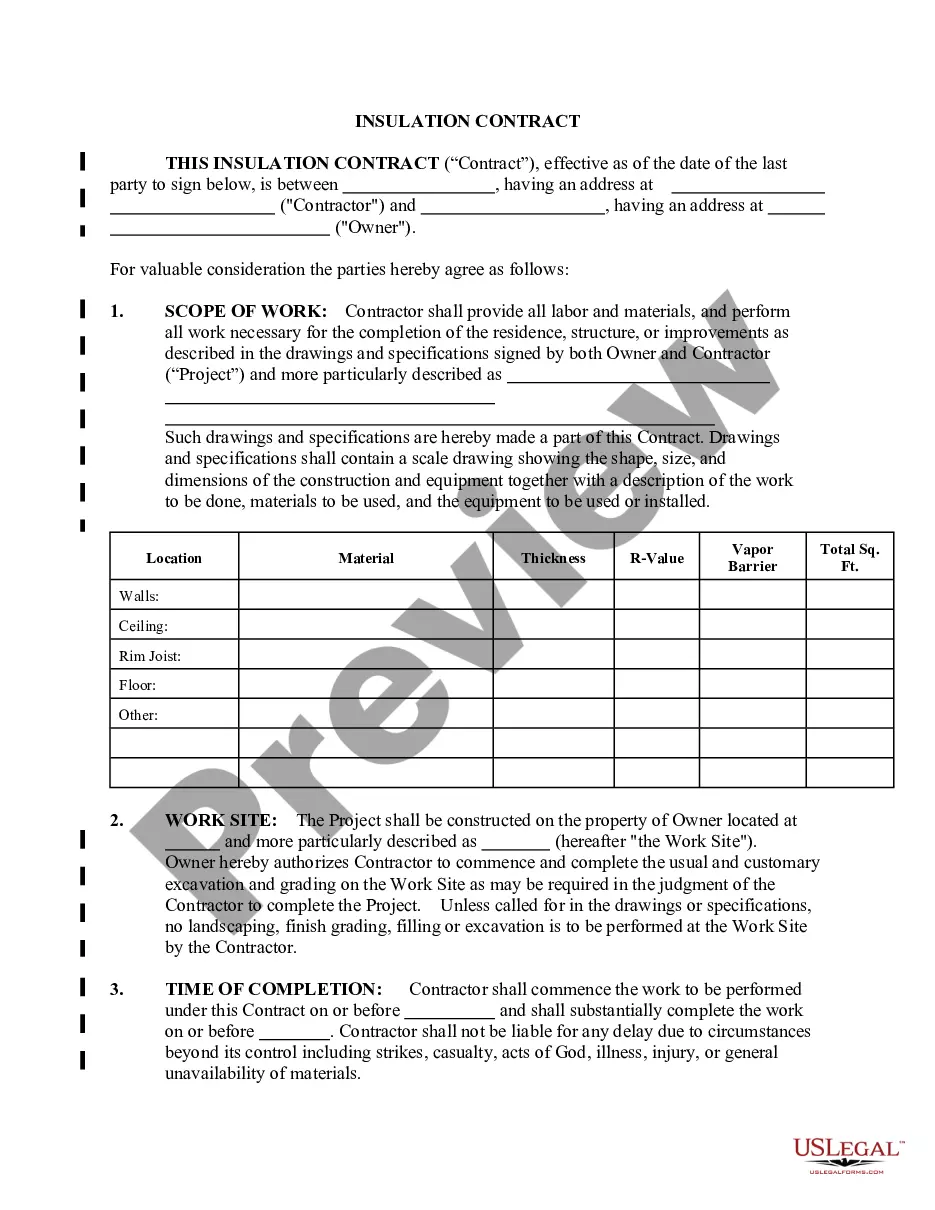

Kansas Insulation Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kansas Insulation Contract For Contractor?

Seeking to locate Kansas Insulation Contract for Contractor paperwork and completing it could prove to be a hurdle.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state within a few clicks.

Our lawyers prepare all documents, so you merely need to complete them.

Now you can either print the Kansas Insulation Contract for Contractor form or fill it out using any online editor. There’s no need to worry about making errors, as your form can be utilized, submitted, and printed multiple times. Try US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the document.

- Your saved templates are stored in My documents and are accessible at any time for future use.

- If you haven't signed up yet, you need to create an account.

- Review our comprehensive guidance on how to obtain the Kansas Insulation Contract for Contractor form in just a few minutes.

- Verify its applicability for your state to find a valid example.

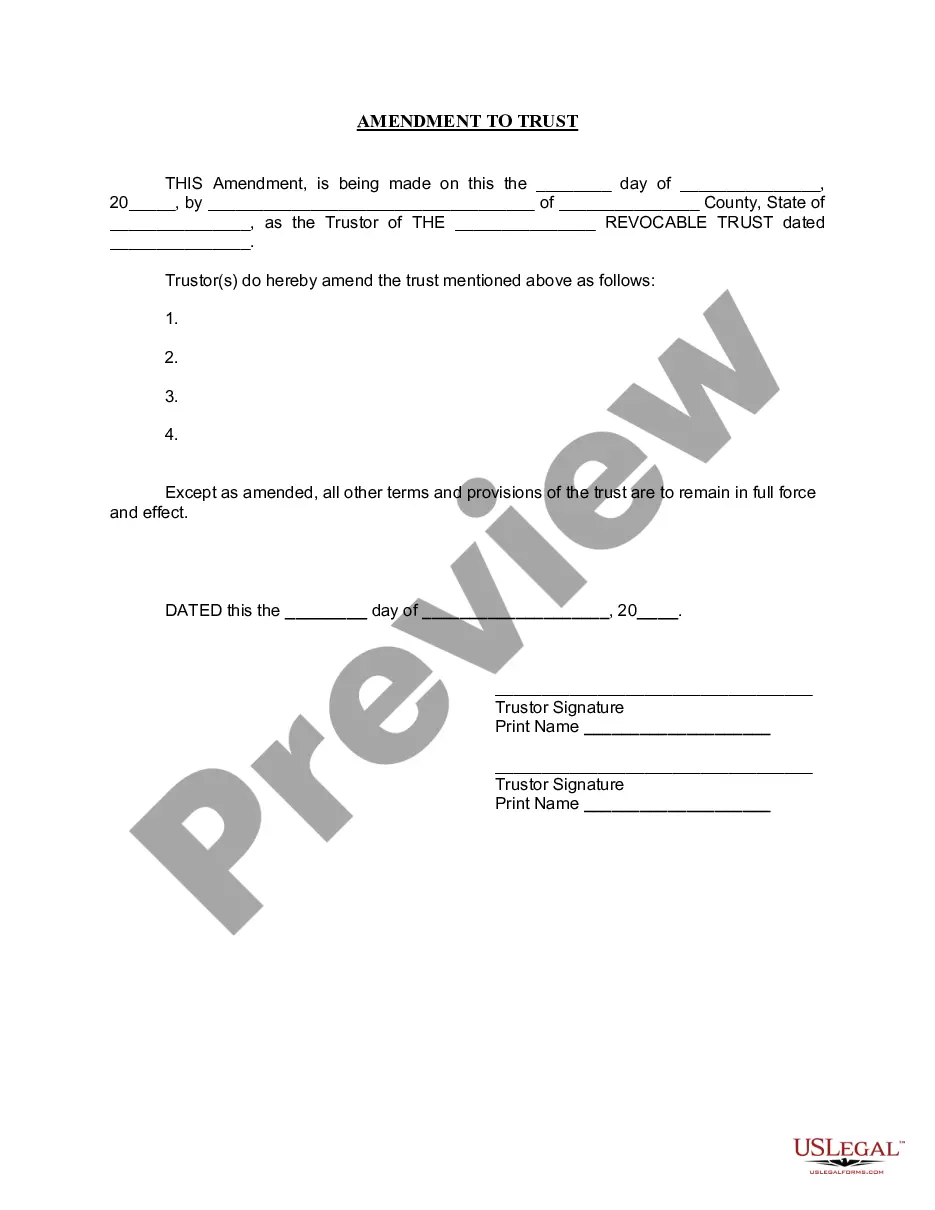

- Examine the template using the Preview option (if available).

- If there's a description, read it to understand the details.

- Click on the Buy Now button if you have found what you are looking for.

- Choose your plan on the pricing page and create an account.

- Indicate whether you wish to pay by credit card or via PayPal.

- Download the file in your desired format.

Form popularity

FAQ

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

Charges for fabrication labor are generally taxable, whether you itemize your labor charges or include them in the price of the product. This is true whether you supply the materials for the job or your customer supplies the materials. Examples of fabrication labor include: Manufacturing a new piece of machinery.

Begin with the Date and the Address of the Other Party. Start with the Basic Details of the Planned Work. Include Special Stipulations. State Whether There Will be a Further Agreement. Create an Area for Signatures. Sign and Date the Contract Letter.

Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).The labor charged by repairmen to repair, service, alter, or maintain tangible personal property is also generally subject to sales tax.

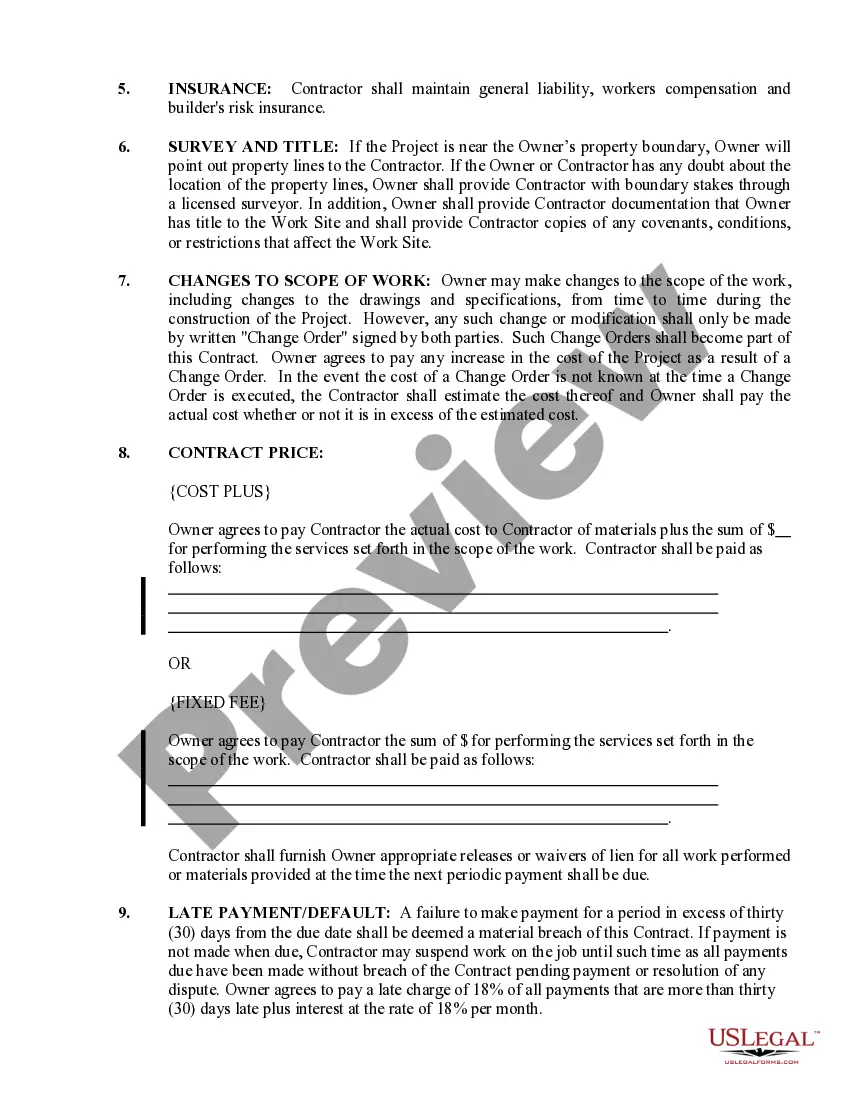

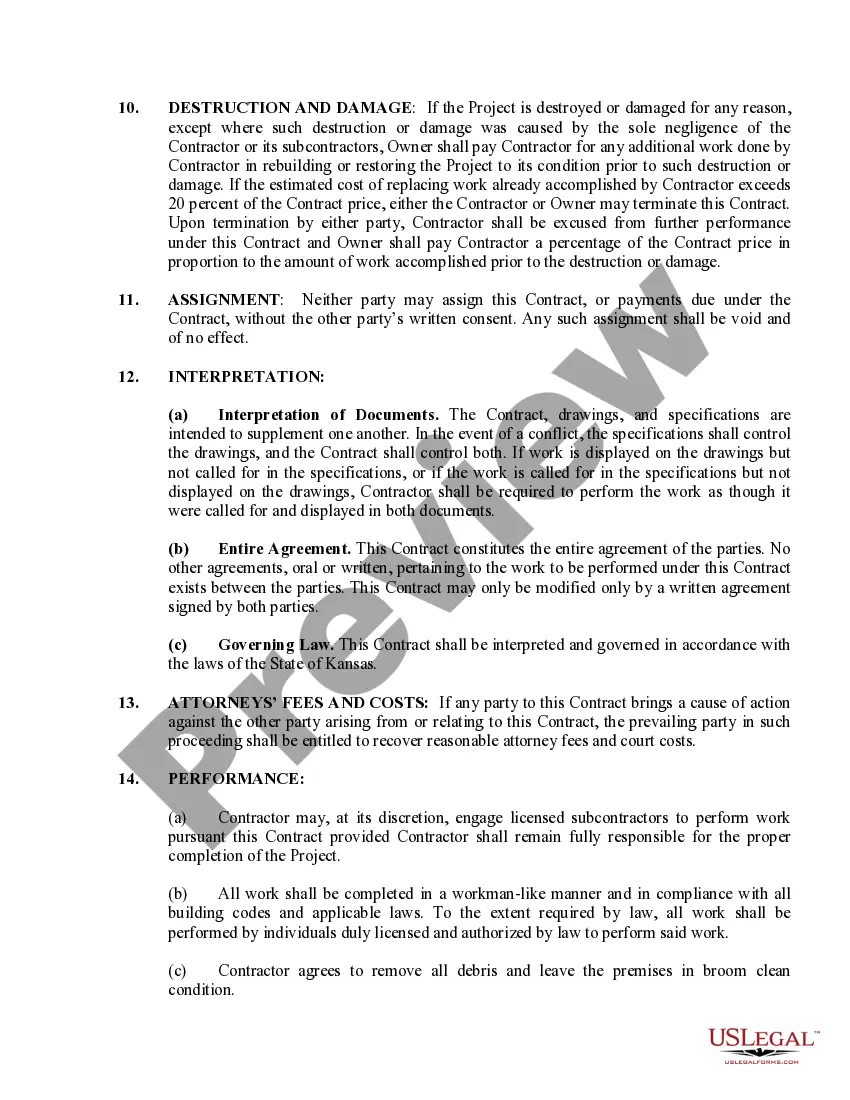

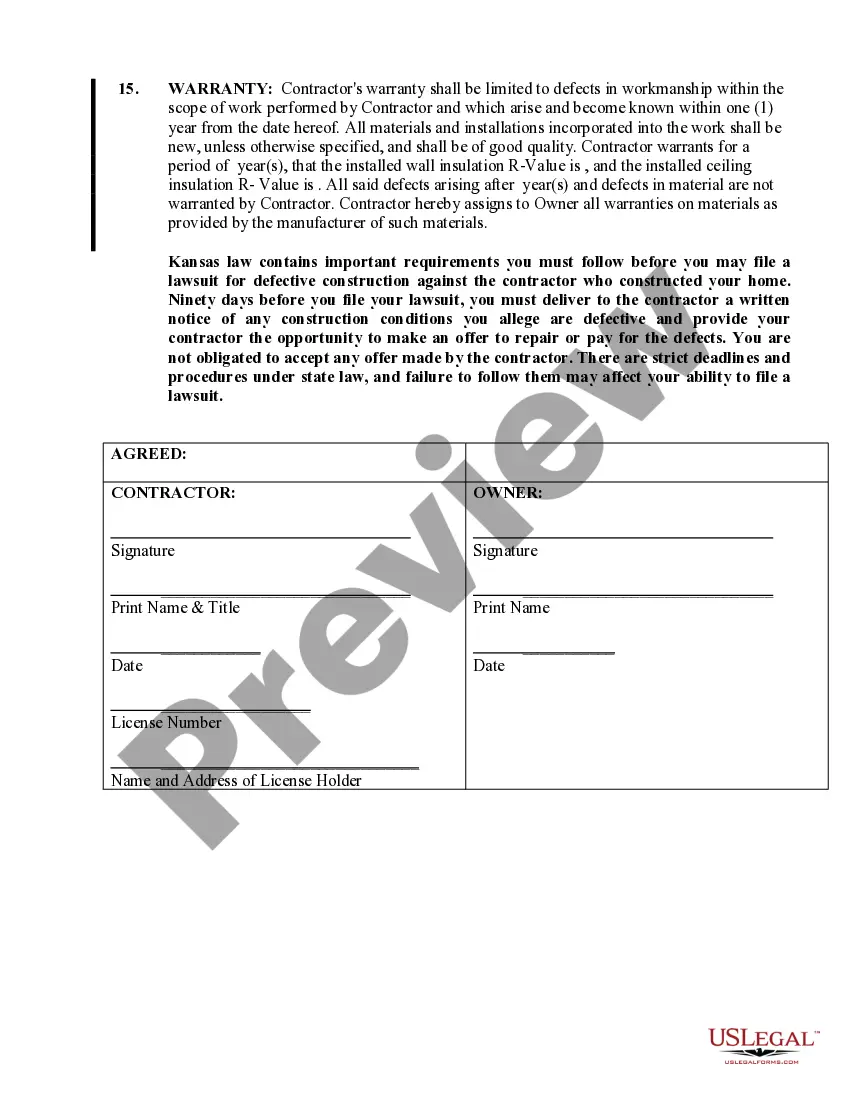

Identifying/Contact Information. Title and Description of the Project. Projected Timeline and Completion Date. Cost Estimate and Payment Schedule. Stop Work Clause and Stop Payment Clause. Act of God Clause. Change Order Agreement. Warranty.

In most states, construction contractors must pay sales tax when they purchase materials used in construction.In some cases, this can be an advantage because any markup you charge to your customer on the materials, supplies and labor, won't be subject to sales tax.

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

Are you a licensed installer? Can I speak with your references? What warranty or guarantee do you provide for your insulation? What personal protective equipment do you require for your workers? Do you carry liability insurance and workers comp insurance? What type of insulation products do you offer?

Some goods are exempt from sales tax under Kansas law. Examples include farm machinery and equipment, prescription drugs, and some medical devices.