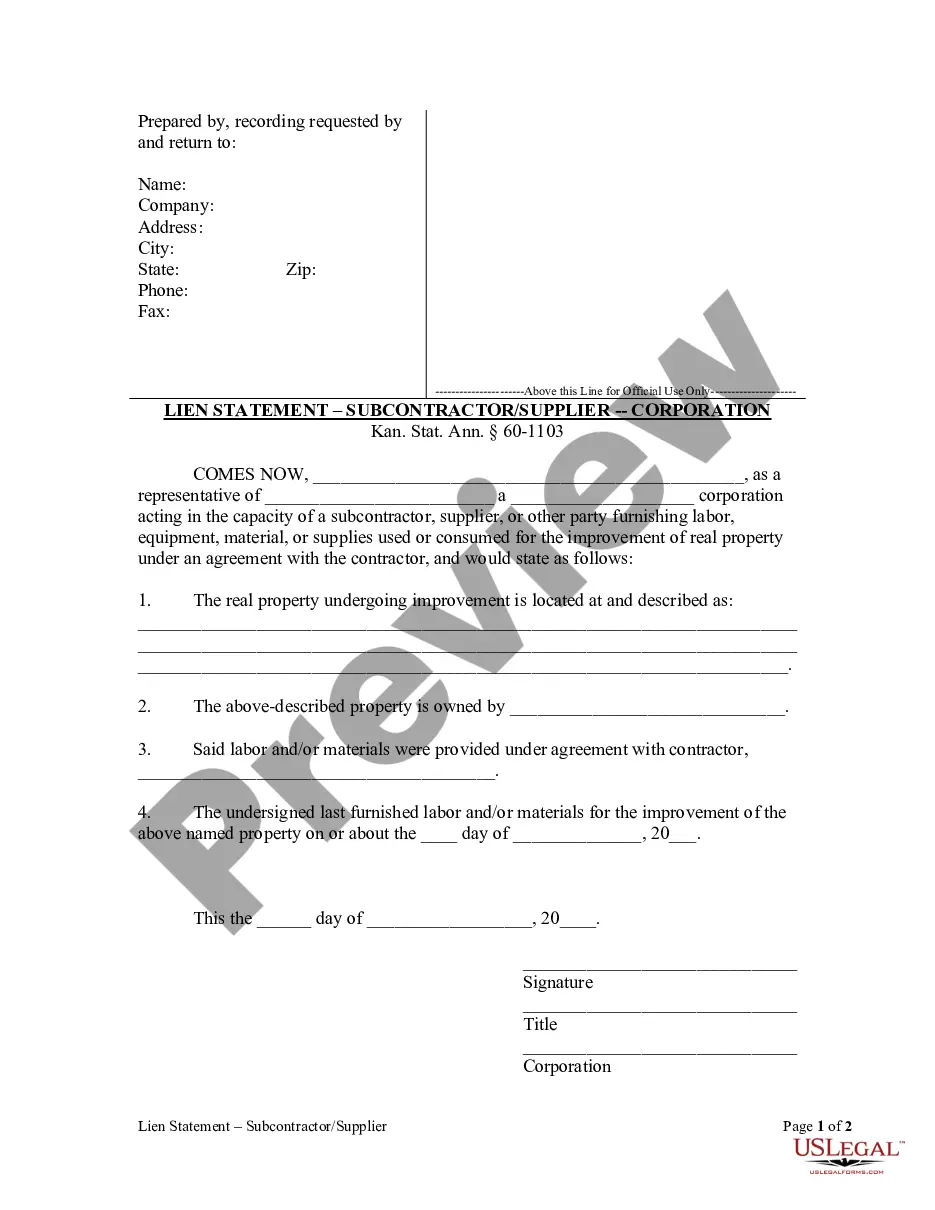

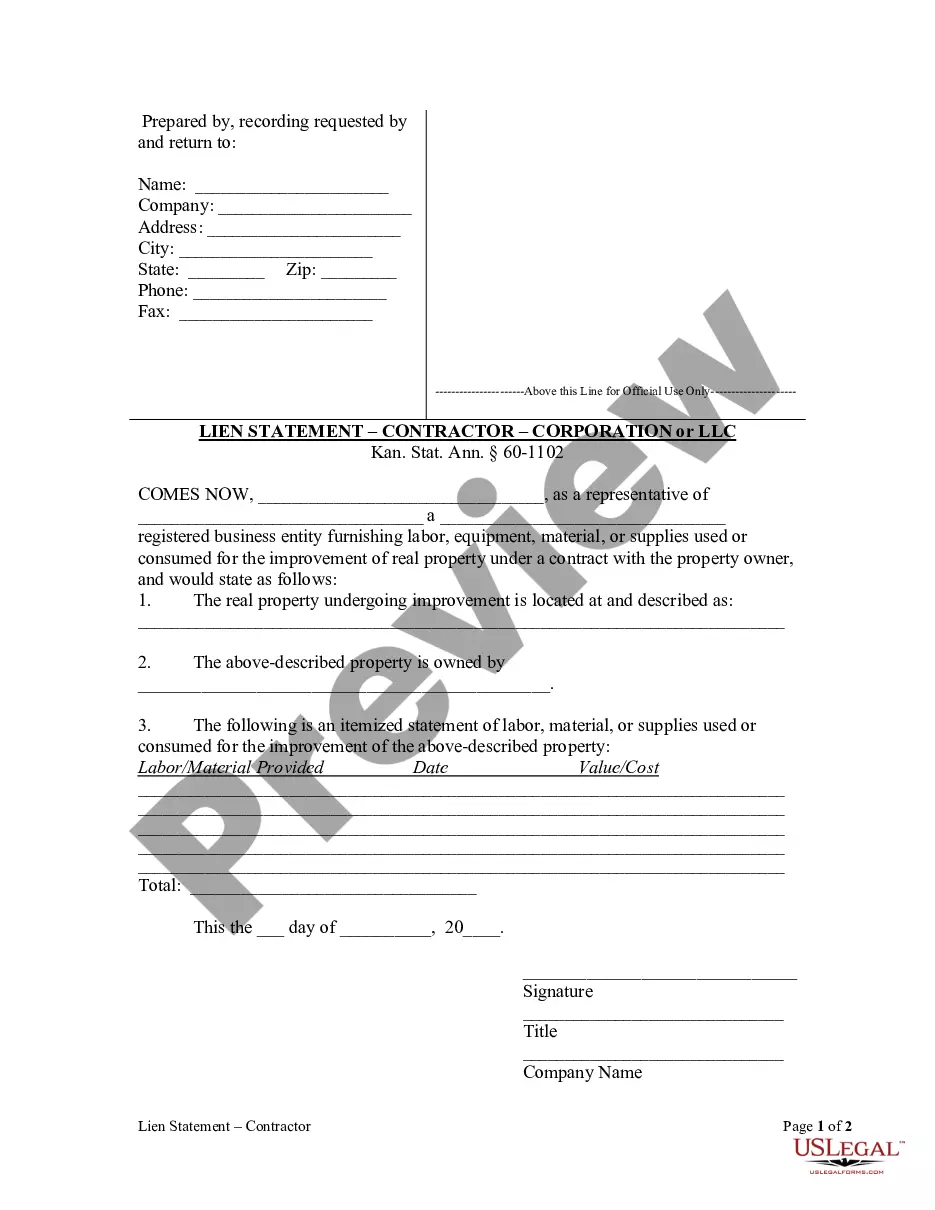

Kansas law makes a distinction between the lien statement to be filed by a contractor and a subcontractor. Both lien statements serve to inform the property owner that a lien is being claimed against his property for labor or materials provided. A subcontractor or supplier contractor must file a lien statement within three months after the date the last labor was performed or material furnished. The lien claimant must cause a copy of the lien statement to be served personally upon the owner or mail a copy by restricted mail.

Kansas Lien Statement for Subcontractor by Corporation or LLC

Description

How to fill out Kansas Lien Statement For Subcontractor By Corporation Or LLC?

Searching for Kansas Lien Statement for Subcontractor by Corporation templates and completing them may be a difficulty.

To conserve time, expenses and effort, utilize US Legal Forms and locate the suitable example specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you merely need to fill them in.

Click on the Buy Now button if you found what you need. Select your plan on the pricing page and create an account. Choose how you wish to pay using a card or via PayPal. Download the file in your preferred format. Now you can print the Kansas Lien Statement for Subcontractor by Corporation template or complete it using any online editor. Don’t worry about making errors, as your sample can be used and submitted, and printed as many times as you desire. Explore US Legal Forms and gain access to more than 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- Your downloaded templates are kept in My documents and are accessible at all times for future use.

- If you haven’t subscribed yet, you ought to register.

- Check our comprehensive instructions on how to obtain your Kansas Lien Statement for Subcontractor by Corporation sample in just a few minutes.

- To acquire a qualified example, verify its relevance for your state.

- Examine the form using the Preview option (if it’s available).

- Read through the description to understand the essential points.

Form popularity

FAQ

Legally, an unpaid contractor, subcontractor or supplier can file a lien (sometimes called a mechanic's lien) that could eventually force the sale of your home in place of compensation.Conversely, if the contractor who worked on your project does not pay for materials, a supplier could place a lien on your property.

In fact, the subcontractor doesn't have any contract with the owner neither written nor verbal!However, presuming that the subcontractor on the project has a written contract with someone, they can still file a lien even if they don't have a written agreement with the property owner.

A lien is essentially a claim for repayment of a debt. In the construction context, a lien is of considerable importance because it offers considerable power to a subcontractor to seek payment from an owner through the property itself for a debt owed to the subcontractor by a general contractor or other third party.

If a general contractor refuses to pay his subcontractors, they can make a claim against the payment bond. The surety company will pay out the subcontractors for at least part of their money and take the contractor to court.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

Invalid Liens A lien stays in the county records and on your property title until you take action to remove it.If the contractor, subcontractor, laborer, or material supplier fails to follow any of the specific time frames, you can petition the court to remove the lien.

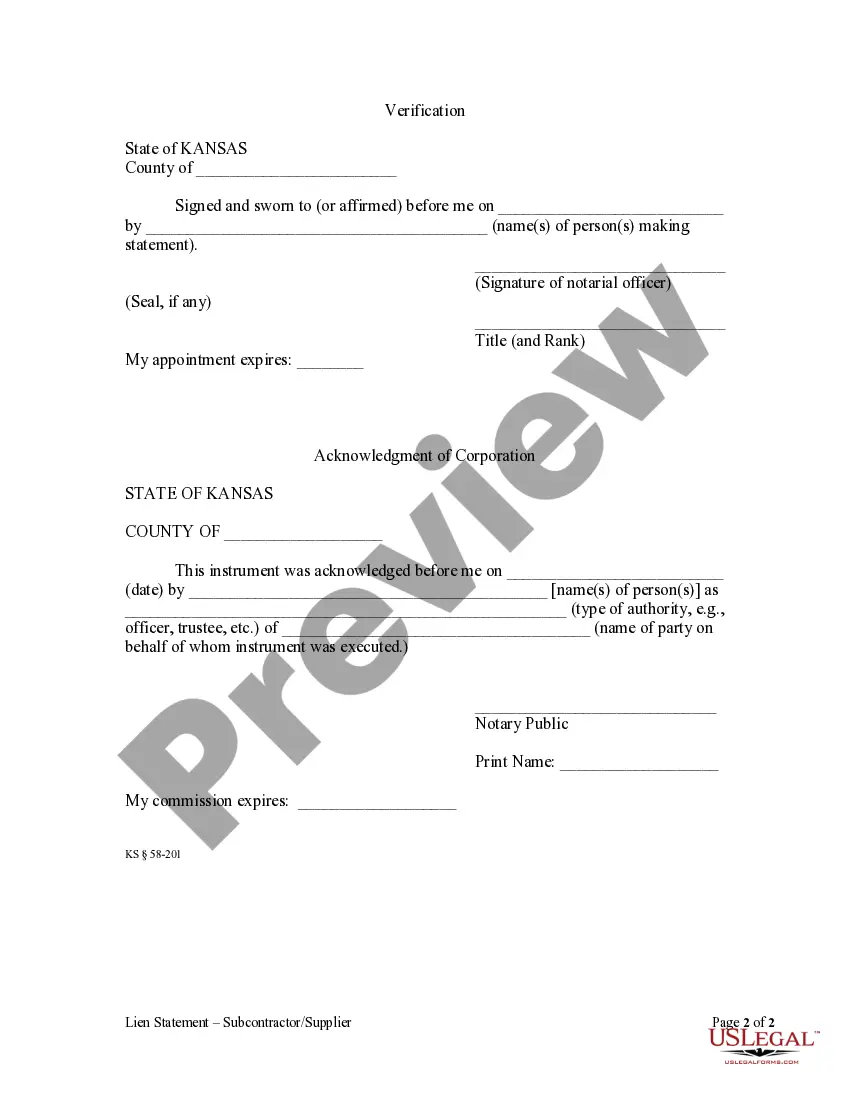

Prepare lien form, taking care to include the necessary information as set forth above, and sign the document with the verification statement. Send the original notarized copy to the office of the clerk of the district court of the county in which property is located.

Legally, an unpaid contractor, subcontractor or supplier can file a lien (sometimes called a mechanic's lien) that could eventually force the sale of your home in place of compensation.Conversely, if the contractor who worked on your project does not pay for materials, a supplier could place a lien on your property.