Professional Corporation Package for Kansas

Description

How to fill out Professional Corporation Package For Kansas?

Among countless free and premium examples that you can discover online, you cannot be assured of their precision and dependability.

For instance, who produced them or whether they possess the qualifications to handle the matter you require assistance with.

Stay calm and make use of US Legal Forms! Find Professional Corporation Package for Kansas documents created by qualified legal professionals and avoid the expensive and time-consuming endeavor of searching for a lawyer and subsequently compensating them to draft a document that you can effortlessly locate by yourself.

Once you have registered and purchased your subscription, you can utilize your Professional Corporation Package for Kansas as many times as necessary or for as long as it stays valid in your jurisdiction. Modify it with your chosen online or offline editor, complete it, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- If you hold a subscription, Log In to your account and find the Download button adjacent to the file you’re seeking.

- You will also have access to your previously downloaded documents in the My documents section.

- If this is your first time using our service, adhere to the instructions outlined below to quickly obtain your Professional Corporation Package for Kansas.

- Ensure that the document you find is valid in the jurisdiction where you reside.

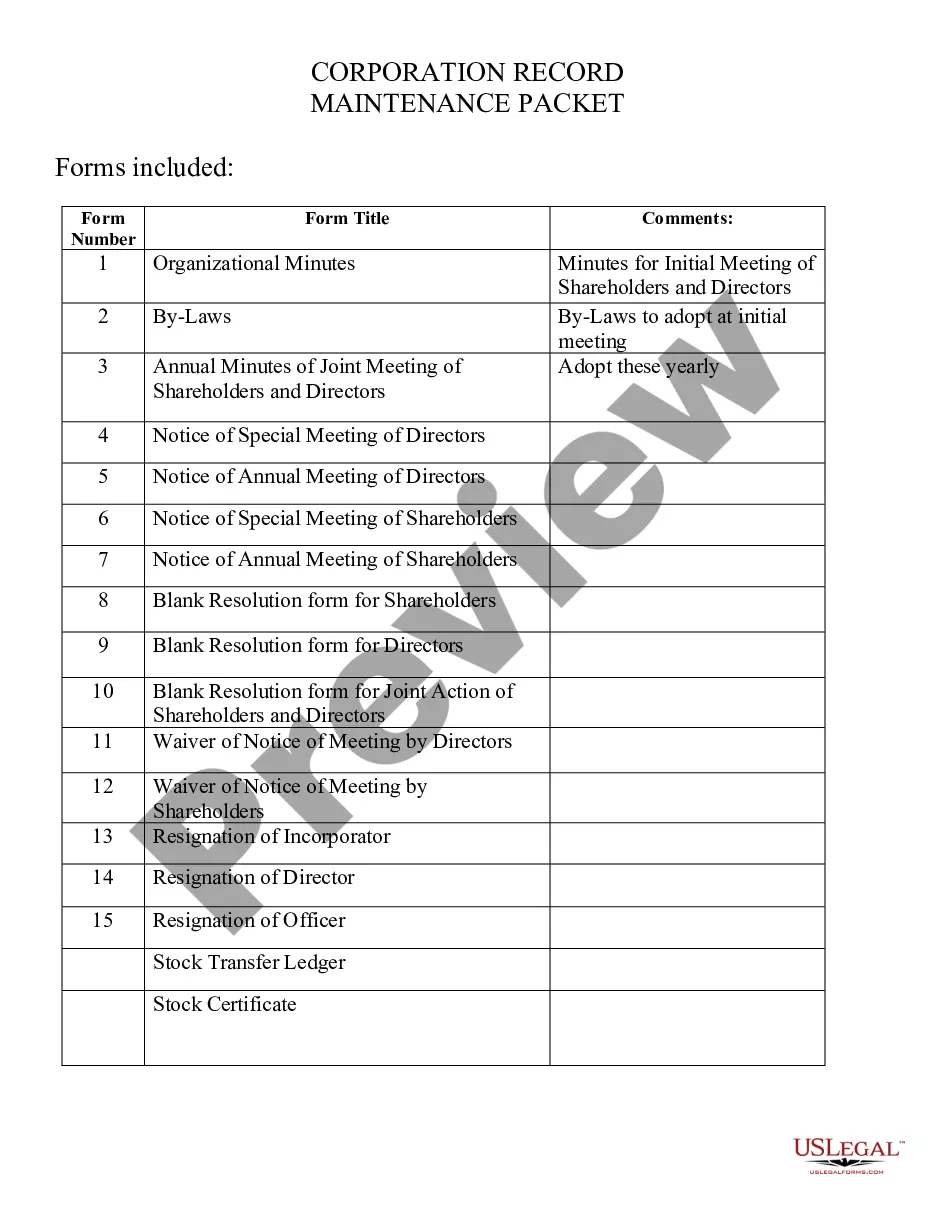

- Examine the file by reviewing the information through the Preview option.

- Click Buy Now to initiate the purchasing process or search for another template using the Search bar located in the header.

Form popularity

FAQ

No. State law does not require or permit the registration or filing of DBAs or fictitious names. Q. How can I protect my business name?

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

Kansas New Employer Registration Register online as a new business. You will receive your Tax ID Number immediately after completing the registration online. After 3-5 business days, call the agency at (785) 368-8222 to receive your filing frequency.

All LLCs doing business in Kansas must file an Annual Report every year. You need to file an Annual Report in order to keep your LLC in compliance with the state and to prevent it from being shut down. You can file your LLC's Annual Report by mail or online.

The filing fee to form an LLC in Kansas is $165 by filing the Articles of Organization with the Secretary of State.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

Register the Business Entity. Register the Business Name. Business License Registration. Register the EIN. Business Tax Registration.

200bThe LLC annual fee is an ongoing fee paid to the state to keep your LLC in compliance and in good standing. It's usually paid every 1 or 2 years, depending on the state. This fee is required, regardless of your LLC's income or activity. Said another way: you have to pay this.

STEP 1: Name your Kansas LLC. STEP 2: Choose a Resident Agent in Kansas. STEP 3: File Your Kansas LLC Articles of Organization. STEP 4: Create Your Kansas LLC Operating Agreement. STEP 5: Get an EIN.