Indiana Employment Resignation Documents Package

Description

How to fill out Employment Resignation Documents Package?

Discovering the right lawful record template can be a have difficulties. Naturally, there are tons of web templates available on the Internet, but how would you get the lawful form you need? Take advantage of the US Legal Forms site. The assistance delivers a huge number of web templates, including the Indiana Employment Resignation Documents Package, that can be used for business and personal requires. All of the types are inspected by experts and meet up with state and federal needs.

In case you are already signed up, log in to your accounts and click on the Download option to get the Indiana Employment Resignation Documents Package. Make use of your accounts to search throughout the lawful types you have ordered formerly. Check out the My Forms tab of your respective accounts and get another version of the record you need.

In case you are a brand new end user of US Legal Forms, listed here are basic directions for you to comply with:

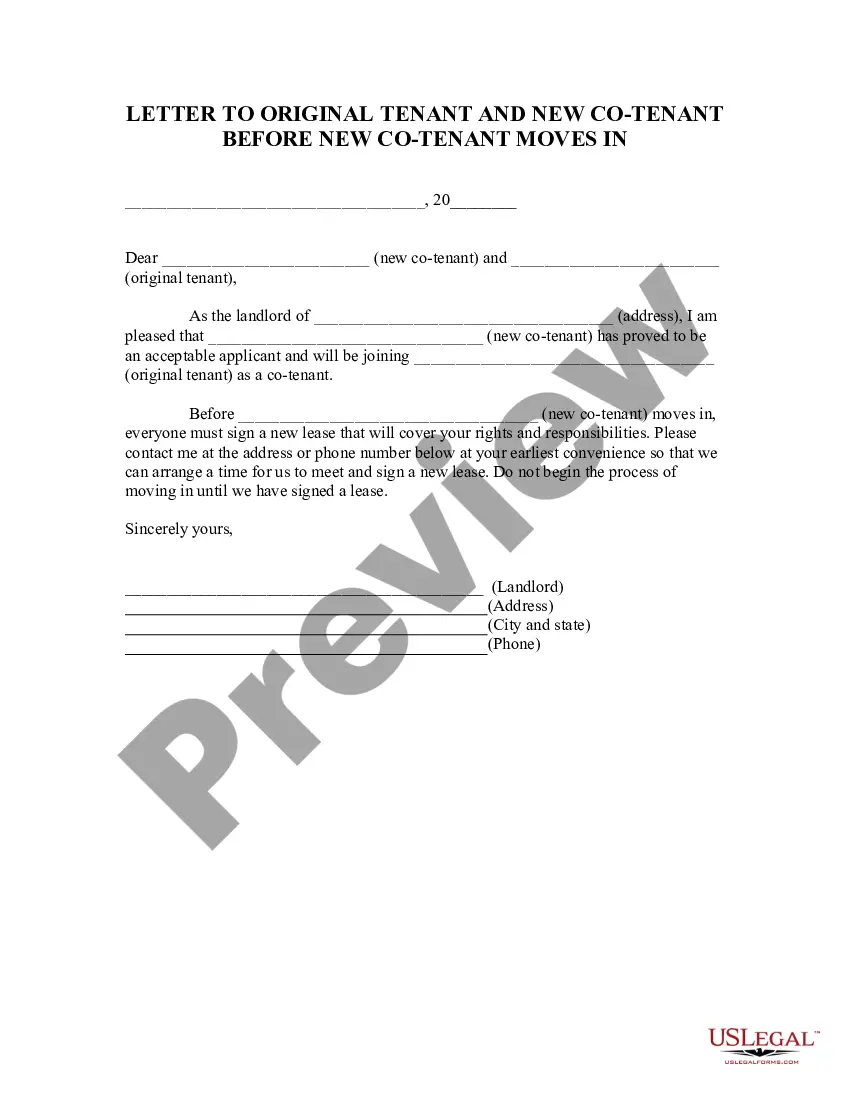

- Initial, be sure you have selected the correct form for your personal area/area. You are able to look over the form utilizing the Review option and study the form information to ensure it is the right one for you.

- In case the form does not meet up with your requirements, utilize the Seach industry to find the appropriate form.

- Once you are certain the form is suitable, go through the Purchase now option to get the form.

- Choose the pricing prepare you would like and enter the necessary information. Build your accounts and purchase your order using your PayPal accounts or credit card.

- Pick the data file file format and down load the lawful record template to your product.

- Full, edit and print out and indicator the obtained Indiana Employment Resignation Documents Package.

US Legal Forms is definitely the greatest catalogue of lawful types for which you can discover a variety of record web templates. Take advantage of the service to down load professionally-manufactured files that comply with express needs.

Form popularity

FAQ

Following a resignation, the employer must give the worker all the sums they are due, such as wages, overtime pay and the vacation indemnity (4% or 6%). The employer must also produce a record of employment for the worker who has resigned which reports, for instance, the number of insurable hours they worked.

Severance pay is usually based on the number of years you've worked at your employer. Generally, you'll get one week to four weeks of pay per year of service, but it is common for employers to pay out two weeks of pay for each year at the company. Of course, every company differs in calculating total severance pay.

WH-4 Indiana State Tax Form Indiana employers must obtain a WH-4 form to process new hires. The form collects personal information such as: Name. Address.

However, severance packages typically include pay through the termination date and any accrued vacation time, unreimbursed business expenses, and an additional lump sum. By law, employers of a certain size must offer the opportunity to continue health care coverage under the company's plan at the ex-employee's expense.

The California Labor Code specifically prohibits an employer from any such requirement. Know that even though you are not required to sign anything, there may be repercussions if you do not; for example, the employer may gave you a bad reference.

Your employer must pay any outstanding wages Regardless of whether you notify your employer ahead of time that you're quitting, your employer must pay all wages owed to you through your last day of work. This includes annual vacation pay, statutory holiday pay, and overtime.

Generally, upon resignation or dismissal, an employee is entitled to be paid the notice pay where applicable, salary up to last day worked, plus any outstanding leave pay.

Some states require the termination letter be given to the fired employee by default. Indiana, however, only requires the letter if the former employee requests it.