Kansas Insulation Contract for Contractor

What is this form?

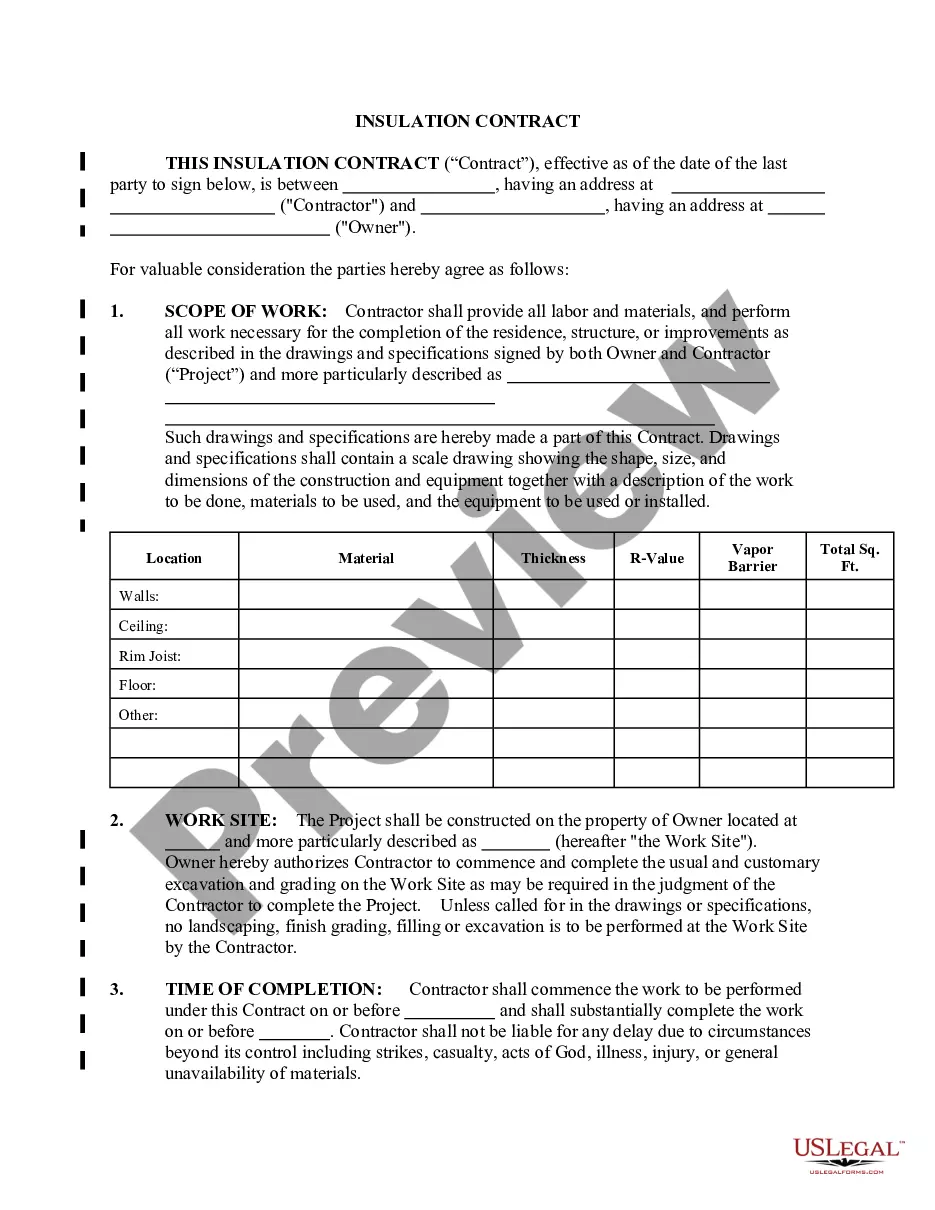

The Insulation Contract for Contractor is a legal document specifically designed to outline the agreement between insulation contractors and property owners. This form allows for various payment arrangements, including cost-plus and fixed-fee payments. It ensures that both parties understand their responsibilities regarding change orders, warranties, insurance, and worksite specifics. Tailored to comply with Kansas state laws, this contract serves as a reliable foundation for insulation projects, distinguishing itself from general contracts by its specialized focus on insulation work intricacies.

What’s included in this form

- Project details, including location, material, thickness, and R-value.

- Requirements for permits and regulatory approvals.

- Insurance mandates covering general liability, workers compensation, and builders risk.

- Provisions for changes in the scope of work through written change orders.

- Terms regarding destruction or damage and how to handle contract termination.

- Conditions for assignment of the contract and interpretation of conflicting documents.

When to use this form

This insulation contract should be used whenever a property owner engages an insulation contractor to undertake insulation work on their property. It is applicable in both residential and commercial settings when specific details regarding scope, payment methods, and responsibilities need to be outlined clearly. Utilize this form if you are changing the scope of work or if significant changes to project costs are anticipated.

Who should use this form

- Property owners hiring insulation contractors for their projects.

- Insulation contractors seeking a clear contractual agreement with property owners.

- Parties involved in insulation projects that require formal documentation of terms.

How to complete this form

- Identify the parties involved by entering the names and contact details of both the contractor and the property owner.

- Specify the project's location, the insulation materials to be used, and the required thickness and R-value.

- Detail any necessary permits and the costs associated with these regulatory approvals.

- Include insurance requirements, ensuring that all necessary coverages are specified.

- Document any changes to the work scope through signed change orders as they arise during the project.

- Ensure both parties sign the contract to formalize the agreement.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to specify all project details, such as material types or thickness.

- Not including insurance provisions, which could expose both parties to liability issues.

- Neglecting to document change orders, leading to disputes over project costs.

- Overlooking local permit requirements, resulting in legal complications.

Advantages of online completion

- Convenience of instant downloading, allowing immediate access to the contract.

- Editability to customize the form to meet specific project needs.

- Reliability as it is drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

Charges for fabrication labor are generally taxable, whether you itemize your labor charges or include them in the price of the product. This is true whether you supply the materials for the job or your customer supplies the materials. Examples of fabrication labor include: Manufacturing a new piece of machinery.

Begin with the Date and the Address of the Other Party. Start with the Basic Details of the Planned Work. Include Special Stipulations. State Whether There Will be a Further Agreement. Create an Area for Signatures. Sign and Date the Contract Letter.

Labor services of installing or applying tangible personal property is subject to sales tax (as a general rule).The labor charged by repairmen to repair, service, alter, or maintain tangible personal property is also generally subject to sales tax.

Identifying/Contact Information. Title and Description of the Project. Projected Timeline and Completion Date. Cost Estimate and Payment Schedule. Stop Work Clause and Stop Payment Clause. Act of God Clause. Change Order Agreement. Warranty.

In most states, construction contractors must pay sales tax when they purchase materials used in construction.In some cases, this can be an advantage because any markup you charge to your customer on the materials, supplies and labor, won't be subject to sales tax.

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

Are you a licensed installer? Can I speak with your references? What warranty or guarantee do you provide for your insulation? What personal protective equipment do you require for your workers? Do you carry liability insurance and workers comp insurance? What type of insulation products do you offer?

Some goods are exempt from sales tax under Kansas law. Examples include farm machinery and equipment, prescription drugs, and some medical devices.